When I finished June with $2,331.00 income I thought “that was it!” It was a great income and I haven’t expected that I could ever exceed it. I hoped, I could beat it by a thousand and finish July 2016 month at around $3,000 dollar income.

But by July 10 my account was making $2 dollars. Yes, I was making just two dollars and I was thinking what would I do when I start trading for a living and make only two dollars? Will two bucks pay my bills? So I was comforting myself saying that it would be OK to make less in July. That’s why I do not withdraw all I make but only 20% until I reach 1$0,000 monthly income when I start withdrawing 50%. So, if I make less in one month I still will be ahead.

But then it all started coming together and I made even more than in June. I made $5,734.00 in July in premiums trading options!

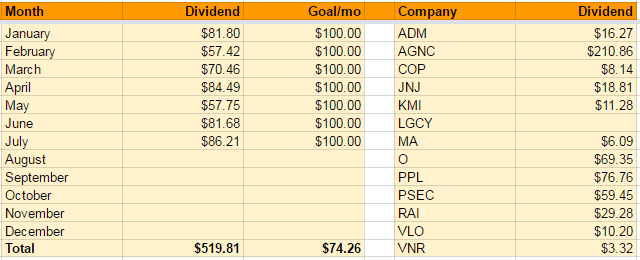

My dividend income this month was also higher than in June. It was actually the highest month I ever had. The dividend income was $86.21 vs. $81.68 last month.

Options Income = $5,734.00 (account value = $10,124.81 +293.04%)

Dividend Income = $86.21 (account value = $20,596.08 +36.04%)

If you wish to see details about each account, continue reading below.

You may be interested in:

August 2016 Stock Considerations By Keith with DivHut

Promising Canadian Aristocrats Companies By Mike with The Div Guy

8 Inexpensive Marketing Tools To Transform to a Business Owner By OCT with One Cent at a Time

Let your winners ride and your losers wither By Integrator with Get Financially Integrated

· July 2016 trading results

As I mentioned above July was my record month trading options and I made $5,734.00 in premiums although at first, it didn’t look like I would make any money. But then the trades started being closed one after another and the trading went fast and smooth.

It was a blizzard speed.

And it was also ecstatic. It was like a drug. The more I traded and the more trades ended winning big the more high I felt.

And I was opening more and more trades. I started feeling invincible.

I forgot my rules and every end of the week I took several trades exceeding my account ability to absorb it should something go wrong.

On Wednesdays and Thursdays I maxed my account opening put selling trades against SRPT, STX, TRGP, and WYNN.

Nothing could go wrong!

Until the Market showed its teeth to me and warned me that if I continue doing this he would bite me hard and destroy my account.

I realized that I was acting like an idiot.

I stretched my account and warnings from my broker about potential margin call stopped my madness blindly chasing performance. Then and only then I realized that as the end of the month was approaching I was opening more and more trades ignoring the danger.

Fortunately, I was able to stop it, maneuver my trades out and end the month with nice profit, but most importantly out of the danger.

Winning trading can be very dangerous and addictive. If you do not self control your emotions you end up as a loser.

What happens if your buying power is depleted?

The broker issues a warning about a potential margin call and blocks your account for trading. All you can do is close trades. But you cannot roll them, you cannot do any adjustments, you cannot maneuver your trades. All you can do is close your trades. And when you are closing your trades because of a margin call, it is usually at a loss.

When you see yourself in a craziness like this, you must stop trading immediately and force yourself back to the rules. Ignore the market and its luring scheme trying to seduce you for more trading.

Alexander Elder shares a story of a religious woman trader in his book The New Trading for a Living who every day before trading prays and remind herself that she is actually trading the Lord’s money and that she cannot lose His money. He recommends starting any trading day reminding yourself that you are a loser and thus you have rules to overcome it and stop being one.

Overcoming impulses and emotions when trading can be tricky and I understand the importance of having rules and repeating them to yourself every time. Mr. Elder compares it to curing an alcoholic from alcoholism. Use a same approach as Anonymous Alcoholic group to re-program your mind.

Long journey though.

I post my trades any time I take them on Facebook. When I post a trade I try to write my reasons for taking that trade and write all my feelings about it and plan I am about to take for that trade. It helps tremendously and twofold.

One, other members of the group can see and learn from my approach, success but also mistakes. Two, it helps me to stay on track and follow the rules.

If you want to see and follow those trades, new trades I open and why, you can join our Facebook group. There are other traders like me posting their trades and ideas. You can follow those trades (mirror them), paper trade them, or just watch them and learn.

Here is my trading result for the month:

| July 2016 options trading income: | $5,734.00 (225.77%) |

| 2016 portfolio Net-Liq: | $10,124.81 (81.15%) |

| 2016 portfolio Cash Value: | $15,874.64 (85.78%) |

| 2016 overall trading account result: | 293.04% |

Here are the results of my options trading:

Here is my monthly income from options trading:

Here are the results of my options strategy:

The table above shows my trades up to date. They are real trades I really traded with my own real money. Some people do not believe it could be possible and call me names, fake, liar, and fraud. But what you see in that table above is the final result of my trades management. You are looking at my ability to turn a losing trade into a winner. So the end result seems too good to be true, but it wasn’t that easy.

Not all trades were immediate winners. Some turned bad the very next day and some required an extensive management and adjustments to end them in green. Mystics, Random Walk academics, and Efficient Market theorists are typically and equally divorced from the reality of the market and trading. Amateurs who love forecasting and mysticism (Alexander Elder, The New Trading for a Living), will not get it and will cal you names.

My average trade holding time is currently 19 days, average P/L 2.32% and 93.23% annualized return.

I have a plan for 2016 to create income from trading:

2016 plan $1,000 monthly income – COMPLETED in July 2016

2016 plan $2,000 monthly income – IN PROGRESS

Here are results of the individual trades I traded this month:

ESV

ESV was a trade in the category of becoming bust after opening. A few first trades went well, but later trades turned sour. Currently I own a covered call and I would love to get rid of that trade and the shares with it. But I cannot do it as I would be closing for a loss. I was assigned some time ago for $11 a share. The stock is selling at around $9 a share. Selling at this price would cause me $200 loss on the stock. Although I could offset this loss selling calls and puts I still do not want to sell the stock at a loss.

So I am keeping this stock and I will be selling covered calls as long as the price rises to $11 or more when I can let the calls assign.

I also own three put contracts. Originally I sold 10 strike puts but as ESV tanked to $8 a share I decided to roll the trade down and away in time. Unfortunately, ESV premiums are no longer what it was when I started trading it early this year, so I had to roll far away in time. Now this trade is sitting back in March and blocking my money. But hey, not all trades will be nice and rosy. I will have some trades which will stink. We have to manage them and finish them as winners one day.

So, I rolled my puts down and collected additional credit doing so, thus I do not mind staying in this trade longer than originally planned. If ESV starts rallying as oils may start recovering again I might be able to get out of this trade with profits earlier than in March.

ABBV

ABBV was another trade which went smooth and nice but the last trade which turned bad too. I opened my last trade in May and had to hold it 55 days and roll it once down and away in time to be able to finish this trade as a winner. Originally, I opened this trade with 62 strike but soon the stock tanked and traded at around $60 a share. I rolled the trade down to 60 strike but the stock traded even lower to $58 a share. At some point it looked like I would be stuck to this trade forever.

Fortunately, lately the stock recovered and continued higher. It continued high enough so I could close this trade for 50% of received credit.

LULU

If you too think that the table far above is too good to be true and fake then this trade against LULU is yet another example of a trade which wasn’t good at first but ended well thanks to the trade management.

This is a beauty of options which allow you to manage the total loser trade into a winner although it takes time. You can’t do any of it with stocks. Once you buy a stock, you are done and if the stock tanks, you can’t do much about it. Options do not work like that and allow you to manage a trade into a winner.

I originally opened a put selling trade against LULU in March 2016 at 65 strike. Soon the stock tanked and I had to roll twice. I rolled down to 62.50 strike in April and again to 60 strike in May. I could close this trade in July. It took 106 days (more than three and a half months) to get out of this trade!

But when the stock continued tanking I also sold naked calls to collect more premiums to offset any loss on the put trade. Worked well until the stock recovered and started moving higher. Suddenly those calls weren’t that good idea as it looked like at first. So I converted them into puts (I bought back the busted calls and sold new puts collecting enough premium to buy back the calls and make some more). In July I had to close the trade because of my WYNN trades (see below) which caused me margin calls. Fortunately, I could be closing for a profit.

TRGP

Still not convinced that it is the money and trade management which makes losing trades winners? Then here is yet another example. Trading TRGP was a great experience and I hope and believe that I will be able to make even more money with this stock. Last two trades turned sour however. I sold 42 strike put contracts, the next day when the stock dropped I sold more of 42 strike put contracts. But then the stock tanked all the way to $35 a share. I rolled down to in-the-money 40 strike and collected nice premium doing so, but at $37.26 stock price I am sitting on a deep in the money unrealized loss. I will keep watching this trade of course and rolling it down as needed.

When I rolled to 40 strike I rolled into January 2017 so I have no plenty of time to do nothing about this trade. Now I will wait and if the stock recovers I might be able to close it early for a profit. If it stays this low, then in January I will roll again, this time maybe to 39 or 38 strike. I will continue rolling as low as needed to get out of this trade with a profit.

I collected over $3,000 in premiums with this stock and sitting on another $3,000 or more premiums. Trading TRGP was easy money, so some troubles now is OK with me.

PSX

PSX is another trade which goes back all the way to April when I opened the first put selling trade at 82.50 strike. Since then the stock continued drifting down from $87.85 a share down to below $70 at some point. I had to roll three times – from 82.50 strike down to 77.50, then to 75, and now to 72.50 strikes. Now it is a waiting time for resolution. Will the stock move higher and I will be able to get out for a profit, or will I have to wait longer or even roll the strike lower in order to get out? Time will show. And with the last roll, I have a great abundance of it.

STX

STX was a stock which also went bad at first, but by managing it I was able to make it a winner. Although I still have a few open positions which turned OK just recently and there is still a chance that I may need to roll them.

I described my trades against STX in the second part of my previous post on how to manage losing trades.

OKE

My first OKE trade went well as the stock was a bit lazy in terms of reacting to the market and its volatility. It was steadily moving up. So I decided to take a second trade. This time the stock dropped and it is currently in the money. I still have 19 days till expiration, so I will wait and eventually roll the trade.

SRPT

SRPT was a good winner in the last month. The company is awaiting an FDA approval on their drug Eteplirsen (who the heck is inventing these names?) so the premiums were elevated. It was great trading puts against this stock but also extremely dangerous. If the FDA came out and declined the drug approval, the stock could collapse from $25 price level to a few cents and that would cause a huge loss. On the other hand the approval wasn’t a guarantee of a further stock growth. Some said that at current prices the approval is already priced in so if the FDA approval would get out, the stock would likely drop too.

I am hesitant trading this stock. I may be taking a few trades and if so it will be a very short term trade taking advantage of elevated premiums. If opening a new trade, I would be opening a new trade on Thursday afternoon and hold only one day until Friday end of the day.

WYNN

WYNN offered good premiums too. A bit expensive stock compared to STX for example but I liked trading it. This month however, WYNN played a game with me. But it wasn’t my fault. At first, brokers were listing WYNN reporting earnings on August 3rd but the company later announced that they would report in July 28th. Suddenly I ended up holding positions (which I expected to end before earnings) through earnings. You can read my post about managing WYNN trade in my previous post.

MOS

I opened a trade against MOS with expiration in August, but because now the puts are in the money, it is a waiting game. If the stock won’t recover by expiration I will roll this trade.

ETE

This trade was smooth and easy. I opened two trades and both ended well in short time.

If you like these trades and want to be informed when I place them and trade them in real time, you can join our closed Facebook Group. The group is a closed group and there are other traders posting their trade ideas too. We learn from each other, eventually ask questions, get answers, but most importantly you can see what we trade and how. You can follow those trades.

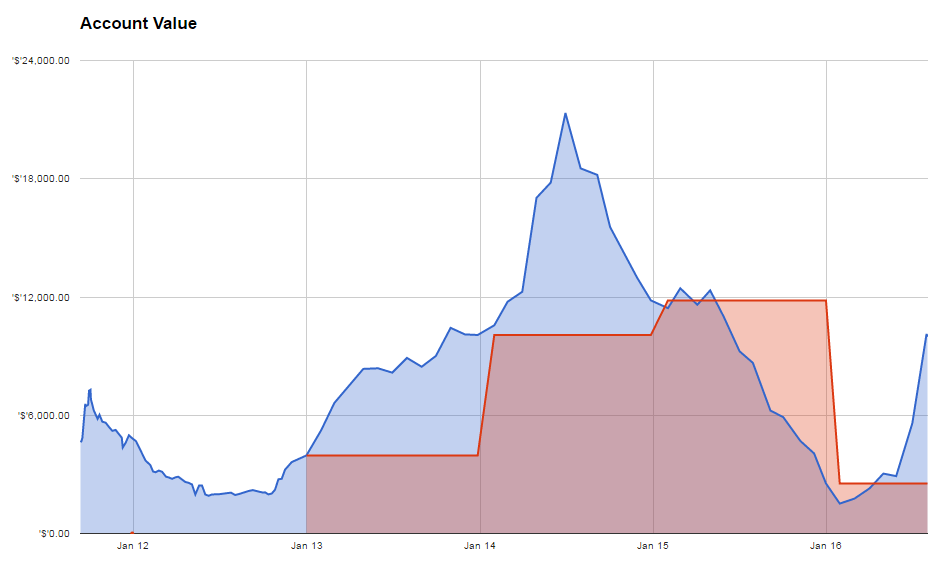

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

WKW 96: How to Run a Successful Business from Home as a Mother of Four with Carrie Wilkerson By Deacon Hayes with Well Kept Wallet

The First 6 Steps To Financial Wealth By Fritz with The Retirement Manifesto

After this, Is Apple About To Fall From The Tree By Option Pundit with Option Pundit

Dividend Income for June 2016 By NMW with No More Waffles

· July 2016 dividend investing results

My dividend income surprisingly jumped up in July. I expected a weak month similar to May but no, July was a month with the largest dividend income I ever had. It is nicely and slowly growing.

It is always said that dividend investing is boring and I must agree. I have nothing else to write about it.

Yes, it is boring but it is nicely boring.

I use DRIP to reinvest dividends and what I like to watch is how DRIP is affecting my dividends and a slow (and yes boring) growth of my account.

For example a stock American Capital Agency Corp (AGNC).

I received dividends and reinvested them via DRIP. And each reinvested dividend bouth me more shares and more shares paid more dividends.

And here is an example of how DRIP grew the dividends this year:

| 1/11/2016 | ORDINARY DIVIDEND (AGNC) | 29.14 |

| 2/9/2016 | ORDINARY DIVIDEND (AGNC) | 29.47 |

| 3/9/2016 | ORDINARY DIVIDEND (AGNC) | 29.8 |

| 4/11/2016 | ORDINARY DIVIDEND (AGNC) | 30.13 |

| 5/10/2016 | ORDINARY DIVIDEND (AGNC) | 30.45 |

| 6/10/2016 | ORDINARY DIVIDEND (AGNC) | 30.77 |

| 7/11/2016 | ORDINARY DIVIDEND (AGNC) | 31.1 |

I don’t know how about you, but it is so lovely watching those dividends slowly growing every month. Sometimes I dream to see them multiplied by thousand and see hunderd or thousands of dollars rolling into my account.

To speed things up I decided to trade options in ROTH IRA although not as a primary source of income, just to increase money to be able to reinvest them. So I sell puts against stocks I do not mind owning such as PSEC, ETE, ESV, etc. (I do not have yet too much money available to invest into options, so I have to stick with cheaper stocks).

I decided to create three sub-accounts (created in my spreadsheet as a mental sub-accounts) with a certain purpose. Here is my plan for 2016:

1) In 2016 I want to save $1,000 for great opportunity. Time to time a stock with a great opportunity shows up. A sudden fall in price or selloff can happen. Then, I do not have cash to buy such stock. This fund would serve this purpose to have cash to buy.

2) My next “virtual account” is dedicated to options trading. In 2016 I planned to save $2,000 dollars and use them for options trading. This month I was able to save $2,000 and have it fully invested in options to generate cash. All income from options is now being relocated to my “Great opportunity virtual account”.

3) Once my “Great opportunity virtual account” will be funded I will be relocating all income into my next virtual account – stock purchasing account. Once I save at least $1,000 in this account, I will buy shares of a stock in my buy list.

Well, little game of mine.

But, it helps me to stay on track.

Here is a picture of my spreadsheet showing my “virtual accounts”:

Here is my ROTH account review:

My annual dividend income this month dropped from $925.26 to $920.74.

Dividend stocks added or removed from portfolio:

| July 2016 dividend stock buys: | none |

| July 2016 dividend stock sells: | none |

To purchase stocks I use trailing stock order strategy OTO trade order (one triggers other) and I described this strategy in my post about purchasing stocks in falling markets.

I also invest into dividend paying stocks using Motif investing which allows me to buy all 30 stocks I want in one purchase using fractional investing, similar to a mutual fund.

You can actually build your own mutual fund with Motif investing.

Here is my Motif Investing account you can review:

I continue reinvesting my dividends using DRIP program. I love how my holdings grow when reinvesting the dividends and when the stock prices are going lower. As I believe we are heading into a recession I will be able buying more shares for a lot cheaper.

Dividend stocks DRIP:

| July 2016 DRIP: |

American Capital Agency Corp. (AGNC) |

Here are my ROTH IRA trading/investing results:

| June 2016 dividend income: | $86.21 |

| June 2016 options income: | $216.00 |

| 2016 portfolio value: | $20,596.08 (2.25%) |

| 2016 overall dividend account result: | 36.04% |

The account grew by 2.25% from last month, overall I am up 36.04%. The dividend income was up from last month. All dividends were reinvested back to the companies which generated them.

Here is my dividend income:

Annual dividends since the beginning:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

End of the Month Summary – July 2016 By Alexander with My Trader’s Journal

Weekly Trade Setups Ideas & Market Analysis – August 1st to 5th 2016 By Nial with Learn to Trade the Market

Where to Get Good Dividend Investment Ideas By R2R with Roadmap2Retire

Where to Get Good Dividend Investment Ideas By PIP with Passive Income Pursuit

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts increased from previous month and are making 38.26% (up 4.18% from previous month) for the year.

Remember, if you like trading options and want to have trade ideas for free, join my Facebook closed group and follow my put selling trade ideas in real time, comment, ask questions, and interact with other members. Other members of the group can also post their trades so you can learn from them too.

What do you think?

How about your investing or trading results?

Do you have any question? Need help to start trading or investing? Shoot me an email or let me know below in comments how I can help you.

I’m intrigued! Interested to follow your progress with all of these naked puts!

Thanks for stopping by. I believe trading puts is really a good strategy and money making tool. But one has to learn a lot otherwise it can be a losing game. I lost a lot of money before I developed a strategy which is now making me money.

Congrats on an amazing options month. $5k is insane. Keep up the good work.

Yes, $5k this month was really great and totally unexpected. I traded a symbol which boosted my income beyond my imagination, but it was very risky and I am staying aside on that one so I think I will not be able to repeat this next month.

Thanks for stopping by.