Tyler Durden: There is much stunned confusion among Wall Street’s “best and brightest” following China’s historic Yuan devaluation overnight which was predicted by exactly zero of said best and brightest, just like nobody expected the SNB to give up its own peg to the EUR in January.

Tyler Durden: There is much stunned confusion among Wall Street’s “best and brightest” following China’s historic Yuan devaluation overnight which was predicted by exactly zero of said best and brightest, just like nobody expected the SNB to give up its own peg to the EUR in January.

The problem as the WSJ puts it, is that a devaluation for China is both good, and very bad. Good because it will help the struggling export sector, which has stalled amid weak global demand. Exports in July, for example, sank more than 8% and they were down nearly 1% for the first seven months of the year.

At the same time, it was essential for the People’s Bank of China not to alarm domestic and foreign investors to avoid triggering a wave of capital outflows. Investors tend to dump a weakening currency and move their assets into other currencies. Thus, the PBOC said the move was a one-time reform effort to bring the yuan more in line with the markets.

That, of course, is a lie: the Fed’s first QE was a “one-time” abnormal monetary intervention which has since become the de facto standard of every single central bank.

Finally, the central bank may also have had the International Monetary Fund in its sights. The yuan is up for possible inclusion in international agency’s Special Drawing Rights, a basket of currencies that serves as a global reserve. Too big a move might have damaged Beijing’s case that the yuan is a suitable candidate for addition to that basket of currencies, analysts said.

To show the many different and often opposing views, here is a summary of sellside views compiled by Zero Hedge and the WSJ:

The PBOC adjusted the CNY fixing mechanism, which prompted a step weakening in today’s fixing. From now on, FX market makers are asked to base their contribution to CNY fixing on: i) the closing FX rate in the previous day, ii) CNY supply-demand conditions, and iii) the movements of other major currencies. While public comments suggest this could be a one-off move, in our view it increases the uncertainty around the future path of the CNY, especially if closing FX rate significantly deviates from the fixing. In our view, the market’s previous expectations for a fairly stable CNY have seemingly been de-anchored by the surprising move today. Although information at this stage is limited, our current expectation is that the PBOC will likely use open market FX operations to try to reduce sharp volatilities and avoid further destabilizing the market’s CNY expectations in coming days. – MK Tang, Goldman Sachs

The People’s Bank of China shocked the market today by weakening the yuan reference rate in the largest single-day depreciation since the central bank’s exchange rate reform on July 21, 2005. The PBOC statement interprets the depreciation as a one-off adjustment to fix the persistent discrepancy between the reference rate and the actual spot rate in the market. Since June, the yuan/dollar spot has been consistently about 1.5% higher than the daily fixing. The PBOC statement said that today’s adjustment will fix the discrepancy, and going forward daily fixing will align more closely with the closing spot rate on the previous day. The strong appreciation of the yuan has put a lot of pressure on China’s exports. It is unlikely that China will achieve the 6% trade growth target set for this year. Today’s announcement is also a response to weakening currencies around the Asian region.- Haibin Zhu, JPMorgan

The PBOC was hitting two birds with one stone: The PBOC’s move will lead to a weaker yuan, lending support to export growth. It will also make the yuan exchange rate more market-determined, which could help China at the upcoming Special Drawing Rights review in November. In the past, one major problem with the yuan exchange rate setting was too much emphasis on its stability against the U.S. dollar while neglecting [trends in] other currencies. In the past 12 months, the yuan appreciated by 23% against the euro and 17% against the yen. As a result, so far this year, China’s exports to the EU and Japan are down 4% and 11% year on year. Today’s change should mitigate the problem. –Larry Hu, Macquarie Securities

We believe the unexpected devaluation today is more about the Special Drawing Rights bid rather than an intention to support exports. Tomorrow’s fixing will be the key to test whether this devaluation of fixing is one-off event or a start of new fixing system. Our best guess is that it may be a one-off adjustment. Should it prove to be a one-off event, we think a combination of a widening of the yuan’s daily trading band and a cut in the bank reserve requirement ratio is likely to be the next policy option to increase the yuan’s flexibility. In the near term,

we may see more volatility ahead.

|

We all want to hear your opinion on the article above: 2 Comments |

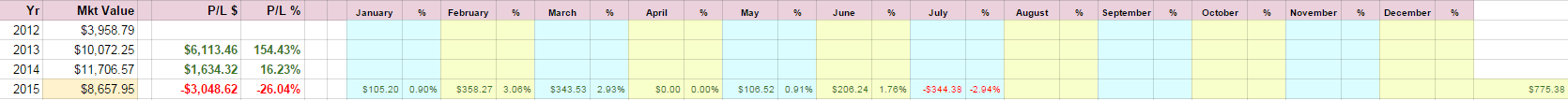

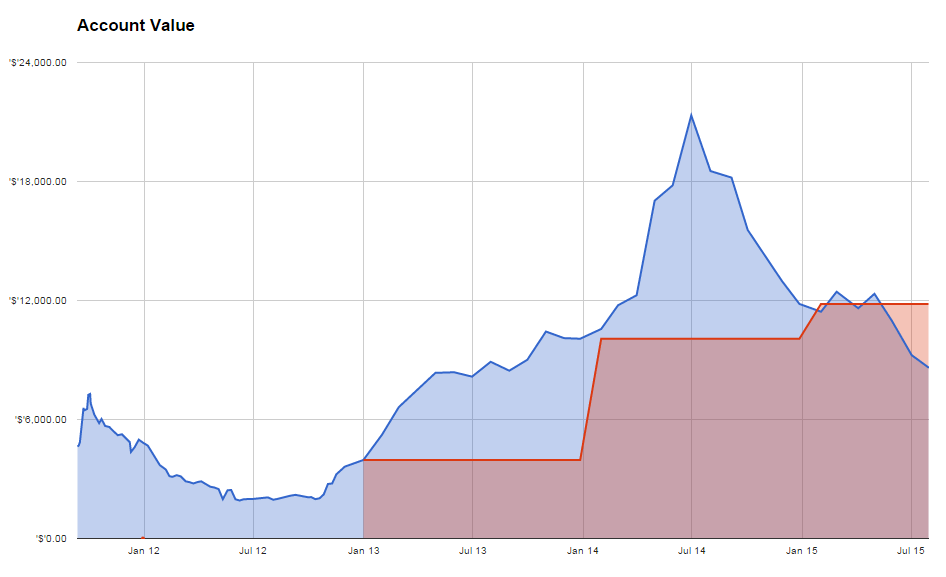

Now, that we know how much money is the best to start with, the question is where do we get that money if we do not possess them in the first place. Getting money for trading business or investing is extremely difficult. Nobody will trust you and nobody will fund you.

Now, that we know how much money is the best to start with, the question is where do we get that money if we do not possess them in the first place. Getting money for trading business or investing is extremely difficult. Nobody will trust you and nobody will fund you.

Recent Comments