|

|

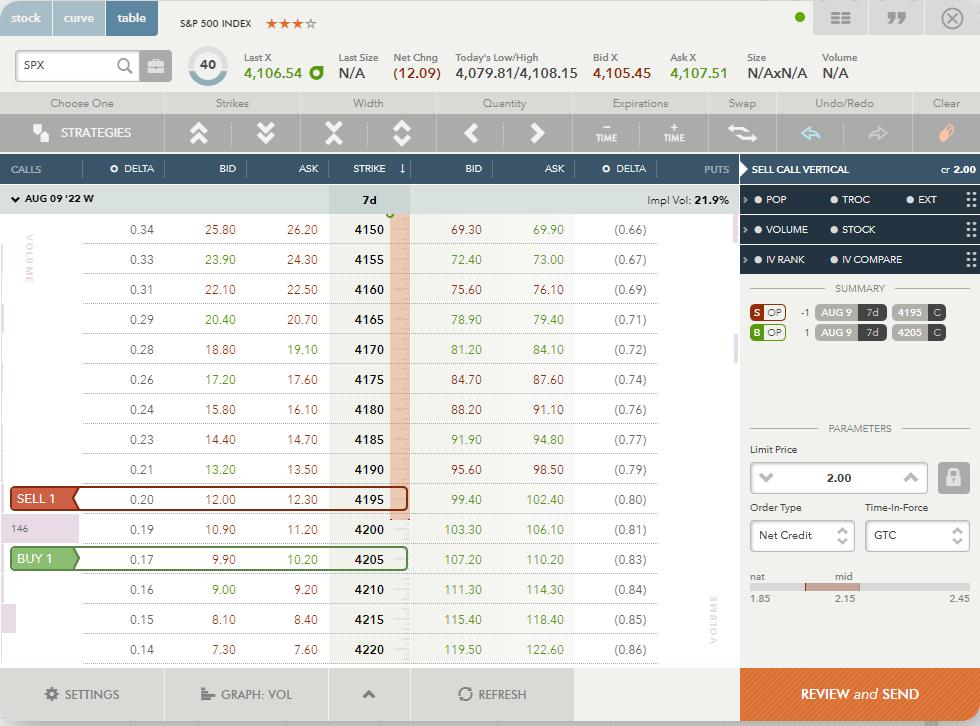

The signal for the market is bearish (we expect to market to pull back to 4,020 this week unless it changes to a consolidation pattern). We will open a bear call spread with a shorter expiration than the typical 30 days.

|

Sell SPX 10 wide bull put spread

30 DTE (We are shortening the DTE to 7 days)

45 delta (we are changing the Delta to 20)

|

Sold 1 SPX 08/09/22 Call 4195.00 @ 12.67

Bought 1 SPX 08/09/22 Call 4205.00 @ 10.52

|

The trade was executed for 2.15 credit.

|

|

|

We will let the trade expire if possible.

|

I am also testing using Twitter to send trade alerts. If you are interested, you can follow this handle to get trade alerts notifications on Twitter: @TradingZz

|

|

If your handle is different from your subscription, you must let me know that you applied for the Twitter Alerts otherwise I will not be able to recognize you and won't admit you to the Twitter group.

|

|

|

We are also placing a GTC (good till canceled) buyback order for 75% of the credit.

|

|

|

|

|

|

|

|

|