November passed by even faster than October. I feel like it was just yesterday when October finished and cannot believe that it was already November which ended a few days ago.

It is time to review my November result and see how my investing and trading performed.

Those of you, new to my blog, here is a quick review of my investing and trading strategy. I invest into dividend growth stocks in my ROTH IRA account, reinvest all dividends using DRIP program and plan on investing for the next 20 – 25 years. I believe that it would be better for me to have a portfolio made of fewer stocks as such portfolio is better to manage.

Thus I hold about 10 – 15 stocks only, reinvest dividends, and accumulate stocks.

I also like to trade as I believe that one day I will be able to generate enough income to retire early and trade for a living. I plan to contribute my trading proceeds to my dividend portfolio and invest into dividend growth stocks so once I build a large enough portfolio I can stop trading and live off of my dividends.

This is a report how I did fulfilling this plan in November 2015. I must admit that 2015 year will be a bad year for me, however, I may state that I have learned enough to start trading successfully and be consistent.

You may be interested in:

How to Create a Dividend Tracker Spreadsheet By Dividend Meter with Dividend Meter

SPY Vs Dividend Growth Portfolio By Mike with The Dividend Guy

Paying Off Your Partner’s Debt By Dan with Our Big Fat Wallet

Financial Disaster- From Baby Boomers To Elder Doomers, So What’s A Millennial To Do? By Rich Rabbit with Cure Rabbit Ears

November Aims By Nicola with The Frugal Cottage

· November 2015 trading results

November was finally a month when I was able to stop my losing strike, calm myself down and get back to be in sync with the market. I have two trades in my accounts which are a bit risky and it will take some effort to manage those trades so they do not end as a disaster, but other trades are finally in shape and I hope I will be able to manage them well and make money.

I slowed down on my trading frequency as well as number of opened trades at one time as it showed to be a bad trading strategy. It was nice to have several trades at a time when they were all making money, expiring one by one, but when they turned ugly on my I wasn’t able to react, panicked, and lost money.

To avoid this bad trading I decided to trade only two to three trades at a time and open a new trade only when the old trade will be over. For example, I will open a bull put spread, then I can open a bear call spread against it to make the trade an Iron Condor. To that I can open a second trade and that’s it. No more trades.

I will be opening one trade (combo) with longer time frame (expiration 45> DTE) and weekly short term trades (expiration <5 DTE). I will be opening one trade for each strategy only and max. 10 dollar wide spreads.

You may be interested in:

Moved to Manhattan to Make More, Save More, and Speed Up FI By Fervent Finance with Fervent Finance

How Much is a Commute Worth? By Red to Riches with Red to Riches

Sorry for the delay – we totally restructured our finances, so we can retire in 2-5 years By KV with King Viking

Wealth inequality and averages: Where do you land? By Revanche with a gai shan life

How much do you need to become financially independent in the Netherlands? By CF with Cheesy Finance

The Ten Questions to Answer Before You Retire Early By Our Next Life with Our Next Life

5 Things To Do Instead of Standing In Line on Black Friday By Thias with It Pays Dividends

If you are interested in seeing and following those trades, I created a Facebook closed group in lieu of my newsletters where you can join and see the trades in real time when I post them at the time of opening. It is easier to manage and follow all the trades than via a newsletter and I hope that it will be beneficial for all members of the group who might be interested in trading options and generate an additional income.

To me, at first, I may generate an income of $120 to $360 per month, but as my account will be growing bigger, this amount will grow too.

All trades are spreads against SPX with minimum money to trade as low as $500. If that is something you may be interested in, I recommend you joining the group.

However, if you decided to trade options against SPX, be ready for some hard work, frustration, and tears. Be prepared for your account net-liq fluctuating up and down almost to a break point. Trading is not easy, get rich quick scheme. We will have to work it up slowly, step by step before we become confident, consistent traders.

Here is my trading result for the month:

| November 2015 options trading income: | $184.00 (1.57%) |

| 2015 portfolio Net-Liq: | $4,061.51 (-13.53%) |

| 2015 portfolio Cash Value: | $6,431.51 (-6.01%) |

| 2015 overall trading account result: | -65.31% |

Here are the results of my options trading:

Here are the results of my new options strategy:

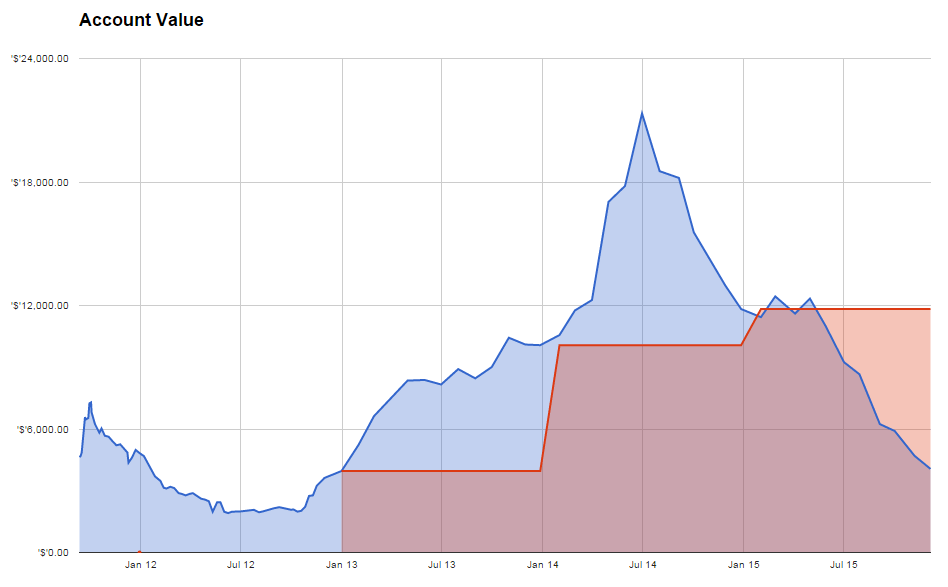

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Trade – Buy (GILD) By FF with Financial Freedom

The S&P 500 Hot Hand Fallacy By Ben Carlson with A Wealth of Common Sense

4 Companies Moving Higher By Dennis McCain with Dennis McCain Investing

It’s F$*$ing Tiring Losing Money By Under The Money Tree with Under The Money Tree

Dividend Income Update November 2015 By Keith with Dividend Hut

Investment Income Update – November 2015 By RBD with Retire Before Dad

End of the Month Summary – November 2015 By Alex with My Trader’s Journal

November 2015 YTD Progress Toward Goals By Bill with Retirement Income – Stocks and Options

Top 10 Things You Must Know Before You Trade Options By OP with Option Pundit

How to Trade Successfully with a Small Trading Account By Nial Fuller with Learn To Trade The Market

Real-Time Option Alpha Performance Stats & Options Trading Metrics Now Live By Kirk Du Plessis with Option Alpha

· November 2015 dividend investing results

My dividend investing continues growing slowly but steadily, although the portfolio value dropped this month thanks to a turbulence in the market when traders are too fixed to FED policy instead of on the economy and companies.

In October the FED was supposed to raise the interest rates. It didn’t happen and everybody is now expecting the FED to hike the rates in December. I personally believe that FED will not raise rates. If they do it, then they will prove that they never were “data dependent” as Janet Yellen was always claiming. As a Democrat, I believe she will be protecting Obama administration until the election. Or she will be that stupid that she will really raise rates into coming recession.

High interest rates are considered to be and work as a break to speeding economy, to slow it down if it moves too fast not to overheat. I am not convinced that our economy is in such shape that we can afford slowing it down.

Yet, if Yellen really raises the rates in December, it will have an impact on your and my stocks. They will temporarily drop in price and if you have been accumulating in recent years, be ready for losses in your portfolio. The question would be, how long the drop will last and how long it will take to recover. Nevertheless, it will be the second time when FED’s policies hurt the regular folks like you and me damaging their savings.

But if you are in this game for a long haul, like next 25 years, don’t be afraid. Your portfolio will survive it. Just do not panic, do not react to the short term storms. Have your plan ready and execute it every day. My plan is continue saving into dividend growth stocks even if they are beaten down hard. I do not care about the value of the portfolio, but about the income it generates.

Dividend stocks added or removed from portfolio:

| November 2015 dividend stock buys: | none |

| November 2015 dividend stock sells: | none |

This month I didn’t purchase any stock. I am out of cash and fully invested but saving hard for my next purchase. I plan on adding KMI stock and I will write about it why in my next post although the stock is heavily beaten down by recent oil turmoil. I do not consider it a tragedy for this stock but a great opportunity.

Dividend stocks DRIP:

| November 2015 DRIP: | American Capital Agency Corp. (AGNC) MasterCard Incorporated (MA) Legacy Reserves LP (LGCY) Vanguard Natural Resources, LLC (VNR) Kinder Morgan, Inc. (KMI) Realty Income Corporation (O) Prospect Capital Corporation (PSEC) |

I continued reinvesting my dividends and accumulating into the stocks listed above. It is nice to see the stocks falling down and seeing that I could buy more shares than originally planned and now those stocks will bear more dividends into my account. I consider those stocks good stocks although you may argue that some are risky and you may even find opinions on the internet that some of the stocks will bankrupt. I do not think it will be the case.

However, I admit that it is a gut-wrenching to invest into stocks heavily falling in price and the company battling its survival like LGCY. But I think LGCY will survive the oil glut and in the near future we will see the stock performing well again. And if not, well, I will take the loss and move on.

Last month I also used a FRIP program in my Scottrade account (I am not listing it in here) accumulating my LGCY holding and I can see the snowball rolling faster and faster down the hill. In my last report I expressed my hope that I would soon see the same result in my ROTH IRA account. I must say that my DRIP in my ROTH is already rolling faster and faster, so I must admit I regret that I didn’t use DRIP earlier. I fell in love with this program.

Before I used to keep the dividends in the account and invested them once I accumulated enough to invest. You can do this as long as you accumulate enough to invest right away and without waiting. If your account is small (like mine) and you collect little dividends every month, do not do this, use DRIP. Believe me. I have my experience now that your account will grow faster. Once you receive at least $1,000 dollars in dividends every month then you can switch from DRIP to individual reinvesting.

I also used non-transaction fee ETFs to park my money in there but it also didn’t grow as well as I would expect.

Here are my ROTH IRA trading/investing results:

| November 2015 dividend income: | $86.92 |

| November 2015 options income: | $0.00 |

| 2015 portfolio value: | $14,905.70 (-7.16%) |

| 2015 overall dividend account result: | -14.58% |

As I mentioned above, my portfolio value dropped this month due to some oil exposed companies. See for yourself:

| Gainers by Position ($) | |

| JNJ | $6.96 |

| PPL | $6.01 |

| RWX | $5.80 |

| Losers by Position ($) | |

| KMI | -$316.90 |

| LGCY | -$103.81 |

| EPD | -$76.20 |

| Gainers by Percentage (%) | |

| RWX | 0.6% |

| JNJ | 0.6% |

| PPL | 0.3% |

| Losers by Percentage (%) | |

| KMI | -29.5% |

| LGCY | -20.6% |

| VNR | -20.4% |

Here my dividend income:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

What Should I Teach College Students About Money? By Neil & Kalie with Pretend to Be Poor

4 THINGS TO REMEMBER ON YOUR JOURNEY TO FREEDOM By Laura with How To Get Rich Slowly

How To Manage Personal Finances? Money Management Ideas You Should Follow By Raj with Mint Investor

Financial Independence 101: What are Stock Dividends and Stock Splits? By Steve with We Retired Early

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts dropped from previous month and are losing -3.00% (down from previous month) for the year. This year will be a losing year for my investments.

Remember, if you like trading options and want to have trade ideas for free, join my Facebook closed group and follow my SPX trades in real time, comment, ask questions, and interact with other members.

What do you think?

How about your investing or trading result?

Wow this is really cool what you are doing. I have always wanted to do exactly what you are doing with the trading and investing in dividents but I just dont know enough about it and don’t have the courage to just start doing it.

I have had a lot of good luck with real estate investing so far and generating passive income from that source but I really want dividend income as well to supplement.

Sorry to hear on your down year overall but like you said, now you know exactly what to do for 2016. Ill be pulling for you!!

Hello Alexander,

Thanks for stopping by. I know, this year I took a beating, but mostly due to my own mistakes such as impatience and greed which lead to over-trading and taking larger risk than I could sustain in case when the trades turn against me. Proud also played a large role in this. I still have a few trades still against me but when those end, I will be rebuilding my portfolio, this time hopefully the right way.

You can start trading options too, do it small, only one trade at a time and only against stocks you are OK to buy (for example selling puts against a stock you do not mind to be assigned and buy it). That will be the easiest and simplest way to learn. That’s how I started three years ago myself before I moved into more complex options trading. You will see how easy it will become – and then that would be when troubles will come :))

Good luck and cheers!

Thanks for the link!

You are welcome, Rabbit.

Thank you for the DivHut mention. Much appreciated. Keep reinvesting those dividends. The oil sector is really delivering some near term hurt to many investors but as long as those dividends keep rolling in and are safe you should do well when prices recover.

I agree with you and I think the companies I have will survive this although it is scary. I am staying the course.

Thanks for visiting.