As expected, the December market recovered once the panicking investors realized that the Omicron fear was not justified. Fear of the increased inflation didn’t materialize as inflation, though high, was within expectations. The market rallied last week and in this investing and trading report, we can announce another great achievement: our account reached the $100,000 mark for the first time in the history of our trading.

Our Net-Liq jumped up by +17.46%), our options income increased in December by 3.81% and our dividend income also exceeded our monthly goal.

Overall, this market is bullish and I expect it to continue for the rest of the year. The only thing that can derail it is the FED but it is unlikely that they would do anything before the end of the year.

Here is our investing and trading report:

| Account Value: | $102,520.41 | +$15,242.08 | +17.46% |

| Options trading results | |||

| Options Premiums Received: | $1,609.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $6,133.00 | +7.40% | |

| 09 September 2021 Options: | $2,353.00 | +2.97% | |

| 10 October 2021 Options: | $8,721.00 | +9.27% | |

| 11 November 2021 Options: | $4,577.00 | +5.24% | |

| 12 December 2021 Options: | $3,904.00 | +3.81% | |

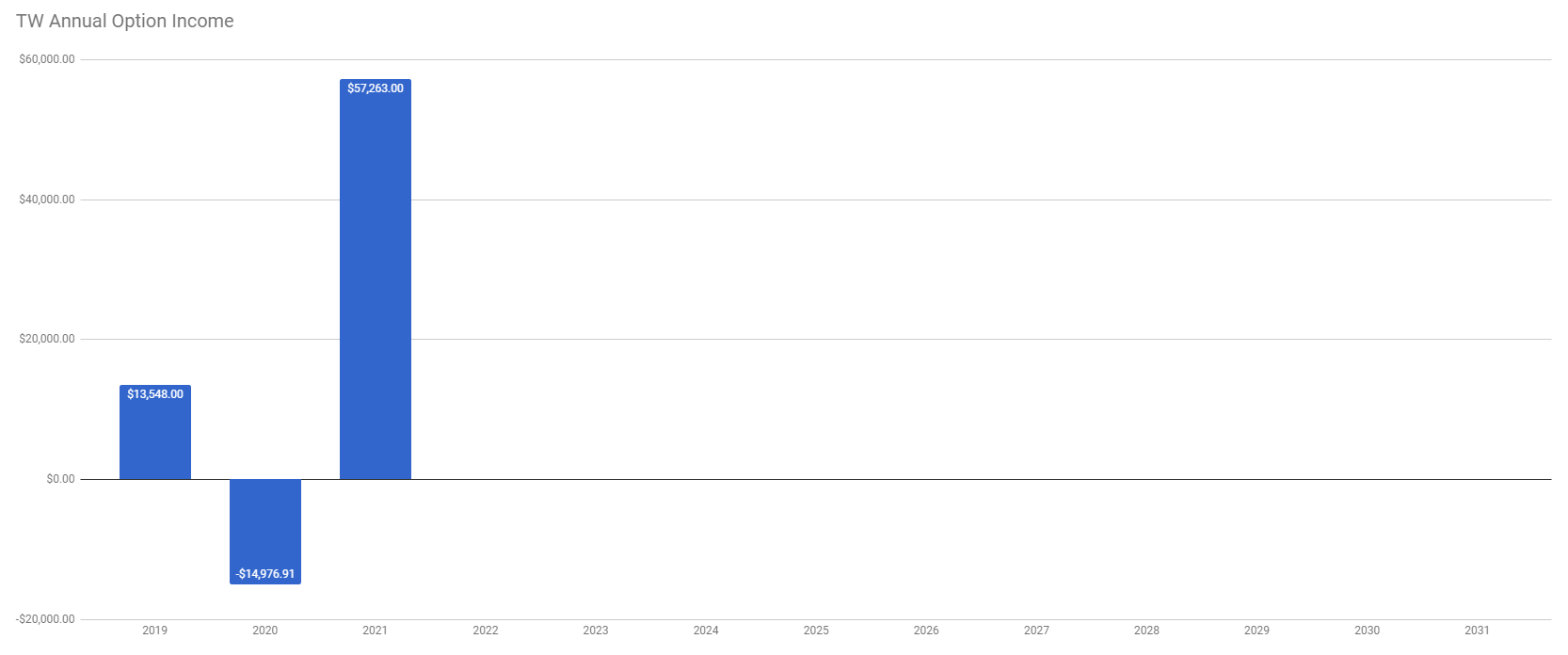

| Options Premiums YTD: | $57,263.00 | +55.86% | |

| Dividend income results | |||

| Dividends Received: | $13.21 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $780.09 | ||

| 09 September 2021 Dividends: | $176.60 | ||

| 10 October 2021 Dividends: | $256.73 | ||

| 11 November 2021 Dividends: | $463.90 | ||

| 12 December 2021 Dividends: | $95.73 | ||

| Dividends YTD: | $2,681.06 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.52% | ||

| Portfolio Dividend Growth: | 8.80% | ||

| Ann. Div Income & YOC in 10 yrs: | $22,999.73 | 19.29% | |

| Ann. Div Income & YOC in 20 yrs: | $230,565.27 | 193.36% | |

| Ann. Div Income & YOC in 25 yrs: | $1,258,148.17 | 1055.13% | |

| Ann. Div Income & YOC in 30 yrs: | $11,986,639.10 | 10,052.44% | |

| Portfolio Alpha: | 49.53% | ||

| Portfolio Weighted Beta: | 0.59 | ||

| CAGR: | 593.42% | ||

| AROC: | 45.95% | ||

| TROC: | 13.10% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 250.23% | Accomplished |

| 2021 Portfolio Value Goal: | $42,344.06 | 242.11% | Accomplished |

| 6-year Portfolio Value Goal: | $175,000.00 | 58.58% | |

| 10-year Portfolio Value Goal: | $1,000,000.00 | 10.25% |

Dividend Investing and Trading Report

Last week we have received $13.21 in dividends bringing December’s dividend income to $95.73.

Here you can see our dividend income per stock holding:

Options Investing and Trading Report

The market recovered strongly last week and we only rolled a few trades last week, such as TSLA put spreads, ABBV strangles, WBA strangles, AAPL, AXP, SNOW, and BA. We rolled these trades to release buying power and center the trades. A week ago we had to roll the trades lower, last week we rolled these trades back up as our calls got in danger. Sometimes, it is a cat-mouse chase. But once the market calms down again with no wild swings these trades will work well again.

These adjustments delivered $1,609.00 of additional options income bringing December at $3,904.00.

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

Expected Future Dividend Income

We have received $13.21 in dividends last week. Our portfolio currently yields 4.52% at $102,520.41 market value.

Our projected annual dividend income in 10 years is $22,999.73 but that projection is if we do absolutely nothing and let our positions grow on their own without adding new positions or reinvesting the dividends.

We are also set to receive a $4,439.42 annual dividend income. We are 19.30% of our 10 year goal of $22,999.73 dividend income.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $122,486.39 to $129,791.56 last week. On month to month our stock holding value increased from $121,107.63 to $129,791.56 value.

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

Investing and trading ROI

Our options trading delivered a 3.81% monthly ROI in November 2021, totaling a 55.86% ROI YTD. We again exceeded our 45% annual revenue selling options against dividend stocks target!

Our account grew by 398.34% beating our projections and the market.

Our options trading averaged $4,771.92 per month this year. If this trend continues, we are on track to make $57,263.00 trading options in 2021. As of today, we have made $57,263.00 trading options.

Old SPX trades repair

This week, we didn’t adjust our old SPX trades. Our goal is to reach a level that we will be eligible for portfolio margin (PM). Once that happens, we plan on converting the existing SPX Iron Condors to strangles and trade these positions as strangles.

With RegT margin, the capital requirements would be approx. $66,586.06 and that is beyond our means. With PM the requirement for margin would drop to around $10k. That is doable in our account. Once we reach this level, we will start adjusting our SPX trades accordingly. Until then, we will just roll these trades around.

‘

Weekly SPX Put Credit Spreads

I traded Iron Condors in the past and it was a great money-making strategy. Until it was not. One bad trade and all your profits are gone. And sometimes more than just the profits.

I stopped trading SPX spreads as I didn’t know how to protect them. But I still liked the strategy so when I stopped, I started learnings and researching how to hedge those strategies so I am out of the market when there is trouble and everyone panics. The question was: how to hedge my trades (and the entire portfolio) to protect it from the black swans and how to protect my SPX spreads from selling and getting wiped out.

After a year of testing, paper trading, backtesting, reading books, and studying other successful traders and how they trade SPX spreads, I developed a strategy that is working. Of course, it is not a 100% sure bet. There will be trades that will not work, and that is normal, but overall, the strategy will deliver more winners than losers.

Now, I am making my strategy available to everyone to subscribe to SPX weekly PCS alerts.

Last week, we opened a few trades and added hedges to our portfolio:

Accumulating Growth Stocks

Last week we continued to accumulate our HFEA holdings (purchasing SPXL and TMF).

Here is a quick review of our HFEA strategy.

We also added a few shares of SNOW to our holdings.

Accumulating Dividend Growth Stocks

Last week, we also added FLMN shares to our portfolio and finished accumulating 100 shares of this stock. We will be accumulating RYLD to accumulate $5,000 value in this ETF.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

Last week in our newsletter, I wrote that if the market holds the previous resistance level, now support, at $4,550, the market will resume the uptrend. As soon as the market participants realized that all the Omicron fear was not justified and FED tapering, inflation, and other fears are in fact within expectations, the markets rallied.

This is what I published last week:

The support was held so no further selling happened. In fact, we experienced a FOMO when investors rushed to the market (buying higher from where they were selling before) and the market created new all-time highs.

On Friday, the CPI numbers were released before the bell and reported the highest inflation since 1982. Many people on social media were predicting crash and doom. When the market went up 0.92%, all in unison claimed that the market is rigged. But they forget that the market doesn’t react on numbers but on expectations. It is the same with earnings. It doesn’t matter what the company reports. What matters is whether the reported numbers met or missed the expectations. And the CPI numbers met the expectations. It was expected that the CPI will be at 6.7%, and 6.8% was reported. The market rallied.

So what’s next for the market?

Expect more rallying next week. The earnings expectations are not changed – still higher than this year. Holidays are coming and Americans are still spending. In fact, the demand is at the highest levels, higher than pre-pandemic levels. People are afraid of inflation and predict doom but the inflation is caused by supply chain issues. But prices are rising due to the lack of goods on the shelves and high demand. Once the companies catch up with the demand, the inflation will drop.

A great example is the latest Nintendo Switch. It is completely and helplessly sold out. No retailer is able to deliver the gaming console. The only place, you can buy the unit today is on eBay. Although the retail price is at $399, eBay sellers sell the system for $499 – $599 apiece. A 25% to 50% markup. Here is your inflation, folks. Once the Nintendo manufacturer catches up and delivers enough consoles to the stores, the price will drop back to the retail price.

What is my expectation for the next week? I expect the market to reach $4,800 next week and possibly $5,000 by year-end. Then, we enter another earnings season and companies will report 4Q earnings. If reports meet expectations, expect more uptrend. If not, a correction will happen.

If you want to learn more about the stock market, events that moved the market last week and will likely impact it in the near future, I recommend you to subscribe to our weekly newsletter. Knowing where the market is heading and knowing when you should expect its reversal can benefit your trading and investing. Subscribe and you get one month free.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

Last week, S&P 500 grew 62.89% since we opened our portfolio while our portfolio grew 28.43%. On YTD basis, the S&P 500 grew 33.05% and our portfolio 21.45%.

The numbers above apply to our stock holdings only. Our overall account net-liq grew by 398.34% this year! This is thanks to options trading that generates income. It can be also seen how the options help lower our cost basis. Just compare the P&L in the regular (left) column with the P&L in the “Options adjusted” column. For example, our AES holding would be a loser as of today (down -6.85%), but we generated enough income (we can call it also a return of our invested capital) and that position is 134.44% up.

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market hopefully soon. The entire portfolio beats the market by far thanks to monetizing those positions.

Our 10-year goal is to grow this account to $1,000,000.00 value in ten years. We are in year two and we accomplished 10.25% of that goal.

Our 6-year goal is to reach $175,000 account value to be eligible for portfolio margin (PM) and today we accomplished 58.58% of that goal.

Our 2021 year goal is to grow this account to a $42,344.00. We already accomplished this goal.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We have accomplished our dividend income goal. We planned to make $1,071 of dividend income this year and we finished receiving $2,681.06. However, we accumulated enough shares to start making $4,439.42 a year.

Our account cumulative return

The chart below indicates our cumulative adjusted return.

As of today, our account cumulative return is 53.29% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading was within our expectations and I believe, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares and continue building our cash reserves so we have enough cash to sustain any market corrections and be able to buy depressed stocks.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

Leave a Reply