February 2016 is over. To me it marks a new milestone in my trading career. In my past posts I mentioned that if I will not be able to make profit trading options against SPX, I stop trading this strategy.

This time has arrived. I tried hard. I tried everything I could to make my trading profitable. But I wasn’t able to make it. So I am abandoning this strategy for the time being. In the future I may return to this strategy, but not until I will recover my account and will have enough money to trade this strategy.

My dividend investing continued performing well in February. I purchased new stocks and I can see results of DRIP investing. I also decided to apply my put selling trading in ROTH account too. But, again, no SPX trading.

You may be interested in:

2015 In Review: Spending By Leigh with Leigh’s Financial Journey

Where can you find things to read for free (or cheap)? By nicoleandmaggie with Grumpy Rumblings (of the formerly untenured)

Sharebuilder Weekly Purchases By AA with Accumulating Assets

20 Strong Dividend Growth Stocks – Rock Solid Ranking Free Report By Mike with The Dividend Guy

· February 2016 trading results

For the time being I am abandoning SPX options trading strategy and going back to put selling strategy. In my post I wrote early this morning about opening a new trade against Ensco (ESV) that I was going back trading options against dividend paying stocks.

It is a win-win strategy and used to trade this strategy in the past. I multiplied my account using this strategy.

The reason why this strategy is great is that you are OK to get assigned to the stock if the put option gets in the money.

If that happens, you will buy a stock which will pay you dividends in the meantime while you continue selling calls.

With the SPX strategy, I couldn’t afford to get assigned because my account had not enough money for a cash settlement. So I needed to defend my trades. And defending my trades was the moment which was losing me money heavily.

You may be interested in:

Encrypted USB Flash Drive For Financial and Legal Documents By Harry Sit with The Finance Buff

WHEN THE UNIVERSE SAYS STOP SPENDING! By WHB with Well Heeled Blog

March 2016 Stock Considerations By Keith with DivHut

How Much Do We Spend on Guilty Pleasures? By Alyssa with Mixed Up Money

I started trading the put selling strategy at the end of February, so the results were not yet visible but I was able to recover majority of losses from SPX trading strategy. In the next coming months this strategy should start paying off.

However, the progress will be slow as of now. Because my account is small (since I destroyed it in the past), so I will not be able to trade this strategy monthly yet, but as the account will be growing I believe, I will be able to speed my trading up again.

Here is my trading result for the month:

| February 2016 options trading income: | -$72.00 (-0.62%) |

| 2016 portfolio Net-Liq: | $1,769.29 (16.50%) |

| 2016 portfolio Cash Value: | $2,166.79 (20.96%) |

| 2016 overall trading account result: | -30.34% |

Here are the results of my options trading:

Here are the results of my options strategy:

As I mentioned above, I am not going to trade this strategy for time being. So this will be my last report on trading SPX spreads such as Iron Condors, or vertical spreads.

Instead, I will be posting my individual trades against dividend paying stocks.

Since my account is small, I am starting with cheap dividend stocks such as PSEC or ESV, but as my account continues going up, I will start trading more expensive and stable dividend stocks to generate income.

Here are the results of my PSEC put selling strategy:

The first stock I decided to start selling puts against was PSEC. It is a BDC company, it pays dividend monthly and I own this stock in my ROTH account. I do not mind buying more shares of this stock if I get assigned. I have owned this stock since 2010 and although it lost some value and many consider it a dead stock I believe this stock will perform great in the future.

With the put selling strategy I am lowering my cost basis so even if I get assigned to the stock at the current strikes, my real cost will be a lot lower because of premiums received.

My latest trade, as you can see below, had strike 7 dollars, I collected 2.60 premiums. Even if I get assigned at 7 dollars a share, my cost basis will only be 5.10 a share. I can immediately start selling 6 dollars calls (which will be deep in the money) and get out of the stock fairly quickly and still make another 0.90 or $90 dollars profit. And in the meantime I can collect dividends (it will be $8 dollars for 100 shares owned).

I think this is not a bad prospect, isn’t it?

Here are the results of my ESV put selling strategy:

Similarly, in my trading account I can open a bit more trades than in my ROTH account thanks to margin trading. So I decided to add Ensco (ESV) put selling strategy. Ensco is involved in offshore drilling so it is heavily dependent on oil price. As of today, the stock may be risky, riskier than PSEC, but I am OK to take that risk and I am OK to own the stock should I get assigned.

However, I will not be as aggressive selling too many puts against this stock as with PSEC. I will be selling new puts against Ensco only when the old one expire or I get assigned (in which case I start selling calls instead).

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Figuring out the job in 2016 By SP with Stacking Pennies

January Eating Out By Jessie with Jessie’s Money, Jordan’s and Little Man’s Too

Leveraged Dividend Investing By DGI with Dividend Growth Investor

10 Innovative Personal Finance Tips By Generation YRA with Generation Y Retirement Account

· February 2016 dividend investing results

My dividend investing continues being a boring and same routine month to month. Great strategy, however. Every month I collect my dividends, use DRIP to reinvest them into the stocks that generated them and if I happen to save more money ($1,000 limit for an individual trade) I purchase a new stock (or existing if it offers a great purchase opportunity.

I have big plans and dreams what stocks to add into my portfolio and I am slowly getting there. Well, very slowly right now. This is why I will be applying my put selling strategy in my ROTH account too to generate more income which I can reinvest.

There will be one difference to the put selling strategy. I will not be selling calls against my core holdings, only stocks I acquire thru put selling.

For example, I currently hold 100 shares of PSEC. I sold a new put contract against PSEC. If I get assigned, I will start selling calls only against the acquired 100 shares of PSEC and not the entire 200 shares holding. In the meantime I will be collecting dividends which will be automatically reinvested to increase my core holding. In case my calls get assigned, I will get rid of the new 100 shares only and not the entire core holdings.

Here are the results of my PSEC put selling strategy:

This time I do not have to be worried about unwanted assignments or trade repairs which end up a huge loss. If I get assigned, I get to be buying a stock I want anyway.

Dividend stocks added or removed from portfolio:

| February 2016 dividend stock buys: | 17 shares Valero (VLO) @ $57.84 |

| February 2016 dividend stock sells: | none |

To purchase stocks I use trailing stock order strategy OTO trade order (one triggers other) and I described this strategy in my post about purchasing stocks in falling markets.

I also invest into dividend paying stocks using Motif investing which allows me to buy all 30 stocks I want in one purchase using fractional investing, similar to a mutual fund.

You can actually build your own mutual fund with Motif investing.

Here is my Motif Investing account you can review:

I continue reinvesting my dividends using DRIP program. I love how my holdings grow when reinvesting the dividends and when the stock prices are going lower. As I believe we are heading into a recession I will be able buying more shares for a lot cheaper.

Dividend stocks DRIP:

| February 2016 DRIP: |

American Capital Agency Corp. (AGNC) Master Card (MA) Realty Income Corporation (O) Prospect Capital Corporation (PSEC) Vanguard Natural Resources, LLC (VNR) Kinder Morgan (KMI) |

Here are my ROTH IRA trading/investing results:

| February 2016 dividend income: | $57.42 |

| February 2016 options income: | $55.00 |

| 2016 portfolio value: | $16,678.80 (8.95%) |

| 2016 overall dividend account result: | 10.26% |

It is nice to see that my account jumped up 10% in February. But my dividend income got hit by another dividend cut, this time by ConocoPhillips (COP), so there is still a lot of work to do and buy better stocks which will not be cutting dividends. But that was the price I paid when playing the oil game investing into energy stocks hoping we would recover faster than this.

Here my dividend income:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Travel on the cheap By Aah-Yeah with NZ Muse

Kennedy Wilson Holdings By Dennis with Dennis McCain Investing

Favorite Dividend Stocks for 2016 By DL with Dividend Ladder

7 Money Moves You MUST Make Before You’re 30 By PFG with Personal Finance Genius

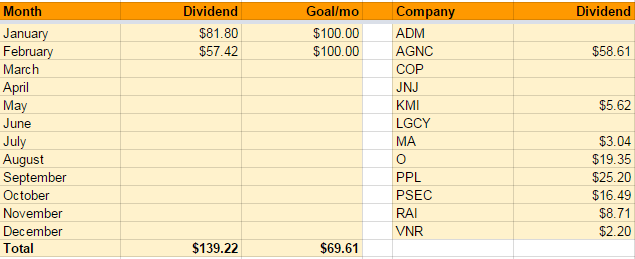

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts increased from previous month and are making 2.09% (up from previous month) for the year.

Remember, if you like trading options and want to have trade ideas for free, join my Facebook closed group and follow my put selling trade ideas in real time, comment, ask questions, and interact with other members. other members of the group can also post their trades so you can learn from them too.

What do you think?

How about your investing or trading results?

If a strategy is not making you money then it is probably not a strategy for you.

My option strategy is also on writing puts against trackers and stock i do not mind to own. Let’s be clear: the goal is not to own them and only collect the premium.

I just posted my trading results and Feb was a good month. I hope I can keep the momentum. And even more important: can I keep my emotions under control and my risk within my limits.

I must admit that as soon as I stopped trading the index it was a great relief to me. Now I trade options against stocks I am OK to own so I have no fear or greed. and I do not care what the outcome will be because no matter what happens I will be OK with it.

In my trading account I do not want to own the stocks as a core portfolio. I am still OK to own them for selling calls against them, but as soon as they get called away, I am fine with it and I will start selling puts again. In my ROTH I won’t do this against my core portfolio.

Thanks for stopping by. I will be checking yours soon.

As always, I appreciate the DivHut mention. Thank you. Thanks for sharing your trading results as well. I do enjoy seeing the results of your options trades.

Keith, it was a hard and bumpy way and I hope I am done with experimenting and sticking with what works. Thanks for stopping by.