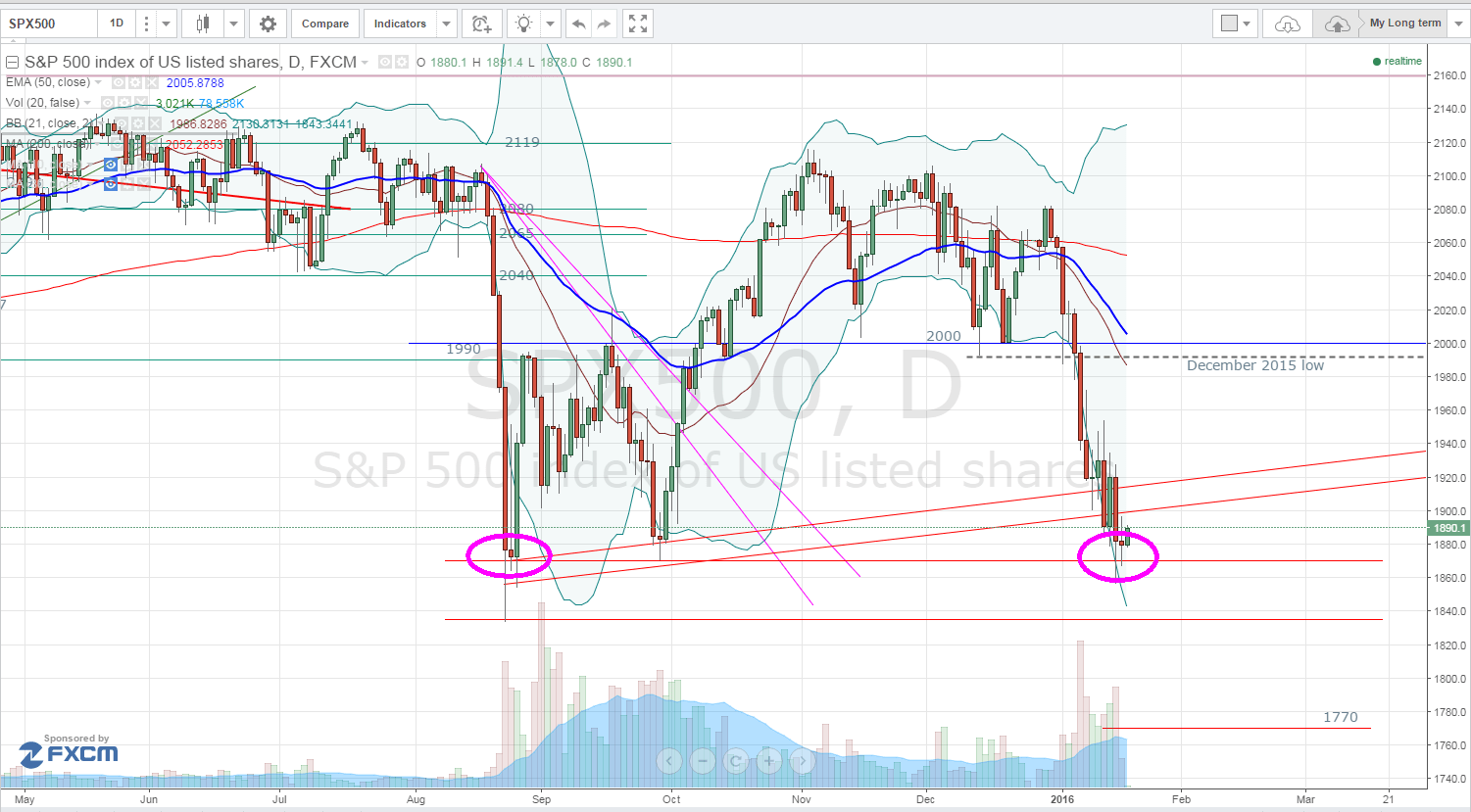

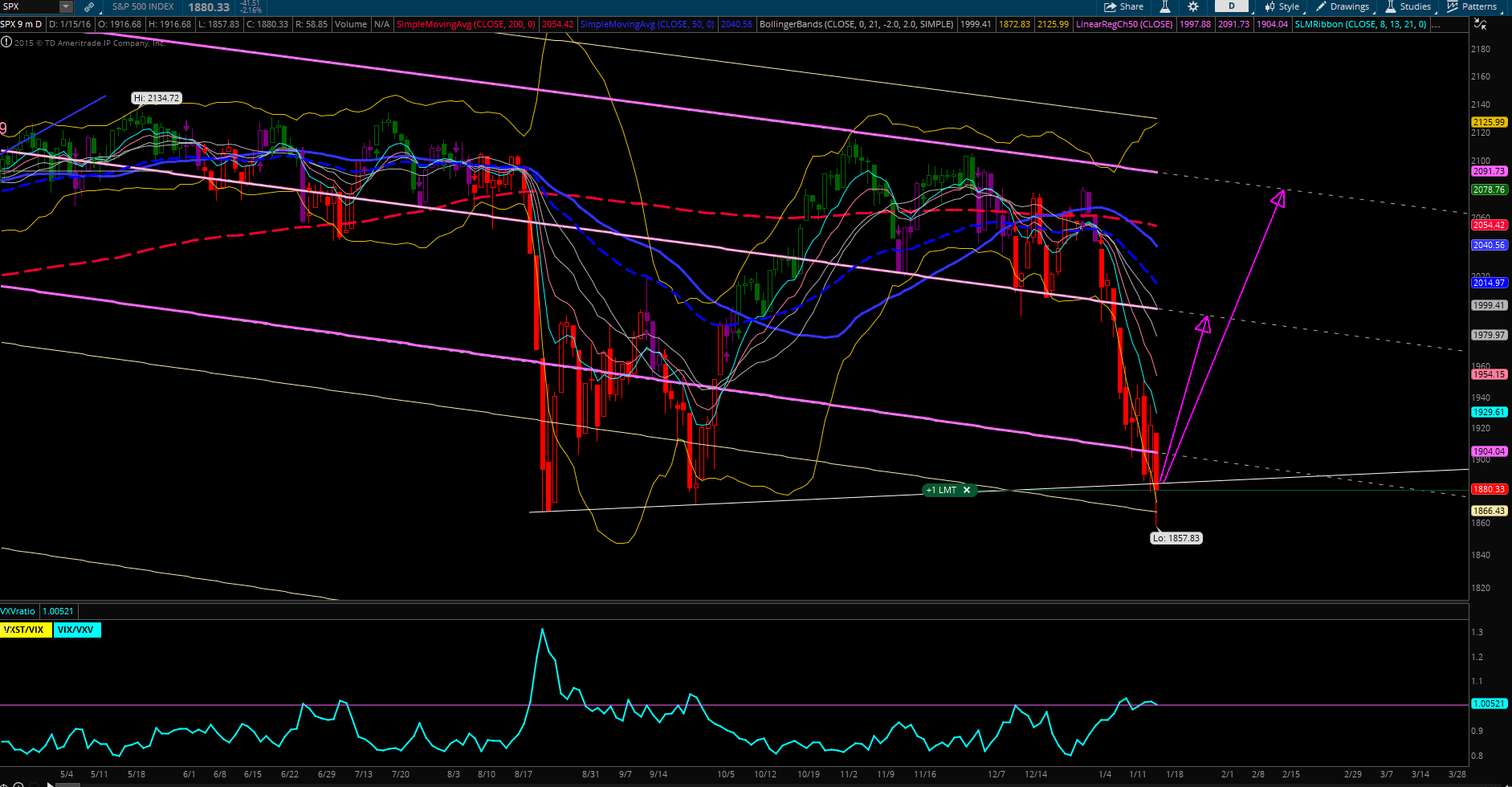

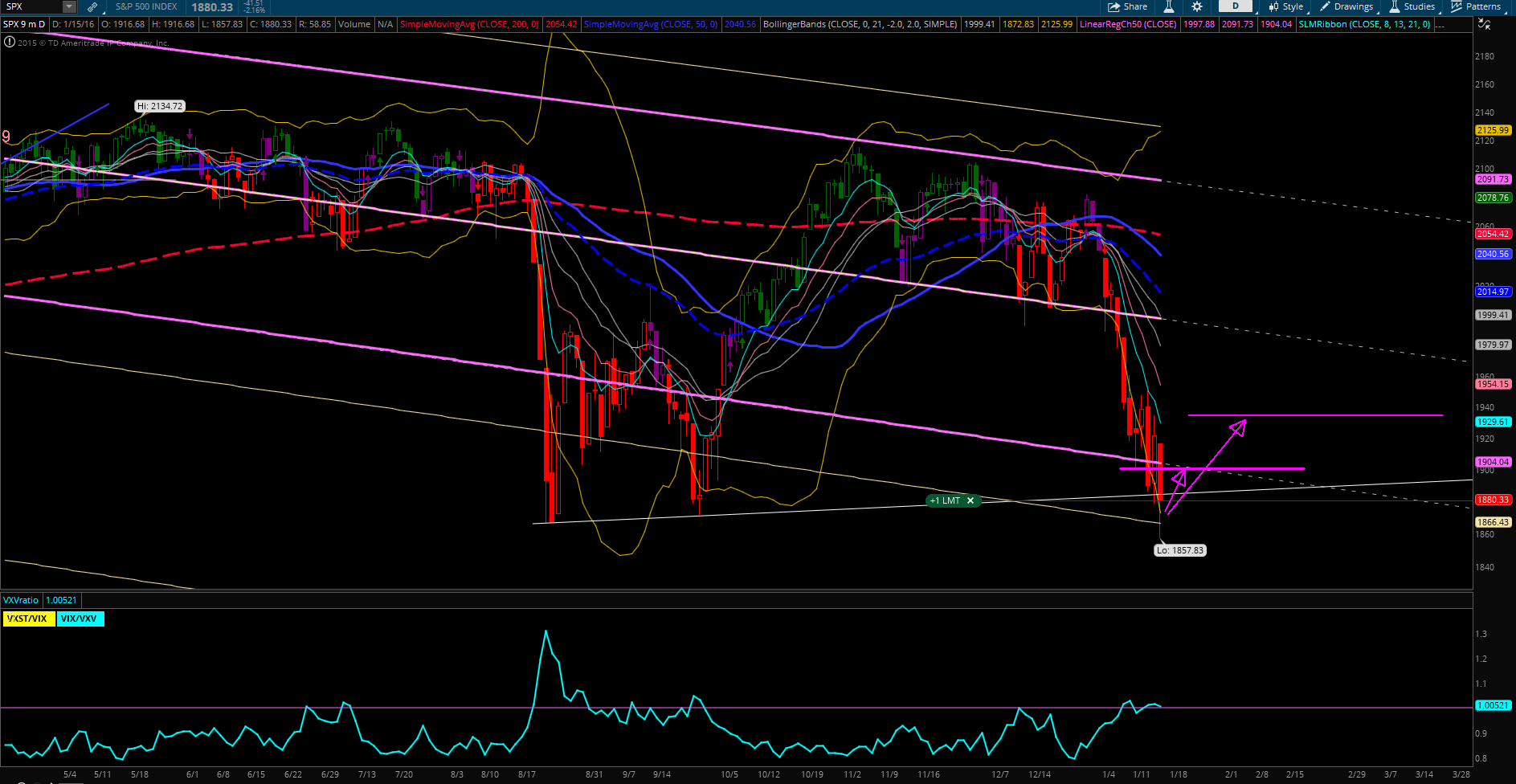

The S&P 500 is now 12% off of the all-time high price. Many investors and traders say that we are way oversold and we should go up from now here or bounce.

Yes, we may bounce, but overall, market price action data indicate that selling is far from over and that we may see more selling to come. The data shows that we may drop yet another 10% before we can claim an exhaustion and trend reversal.

The video worth watching with Peter Schiff predicting how FED and Congress will most likely try to fix the coming crisis, which will at the end create an even bigger crisis. The result may be that the new medicine FED is going to prescribe may not work at all.

But I admit, we are at the critical support which may hold. But will it really hold? What’s ahead of us then?

We may see a relief rally, bounce, or a plain rally failure and resumed selling.

· Relief rally

The S&P500 is at the critical support level. Last week we dropped all the way down to the August lows. Some traders were predicting this outcome way before in October and November last year. I refused to believe it as I didn’t see any catalyst for a renewed selling. Yet it happened.

This creates a significant support which may attract “big dippers” (dip buyers) who will be buying at these levels. The buying spree may be strong enough to move the market relatively high.

We can see the market push back up to 1980 level.

The dipper’s buying may even push the market all the way back to back 2060- 2070 level. However, I do not expect this outcome at all.

· Bounce

It is possible that bulls will be able to push the market only a little, more like in August 2015 when we saw only a moderate recovery and a second dip afterwards signaling a problem. We may see a bounce to 1930 – 1940 level only. We may even see a bounce to 1900 level which is now yet another significant resistance level which bulls may not be able to overcome.

When reviewing other data and market behavior as I will show below, I believe this is a more probably outcome, that we only see a small bounce and then selling will resume.

But I see an even bigger chance of the market opening with a bounce up tomorrow morning, then selling resumes in the afternoon and we will see another 10% selloff in the coming days or weeks.

· Another 10% selloff

Why I think there will be more selling coming?

There are a few reasons for it. Of course the first reason is slowing US and world (global) economy. Do you remember my post about transatlanting transportation? I wrote the post 8 days ago and I was checking the cargo ship movements time to time on the Marine Traffic website to see if the halted commerce was an anomaly or something more serious.

There are still no ships transporting goods over the Atlantic Ocean. No single oil tanker or cargo ship. They are still halted docked at the port or near cost.

If you open the web site, you will still see the same picture as the one below I posted eight day ago:

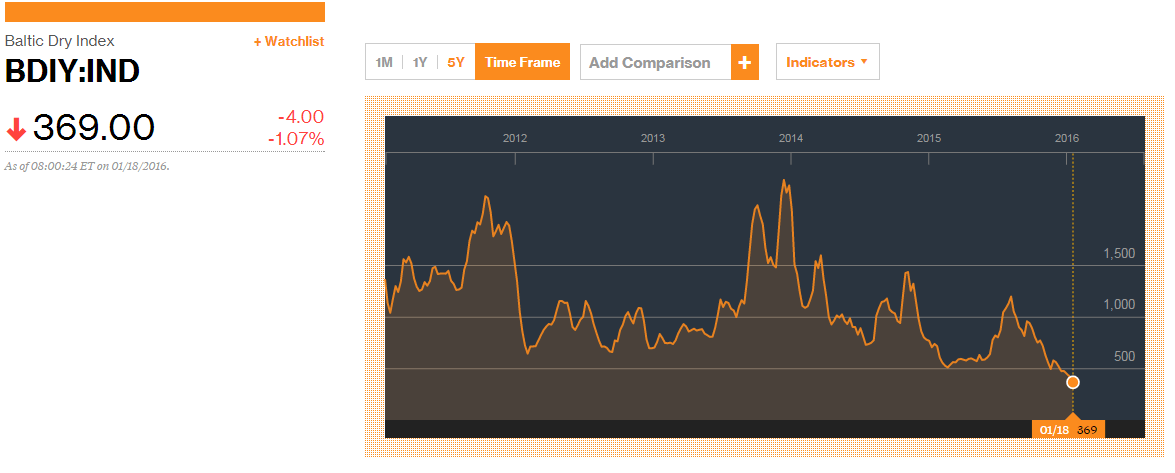

Is this an anomaly? Or is the website working? How else we can verify whether the traffic is moving? Let’s take a look at Bloomberg Baltic Dry Shipping index:

The Baltic Dry Index (BDI) measures the rates for chartering the giant ships that transport iron ore, coal and grain, and it has attracted the attention of traders and market commentators hoping to take the pulse of world trade. This index has been falling the entire second half of 2015 and is at all-time low.

It corresponds with the calm seas and no ships being deployed to transport goods overseas. It seems like no one is buying any goods and no one is selling. If this trend continues, this will impact the economy further. And not only the US economy but the entire world one.

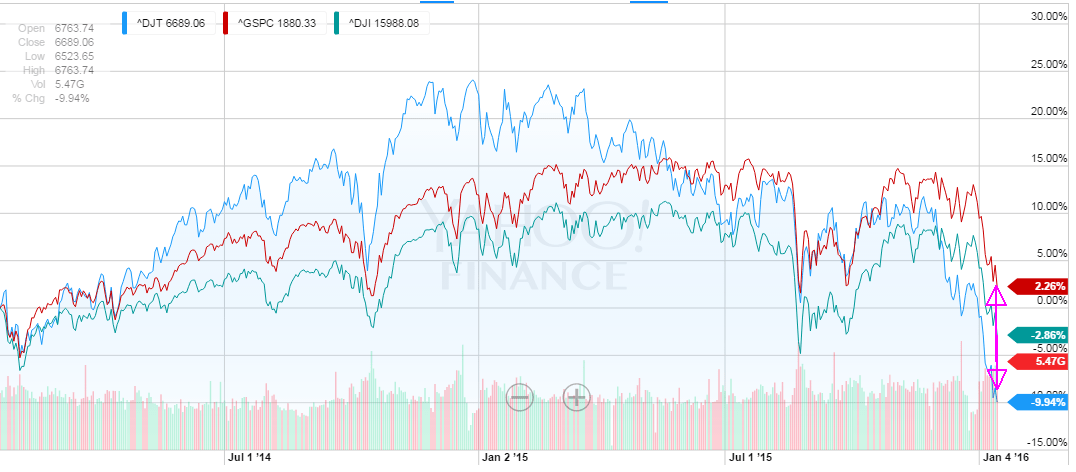

We can see this same evolution in the transportation index (DJT). For most of the time we could see the transportation index in line with other indexes such as Dow Jones or S&P 500. but recently the transportation index has been also falling hard and dragging other indexes with it. It too fell hard in the second half of 2015.

But the divergence of the transportation index and other indexes is so big, that I believe the markets will tend to get into alignment with the transportation index to find equilibrium. The transportation index may rise a bit to go to meet the indexes, but mostly the indexes will fall lower to meet the transportation index. But given the fact that there is no commercial activity out there, it is more likely that it will be the indexes to go to meet the transportation index.

To do so, the indexes will have to fall another 10%.

· How to protect yourself?

It is quite hard to provide an advice and I cannot provide any financial or investment advice. But this is what I will be doing if my expectations are correct and the markets fall another 10%.

Dividend investor

There is not much to do as a dividend investor. Even if there will be a tornado in Wall Street and markets crash I will still continue reinvesting dividends using DRIP program.

I will continue buying shares on the way down (dollar cost averaging) but I will apply a strategy I call a contingency buying order. It means that I split my cash into smaller buying lots (not the market lots). For example, if I have $3,000 to buy my next stock, I will split it into (3) $1,000 lots.

Then I will place an OTO (one triggers other) buying order, which will basically do: If the price gets at or above a certain level, trigger a buy order at or below that level at market. Then I will place my limit price approx. 10% above the previous day high price.

What this does is that if the price of the stock is falling, the buy order is not triggered and I trace it down with the stock price. Once the stock reverses and reaches my limit, it triggers the buy order and buys the stock.

I used this method successfully in the past and thanks to that I could buy stocks at a lot cheaper price than originally expected. Don’t be greedy, wait for the price to come to you.

Options trader

As an option trader I will be very careful selling puts as of now. The market doesn’t show any strength which can be used and ridden. The bounces are weak and shallow and they can be quickly sold off by bears. We are in a bear market and when in a bear market, you want to go with the trend and not against it.

I will most likely wait for a bounce and then sell that bounce by selling call spreads.

What about you? Do you have any trading plan for the bear market protecting your investments? Are you going to sell everything and stay in cash until this storm calms down or continue diligently investing?

Leave a Reply