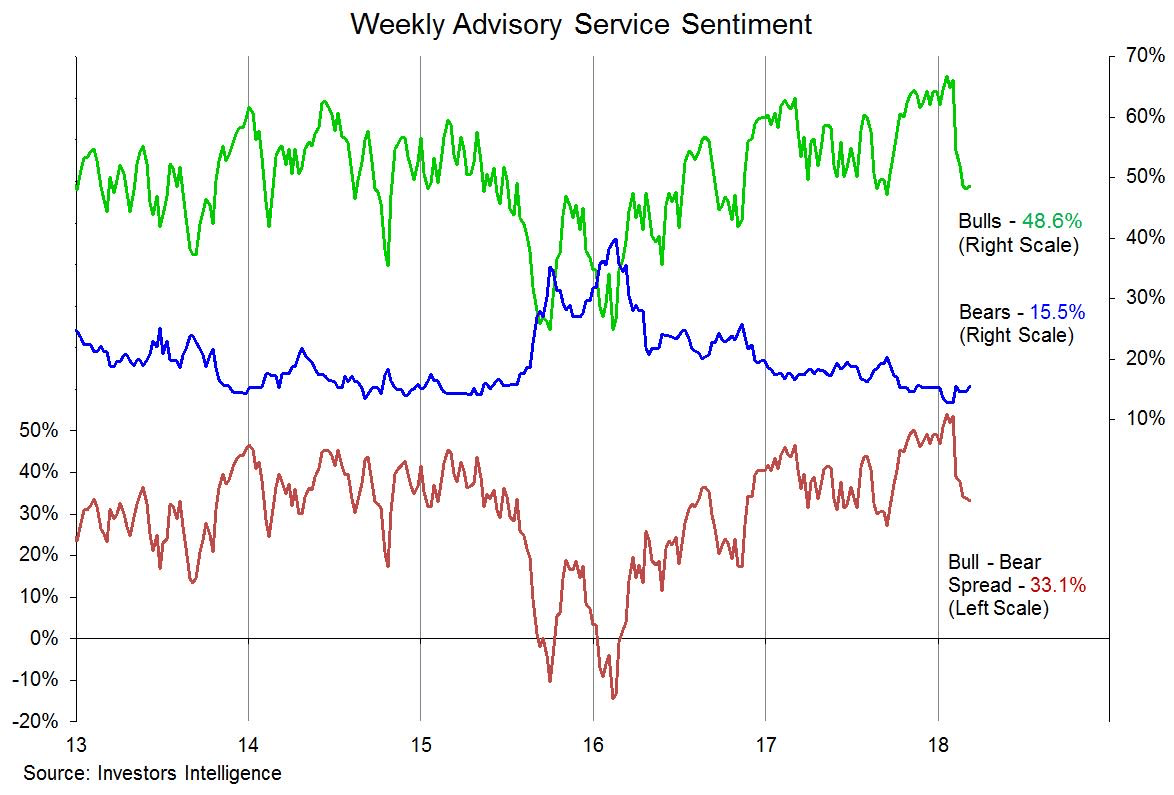

I have seen media saying that this is the longest bull market in history. I have seen people predicting the end of this bull market in 2017 and now in 2018. Some people were predicting this bull market to end in 2013, 2014, 2015, and 2016. Others were predicting the collapse since 2009.

To answer the question, is this the longest bull market in history, my answer is a resolute no!

No, this is not the longest bull we have seen.

To find out we need to define the bear market first. Again, the general public and talking heads define the bear market when the stocks represented by three major indexes lose 20% or more. Let’s ignore the reasons where this bogus number came from and why, but think about it. Why 20%? Why not just 19%? Or 30%? Why 20% is the magic number and 19% is not?

If you ask this question people will have no answer.

Another point is what price qualifies as a determining factor to judge the market to be a bull or bear? They will say that the industry standard is that the “CLOSE” price counts. But why not day LOW? or Intraday CLOSE which happens to be a day LOW at one point in a time line?

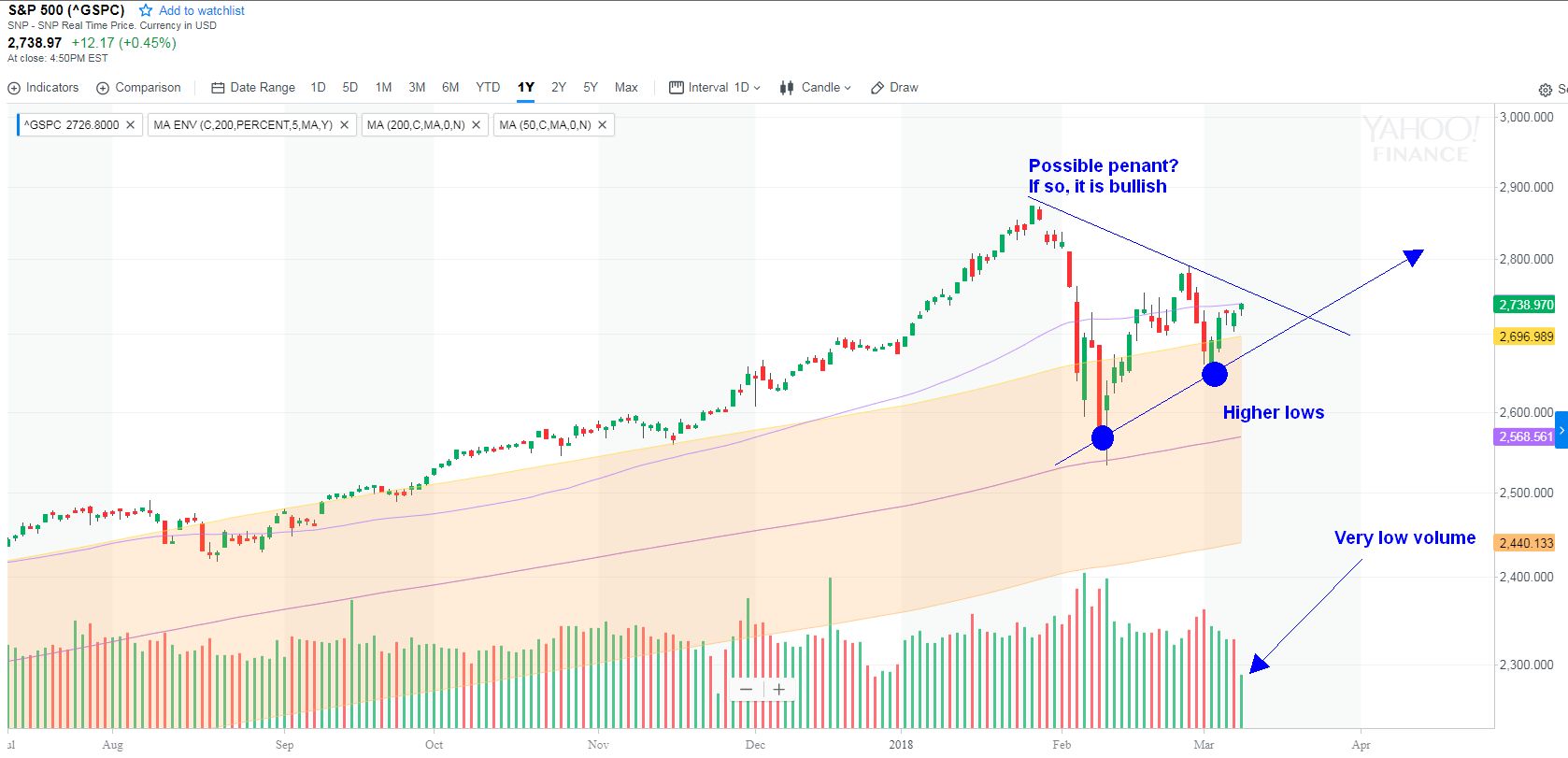

If you look at the chart below, in 2011 the market actually went into a two months long bear market!

Look at the chart!

Each candle represents a week. During that one week the market dropped all the way down to 1076 points. Down from all time highs of 1363 points. That is 21% drop! According to bear market definition, this was a bear market!

Yes, later that week, the stock market recovered and ended the week higher but during that week we experienced a bear market already.

And thus this is not the longest bear market in history.

The bull market then went from 2009 to mid 2011 and after a two months long bear market it went up from mid 2011 till 2018. That is only 6.5 years long bull market! Nothing extraordinary according to historical standards.

However, people still remembered the very painful Great Recession in 2008 as one of the most significant event in Wall Street since Great Depression so any drop of 21% was considered small and fairly quickly forgotten. Another contributing factor to this loss of memory is that the market didn’t stay below 21% for long, only about a week. And investors have a very short memory span.

· Market outlook

I still believe this bull market is not over yet and it will create new all time highs in the next 2 to 3 months. I am basing my estimate on historical market behavior, which you can verify for yourself when the market, almost in all instances, always made new ATH after 10% correction.

Of course, I am not saying that this must happen because out of last 16 occurrences it happened in the previous 15. To claim that the market must act this way based on past occurrences would be an investor’s gambling mentality. A gambling mentality is a probability trap investors fail often for. It says that if you flip a coin for 10 times and it lands head ten times people are convinced that the 11th flip must be a tail after so many heads in a row. It is not true. The coin doesn’t know that it flipped head up 10 previous flips so this time it must get tail. The probability of landing on tail is still 50% no matter how many times it ended on head.

Thus it still may not happen but since the market is influenced by human behavior and people tend to incline to patterns chance that this time we too will make all time highs in the next 2 to 3 months is high.

I also still believe that this bull market has 2 years left before we see a significant correction or bear market (possibly in 2019). However, again, approach my expectation with understanding that anything and everything can happen and unexpected is inevitable. My reasoning is that we are seeing an economic slowdown. It may be just a cycle within an established expansion trend, or really a slow down. Another reason is Trump as a wild cannon ball implying economic policies which may cause a trade war or economic slowdowns or even an economic halt and all that to fulfill his flawed promises either not knowing or ignoring impacts of those promises.

However, short term, this market is still bullish although we may see some bumpy moves.

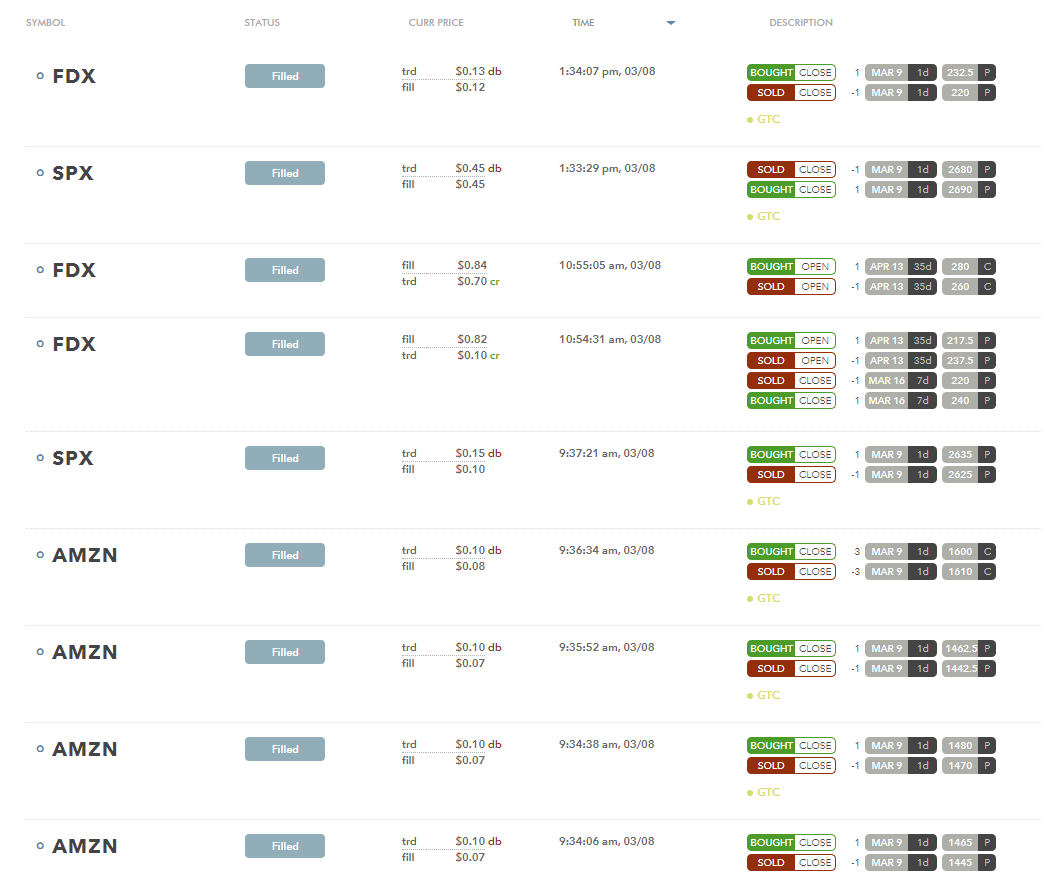

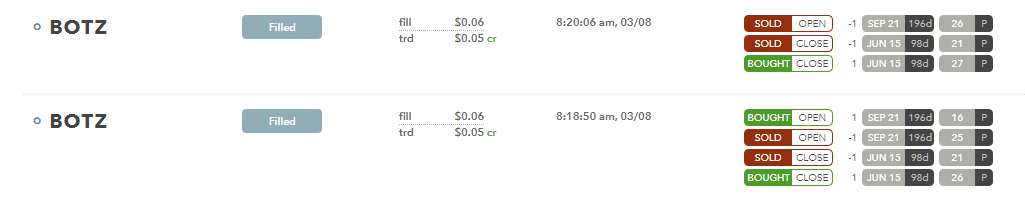

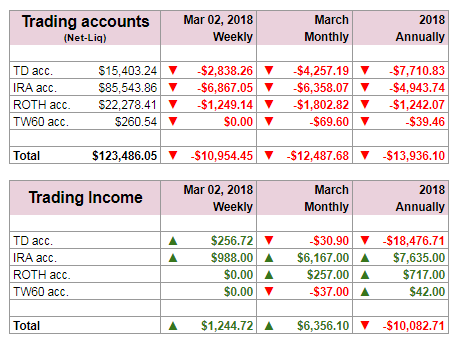

· Trading activity today

This morning the markets went up and I expected another rally. It faltered fairly quickly and the rest of the day the markets was flat. We opened a new put spread but when the market reversed from the rally, the put spread became somewhat hot. But the market was lazy and soon it became apparent that the trades I opened during the day would end up safe and expire out of the money for a full profit:

At the end of the market session, all trades expired worthless for a full profit.

A summary of opening and closing trades.

(balance + $430.00)

· Dividend stocks to buy

Out of our watch list of 36 dividend stocks the following ones are a good buy at today’s prices (03/12/2018):

AGNC

CVX

HD

KMB

MCD

OXY

PG

XOM

As announced yesterday, today morning, we bought the following dividend stocks:

American Water Works Company, Inc. (AWK)

The Home Depot, Inc. (HD)

Occidental Petroleum Corporation (OXY)

What are your expectations of this stock market? How are you preparing yourself for a potential bear market?

|

We all want to hear your opinion on the article above: No Comments |

As I mentioned many times before and it is a part of

As I mentioned many times before and it is a part of

Recent Comments