I created a great strategy for myself and I thought that the strategy was completely invincible. And it was running great and I was making money.

I also created a defense strategy in case something would go wrong however, I never expected to use the defense.

Until the recent sell off and market crash.

Then I realized how weak my defense was and how vulnerable I was. I decided not to believe in the crash, not to react and take a small loss. By doing so, I decided to swap a small loss for an even bigger loss I am dealing with now.

I found out, that the biggest enemy during violent markets was myself. Thanks to my emotions I was unable to react or reacted at the wrong time and wrong price.

How many times have you heard or read that a trader must eliminate emotions? Dozen, right? How many times have you heard or read how to do it?

I haven’t heard of any great advice. All was just a gravy beating around the bush and no advice was applicable.

The recent market moves made me to sit down again and think about my defense strategy to make it bullet proof and eliminate emotions, so all trading would happen automatically and without me.

And here are my findings and adjustments to my strategy.

· 50% credit capturing

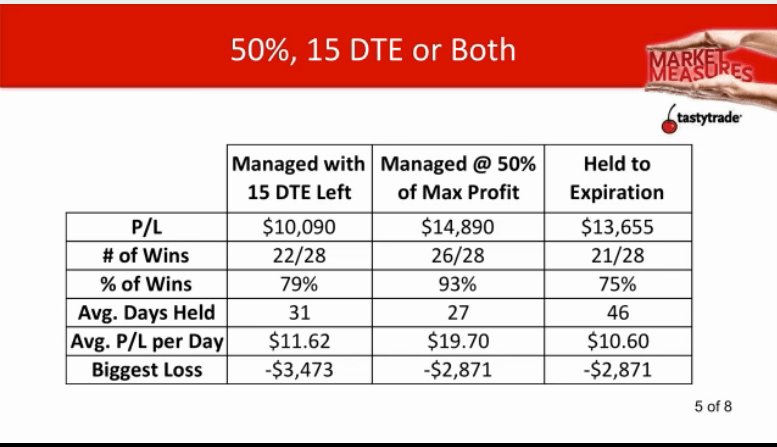

This is nothing new. Many experienced traders use this strategy. Tom Sosnoff from Tasty Trade advocates very strongly this strategy of taking profits off the table. Tasty Trade even performed a study which proved that when you take 50% of the original credit, you will be better off. You will hold a trade shorter period of time and you will eliminate a negative gamma effect as the expiration approaches.

Within the same period of 45 days cycle if I capture 50% credit, I can make 2 to 3 trades for about the same credit as the first trade and actually make more money. Look at it this way, if I make a trade #1 and get 1.50 (or $150 dollars) credit, then I can close it in 15 days for 0.75 (or $75 credit) and immediately open a new trade, again for $150 dollars credit, close it again in 15 days for $75 dollars, I still can open another $150 dollar trade for the remaining 15 days in the entire 45 day cycle. If all goes well, I can actually make $225 dollars instead of the original $150. And reduce risk.

Of course the projection above is theoretical and the best case scenario which may never happen. For example Tasty Trade results show average holding period 27 days instead of my 15 days. I could close a trade in 15 days due to a recent drop in volatility. Also the premiums may differ and will not be same in all three trades. But the point has been made. It is safer, you may make more money, and your probability of success is larger.

In the picture above you can ignore the first column as we do not use that strategy and pay attention to the column 2 and 3. As you can see, we hold shorter period of time, make more money ($1,235 dollars more than in unmanaged trades) while our risk is same.

That’s what we definitely want.

· Protecting Iron Condors against downside risk

The next step is to protect our trades during sell off, crashes, panic, freak-outs and similar disasters Wall Street time to time suffers. As of this writing, we are heading towards a possible interest rate hike in 7 years. Next Thursday the FED will hold an FOMC meeting and may or may not announce a rate hike or not. Nobody knows. And market may react violently to this event.

It may crash again or it may spike up. If I had a crystal ball I would reposition all my trades accordingly. But I do not have one. I can postpone my new trades after the meeting, but what about the running trades? Close them with a loss? Let them run and risk even bigger loss?

A crash would be nice. I can open many new put spreads collecting fat premiums. But what to do with the existing trades and not to repeat the same mistake of being inactive when I was supposed to act?

There is a strategy to remove the put spread if the price to buy it back doubles the credit received. For example, if we open a new trade and receive 1.50 or $150 premium. I would close the put spread if its price gets to 3.00 or $300. I will limit my loss to $150 dollars only. I can then use calls and roll them lower to collect another credit to offset this loss a bit to make it even smaller.

Now we know, what we want to do. We want to take profits if the trade goes with us and close it quickly if it goes against us.

But how to do it to eliminate emotions?

· Create closing orders to eliminate emotions

There are three methods known to me how you can protect your downside of a trade – be it just a put spread or the entire Iron Condor.

You can hedge the Condor by adding more long puts to your short puts (for example to each one short put you add another long put, so you will have 1 short and 2 long puts). But with SPX hedging with long puts can be quite expensive and in many cases you may end up with no profit at all.

The second method is to buy VIX calls, but VIX not always acts rationally and in correlation to the hedged index, so I actually see this as adding risk or worsening my risk/reward ratio.

The third method is to take the put portion off the Condor out when the value of puts reach two and a half of the received credit. I like this method better and I am going to use it.

Why puts only and not the entire Condor? The risk to the downside is bigger than to the upside. I have seen the market crashing down violently many times but never to crash to the upside. There is a saying that the market takes stairs up, but elevator down. If we close puts only for a small loss, we still have calls to play with and by rolling them down, we can make the loss even smaller.

Therefore, we want to place an order with our broker to achieve the following strategy:

- Right after a new trade executes we want to place an OCO order (One Cancels Other).

- The order will consist of two parts – one closing the entire Condor, the second closing put spread only.

- If the price of the entire Condor drops down to 50% of the original credit, the first part of the OCO order executes and the second part is canceled.

- If the price of puts rises to two and a half of the original credit the second part of the order executes and the first part of the order is canceled.

- If only call spread are left, we lower them to collect more credit.

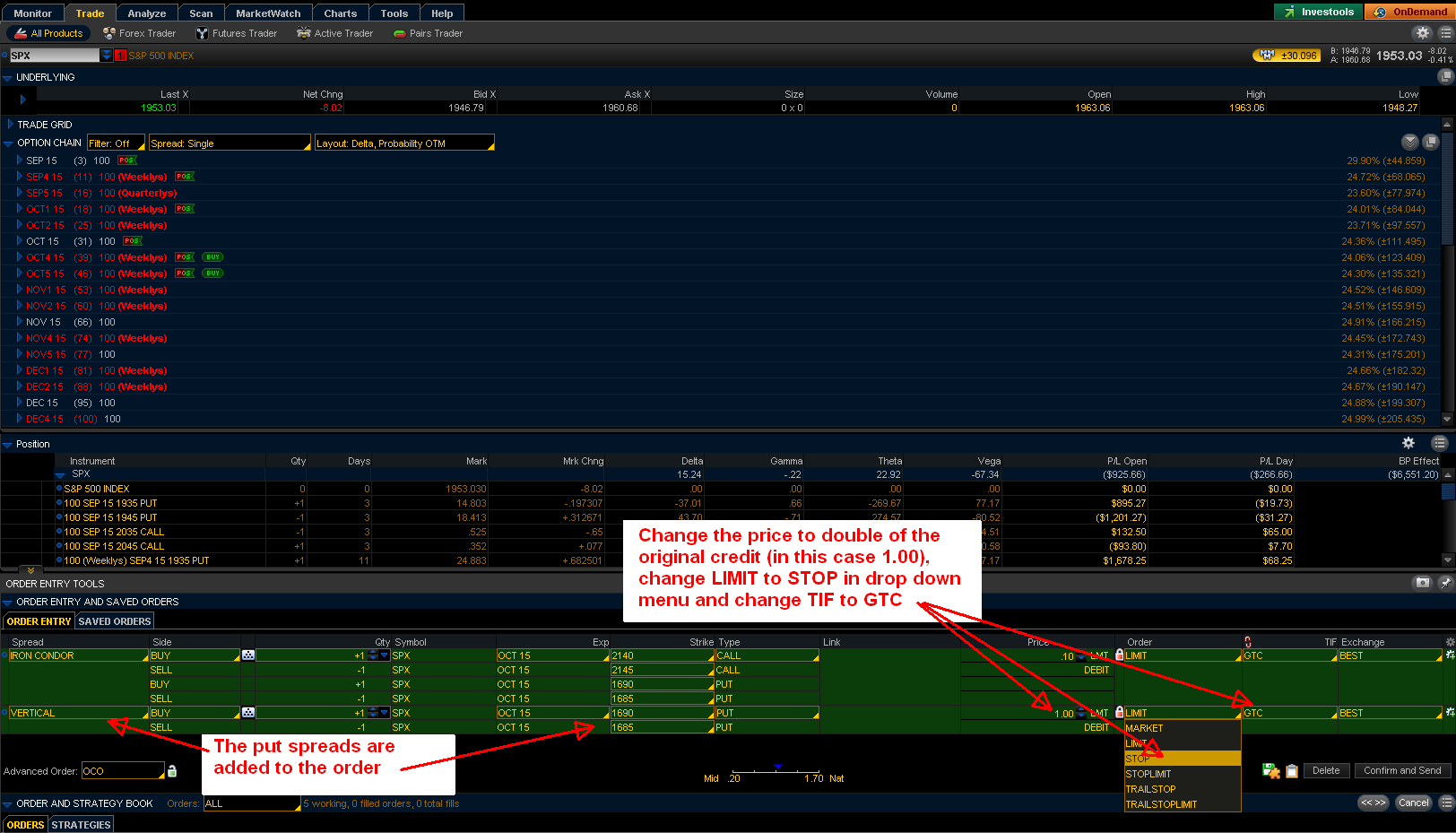

Since picture is worth 1000 words below are screen shots of how to create above described order in Think or Swim application. If you trade with a different broker at a different platform, you may contact your broker and ask them for help how to create such order. If a broker you trade with doesn’t support OCO orders, then you have to watch your trades mentally and act manually. But that’s something I failed to do myself in the past, so I like to place those orders after opening each trade and forget about it. If you are like me, I would change a broker which allows OCO orders.

The pictures below are based on actual trades I had in place. It was against trade #13, trade #14, and trade #15.

1. Cancel the original closing trade

Originally, I had a 50% capture order in place. Such trade couldn’t be replaced with an OCO trade, so I had to cancel the old trade order first.

2. Select the trade to be closed for profit or loss

Then go to the “Monitor” tab, select the trade you want to close for a profit or a loss, highlight all four legs of the Iron Condor (yellow highlight), right click on the selection and from the menu select “Create closing trade > select the top option to buy back the entire Condor”.

3. Modify the closing ticket

The closing order is added to the trade ticket. Change the “Single Order” to the OCO in the lower left drop down menu. Also change the limit debit price to 50% of the original credit. If you originally received $80 premium, change the price to 0.40 limit or $40 debit. In the example above I has a trade which I wanted to close for $10 only as this was a 5 dollar wide spread only. Change TIF (time in force) to GTC (good till canceled).

4. Add put spread to OCO

Go back to the “Monitor” tab and go to the same trade. This time, instead of selecting all four legs, select (highlight) puts only.

5. Create OCO closing trade on puts

Right click on your selection and from the menu select “Create closing order” and select the top line to buy back vertical spread. This is a similar step as in number 2 above.

6. Modify the added closing trade

The new vertical spread closing trade is added to the order ticket as shown on the picture above. Now, change the limit price to the double of the original credit. In the example above I originally collected 0.50 or $50 premium, so my trade above is set to 1.00 or $100 debit (Note, I changed this to 2.5 of the credit, so it should be 1.5 or $150 in my next trades). Change the LIMIT order to STOP order from the drop down menu. Also change the TIF (time in force) to GTC (good till canceled).

Now you can send the order to the broker.

7. Final result

If you did everything as described above, your order should look like the one on the picture. You should have two orders linked together. For example the highlighted Iron Condor is currently trading at 1.474195 (see the price next to the “WORKING” tag. The highlighted order says, that if the price drops down to 0.70 the entire Iron Condor will be closed and the put spread order will be canceled.

If the price of the put spread rises at or above 2.80 the put spreads will be closed and the first order to close the entire Iron Condor will be canceled.

· Rolling calls

When the puts spread is taken away from the trade at a loss I roll down my calls. If the puts are taken off with break even or gain, I just place a buy order on the calls to buy them back for the desired 50% total gain.

For example, I had a trade where I received $140 credit. My 50% credit capturing strategy would dictate to buy back the entire Iron Condor for $70 dollars. During the volatile market my puts happen to be closed for $35. So I placed a buy to close order for calls for the remaining $35 dollars.

If my puts are taken off for a loss instead, I then lower (roll down) call spread to collect additional credit. I roll calls down with the same expiration and I do it a week prior to expiration (usually on Monday/Tuesday). This allows me to collect additional $40 – $50 dollars to offset the loss.

For example, if I originally collected $140, my stop loss is placed to 2.5 times (updated) of the credit higher, thus to $350 (or 3.50). If the stop loss trade executes, my loss will be $350 – $140 = $210. If I lower my calls down and collect additional $50 dollars, my loss will be $160 or 18% (860 total risk). Instead of losing the entire risked amount of $860 dollars, with this strategy I could limit the risk to $160 only.

What if the SPX price slices thru both put strikes?

This is tricky to deal with, in this case you have to assess whether the market recovers or not. Hard to say. If it does recover, all your adjustments will go against you. If it doesn’t you salvage your trade. So you decide what you want to do.

If that happens and there is no prospect of recovery, All you can do is lower you calls to match your puts. It is called an Iron Clad trade. Let’s say you have the following put spread:

– 1950 puts

+ 1940 puts

You ten roll your calls lower to the following strikes:

+ 1960 calls

– 1950 calls

With this strategy you collect more premium. You may collect 50% or more (if done in time) to offset majority of your loss. I had a trade where I risked $1,500 dollars total. With the original credit and Iron Clad adjustment I could collect additional $980 dollars, the trade recovered a bit and closed with short put ITM only leaving the long puts OTM for partial loss of only $200 dollars. With all the collected credit the trade was a winner ($980 – $200 = $780 profit).

· Conclusion

With the closing OCO orders as described above I will be able to capture profits if they occur and close potentially losing trades when the losses are still small before they become big. Remember, there is a saying, “if you are not willing to take a small loss now, you will take a mother of all losses later.”

The protective trade above will eliminate my guessing whether the market recovers or not. It will eliminate my emotions, hope, wishful thinking or prayers from trading. With those order I take a small loss compared to the entire risk. I trade 10 dollars wide spreads, thus I risk $1,000 dollars for the entire trade. With the closing order I limit the risk to approx. $100 – $150 dollars per trade. And that is something what we can afford if the market goes against us.

We can take the released cash and sell a new Iron Condor with better strikes and offset the loss. If we lose $500 or even $1,000 in one trade, we basically liquidate a year of profits. So why let our guesswork and hopes whether the market returns back up or not ruin our trades, right?

Hi, thanks for penning down your thoughts & strategies. This is very valuable info and exactly what I was looking for to understand how to take adjustments when the market violently corrects/crashes.

Are you able to share how this automated strategy has worked for you thus far?

Cheers

Ethan

I changed brokers and now using Tastyworks. I think TW doesn’t have the OCO orders option available, so I was doing it manually. The desktop version may have it but I was not investigating it.

Hi,

I just wanted to say thank you for this post, very detailed and interesting. I also trade Iron Condors on SPX, and I agree with you: the more automatic the trade, the lesser the emotions. I will check if my broker supports this kind of conditional orders. I have my manual limits, but I’ve never tried to make it automatic. Like you, I close at 50% of benefits. But I use a limit of 3% of losses, I mean, if losses reach 3% of my account, then I close 50% of the trade, if the continue, I close 100%.

Anyway, thanks again and good luck with your investments.

Regards,

Curro