September seemed again to be a slow month, yet it ended very nice with a great income from trading options.

In September, we made $5,083.50 in premiums!

However, many of our trades gave us a hard time and once again we found ourselves in a trouble of being over-invested. Thus October may be slow as we will not be opening any new trades, but mostly managing the existing ones, and attempting to close them for profit. If the market will not cooperate, this may have an impact on our next month revenue.

September dividend income was better than August but not as much as we would like and expect. This month, the dividend income was $80.24 which was higher than the last month income of $59.16 dollars.

Options Income = $5,083.50 (account value = $13,873.32 +446.25%)

Dividend Income = $80.24 (account value = $20,329.86 +34.28%)

If you wish to see details about each account, continue reading below.

You may be interested in:

Should the Fed start buying stocks? Not according to these market experts By Michelle Fox with MFoxCNBC

Common Misconceptions about Dividend Growth Investing By DGI with Dividend Growth Investor

Day Trading Salary – How much money can you really make? By Alton Hill with Tradingsim

Recent Sell – Bank of Nova Scotia By R2R with Roadmap 2 Retire

How Things Have Changed on Wall Street in the Last 50 Years By Ben Carlson with A Wealth of Common Sense

· September 2016 trading results

September options trading was very successful again. We have made a nice $5,083.50 dollars revenue this month. We have currently open trades with a potential of gross profit of another $13,000 dollars (a current trades’ extrinsic value). If everything goes well and we will be able to close the trades for profit, without rolling them too much, we should be able to collect at least 50% of that extrinsic value (another approx. $7,500 dollars). Of course, this depends on how well our positions would perform next month.

In September, we again went a bit rogue with opening new positions (we expected better results from the underlying stocks and we were a bit more optimistic) and this got us into trouble of being over-invested. Therefore we will be mostly managing the existing trades and closing them rather than opening any new trades.

For September 2016, we set a revenue expectation at $3,000 dollars, which was a revised amount after weak August. I am happy to announce that we have exceeded this amount by far. Nevertheless, this was achieved mostly by being able to close a few old trades and collect great premiums. All remaining trades are still not matured enough to be closed so we are expecting October to be back to our original estimates and we should be able to provide $3,500 revenue for October 2016.

I am happy to see that our business is slowly picking up and growing at a nice pace of average monthly rate of 4.33% account growth. This rate would provide a nice 51.96% average annual growth. With that being said, we are performing above the average this year so far as our account is up by 446.25%.

Below is a quick review of all trades we made this month.

I also post our trades in real time on Facebook. When we post a trade we try to write reasons for taking that trade, all our expectations, and a plan for that trade for every possible situation. Sometimes not easy to write about trading, but I am trying my best, so other can learn.

If you want to see, follow, or mirror those trades, you can join our Facebook group.

There are also other traders in the group and they are posting their own trades and ideas. They are also willing to help and provide their view and advice for every one to learn. You can follow those trades (mirror them), paper trade them, or just watch them and learn.

But note that the group is limited to 250 members, new members will be admitted into the group only if free seats are available. Once the group is full, no new members are allowed.

Here are our trading results for the month:

| September 2016 options trading income: | $5,083.50 (200.16%) |

| 2016 portfolio Net-Liq: | $13,873.32 (35.08%) |

| 2016 portfolio Cash Value: | $20,762.32 (9.16%) |

| 2016 overall trading account result: | 446.25% |

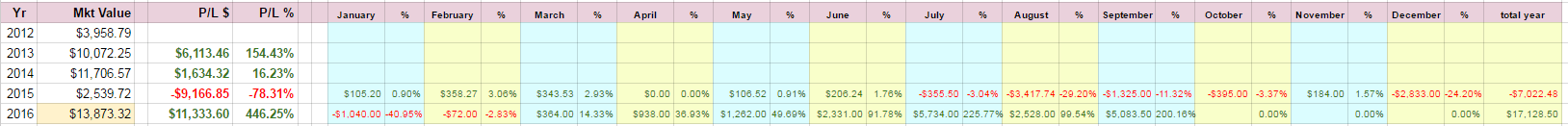

Here are the results of our options trading:

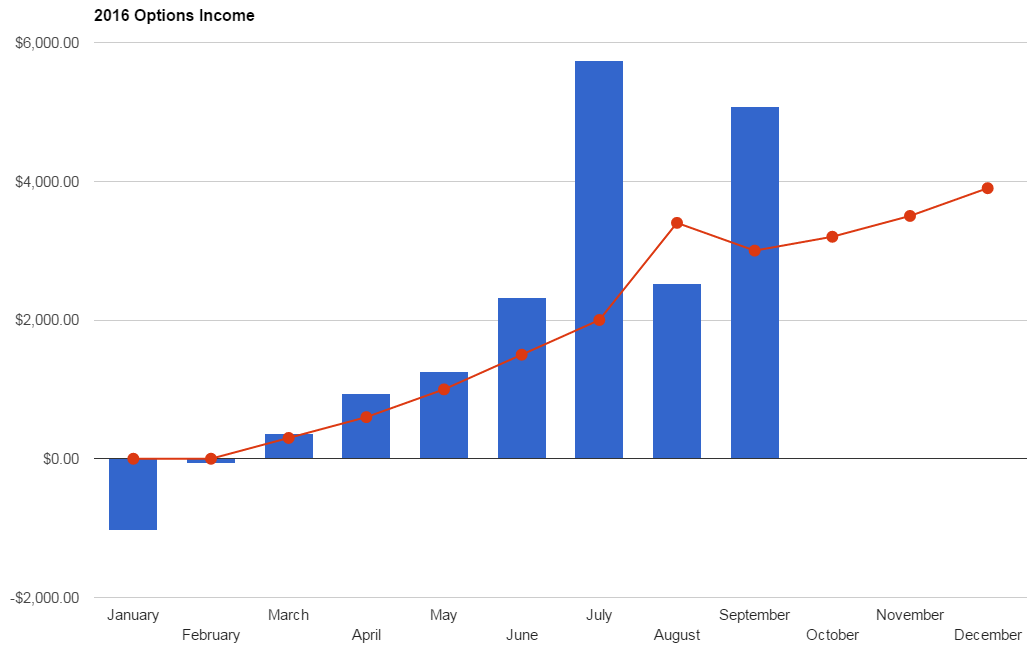

Here is our monthly income from options trading:

Here are the individual trades from the beginning of the year thruough this month:

The table above shows our trades up to date. They are real trades we really traded with our own real money. Some people do not believe that it could be possible to achieve such results, and called me names, fake, liar, and fraud. But what you see in that table above, is the final result of our trading and our trade management. You want see the entire picture of what happened between opening a trade and closing it. There could be several rolls in between. However, it still indicates our ability to manage our losing trades into winning ones. And that sometimes take time (a lot of time) and additional buying power (if you are adding another leg or converting a trade into a different structure).

As I said, not all trades are immediate winners. Some turn bad the very next day and some require an extensive management and adjustments to end them in green. Mystics, Random Walk academics, and Efficient Market theorists are typically and equally divorced from the reality of the market and trading. Amateurs who love forecasting and mysticism (Alexander Elder, The New Trading for a Living), will not get it and will cal you names.

From our trading records we can report our average trade holding time to be currently 18 days, average P/L 1.82% and 72.17% annualized return.

We also have a plan for 2016 to create an average monthly income from trading:

2016 plan $1,000 monthly income – COMPLETED in July 2016

2016 plan $2,000 monthly income – IN PROGRESS ($1,903.17)

Note, these are monthly averages based on 12 month results. The individual monthly results month to month may differ.

Here are results of the individual trades we traded this month and my comments:

ESV

ESV continued its steep decline running away from our assignment price of $11 a share. It dropped to $6.50 dollars a share at some point and it didn’t look very uplifting. I is obvious that we will stay in this trade a lot longer than I originally thought. So we continued selling covered calls against the stock. At some point we sold a call with 7 dollars strike. At first I was a bit hesitant about this strike but as the stock continued lower I was thinking that this might work and we might get out before the stock starts recovering, if at all.

Sure enough, the stock jumped high and above $8 dollars on the oil recovery and Saudis reaching the deal/no-deal on oil freeze. There was a time to take action and roll. So we rolled our 7 call strike up to 10 strike, further away in time and we sold a new 8 dollar strike put to offset the cost.

We now have a few put trades at 7 strike, 8 strike, and a very old trade at 9 strike (which we may roll lower when the time comes).

The details of the trades and all adjustments can be found in our Facebook group.

LULU

LULU happened to be a bummer trade. It all went well until an assignment of the stock.

Originally, in August, we opened a jade lizard trade with 73 put strike and 83/83.5 call spread. It all was OK until the stock sold off on the small revenue miss (which I personally do not consider a tragedy). Since then, the stock was dropping like a rock.

When the stock reached 67.57 a share, we rolled our short 83 strike call down to 62.50 and created an inverted strangle. We left the 83.50 call expire worthless.

The same day (by a mistake) we rolled the trade again moving our call lower (from 62.50 to 60 strike) while keeping our 73 put strike untouched. We collected enough premiums and lowered any loss down to $313 for the entire trade. I was prepared to roll the entire inverted strangle again into the next month, collect another approx. $250 – $300 dollars credit and get out of the trade with break even or small gain.

Unfortunately, I got assigned a week before expiration. I still wonder, who would early assign already deep in the money put option week before expiration when you could wait one week and let the option assign at expiration. True, if the trader on the other side of my position waited until the next week, I would roll the trade and it wouldn’t be me who got assigned, but someone else.

So, now I own 100 shares at 73 a share, which changed the entire strategy. However, although I have a loss on the stock, I collected enough premiums to sell the stock at a loss and still end this entire trade as a winner (the stock is losing approx. $1,300 dollars, I already collected $2,234 dollars in premiums, so I am still about $934 dollars ahead).

I am not going to take the loss but keep the stock and sell covered calls against it.

Since we will not be able to sell covered calls at or above the assignment price, we have to be selling below (deep below) it and roll the calls up should the stock start recovering again (as of today, there is no sign of recovery, though).

After I got assigned, I immediately sold 67 strike call and a new 65 put against the existing 60 strike call (remember, we had 60c / 73p inverted strangle; 73 put got assigned, 60 call was a left over).

Now we had a new 60c / 65p inverted strangle. The stock seemed to stop at 65 level and for some time it looked like it found a support at that level. I was thinking that if the stock started recovering I would be rolling our calls and let the put be. If on the other hand the stock continued lower, our put would be in the money and that would be great for our inverted strangle trade.

The latter happened. From looking at the chart, it was obvious that if the $65 support wouldn’t hold, the next stop would be at 60 a share. When the stock broke 65 level, I decided to roll our trade again.

We rolled our $65 put down to $55 strike and sold a new $62.50 call against it to offset the cost.

In the mean time, our $67 strike call became close to worthless and we bought it back for a nice profit. The same happened with our original 60 call which we could close for a nice profit. As of now, we hold a regular 55p / 62.50c strangle. The stock struggles to move above $60 level (it seems we will be going lower, probably even to $55 a share). If it continues lower, our $62.50 call will become worthless and we will either let it expire or buy it back for a few cents. If that will be the case, we will sell a new call.

As of now, we will continue selling covered calls (and eventually rolling them up should the stock move higher) and selling naked puts to collect as much premiums as possible.

Anatomy of the trade (LULU) gallery:

[Best_Wordpress_Gallery id=”1″ gal_title=”LULU”]

MNK

I opened two trades against MNK in September. One was a short term strangle, which was supposed to expire in 4 days, the other a standard 45 days jade lizard.

At first both trades went well, but later in the week MNK struggled and went below my short put strikes on both trades. On Friday, expiration day, the stock moved up and ended above the put strike and the trade expired for a profit.

But the second trade, the jade lizard, was still on and the stock refused to cooperate. The stock collapsed. The entire trade went from good to bad and ugly. I decided to roll the trade. I closed the long 78 call option for the remaining value in it (and collected $65 credit) and rolled the remaining strangle down.

The stock continues hoovering around $70 a share. If it stay like that I should be able to close this trade for a profit. As of now, I need to sit tight and wait.

TRGP

TRGP was a good trade. I could close both 40 and 39 strike put trades and collect significant credit for it (respectively end the trade for the credit). I collected almost $1,500 credit to close those trades.

I opened a new naked put trade though and this trade is still on and I am waiting for it to end.

PSX

There are no changes in PSX trades. It is a “waiting game”. I have buy back orders placed so I am waiting for the trades to lose value enough to get closed.

STX

STX was another good trade at the end. I closed my original trades which I opened sometimes in April and then the stock got busted on earnings. I was left with 100 shares and 32 strike puts while the stock was trading at $18 a share. By managing the trade I could end the trade as a winner – I sold the stock using covered calls for a small profit, and this month I even closed my 32 strike puts for a profit.

I described my struggle with STX in the second part of my previous post on how to manage losing trades.

As of now, I have no positions in STX anymore. I still like the stock and may trade it in the future.

WYNN

WYNN is a nice and premium rich stock. I love to trade it although it is giving me a hard time. Nevertheless, the stock movement is very predictable. At least for now. You never know when the stock changes its behavior and starts doing something completely different.

During September we opened several strangles and lizards against WYNN. When the stock reversed and it was obvious that the stock was heading down I opened a few more strangles or rolled down puts while opening more naked calls. At some point my bearishness towards the stock was so significant that when the entire market was selling hard at the beginning of September on a fear of the Fed raising the interest rates, our account was actually growing and making more money. I was stunned of the account performance.

Of course this didn’t last forever and when I saw that the stock started holding its ground I eased the call side a bit. Also as the stock was going down, I was closing the naked calls one by one. I am keeping naked puts as of now and have my “naked calls slots” empty in case the stock resumes selling and I will have to roll our put trades lower and selling new calls against those puts to bring more credit. with a few naked calls open trades this would help me to do without using more of our buying power (in other words, those trades would cost nothing in terms of margin requirements).

However, I do not expect the stock to go much lower (I may be wrong of course) as it started showing some strength recently. If the strength will be confirmed, I will start selling more jade lizards and also closing old puts for a profit.

If you like these trades and want to be informed when I place them and trade them in real time, you can join our closed Facebook Group. The group is a closed group and there are other traders posting their trade ideas too. We learn from each other, eventually ask questions, get answers, but most importantly you can see what we trade and how. You can follow those trades.

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

How to Start a Consultancy Business? By SB with One Cent at a Time

How Starting a Blog Grew My Opportunities to Make Money By Grayson Bell with Debt Roundup

Recent Buy — TROW By MDP with My Dividend Pipeline

Five Fundamental Laws Of Trading By WV with Winvesting

Marriott Vacations Worldwide By Dennis McCain with Dennis McCain Investing

· September 2016 dividend investing results

I use DRIP to reinvest dividends and what I like to watch is how DRIP is affecting my dividends and a slow growth of my account.

To speed things up I decided to trade options in ROTH IRA although not as a primary source of income, just to increase money to be able to reinvest them. So I sell puts against stocks I do not mind owning such as PSEC, ETE, ESV, etc. (I do not have yet too much money available to invest into options, so I have to stick with cheaper and riskier stocks).

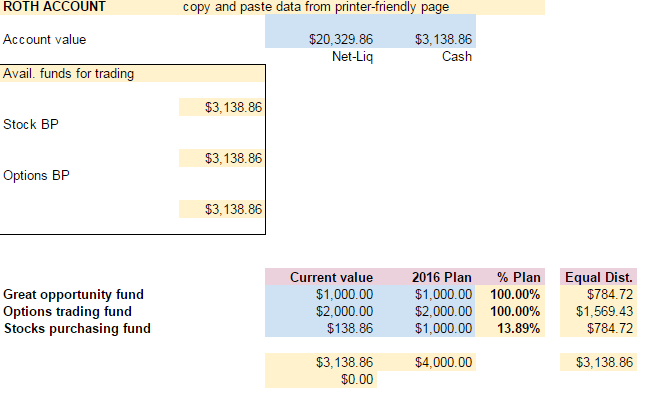

I decided to create three sub-accounts (created in my spreadsheet as a mental sub-accounts) with a certain purpose. Here is my plan for 2016:

1) In 2016 I want to save $1,000 for great opportunity. Time to time a stock with a great opportunity shows up. A sudden fall in price or selloff can happen. Then, I do not have cash to buy such stock. This fund would serve this purpose to have cash to buy.

2) My next “virtual account” is dedicated to options trading. In 2016 I planned to save $2,000 dollars and use them for options trading. This month I was able to save $2,000 and have it fully invested in options to generate cash. All income from options is now being relocated to my “Great opportunity virtual account”.

3) Once my “Great opportunity virtual account” will be funded I will be relocating all income into my next virtual account – stock purchasing account. Once I save at least $1,000 in this account, I will buy shares of a stock in my buy list.

Well, little game of mine.

But, it helps me to stay on track.

Here is a picture of my spreadsheet showing my “virtual accounts”:

Here is my ROTH account review:

My annual dividend income this month increased from $902.41 to $920.74.

Dividend stocks added or removed from portfolio:

| September 2016 dividend stock buys: | none |

| September 2016 dividend stock sells: | none |

To purchase stocks I use trailing stock order strategy OTO trade order (one triggers other) and I described this strategy in my post about purchasing stocks in falling markets.

I also invest into dividend paying stocks using Motif investing which allows me to buy all 30 stocks I want in one purchase using fractional investing, similar to a mutual fund.

You can actually build your own mutual fund with Motif investing.

Here is my Motif Investing account you can review:

I continue reinvesting my dividends using DRIP program. I love how my holdings grow when reinvesting the dividends and when the stock prices are going lower. As I believe we are heading into a recession I will be able buying more shares for a lot cheaper.

Dividend stocks DRIP:

| September 2016 DRIP: |

American Capital Agency Corp. (AGNC) $28.57 |

Here are my ROTH IRA trading/investing results:

| September 2016 dividend income: | $80.24 |

| September 2016 options income: | $0.00 |

| 2016 portfolio value: | $20,329.86 (1.66%) |

| 2016 overall dividend account result: | 34.28% |

The account grew by 1.66% from last month, overall I am up 34.28%. The dividend income was down from last month as August was a weak month. All dividends were reinvested back to the companies which generated them.

Here is my dividend income:

Annual dividends since the beginning:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Week in Review 39/16 By DH with Dividend Hawk

BUSINESS TALK – HOW TO RAISE CAPITAL FOR A HEDGE FUND – THE ROLE OF A GENERAL PARTNER By RC with Raise Capital

My First Near the Money Put with VIAB By Evan with Building Income Investments

Gold set to suffer a ‘deeper dive’ and drop another $200: Wells Fargo strategist By Alex Rosenberg with Trading Nation

Recent Option Transaction By PIP with Passive Income Pursuit

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts increased from previous month and are making 37.05% (up 2.51% from previous month) for the year.

Remember, if you like trading options and want to have trade ideas for free, join my Facebook closed group and follow my put selling trade ideas in real time, comment, ask questions, and interact with other members. Other members of the group can also post their trades so you can learn from them too.

What do you think?

How about your investing or trading results?

Do you have any question? Need help to start trading or investing? Shoot me an email or let me know below in comments how I can help you.

A slow month with over $5k in options premiums!!! I’d like that kind of slow pace too. I realize that going into October many of those premiums made in Sept. are still open trades this month but still you collected a huge amount for the month. As you mentioned, now it’s all about managing those trades. To be honest, that’s a lot of options trades you list above and most are naked which I just see as being too dangerous for my taste. Looks like your focus is pretty much options these days and dividend income secondary. Thank you for sharing your recent results.

Hi Keith, Those premiums are already closed trades, so nobody can take them from me anymore. The goal is to create such sustainable income from options so I can invest into dividend stocks, because I didn’t have enough income from a job to invest. So creating an income which can be reinvested was my goal from day one and it looks like I am getting there. So as of now yes, dividend investing is a secondary goal. And it is not risky, it only may seem as such, but if you know what to do, it is perfectly safe. Good luck!

Hi Martin, really impressive!, I’m just discovering this world of options and its possibilities!, and this web looks very helpful!.

Just want to ask one thing, if your account value for options is $13K and you made $5K in premiumns last month, what is the leverage you are allowed to use with your broker?.

Many thanks!

Oscar.

Hi Oscar,

the 13k account is my own money only without margin and a loan I took to be able to trade more. I have 50,000 equity in the account, and my net-liq value at $33,000 and 42,000 cash as of today, however, I borrowed $30,000 to be able to trade more than if I used my own money only. I use the proceeds to pay the loan down (not all of it as I have rules how much I can withdraw and how much to reinvest), but I paid approx. 8k of that loan down already, so 13k is my own net-liq, 20k my own cash and I still owe about 22k on my “business” loan. So the numbers may not add up without disclosing the loan. At first I didn’t want to disclose it in case I fail so I wouldn’t look like a complete idiot, but it looks like it is working out well so I may disclose it in my next review.

Thank you for commenting.