A reader of mine recently sent me a question: “…is it possible to show me step by step a trade you have recently made with puts?” I decided that it may be a good idea to write a post depicting the entire process step by step with pictures and show how I decide and place a trade.

A reader of mine recently sent me a question: “…is it possible to show me step by step a trade you have recently made with puts?” I decided that it may be a good idea to write a post depicting the entire process step by step with pictures and show how I decide and place a trade.

Although, it may be difficult to do as no trade is exactly same and there will always be the “human factor” in each trade. I try to eliminate as much the “human factor” as possible but it is not always bad idea to have the judgment the computer doesn’t have. Some emotions and fear is good to have, some trade adjustments may be OK to let run or roll earlier than what a computer would do; and there will never be enough space to show all variations a trade may have.

Trading options is not same for every market. It is different when trading equities and when trading indexes. In this post I will explain why and how I trade options using SPX and stocks.

· Why trading SPX index?

I used to trade SPX index in the past. Unfortunately, I lost money doing so. One part of that was that I didn’t have enough capital to trade the index. To trade SPX successfully, you need at least $100,000 dollars account so you have enough capital for adjustments. Yes, you can trade successfully with less but it is a lot harder.

If the market drops suddenly and starts acting weird, doesn’t trend, volatility drives the market up and down in a day, having small account trading SPX can be harmful.

But it also provides good opportunities if you have enough capital.

Our followers in our trading group recently criticized me for abandoning trading equities and trading SPX index more than what this website was claiming and what I was posting in a group.

They were correct in some sort.

But trading options is not a rigid endeavor. It is not a conveyor belt in a car factory performing same task again and again 24/7 without a single modification. The market develops and a trader must react to those changes. The changes in the market are not something new. I am not talking about major changes comparing the market of 1932 to 2018.

For sure, there are events which change the market fundamentally such as showing prices in a chalk board in 1932 vs. having them on screen in a millisecond today. Or predominantly use of fundamental analysis in 1932 vs. technical analysis or hybrid analysis today. Or high frequency trading today vs. nothing like that in 1932, you get the point. These changes take time and they are mostly permanent. And by time, I mean years. So adapting to those changes is slow and sometimes not noticeable. Every trader can adapt easily and without a hassle and losses.

The changes I am talking about are seasonal and pattern changes. There are periods when the market is easy to trade and periods of difficult market.

Like it or not, there will be times when it will be extremely difficult to trade and most people will lose money, and times when it will be easy. Today, after several years of “easy market” (from 2012 – beginning of 2015 and beginning of 2016 – 2017) you will find many enthusiastic “successful traders” trading in the trend and considering themselves great traders but in the recent days they are getting a harsh awakening.

I do not want to downplay these traders with a few years of great experience. Not at all! I just want to preach caution and humility. Do not become overconfident just because of a few successful years behind you. Why?

Because I was there myself!

When I started trading, it also was in a prolonged period of easy market. But every time the market changed to a difficult one, I got punished hard because I failed to recognize the change. And I failed to adjust my trading to that change!

When people ask me about my trading past and when I tell them that I “successfully” wiped out my accounts twice they consider me a loser. But it is easy to judge when all you have ever experienced so far was a market which went from $1,800 to $2,800 almost without interruption in the last three years.

And that is the reason why I stopped trading SPX at some point but returning to it again in today’s market. SPX offers me maneuverability equities can’t provide. With SPX I can trade a several small trades in a very short period of time and stay within the market’s erratic movements.

For example, to trade equities I need to trade at least 14 days or more (more like 20 – 30) days to expiration (DTE). With SPX I can trade 0 DTE, 4 DTE, 10 or 15 DTE and place my strikes far enough to sustain the market’s moves. I still can place a trade to be 1 standard deviation (1 SD) away and still collect a decent premium to make a trade worth the trade. Equities will not offer this luxury. If you place a trade like this using stocks, try to be far away from the market (1 SD), and as short time frame as possible, then, there will be no premium for you to trade it. In order to profit with equities you would have to go closer to the money or take a lot longer trade. In erratic, volatile market, this can get you into trouble.

· SPX trade example

When you go to my strategy page you can read my strategy in there. One condition for a trade I have is premium.

For any trade I want to collect 0.20 or $20 dollars or more for as short term as possible.

If I can find a trade which offers more for a 0 DTE, great I take it. If not, I keep searching.

The next step is to stay as far away from the market as possible. By that I mean I want to place my strikes as far away from the money or current index price as possible and deep OTM enough to be away from the index fluctuations. In this case, I do not have to worry what the market wants to do during the time I am in a trade as my trade would stay safe all the time. Not 100% guarantee, but pretty close.

What to trade? A put spread? A call spread? Or an Iron Condor?

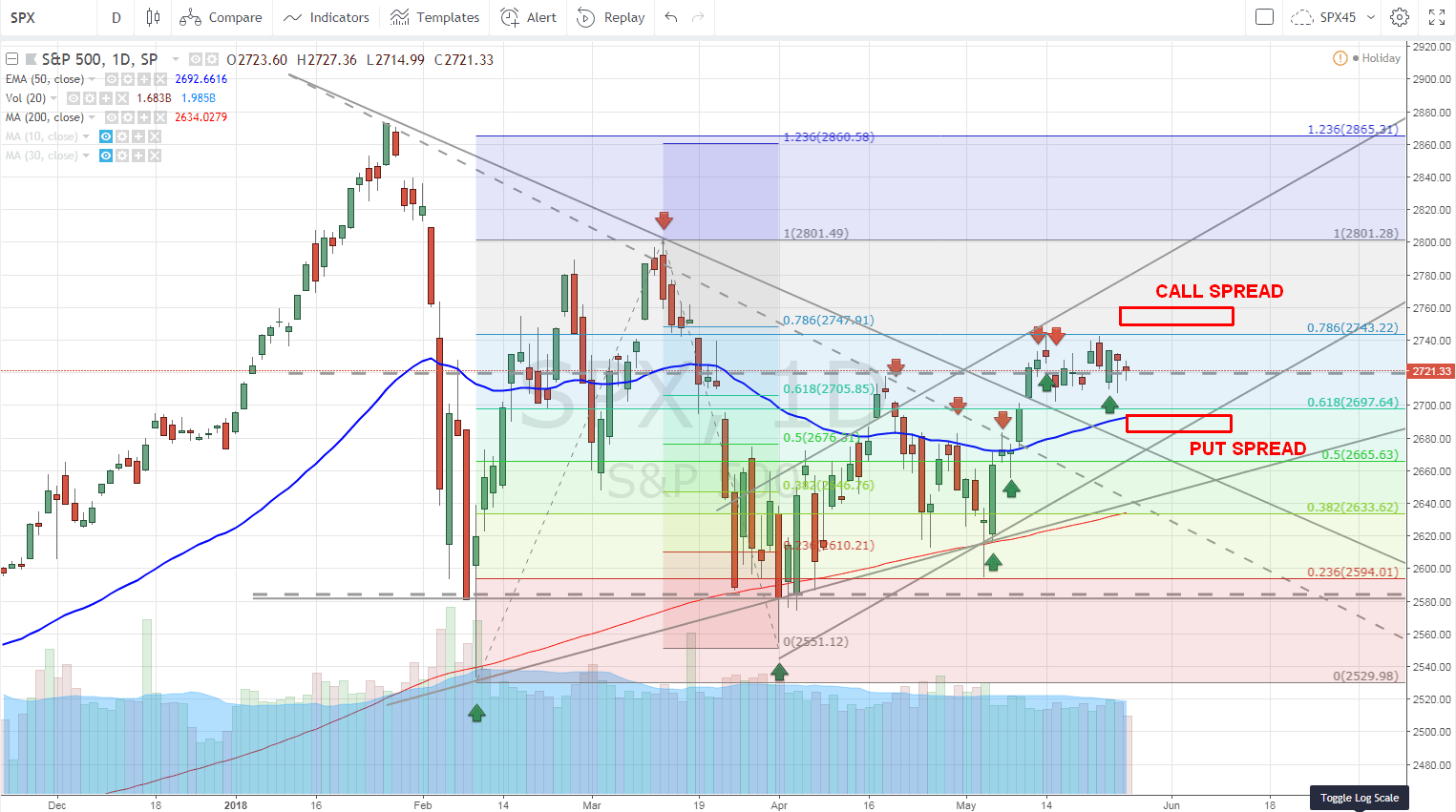

This depends on the market behavior and price action. For that I use chart to see where the market is. I try to determine where the resistances and supports are, what trend we are in, and based on that I select an appropriate strategy. This also is not a sure thing but it still helps. For example, today we are range bound and there is still no indication that we will break that range. and if we break, we do not know which direction (and we will probably never find out beforehand).

If we are in a range bound trend – sideways, the most appropriate strategy will be an Iron Condor. So let’s take a look at the next steps I take to construct a trade.

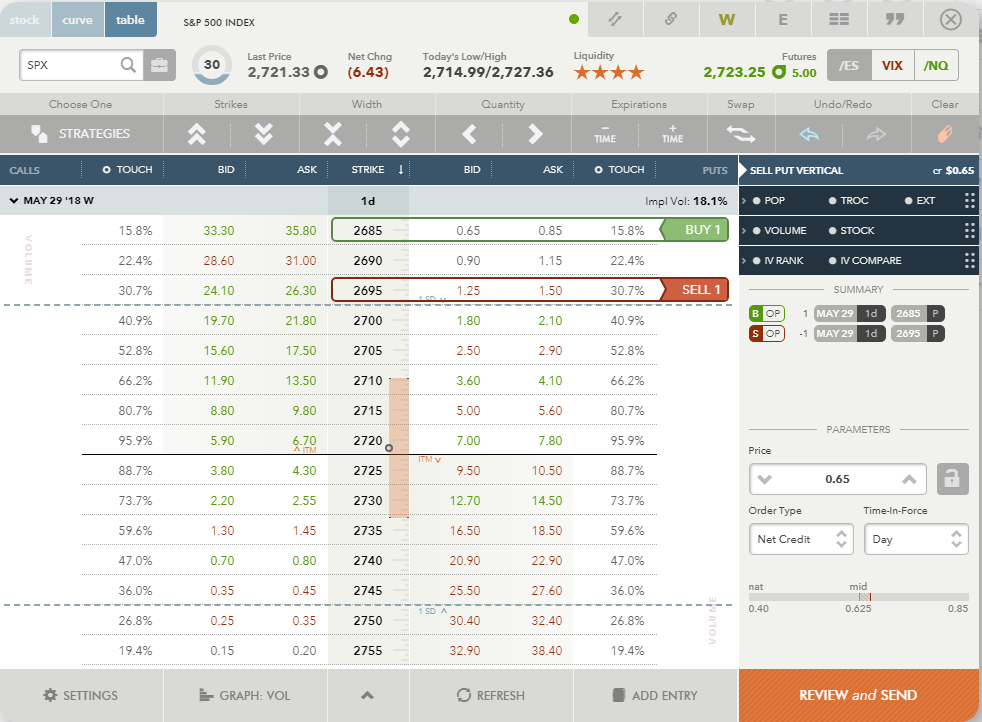

1) as I mentioned above, I look for a trade offering at least 0.20 credit for the shortest DTE and 1 SD or beyond. I open an option chain in my trading platform and review what possible trades I can have:

2) Now, I can create a trade to choose strikes outside the 1 SD level. It is a safe bet but there is still about 30% chance that this level gets touched and only about 13% chance that it will get in the money. The probability of a successful trade is 87%.

I usually choose $10 (or $1,000) dollar wide strikes. You can do a $5 dollar wide trade but you may have to accept a lesser premium or go closer to the money. I like $10 or $15 strikes better. However, this is up to your preference. The process of creating a trade will be same, no matter what width you choose.

The first strike outside the 1 SD range in our example is 2695. So I select that as a short strike. Because I cannot trade naked puts against SPX (not big enough account), I need to trade spreads. The nearest 10 dollar wide spread strike would be 2685 strike, so I place a buy:

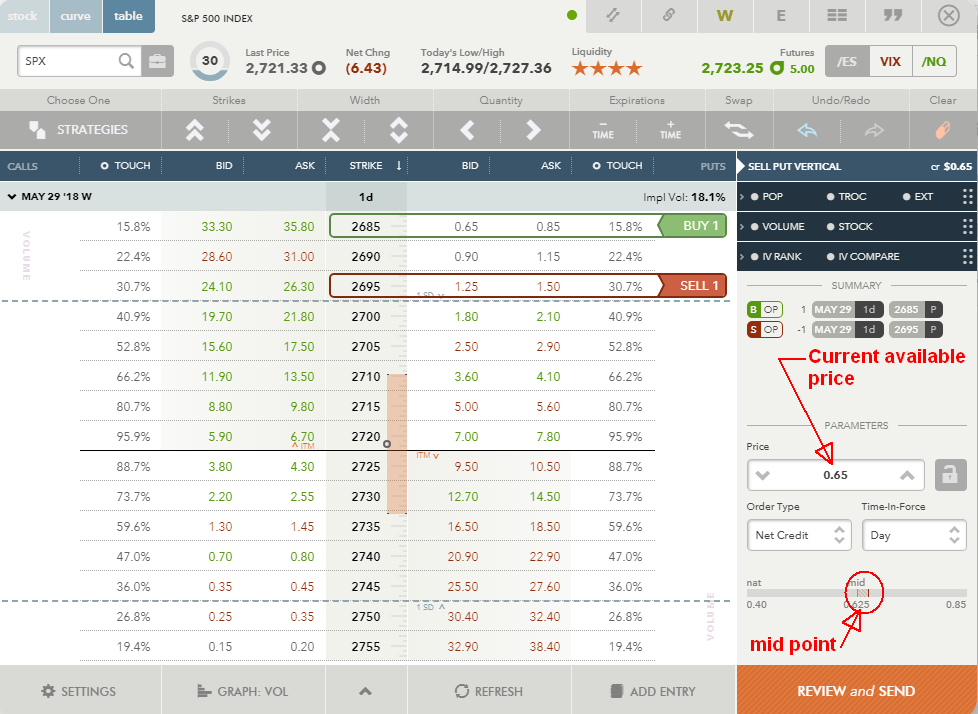

3) Our trade shows that we would collect 0.65 credit or $65 dollars for this trade. But this is not a price we would get executed. I rarely get execution at the mid when trading spreads. I always get executed at mid point when trading single puts, but with spreads I want to get into trade and not wait too long. with a trade this short to expiration the time value is clicking and if the market is moving higher you may actually miss the trade as it moves away from you every second. Before you create a trade and the time you hit “review and send” and then again “send” the price is already elsewhere.

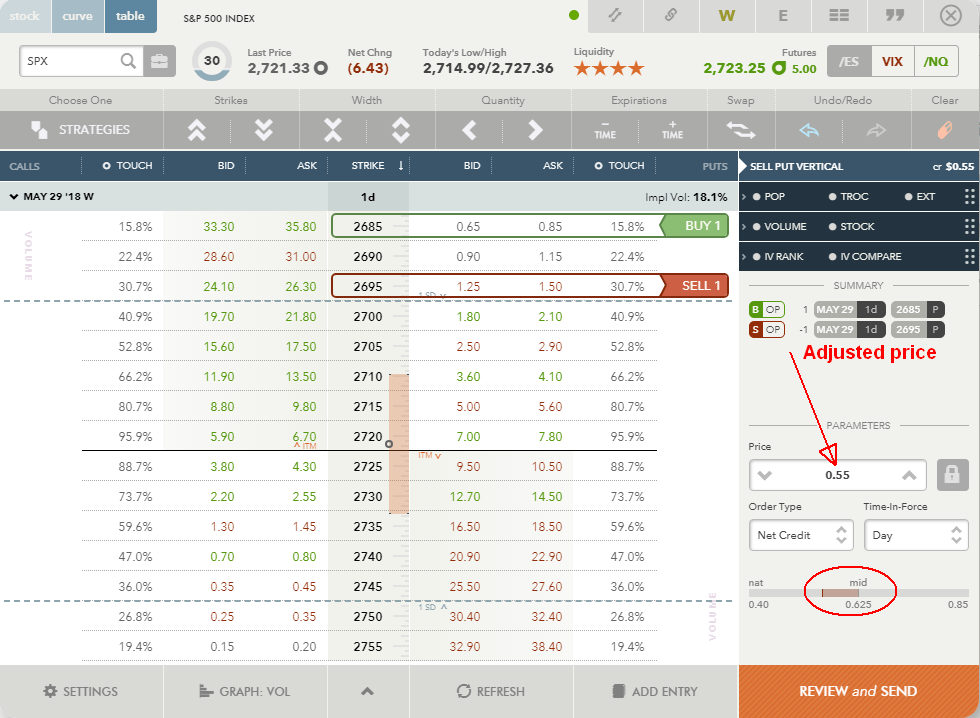

With this price, offered by the platform, we are above the current price mid point. You can choose to place it as is and wait if you get executed or adjust. I usually like to adjust the trade:

4) Now we could go and place the order but since above we established that the market is in a range bound trend and an Iron Condor would be appropriate, instead of placing a single vertical put spread, let’s add a call spread. Again, the nearest strike out of the 1 SD range is 2750 level. I choose this one as my short strike and then add a long strike to it to create $10 dollar wide call spread. The strike would be 2760:

5) But again, the mid point shown in the trade wouldn’t get us into the trade, so we need to adjust it:

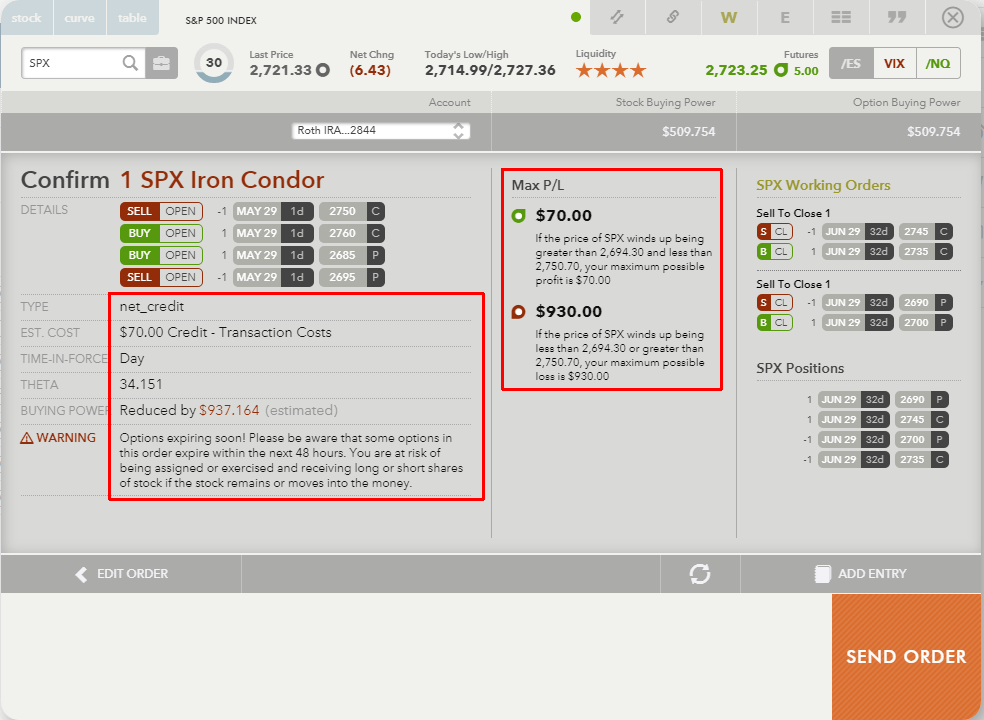

6) Now, the trade is ready to go. Let’s review the overall finance of this trade. If this trade executes, we would get $70 dollars premium. Our max risk would be $930 dollars if any of one side gets in the money – both strikes get in the money; which we will not let to happen and if it has to happen, we will adjust the trade. We will let it go only if adjustment is not available.

7) Before we proceed and hit “send” we want to check the chart and see where the prices of this Condor are compared to the market and its levels of supports and resistances. I usually keep an eye on these levels constantly so I do not have to do it when placing a trade as I already know them but it pay to have a quick look anyway:

Reviewing the charts I feel comfortable with the levels of the trade. Both strikes are safely away of major supports and resistances and it is unlikely (although not impossible) that the price would jump or drop that far in a day (again, it may happen as there is never a 100% guarantee). I can go ahead and place such a trade. Then I sit on it and wait. Usually, after execution, I place a buy back order for 0.05 debit for each leg separately. If the market moves lower, the call spread may close for 0.05 debit and if the market moves higher again the put spread gets closed for 0.05 debit and I am out of a trade for a profit.

· BA trade example

When trading equities the selection process is similar to SPX. However, as I mentioned above, equities not always offer maneuverability of the trades, strikes and premiums needed to trade safely. You would have to choose different stocks, growth stocks or high flying stocks and that is not my strategy. If trading options using equities, I strictly want to trade against dividend aristocrats. The main reason for this is that if I get assigned and have to hold the stock for a while I have to be:

1) OK with that.

2) Get paid for waiting in a stock.

Trading some cheap high flying stocks where you can’t tell what happens with it in the next 3 months or 6 months is not for me. In the past I chose such trades. I traded using stocks such as WYNN, LULU, X, none of the stocks were the ones I would be willing to own so when they went against me I tried to avoid assignment at all cost. And it cost me dearly! I still hold a few positions at a large loss far away expiration (2 years in future) thinking how to deal with it as these positions are still hurting me.

No more stocks I am not OK to hold. And since my background was dividend growth stocks, the only stocks I like to hold and play, are the dividend aristocrats. I will deal with those skeletons in the closet later.

For this example, I will use a trade I placed last week using Boeing (BA) as it was a trending stock, dividend stock, and offering a decent premium:

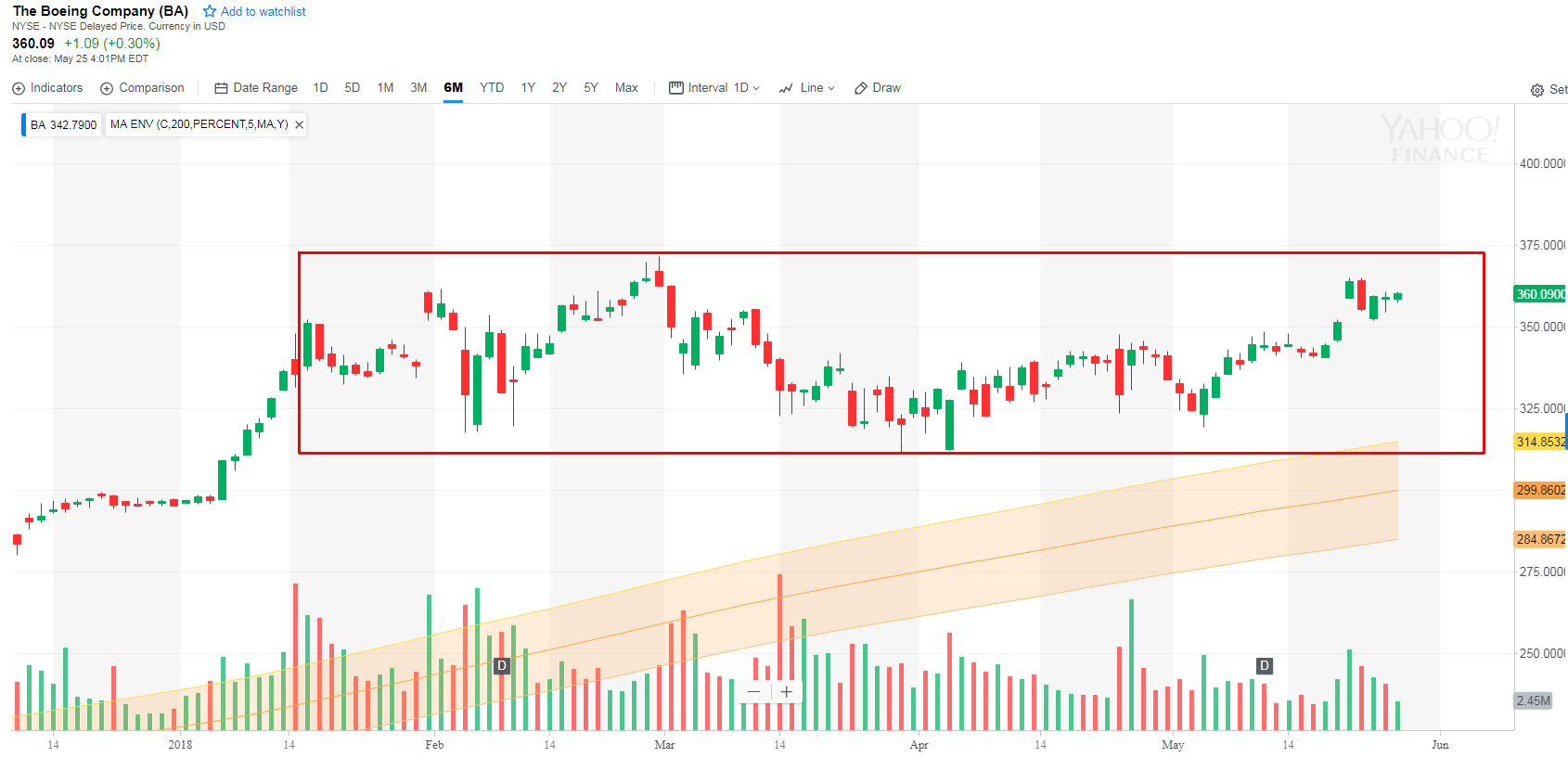

1) Before placing a trade I go and check the chart:

The chart indicates a potential bull flag forming. The stock is trading above major supports but the price action seems to be extended and there may be a pullback (invalidating the bull flag if that happens). We are also near the top of the current trend making a reversal more likely. However, we are also currently in a sideways trend:

But since we want to trade as short time frame as possible, I want to check the shorter time frame too:

This chart still indicates that we are range bound and that Iron Condor may play well. That was the reason for me placing an Iron Condor and not just a bull put or bear call spread.

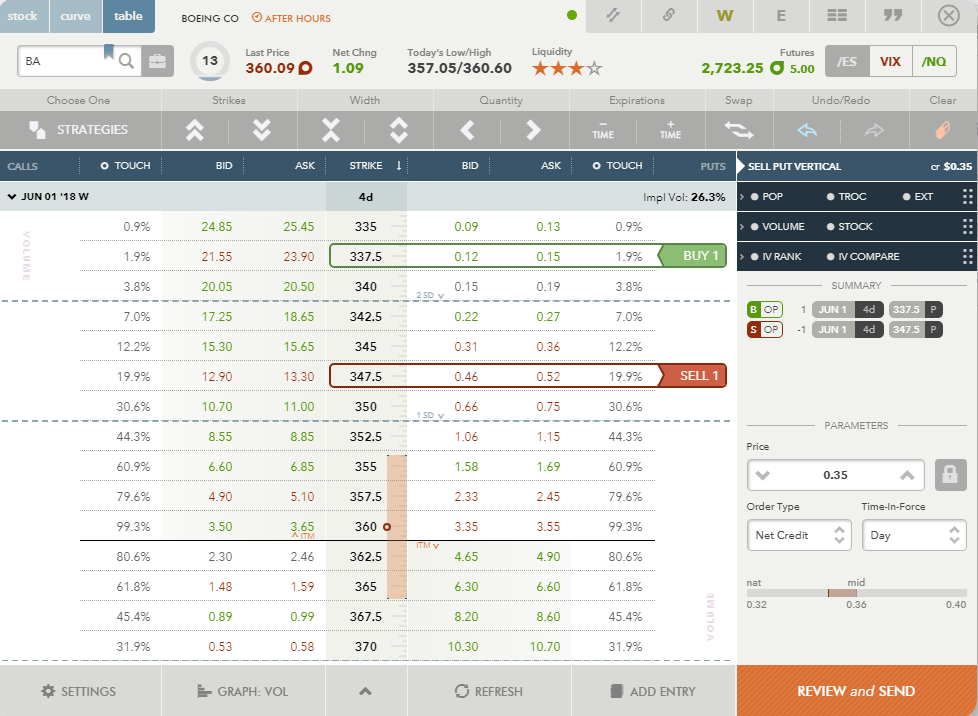

2) Now the process would be the same as with SPX. Let’s review the trade as if I was placing it today (ignoring that it is a Memorial Day today) and check Friday’s expiration.

Because I am aware of BA trend a bit extended I would like to add more protection to the downside and offset my put strike a bit more than just 1 SD.

The nearest out of the 1 SD range put strike is at $350. To offset this a bit further, I would choose $347.50 strike. I would also go with $10 (or $1000 dollar) wide spread, so my long put strike would be at 337.50.

Adjusting the mid point, this trade would deliver $35 (0.35) premium:

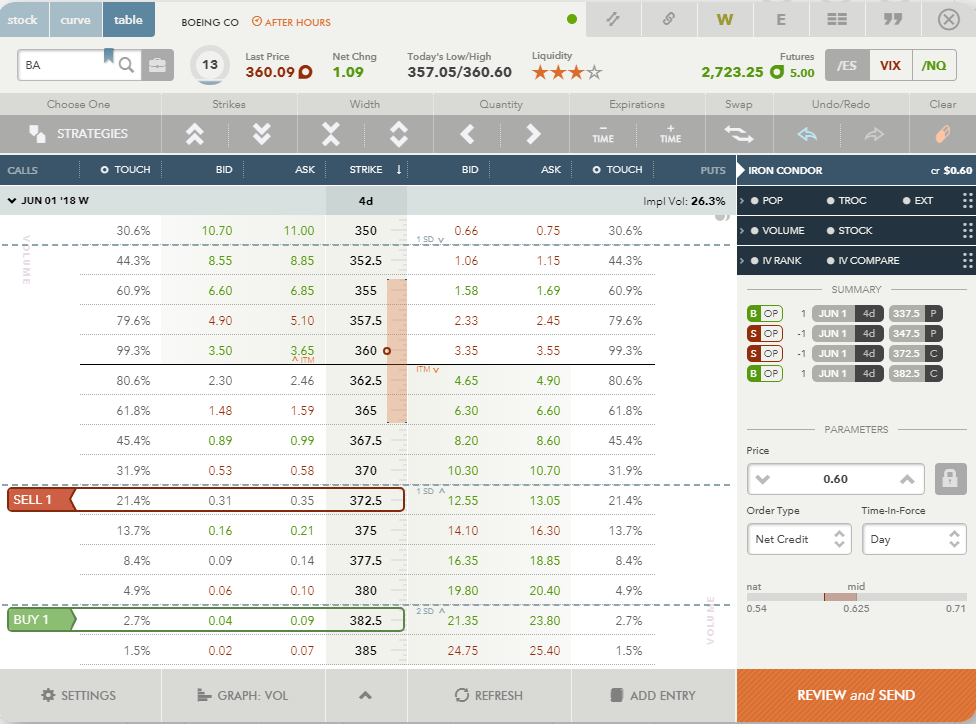

3) Since I am expecting this stock to continue sideways (possibly slightly down or up), I am OK with Iron Condor trade. For this reason, I add a call spread:

Adding a call spread and adjusting the mid point to 0.60 ($60 dollars) premium in 4 days is an excellent trade and I would place it. But beofre I go and hit enter, I want to again review the chart to see where my trade will be standing at:

The trade looks good to me and it appears to be safe. Of course, there is absolutely no guarantee that BA will continue sideways or up. Tomorrow, it may sell off hard based on any creepy prediction of the analysts who are obsessed with short term views unable to see a big picture and I will have to adjust this trade. That is the risk you are taking when trading options, and in fact any equity. But the risk is not in a potential of losing money. The risk is in being wrong in my assessment and chart reading, which I admit I suck at. But the beauty of options is in a great possibility that if you are wrong and the stock goes against your trade, you can adjust the trade.

For example, if the stock reaches $350 in the next 4 days, I will roll the trade away and down. Otherwise, I place a buy back order for each leg for 0.05 debit or let it expire (since it is a 4 days trade, I would most likely let it expire).

Hope this helps and explains my trade process.

Hi, I am actually new one for this site. I read your post about exposure consistent dividend payers. It has more relevant details. I gather so many new details from this post. Thank you for sharing these facts. Love your weblog put up. Please preserve updating. You could additionally go to our blog to know about writing techniques. Our blog contains all kinds of essays writing tips.

Hi, I am actually new one for this site. I read your post about exposure consistent dividend payers. It has more relevant details. I gather so many new details from this post. Thank you for sharing these facts. Love your weblog put up. Please preserve updating. You could additionally go to our blog to know about writing techniques. Our blog contains all kinds of essays writing tips.

Hi, I am actually new one for this site. I read your post about exposure consistent dividend payers. It has more relevant details. I gather so many new details from this post. Thank you for sharing these facts. Love your weblog put up. Please preserve updating. You could additionally go to our blog to know about writing techniques. Our blog contains all kinds of essays writing tips.

Hi, I am actually new one for this site. I read your post about exposure consistent dividend payers. It has more relevant details. I gather so many new details from this post. Thank you for sharing these facts. Love your weblog put up. Please preserve updating. You could additionally go to our blog to know about writing techniques. Our blog contains all kinds of essays writing tips.