Not exactly a dividend growth stock here, but the prospect was appealing and made me think to buy some shares of Alibaba (BABA).

When I first heard about BABA in the news and all the frenzy it created I said myself “Not interested”. I do not do IPOs nor buy post IPOs. I only made one exception to this rule when several years ago I bought Visa (V) post IPO. I bought in the very first day at approx. $55 a share when Visa got on the open market the very first day.

Unfortunately, I was stupid enough to sell a few months later approx. at $65 a share. If I stuck with the stock, today my shares would be worth around $210 a share (as of this writing).

So why I bought post IPO shares of Visa? It was a perfect business model which many people fail to understand and even greater growth.

And that made me think about BABA. Will BABA follow the same fate as Visa, Google, Apple and even Facebook? Or what about Netflix, my another investment failure? Should I repeat my mistakes or is all BABA hype a frenzy?

What if BABA is really a great business with great growth potential and I will once again miss the boat if I stay aside? I decided to do some reading to see if I can justify my strong feeling that BABA is a great play for the long run and I should jump in.

What makes BABA a great business model?

It operates on a similar way as Groupon, Amazon, and eBay. It is a portal which connects together manufacturers from China, Asia, and part of Europe with buyers. It operates mostly on a whole sale level, so not for a small guy who wants to buy a single piece of goods BABA offers thru its website. But if you plan opening a store, BABA can be a great source for you. You no longer need to go large scale shopping to Costco (COST) to get the best price.

If you are a manufacturer, you can join BABA for free (as well as buyers), but what makes BABA unique, unlike eBay you can upgrade for a fee which gets you a better deal, position and listing. Higher chances to sell your stuff.

And that’s a great potential in BABA. It not only gets a share from all transactions it makes. Last year the company netted $8.5 billion dollars. You may say, it’s tiny, Walmart cashes in $246 billion net revenue! It is BABA’s growth potential which is intriguing.

BABA is the only significant ecommerce player in Chinese market and worldwide. And the Chinese market is a big one.

Last year, the Chinese ecommerce market was a $298 billion business. Slightly bigger than the United States’ $263 billion market, making China the largest e-commerce business in the world.

What is impressive however, is the predicted growth of that market. E-commerce in China is predicted to hit $540 billion by 2015!! The consumer base of BABA is expected to grow from 140 million shoppers annually in 2010 to 520 million by 2015. The US is expected to grow the base to only 200 million by 2015.

That is the market potential, what about company growth potential?

If we look just at the mobile division, BABA sales grew 100% last year.

Compare it to Apple for example. Although AAPL is a great company, it went from 45% sales growth in 2012 to approx. 5% this year or even more sluggish 2% in 2016. Alibaba is expected to hit 50% sales growth in just next 12 months.

Apple’s operating margin in 2013 was 28.7% versus Alibaba’s margin of 51%, according to USA Today.

The numbers are just expectations and we yet will see how accurate they are, but when thinking about the E-commerce market and who is who in that field I strongly believe this stock will be a great play over the long run. It may actually outperform even faster, maybe in a year.

You may compare BABA with another Chinese e-commerce company – Baidu (BIDU). Its outrageous performance makes me feel that BABA has a great chance following the same pattern. BIDU went public in the US in 2005 and since then the stock surged 1,600% from its first closing day. Over the past nine years, BIDU outperformed stocks like Apple (APPL), Amazon (AMZN), and Google (GOOG). And BIDU is still growing, its last quarter report showed 34% growth and 58% sales growth.

I believe BABA has a great chance to grow the same way as BIDU did. It operates in a different segment than BIDU and as of now I do not see any stronger competitor besides eBay or Amazon.

Let’s see if my assessment of BABA is correct and maybe five years from now we will see a similar stock price surge.

Moreover, BABA is expected to start trading options next week. Another good reason for me to invest in this company.

For that reason I decided to take a small play in this stock.

Trade Detail

Today, I bought only 12 shares and I am ready to add more if the stock continues lower.

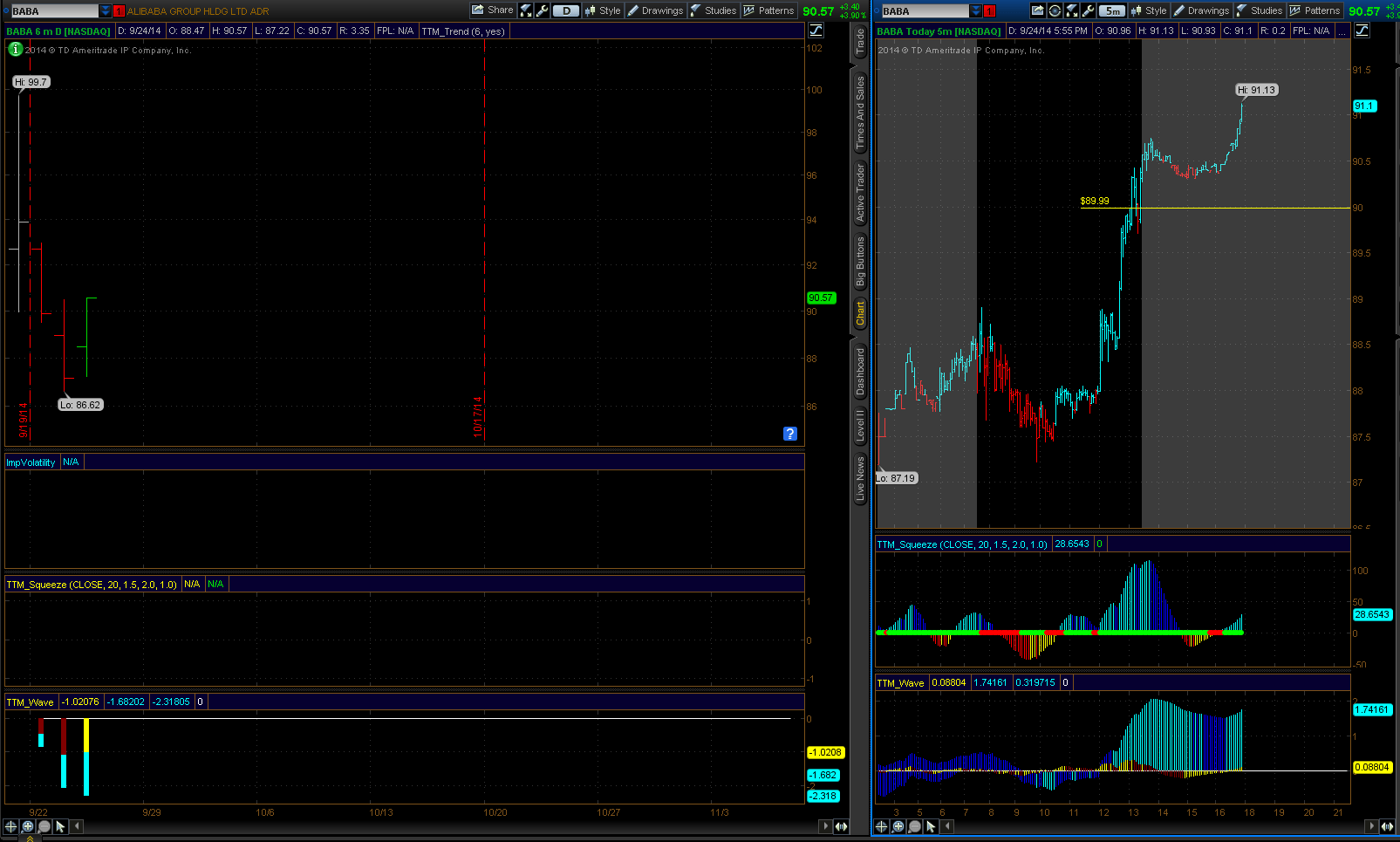

BTO 12 BABA @ 89.99 LIMIT GTC

To get into this trade I used my contingency order system. I was tracking the stock since Friday last week and lowering entry stock as long as the stock reversed and hit my trigger. It happened today.

Good luck to all of you who bought BABA recently. I believe, it will be a good investment.

I have to agree with a lot of what you say regarding BABA. I swore off non-dividend paying companies many years ago and have been quite happy with my portfolio performance thus far, but BABA may be an exception for me. I agree that over the coming years its continued growth will translate into much higher stock prices as with BIDU. They have a growing user base and actually generate meaningful revenues and is not just some hyped up dot com. I’d like to see prices fall closer to the IPO price but that may not happen from these lofty levels. I think it’s OK do diverse from dividend stocks once in a rare while.

Agree with you Keith, that sometimes, when an opportunity presents itself, we should take it. Like me, I invest in dividend stocks and options. You invest in dividend stocks, but sometimes it is OK to take a position of a non-dividend stock, if there is a chance of an excellent performance. There were a few stocks like that I had on my hand and yet missed them (such as Netflix, Google, Amazon, Visa, Apple – all this stocks didn’t pay dividends (some still do not pay) and yet they presented a great opportunity). I believe BABA is another one. If not, I can always dump the stock.

Thanks for stopping by.