Another month is behind us and it is time to write another report about trading options for income.

I am excited that I found option trading as a good income tool and addition to my dividend investing. But this tool must be used wisely and every trader must learn how to trade options, how options can make him money or how a trader can lose money. Once you know it, you can build a strategy and a plan which will help you make money and avoid losses.

It took me some time to learn it. And I still do learn. But this time it is not mechanics of options trading, but I am learning how to use my money in account effectively and avoid being caught in a loss and a margin call.

And lately, my account got dangerously low on available buying power due to a few mistakes I made last year. And those mistakes are still hunting me even today.

So what is it?

A biggest mistake I made (and I have seen many novice traders do) is over trading.

It is so tempting and easy to invest more when your trades go your way and you see your buying power growing with it.

One day you have $5,000 dollars available to invest, the next day you suddenly see $10,000 dollars available. How tempting it is to take a few more trades!

I created calculations in my spreadsheet to be my watch dog but I made a mistake in calculating how many trades I can take. And I opened too many trades and I am still having trouble to manage them. Not that I am, losing money, but anytime the trade has a hiccup, my buying power dangerously shrinks and that makes me very uncomfortable.

So, I decided to change my trading strategy for the rest of this year. I will write about it below at the end of this post.

My plan for June 2017 was to make $2,103.83 dollars of income trading options.

Since I already changed our income strategy, we no longer pursue income trading options for the rest of this year. And in June our trading was driven by this new goal.

That’s why this month we haven’t reached this goal. We received $1,293.42 dollars of option income only.

However, I am perfectly fine with the results. Honestly, I haven’t expected them at all.

· Options Trading Strategy

Over time since I learned trading options I went from trading spreads, single naked puts, later added naked calls and landed on trading strangles. Many people are afraid trading strangles. They do not know how to protect themselves when having naked calls trades. I was afraid too until I found out that it is not as dangerous as others say.

I am not saying that there is no risk, but if you know how to handle the risk, you will be able to navigate through strangles with no fear.

Over time I developed my own rules and strategy. You can review it in this section.

I trade primarily weekly strangles against dividend stocks. A strangle is a strategy where a trader sells OTM naked puts and OTM naked calls with the same expiration day. It is a neutral strategy, so you want the underlying stock to ideally stay between the two strikes.

It is though a manageable trade even when the stock is not staying in between the strikes. You can successfully trade strangles when the stock goes down in a decent decline or up in a decent upward move.

What hurts strangles a lot is a sudden strong (violent) move either direction. Managing strangles when the prices drops suddenly becomes a hard work. It is doable, but it can be frustrating.

Here are my rules for trading strangles:

- I trade aggressive strikes (one or two strikes near the money).

- I also trade strikes based on expected move for the given expiration day.

- I trade weeklys only (longer terms only when rolling and roll is not possible for the next week).

- A stock to trade must be a dividend stock (I want to get paid if I get assigned and have to hold the stock).

- A stock to trade must have weekly options (I do not want to give Mr. Market too much time to go against me).

- A margin requirement for a weekly strangle trade must be less than $1,000 dollars (I want the most bang for as little money as possible).

- A premium for a new weekly strangle trade must be 0.40 or $40 or more.

If you want to learn more about how I trade strangles, read my previous post about it.

With the rules set above I trade every week. Every Thursday, Friday, or Monday I open near the money strangle and as the stock moves one direction, I close the untouched side for 0.05 debit and roll the touched side down (if puts) or up (if calls).

Therefore, I am closing winners for profit and roll losers to avoid a loss.

By rolling, I try to improve the losing trade and make it a winner again.

Over the years I worked on my strategy to make it mechanical as much as possible to eliminate any emotions or second guessing.

I know what I want to trade, how I want to trade it, and when to trade it. And I do it every week. And I do always the same thing every week, same trade methodology, and same execution process.

This allows me to ignore any noise in the market and not tremble in fear “what if I open a trade and it goes against me”.

· Options Trading Results

June 2017 was a very bumpy month for our company. At some point the value of our account skyrocketed (the net-liq almost reached $27,000 dollars) just to lose it all the last few days before the month end. The loss was so deep that our net-liq dropped down to $22,000 dollars and our buying power shrank down to $200 dollars!

That was so dangerous and a game changer.

I knew we were over trading our account and I was not able to force, discipline myself, as our company trader, to follow the given rules of how many trades we can have open at a time.

This was yet another warning from the market to stop playing this hazardous game and follow the rules!

Nevertheless, our trading in June 2017 finished that bad given how dangerously bad our account looked at one point during the tech stocks sell off. We made $1,293.42 dollars which was 5.58% monthly revenue on invested capital (ROC).

Our average monthly revenue dropped to 7.87% from last month’s 9.45% ROC.

However, we increased our exposure in the market by adding more trades (we invested approx. 8.07% more of available cash this month) and our equity grew by 2.76%.

This had negative impact on our net-liq as the net liquidation value actually dropped by 3.90%.

Last month I wrote about a few trades ending soon. These were mostly in tech stocks. One of the largest position was in Amazon (AMZN). Thanks to the sell off at the end of the month I adjusted the trade. Later it seemed to be a mistake. If I waited, I would have been probably OK. Now, I adjusted the trade and if the stock starts rallying again, the trade I was looking forward to close in July may not close and I will be forced to drag it for another month or more.

But that is a nature of trading. We do not know the future and we sometimes react based on the current situation and market moves. Not always this is a correct approach. You should wait patiently for the development and accordingly to your plan.

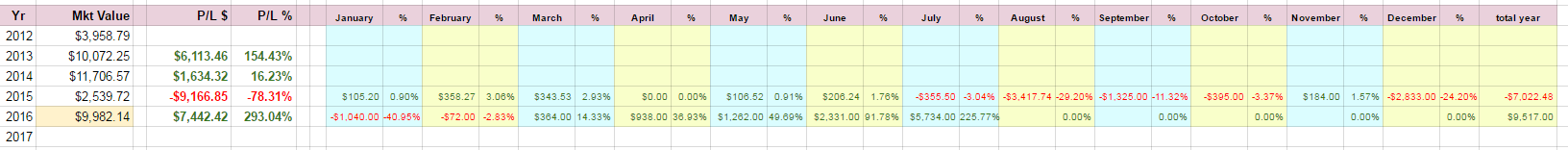

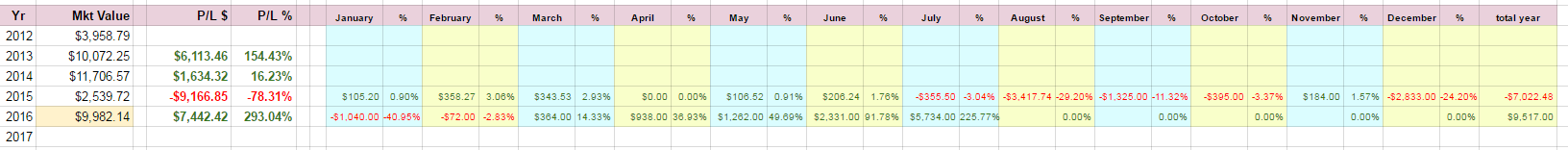

Below you can see all data and progress in our trading account:

Month-to-moth trading results

(The red dots on the chart indicate income estimate, blue bars actual earnings.)

| In June 2017 we made: |

18 trades |

| Total trades in 2017: |

227 trades |

| June 2017 options trading income: |

$1,293.42 (37.75%) |

| 2017 portfolio Net-Liq (net)*: |

$3,832.19 (-1.62%) |

| 2017 portfolio Net-Liq (gross)*: |

$23,165.26 (-3.90%) |

| 2017 portfolio Cash Value (net)*: |

$34,461.19 (8.85%) |

| 2017 portfolio Cash Value (gross)*: |

$53,794.26 (3.71%) |

| 2017 portfolio Equity (net)*: |

$38,336.19 (6.75%) |

| 2017 portfolio Equity (gross)*: |

$57,669.26 (2.76%) |

| 2017 Liability/Debt: |

$19,233.07 (-4.83%) |

| 2017 overall trading account result: |

16.11% |

* The numbers marked as “net” and “gross” are results with loan (liability) included (gross) or excluded (net).

We are presenting you our month-to-month business performance review:

In June we traded only a few trades, mostly roll overs of trades which didn’t go well.

I still struggle finding the best way to post the open trades and write about them in some meaningful way, so it will be easy to follow for you, our readers.

If you have an idea or recommendation on how you want to see our trades, please let us know what should we post and how should we present our trades to you.

This month, I will try to present all our open trades to you in the spreadsheet below, so if you follow our trades either in our Facebook group or via our emails, you can be comparing what trades we have and what trades we either opened or closed every month.

Here is the spreadsheet for June 2017:

(The image shows open trades through June 2017, if you wish to see up to date open trades, click on the image or here.)

The main reason behind our net liquidation value stagnation or even drop was too many open bad trades. We are still rolling those trades and manage them as I hope to finish them as winners one day. But they consume and block our buying power.

Some traders will tell you that such strategy of defending bad trades is not worth it and that they would rather close a trade for a loss and redeploy their money elsewhere.

Well, I was there myself. I have done that. In 2015 I did exactly that. I was closing bad trades and wanted to redeploy my money elsewhere.

I finished doing this piling one losing trade on another, collecting losses, and wiping my account out. I lost $28,000 dollars doing this.

So, I am not convinced about this strategy and my plan is defending the trade as much as possible no matter what others say or think about what this strategy would do to my AR%, net-liq, revenue %% or whatever else. Once a trade becomes a losing trade, I apply repair strategies and I do not care whether my AR% is 120% or 0.0000001%. I am repairing the trade. I am no longer expecting the trade to make money for me. I just want out for break even or original credit. Period.

Below are my comments about our existing open trades:

Amazon (AMZN) is a bitch! It keeps hunting me. I opened this earnings play in February 2017 and I am still in it unable to finish it. I traded Amazon in the past for a client on his account and I made tons of money. But back then, Amazon was the exact same bitch as today.

I collected great credit trading this stock, but it was not an easy money. Amazon will not give the premiums for free, it will sell its skin dearly.

As our trade in Amazon neared to expiration a tech stock sell off sent the price so low that our put spreads became ATM and at some point even ITM. What looked like a no brainer trade was suddenly a nightmare.

So, I adjusted the trade. I rolled puts down and opened a new call spread creating a new Iron Condor (the trade hasn’t been reported in the review below yet).

Now, this bitch is rallying again and it seems the call spread will continue hunting me again.

Here is the trade review:

AMZN earnings play – TRADE OPEN

In June we only closed a TECK trade and we still sit on the rolls or new trades from previous month. No new trades were opened.

Here are the trade reviews:

TECK strangle trade – TRADE OPEN

TECK strangle trade #2 – TRADE OPEN

We also have trades against STX, X, ESV, BMY, WYNN,LULU, and MNK which I haven’t reported regularly in this blog and I plan on doing so later as these trades end or I open new ones.

· Our New Options Trading objectives

As I mentioned above, I decided to change the strategy of our options trading. To be exact we are not changing the strategy, it still is the same, but our objectives or goals we want to achieve are now different.

Since we have so many opened trades in relation to our account and any serious sell off can dangerously damage our account and liquidate our trading (and eventually put my dream of trading for a living to an end), I decided not to focus on income for the rest of the year, but to raise cash available for trading.

This means, that for the rest of the year we will:

- We will not open any new trade.

- We will only maintain existing trades – roll, adjust, convert.

- We will close existing trades only.

The goal is to close as many trades as possible and raise buying power and eventually net-liq to match our cash value and equity value.

· Options Trading July 2017 outlook

I expect the stock market to be volatile in July. We still may see some pressure when bears would try to overcome the market but I think they will not succeed and that the US macro data would steamroll them back to defeat.

The recent selling and 5.3% correction of QQQ will most likely stay as is – the correction and not a beginning of a new trend. We still may see some pressure though.

But if we believe that the US economy is in fact accelerating it is logical that we want to be on the long side and not bears. The recent good job numbers (amid almost a full employment) indicates that there is still plenty of room for growth and that growth is picking up.

In a few years ago we were complaining about Obama administration changing the rules on counting employment rate excluding people who stop looking for jobs. These people are now coming back to the labor pool and that would push the labor numbers higher even more. And you can see it all over the place that companies are hiring and in fact struggling to find workers.

So why all are concerned and the consensus is that the stocks are expensive and due for a catastrophic bear market, I believe this is just a dip you want to buy.

What do you expect from the stock market in July or the following months? What do you think: Is the US economy accelerating or decelerating?

Just look at recent data on durable goods, capital expenditures and corporate profits. Here are the key charts:

HOUSEHOLD DEMAND

CAPITAL EXPENDITURES

CORPORATE PROFITS

(Source: Hedgeye.com)

We all want to hear your opinion on the article above:

5 Comments |

For Monday morning, I am placing a new strangle trade using

For Monday morning, I am placing a new strangle trade using

Recent Comments