Wow, the end of the month got pretty wacky! We have received news about a new Covid variant and “although experts do not know yet if it will cause more or less severe COVID-19 compared to other strains” investors already started shooting themselves, jumping out of the windows, and selling their wives and kids off. This panic obviously hit our account but I consider this selloff panic as an overreaction and a buying opportunity even though it may continue next week. We just need to wait for the panickers out there to calm down. However, calming down will be a difficult process now that the new strain was detected in Belgium, the UK, Hong Kong, and Israel despite the ramping travel bans. Looks like, Covid has its own planes and travels on its own.

Our account net-liq lost -3.22% last week compared to -2.70% SPX, but our options trading improved (and I expect it to get better next week as I will be adjusting positions for the new selloff. I usually make a lot more money when the markets panic). We had no dividend income last week but we are still on track with the dividend income monthly projection.

Here is our investing and trading report:

| Account Value: | $91,149.20 | -$3,035.80 | -3.22% |

| Options trading results | |||

| Options Premiums Received: | $1,670.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $6,133.00 | +7.40% | |

| 09 September 2021 Options: | $2,353.00 | +2.97% | |

| 10 October 2021 Options: | $8,721.00 | +9.27% | |

| 11 November 2021 Options: | $3,523.00 | 3.87% | |

| Options Premiums YTD: | $52,305.00 | +57.38% | |

| Dividend income results | |||

| Dividends Received: | $0.00 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $780.09 | ||

| 09 September 2021 Dividends: | $176.60 | ||

| 10 October 2021 Dividends: | $256.73 | ||

| 11 November 2021 Dividends: | $349.82 | ||

| Dividends YTD: | $2,471.25 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.59% | ||

| Portfolio Dividend Growth: | 8.80% | ||

| Ann. Div Income & YOC in 10 yrs: | $23,281.65 | 19.71% | |

| Ann. Div Income & YOC in 20 yrs: | $237,792.95 | 201.35% | |

| Ann. Div Income & YOC in 25 yrs: | $1,317,843.38 | 1115.88% | |

| Ann. Div Income & YOC in 30 yrs: | $12,823,046.88 | 10,857.90% | |

| Portfolio Alpha: | 51.11% | ||

| Portfolio Weighted Beta: | 0.58 | ||

| CAGR: | 582.19% | ||

| AROC: | 56.34% | ||

| TROC: | 17.19% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 230.65% | Accomplished |

| 2021 Portfolio Value Goal: | $42,344.06 | 215.26% | Accomplished |

| 6-year Portfolio Value Goal: | $175,000.00 | 52.09% | |

| 10-year Portfolio Value Goal: | $1,000,000.00 | 9.11% |

Dividend Investing and Trading Report

Last week we have received no dividends. Our dividend income is still well in line with our goals and plans. We planned on receiving $472.82 in dividends in November and so far we have received $349.82 income.

Here you can see our dividend income per stock holding:

Options Investing and Trading Report

We received nice options income last week as we were re-opening the trades that expired the previous week. I expected that to boost our income. We also rolled some trades that were not in a good shape.

We opened new trades replacing the ones that expired:

BAC 42/50 strangle for 0.38

WBA 43/51 strangle for 0.45

TSLA 1035/1040 bull put spread for 1.10

SPY 450/455 bull put spread for 0.55

TSLA 995/1000 bull put spread for 1.34

BA 185/237.5 strangle for 3.22

KBE 53/62 strangle for 0.42

F 23.5 covered call for 0.26

O 62.5/77.5 strangle for 0.49

&nbs;

We rolled these trades:

AAPL 125/165 strangle to 155/185 strangle for 1.00

BABA 130/165 strangle to 110/165 strangle for 0.90

DKNG 35/45 strangle to 30/45 strangle for 0.07 (debit)

MU 70/85 strangle to 75/90 strangle for 0.80

SNOW 335/340 bull put spread converted to 315/320/365/370 Iron Condor for 0.12

VZ 55/60/60/65 Butterfly converted to 40/47/60/65 Iron Condor for 0.38

SPCE 1x 23/ 3x 27 uneven strangle to 2x 18 / 3x 25 uneven strangle for 5.36

These adjustments delivered $1,670.00 of additional options income topping November at $3,523.00. Not the best month but not the worst one either. I expected November to be choppy but unfortunately, I was not very well prepared for it.

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

Expected Future Dividend Income

We have received no dividends last week. Our portfolio currently yields 4.58% at $91,149.20 market value.

Our projected annual dividend income in 10 years is $23,281.65 but that projection is if we do absolutely nothing and let our positions grow on their own without adding new positions or reinvesting the dividends.

We are also set to receive a $4,694.96 annual dividend income. We are 20.17% of our 10 year goal of $23,281.65 dividend income.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $109,599.80 to $126,058.32 last week. I expected the improvement after closing the short AAPL position after the assignment. In the hindsight, I should have held the position. It would be making me money today. But I do not short stocks as I do not have the skills to do it successfully.

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

Investing and trading ROI

Our options trading delivered a 3.87% monthly ROI in November 2021, totaling a 57.38% ROI YTD. We again exceeded our 45% annual revenue selling options against dividend stocks target!

Our account grew by 343.07% beating our projections and the market.

Our options trading averaged $4,755.00 per month this year. If this trend continues, we are on track to make $57,060.00 trading options in 2021. As of today, we have made $52,305.00 trading options.

Old SPX trades repair

This week, we didn’t adjust any SPX trades. Our goal is to reach a level that we will be eligible for portfolio margin (PM). Once that happens, we plan on converting the existing SPX Iron Condors to strangles and trade these positions as strangles.

With RegT margin, the capital requirements would be approx. $66,586.06 and that is beyond our means. With PM the requirement for margin would drop to around $10k. That is doable in our account. Once we reach this level, we will start adjusting our SPX trades accordingly. Until then, we will just roll these trades around.

Accumulating Growth Stocks

Last week we liquidated our RIVN position (for a loss) and purchased 100 shares of Ford (F). Ford is an established automaker that is now going electric and will be manufacturing their electric F-150 Lighting truck. Unlike Rivian, Ford is delivering their cars and they have the capacity to deliver the number of trucks their CEO announced. Rivian doesn’t even have a factory established and so far delivered a prototype only. This video below made me change my mind about Rivian:

Ford is also a dividend stock as they re-established their dividend recently. I wouldn’t consider it a dividend growth stock, but along with the dividends, I expect the company to deliver returns on their electric trucks.

We also added 6 more shares of SNOW to our portfolio.

But I realized that I was deviating from my original accumulating plans and rules. See below.

I also split my SPXL and SSO accumulation goals into an HFEA strategy.

Accumulating Rules

Despite the rule below, I was still running low on buying power and I was wondering why. Then I saw it. Although I am limiting my options trading, I go on a shopping spree and use a lot of free BP buying stocks. That is not necessarily bad, but these purchases reduce my BP and when the market drops, my BP is depressed even more. I am buying more shares than what my options are generating. When I sell options and generate for example $100 dollars, I go and buy shares worth $200 (thank you margin!). That depletes my reserves. And this also was not my plan at the beginning!

Originally, my goal was to use options income only, so it is time to return to the roots.

Our rule is to buy shares of growth stocks using options income only and only when the BP is above the $4,000 November limit. In December 2021, we plan on increasing the limit to the $5,000 level.

Why such a rule? Up to today, I was scaling up my trades and portfolio. That resulted in rapid growth but also all our proceeds were constantly locked in the trades. If we want to live off of our dividends and options income, we cannot have them locked by new trades. We need to start accumulating “cash available to withdraw”. Therefore, I am shifting my trading to trade the same amount of contracts and invest only a certain excess of the accumulated cash.

Another reason, of course, is to have enough cash to buy opportunities when the market crashes or corrects. As is typical, Wall Street usually overreacts (stupidly) and I want to buy shares when the market is in panic. Like last week. the almost 3% sell-off provided a good opportunity but I have no available buying power!

Accumulating Dividend Growth Stocks

Last week, we also added BAC, FLMN, and LMT shares to our portfolio, obviously spending more than our BP allowed. Now I will have to sit tight and let our portfolio consolidate.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

The market was going mostly sideways last week, as expected. Yet, I noticed that most of the stocks in our portfolio were constantly in red despite the flat market. That was not a good sign. Then on Friday, covid fear hit and we sold off sharply on a significantly high volume despite the US traders digesting their turkeys from the night before. If we see a continuation or even a gap down on Monday next week, brace yourself for more selling next week. If traders shake the Covid news off, this market will recover.

Here is what happened last week:

It is hard to say where we will be going from here. We are sitting on a 50-day moving average right now. It may work as resistance and we may bounce from here, or it will slash through like a hot knife through butter and more damage is to come. We see another stop at $4,550 (and Monday selling pressure may push us there) and then we may bounce. If that doesn’t hold, $4,300 would be the next stop.

Given that more negative news about the new Covid strain is coming from mainstream media, I would expect more selling next week.

If you want to learn more about the stock market, events that moved the market last week and will likely impact it in the near future, I recommend you to subscribe to our weekly newsletter. Knowing where the market is heading and knowing when you should expect its reversal can benefit your trading and investing. Subscribe and you get one month free.

Investing and trading report in charts

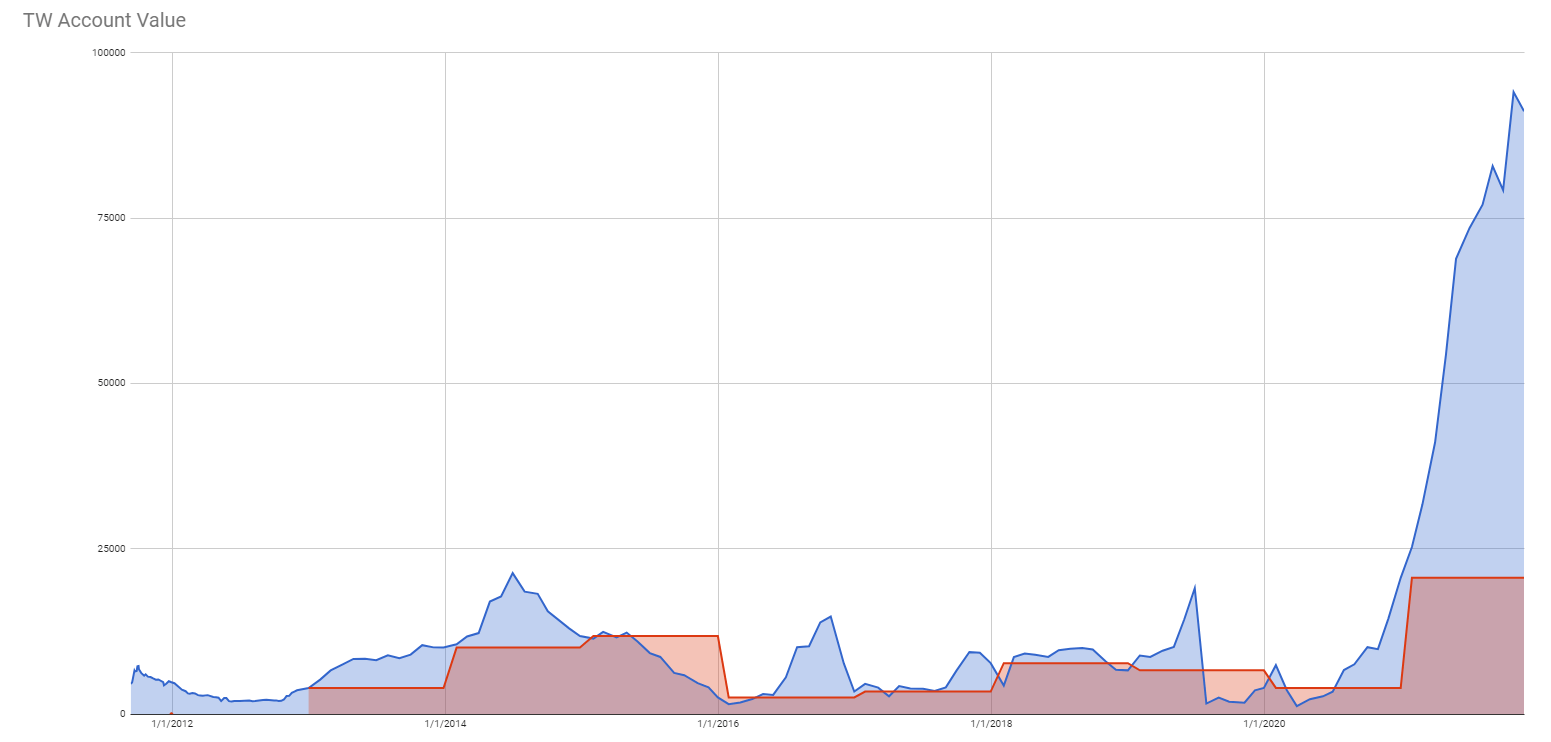

Account Net-Liq

Account Stocks holding

Last week, S&P 500 grew 58.83% since we opened our portfolio while our portfolio grew 23.64%. On YTD basis, the S&P 500 grew 28.99% and our portfolio 16.65%.

The numbers above apply to our stock holdings only. Our overall account net-liq grew by 343.07% this year! This is thanks to options trading that generates income. It can be also seen how the options help lower our cost basis. Just compare the P&L in the regular (left) column with the P&L in the “Options adjusted” column. For example, our AES holding would be a loser as of today (down -9.10%), but we generated enough income (we can call it also a return of our invested capital) and that position is 120.31% up.

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market hopefully soon. The entire portfolio beats the market by far thanks to monetizing those positions.

Our 10-year goal is to grow this account to $1,000,000.00 value in ten years. We are in year two and we accomplished 9.11% of that goal.

Our 6-year goal is to reach $175,000 account value to be eligible for portfolio margin (PM) and today we accomplished 52.09% of that goal.

Our 2021 year goal is to grow this account to a $42,344.00. We already accomplished this goal.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We have accomplished our dividend income goal. We planned to make $1,071 of dividend income this year and we finished receiving $2,471.25. However, we accumulated enough shares to start making $4,669.60 a year.

Our account cumulative return

The chart below indicates our cumulative adjusted return.

As of today, our account cumulative return is 43.57% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading was within our expectations and I believe, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares and continue building our cash reserves so we have enough cash to sustain any market corrections and be able to buy depressed stocks.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

Leave a Reply