December 2017 ended and the whole year with it. It is time once again to review our goals and determine what we accomplished and what we have left untouched.

Our 2017 year was a prosperous but challenging year. On personal note my family and I experienced a lot of changes and also difficulties but I believe, these are behind us. It was a difficult year.

I had to change my job and move for another one (I still hope, one day in a not so distant future, I will be able to trade full time). I thought it could happen in 2017 but once again Mr. Market taught me a lesson. How many lessons will I have to take before I finally get to the end of this race and finish my goal?

I think, I learned yet another trading lesson. I learned patience and discipline. Something, I was ignoring for years and Mr. Market made me pay for it.

What was it?

Many times I wrote and advocated to fellow investors to stay small and not over trade. Yet, I myself was breaking that rule. Many times I told investors: “Do not trade more than 50% of your account.” But many times I went way over that number in my own account.

Our business account is still way stretched and I am battling hard to bring it back in line with my rules. And when I am this badly stretched, it is hard to do so.

I set my goals for 2018 already and I think it will be a prosperous year. The US economy is growing and accelerating (many “valuation gurus” chose to ignore it and they started liquidating their portfolios in preparation for a bad year. I think they will miss a good year). But, it doesn’t matter whether the next year will be good or bad.

What matters is whether you are prepared.

You have to have a goal and plan. I have read a good saying by John Galbraith “Everybody is a buy and hold dividend investor until the next bear market.” What a wisdom and truth in this sentence. When the bear market “hits the fan” everybody panics and start selling. So I am prepared in two ways:

1) Buy and hold high quality dividend aristocrats which proved themselves during last crisis. Stocks like JNJ, O, MA, ADM, KO, MCD, and many others survived not only 2008 crisis but also 2003, 1987 and some even 1932 crisis and came out as winners. Arguments that you may lose 50% of your portfolio during selloff are silly. Yes, you will lose 50% (maybe) but for how long? Most crisis do not last longer than a year and a half. Even 2008 which was the longest one took 16 months only. And look where are we today. My preparedness is to stay invested, reinvest dividends, and eventually buy more shares. Let the other panicking and handing us their cheap shares.

2) As an options trader the preparedness is in being able to reverse all my put trades into call trades (short puts and calls) and eventually reduce amount of trading by opening fewer trades.

We are looking forward into 2018 year with optimism, goals, and improved strategy laid out.

So what the last month of the year looked like? I can conclude that it was gear and successful month again.

As of today, I manage four accounts (my own) and one client account. Here is a list of accounts I manage and review in my monthly reviews her on this blog:

TD – Ameritrade – business trading account, taxable

Traditional IRA – Tastyworks – personal retirement account, pre-tax deferred, former 401k account

ROTH IRA – Tastyworks – personal retirement account, after-tax deferred

TW60 – Tastyworks – personal trading account, after-tax deferred

Lending Club – P2P lending, taxable

December 2017 was a very good month and I made good income trading options. Let’s take a look at each account individually:

· ROTH IRA account:

In the past few months I set a goal to bring this account back in line with my rules. I had to adjust some trades, take a few losses (not extremely large) which, fortunately, had no impact to the account net-liq, in order to accomplish this goal. At the end of December 2017 I can announce that I have accomplished this goal.

This account is now ready for trading and investing according to our trading strategy which you can find on our strategy page. In short, the strategy is to keep selling cash covered puts (or spreads) to generate income which can be reinvested into high quality dividend stocks. If you are a follower of our block since 2008 you may remember that this was our goal since then. Sad, it took 10 years to learn the process and get to this stage of trading and investing. This is a true university studies with a doctorate at the end! If you want to become a lawyer, you will probably spend 10 years in school too.

I think, I can claim, we are there and this account is finally growing again and generating income.

| December 2017 net-liq: | $23,520.48 ▲ | (up by $499.97 2.17%) |

| December 2017 dividends: | $74.92 ▼ | (down from previous $87.09) |

| December 2017 options: | -$132.00 ▼ | (down from previous $125.00) |

| XIRR: | 9.33% ▲ | |

| 2017 results: | 13.21% ▲ |

My dividend holdings:

· TD account:

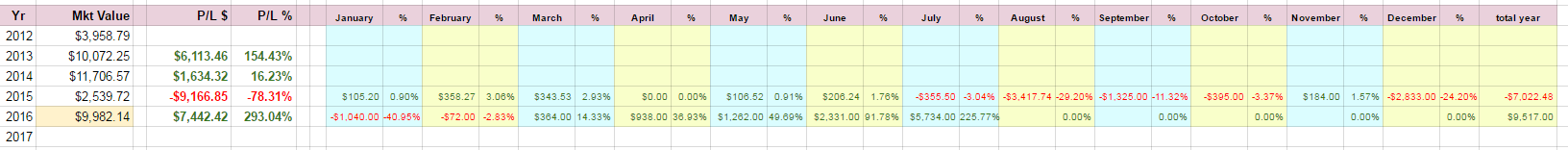

Our business account is very extended and over the limit. That means we couldn’t trade this account much. Mostly managing existing trades. We have many trades from 2016 and early 2017 when I was trading aggressive at the money strangles against stock of a questionable quality. These stocks are now hunting me. Overall, our year 2017 was good as the account finished 125.35% up. However, our annual income was lesser than in 2016.

In 2016 we made $19,054.12 in options premiums.

In 2017 we made $13,432.54 in options premiums.

Most of the money were used to pay of the business loan, thus the income had a very little impact on net liq value of the account and the account actually ended flat for 2017 (up $187.72 or 0.82%). But I am happy with the result. In the next year we plan on reducing the current risk and even start trading small trades again and bring the account in line with our rules.

| December 2017 net liq: | $23,114.07 ▼ | (down by -$1,953.38; -7.79%) |

| December 2017 options: | -$904.00 ▼ | (down from previous $2,094.64; -3.91%) |

| XIRR: | -24.82% ▼ | |

| 2017 results | 0.82% ▲ |

Month-to-moth trading results

(The red dots on the chart indicate income estimate, blue bars actual earnings.)

· Lending Club

Lending Club account got a hit by one note late (now 61 – 120 days; and I expect it to default) but it started growing again. Yet my intent not to add more money remains unchanged. Until I can see the account going up by its own reinvesting what I already deposited I will keep it on an ultra passive mode.

| December 2017 net liq: | $501.29 ▲ | (up by $1.88 0.38%) |

| December 2017 interest: | $11.84 ▲ | (down from previous $8.89) |

| XIRR: | -5.44% ▲ |

· IRA Account

Our Traditional IRA account is the only account performing well and according to our rules and strategy (ROTH was still an adjustment account in December 2017).

As the strategy says, our goal was to trade options, not to exceed 50% of available buying power, and use 50% of options income to purchase high quality dividend stocks.

I am happy to say that all these principles were followed to the T.

Although this account is a cash account, we could achieve $1,780 average monthly income trading spreads. It is a better result than in our business trading account!

| December 2017 net liq: | $90,487.60 ▲ | (up by $1,913.41 2.16%) |

| December 2017 options: | $2,442.00 ▲ | (down from previous $2,567.00) |

| CAGR: | 19.68% ▲ |

Stocks purchased in December 2017:

none

· Conclusion

I hope your December trading was great as ours and we wish you Happy New Year 2018 and a lot of trading success in the new year.

If you like your trades, you can go to our page Trades & Income and see all the trades online on that page. The trades are also posted on our Facebook Page as soon as the trade is opened.

On the page, we post new trades tagged as “NEW TRADE” and all old open trades are then tagged as “OPEN”. That way you will be able to quickly see which trade is new and which is an existing old, open, trade. We change the tag every evening from “NEW TRADE” to “OPEN” so it should be easy to track.

All closed trades are then tagged as “CLOSED – WINNER” or “CLOSED LOSER” so you can also see the results of each trade. When a trade is closed, it is also announced on the page right away and if you follow the page, you should be able to catch it.

Before you start trading (mirroring) our trades, do so in a paper account first and make sure you understand the mechanics and rules of each trade. You can ask questions if you need a trade explanation. Make sure you fully understand the strategy we trade. Later on, you can modify your strategy and start trading on your own.

Hope this helps and good luck!

How was your 2017 trading and investing? Successful? So – so? Or did you lose money?

Leave a Reply