July 2015 is over and it is time to review my trading, investing, and dividends results for the month.

A month ago I adopted a new trading strategy, which works perfectly so far. It is however too early to judge. Also, the market is relatively calm (except a few sell offs) and I would like to see how would the strategy perform in a tumorous days.

Nevertheless, we still can see markets bouncing within a range for the rest of the year with large swings either way, and what’s perfect with my options strategy is that it is immune to those swings. Unlike my previous trading, I now do not have to worry about those moves anymore.

You may be interested in:

Too Thin?! By Bryan with Income Surfer

Looking for Gold By Roadmap2Retire

STOCKS GO NOWHERE: Here’s what you need to know By Akin Oyedele with Business insider via Yahoo Finance

Are Investors Really Panicking In A Historically Boring Market? By Ryan Detrick with Tumblr

Greece crisis escalates as IMF withholds support for a new bail-out deal By Mehreen Khan with The Telegraph

Yet this month, I realized some losses as I decided to get rid of my stock trades and hold them no more. I expect this to be happening in August 2015 too. However, after August is over, I should only have my SPX spreads traded according to my new rules and start showing profits and growth only.

· July 2015 trading results

My July 2015 trading shows a loss. All my trades under the new SPX strategy were however, positive and profitable. All trades ended with average 12% gain. Compared to the entire account value I am making nice 1% weekly! It was the old and closing trades sending my account down.

| With 1% weekly gains I should end the year 20% higher than what I have today. For the entire next year I should see at least 52% gain (compounding excluded). |

This is an excellent outlook and a great hope that I finally found a working strategy which will allow me making money now and not 20 years later.

Although my new strategy works, I realized a loss this month because I was reducing exposure to oil companies. I had (and still have) a few trades against OXY, ESV, AGU, SDLP, and LGCY companies, which are showing mixed results. Since I decided no longer trade options against individual stocks and focus solely on SPX, I closed trades against SDLP (with a small loss), and OXY (with a larger loss).

In my opinion, it was a good move to start fresh.

You may be interested in:

Options Expiration – July 2015 By Alex Fotopoulos with My Trader’s Journal

Daily Scan for Thursday, July 30th, 2015 By Options Guru

Standard & Poor’s 500 Stock Index Outlook By Financial Forecast Center

Buying oil stocks at these prices is just spilling money By Jeff Reeves with Market Watch

I also closed a spread against LGCY with a small gain and moved naked puts against LGCY lower to improve the trade. After some time I plan to close this trade entirely.

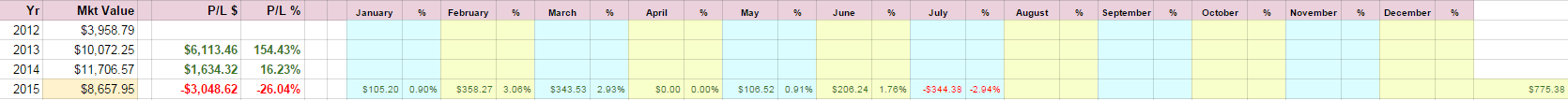

Here is my trading result for the month:

| July 2015 options trading income: | -$344.38 (-2.94%) |

| 2015 portfolio Net-Liq: | $8,657.95 (-6.72%) |

| 2015 portfolio Cash Value: | 12,927.95 (-0.13%) |

| 2015 overall trading account result: | -26.04% |

Here are the results of my options trading:

As I mentioned, this month and the next one will be losing months as I decided no longer holding positions against some stocks and focus on SPX only. I am also getting rid of one old SPX trade which is already a losing trade. However, September 2015 should be already a fresh start month with 45 DTE SPX options trades.

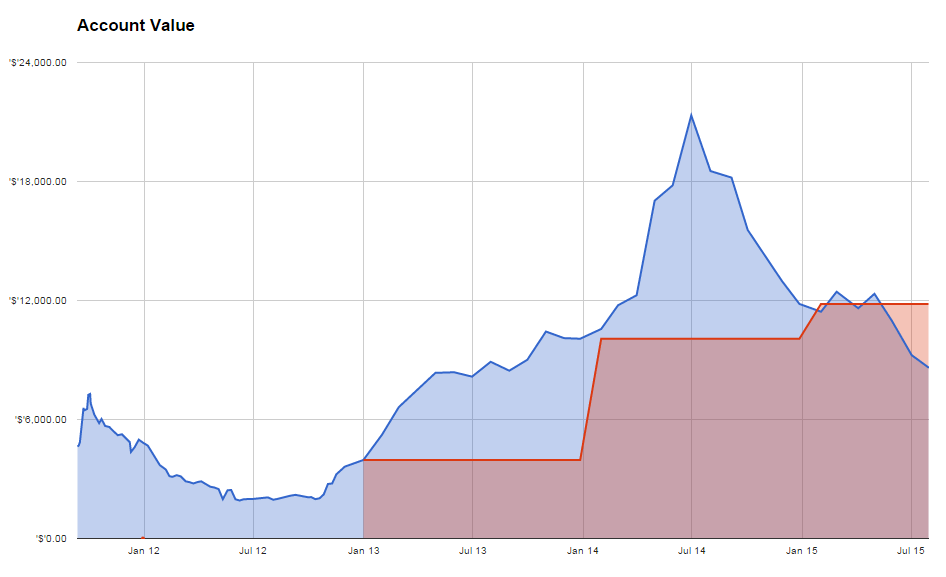

Here is the entire account value from the beginning of tracking it up to today:

· July 2015 dividend investing results

I like my new trading strategy so I decided to use it in my ROTH IRA account. I plan to use proceeds from options trading to buy dividend stocks. I no longer use my non-transaction fee strategy saving money in RWX ETF. Instead, I use the money to trade options to generate income along with dividends I receive.

Once I make at least $2,000 per month, I will use 50% of that money to buy a dividend growth stock. I will reinvest the remaining cash back to options trading to make sure my account is growing faster and generates more money to invest.

Since I started trading options in my ROTH IRA account later, my results are still small. Actually, this month I had my first expiration this Friday. So, I can only report $60 dollar income this month. But in August, the account is set to make $150 from options. That’s twice as much as I make with dividends in weak months and about 50% more in stronger months.

It doesn’t mean that I want to stop investing in dividend stocks. No, read my strategy where I speak about the reasons, why I will continue investing into dividend stocks, but the major reason is, that now I like trading options, it brings me excitement I want from trading and it brings income. But it is not a passive income and one day I want to stop trading too. I may not even be able to trade anymore. And dividends should substitute that income.

So I trade options for income now and have dividends for income in 20 years from now.

You may be interested in:

New Purchase – Whole Foods Market (WFM) By All About Interest

August 2015 Stock Considerations By DivHut

Recent Buy – IBM By DividendDiplomats

Dividend Growth Stocks Protect Investors from Inflation By Dividend Growth Investor

Five Reasons Why Florida Might Be The Best State To Seek Out And Achieve Early Retirement By Jason Fieber with Dividend Mantra

Market Cycles: How to Build Wealth Quickly By FI Fighter

This month, I only traded options against SPX and I had no new stock addition or removal from my portfolio. The portfolio is down because of some oil exposed companies I added in the previous months. I still will be accumulating oil and energy companies to my portfolio if my money management rules allow it and as long as those companies will be depressed.

Dividend stocks added or removed from portfolio:

| July 2015 dividend stock buys: | none |

| July 2015 dividend stock sells: | none |

Here are my ROTH IRA trading/investing results:

| July 2015 dividend income: | $84.52 |

| July 2015 options income: | $60.00 |

| 2015 portfolio value: | $17,835.69 (3.48%) |

| 2015 overall dividend account result: | 2.21% |

Here is the entire account value from the beginning of tracking it up to today:

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts dropped from previous month, but are still up 2.96% for the year. Considering how bad the market was this month I think, this is not a bad result.

What do you think?

How about your investing or trading result?

As always, thank you for the mention of DivHut. It’s much appreciated.

You are welcome DH, glad I could share a good content.

Thanks for including us in the article. I couldn’t be happier with my IBM purchase. You had a great month of July and have shown some great progress. Look at the increase between July and April. Keep up the great work and keep on grinding. You will hit financial freedom before you know it!

Bert, One of the Dividend Diplomats

Bert,

thanks for stopping by. Yes, there was some progress, but not as good as I would like to have. But I believe, it will come. 2015 was a tough year so far, but if we want to achieve success we need to take some risk, right? Hope you had a great month too!

Martin

Thanks for the mention, HS.

Looks like July fell a bit short of your goals. Hope August brings better results for you.

Best wishes

R2R

Hi R2R, actually I expect August still down as I will be liquidating some bad trades but then it should be all bright and green.

Thanks for stopping by and commenting. Hope you had better month.