There is an old adage on Wall Street – “Sell in May and run away”. If you have done that, then you missed a nice returns overall as markets grew quite nice in May 2014. S&P 500 rose by nice 2.18% in May and closed near all-time high. What a blessing!

Should I have sold and stay away from the markets? Absolutely not! Well, it depends.

My overall May 2014 account was down by -2.15% but only because I made a few deposits which lowered my adjusted balance and also my options trades are normally deferred into a later time. What does it mean?

It means that when I sell a premium, I receive cash right away, but my account balance won’t reflect it until expiration or a significant time decay destroys the value of that option. So if I sell a put premium at bid price, let’s say $1.05, my account liquidation value at that same point will be the ask price at let’s say $1.10 and thus showing a loss.

This principle is behind my May 2014 negative account growth along with some deposits I made during the month.

But, because of a sell off at the beginning of May (see my post “Today it was a massacre in my account” or “Disaster continued, but navigated my account well thru the storm” my account was actually down by -10.54% at the beginning of the month!

I was able to recover almost everything! Thus far, I am satisfied with May 2014 returns and results. But my satisfaction is actually elsewhere, not only in the overall recovery during the same month. Check the graph below showing my account balance (note, this is my TD Ameritrade balance only, for all accounts visit “My Trades & Income” page and scroll all the way down to see a table of all my accounts):

A hint: the red area indicates previous years closing balance. With a previous year closing balance of $10,072.25 I am about to double my account value this year! In May 2014 I closed at 17,804.66 with only $2,195.34 to go to close at 20k mark. This is something exciting to me. If my dividend growth & options strategy continues providing with the same results in the following years, I believe I should retire in 6 years.

I understand that it might be tougher every year since it seems easy to double my money when you need to make only $10k to double your account instead of $80k of dollars, for example. But I am optimistic.

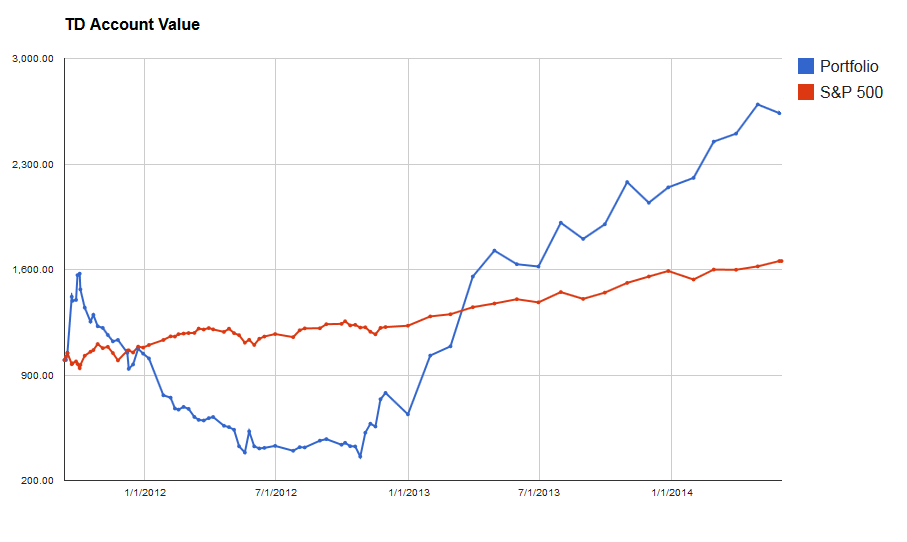

To be fair I am posting my account vs. S&P 500 chart. The chart is adjusted for contributions (basically it shows only gains or losses). That clearly indicates what I mentioned above, that the account closed at a small loss of its value or balance.

That didn’t affect my income at all. May 2014 was my second best month as far as options premiums collected goes and the second best month when speaking of dividends.

Here are new results for May 2014 (TD account only):

| January 2014 premiums: | $156.10 (1.55%) |

| February 2014 premiums: | $139.26 (1.38%) |

| March 2014 premiums: | $746.62 (7.41%) |

| April 2014 premiums: | $421.63 (4.19%) |

| May 2014 premiums: | $803.32 (7.98%) |

| January 2014 dividends: | $25.87 (0.26%) |

| February 2014 dividends: | $167.02 (1.66%) |

| March 2014 dividends: | $68.77 (0.68%) |

| April 2014 dividends: | $25.91 (0.26%) |

| May 2014 dividends: | $168.51 (1.67%) |

| Total 2014 income: | $2,733.09 (27.13%) |

| 2014 unrealized premiums: | $2,318.00 (23.01%) |

| Account balance: | $17,804.66 (4.53%) |

| December 2013 balance: | $10,072.25 |

There is one more thing I would like to mention. Today I also reached my last year options income. Last year I made $2,576.30 in collected premiums. As of today, this year 2014, I collected $2,634.01 in premiums.

You can see my dividend and options income on My Trades & Income page.

I think that’s it for now. I am looking forward to the next month. What about you? How was your May 2014 and the entire year so far? Post a link to your website or write down your results to encourage other investors!

Have a great June 2014 at the markets!

It’s all nonsense. Sell in May, go away, June swoon, January effect, Santa Claus rally, etc. etc. These are all monikers the media uses to justify and explain market behavior. If there is one thing we know it’s that markets behave irrationally. Don’t buy into any of the hype or language. Just keep those dividends coming in, buy high quality, don’t panic sell and reap the rewards down the road.

DivHut, Amen to that! It sounds very funny watching or reading media finding a reason for the market move. But, if they don’t do that, they would have nothing to write about.

The sell in May theory does not bode well for dividend investors either than most market timers strategies. Good job on the options premiums, Quite impressive. What is your base strategy with them? I may ramp up my options in a couple months but have not decided on a strategy yet. I am thinking covered call at around 10%+ out of the money for like 3-6 month terms. We will see. With options there is so much to factor in.

Good Day and Grind On!

AG,

I know, I actually like those theories and sell offs because it allows me buying my favorite dividend stocks for cheap. I am always excited to see stocks like Realty Income, KMI, KMP, JNJ on a sale!

As far as options I do put selling against dividend stocks. There are only two possible outputs:

1) option expires and you keep the premium

2) option doesn’t expire worthless and you get assigned to a dividend paying stock, so it is a win-win situation for me

That is the base of my strategy. I also use it against non-dividend payers and I roll such stocks to avoid assignment. Works well so far.

Thanks for stopping by and good luck!