(Source: Hedgeye.com)

Last Friday trading and rally was impressive. I hoped it would last longer than this. Today, the market gave up almost all gains from Friday. It really didn’t take long.

First, the Friday’s rally was based on a Bank of Japan’s decision to lower the interest rates below zero (negative rates), which itself makes no sense. If the zero interest rates didn’t help the economy, why they think negative rates would do the job?

Second, if you look at the magnitude of the rally, you would think “This is it, that’s the reversal and bottom”. Well the lack of any follow through on Monday or today clearly indicates that this market is weak.

In my few previous posts I mentioned that now we should sell any strength, any rally. Today’s price action reiterates that idea. Even if we bounce tomorrow, which I do not expect at all, sell into it.

Unfortunately since my account is small I cannot take more trades on as I would violate cash management rules otherwise I would have been adding more bear call spreads.

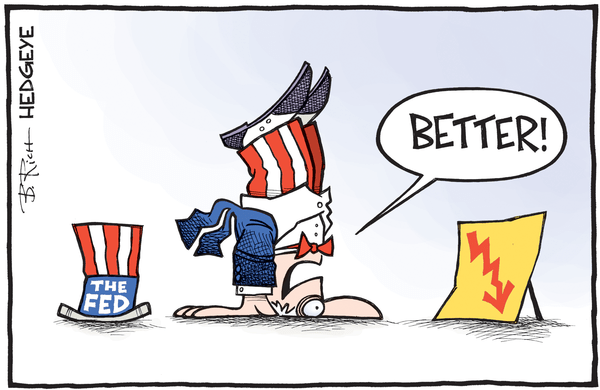

Do not hesitate or be too shy to be aggressively bearish. We are in a bear market and unless FED comes up with negative rates or QE4 we are heading down. Of course, there will be bounces, some even violent and strong on the way down. It is typical for a bear market. These will offer great opportunity to short the market!

Economy is heading into recession. It may burst this year or next one. We may already be in a recession although there is still plenty of people who refuse to accept that fact. Until this changes or until we undergo the self-healing process of the economy without unhealthy interventions of the FED or the US government, we will go down. If FED comes up with any of their sick solution, the problem will only be extended into the distant future.

But one day, we will enter a point when none of the FED’s medicine will have any healing effect and we will crash hard.

My conclusion? Sell any strength of this market.

Leave a Reply