I keep buying what I have been buying since 2006 and that is high quality dividend growth stocks. If you look at the chart from 1982 to 2000 (that is 18 years long bull market) the market was making new all time highs until 2000 for 18 years. 18 years of all time high market. And that is excluding the previous 10 years from 1972 – 1974 bear market when the market rallied from 1975 to 1982 recovering from the lows and then added additional 18 years of rally and some 900%+ gains.

So, if we look at the history and we see that the exact same pattern happened before (twice) what makes you think that this market cannot rally additional 18 years from the recent breakout in 2013?

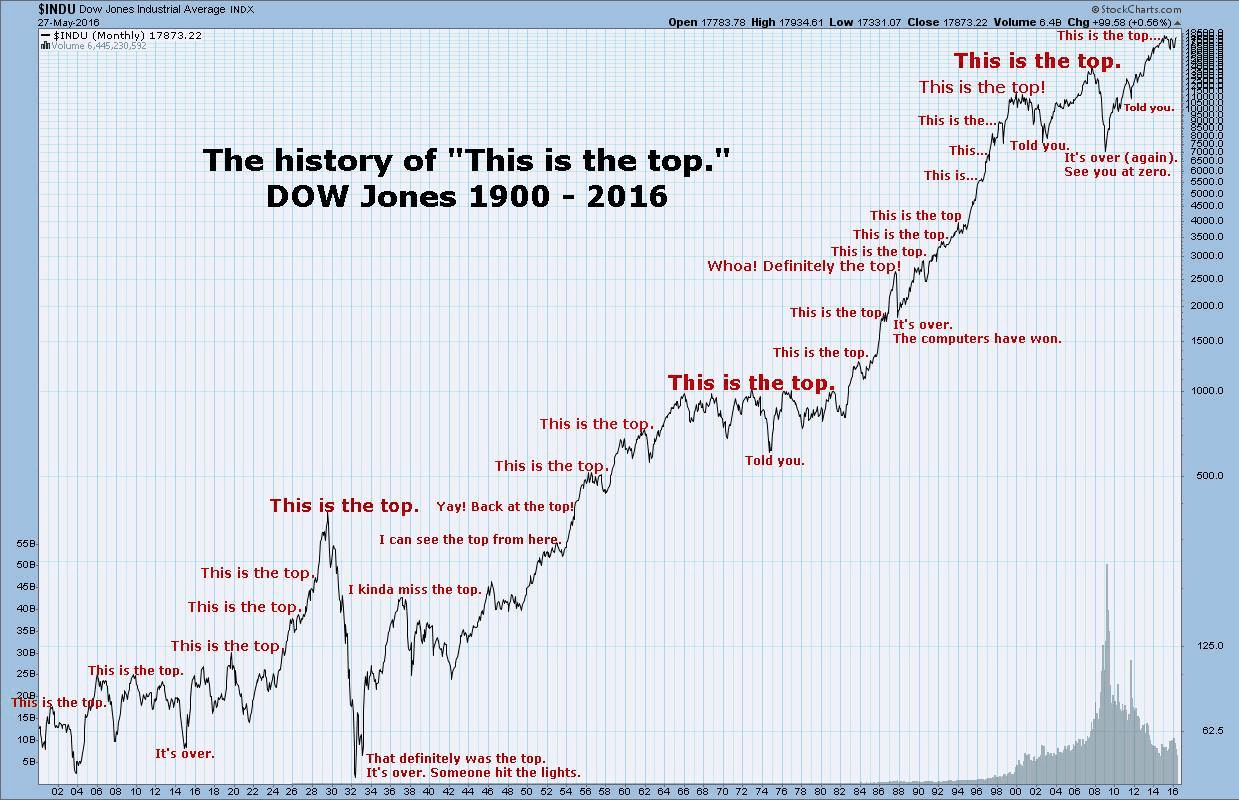

See the chart:

And here are the cycles I was referring to, indicating easy markets and difficult markets. We just broke out from a difficult market and we will see additional cycle of an easy market. It could be additional 18 years and additional 800%+ gains:

Of course, the rally up was not a straight shot. there were corrections and secondary bear markets (drops by 5% to 20% at times), but overall, the markets went up.

So, knowing this, why would you be panicking about all time high when 90% or so the markets in fact spend time making all time highs?

Leave a Reply