Although you receive your premium right at the moment when you sell your put option, you can actually claim that money at expiration of that contract. You have the cash, but it is blocked by the current market value of that contract. That’s why you want your option contract expire as quickly as possible. When the option starts losing value as it is getting close to expiration, it is the moment when you start seeing your money to materialize in your account.

Since I have a small account, I have to trade long term option contracts in order to make it worth it. I wish I could sell a front month and get the money every month, but I do not have enough cash for maintenance for multiple contracts.

If I want to sell a front month option against AT&T (T) for example, then by opening only one contract I can collect circa 30 cents and I will need circa $900 cash (or margin BP) for maintenance to cover this trade.

(MORE: Dividend Income Update – January 2014 – Dividend Mantra)

And that wouldn’t make sense collecting only 30 dollars (0.30 x 100), since commissions would eat up your gains. To avoid this you would have to open multiple contracts, for example ten of them.

With ten contracts I would collect $300 in premiums (0.30 x 10 x 100), but I would need $9000 for maintenance. And that’s what I currently do not have.

The only way to go around this with a small account is to sell a long term contract. If I sell 5 or 6 months contract in lieu of the front month, I have a chance, that I still can collect $300 in premiums and need only $900 for maintenance.

(MORE: January options expiration, naked puts in SLW, POT, RIG, CLF, LINE, GLW & more – Simply Puts)

But then I have to wait 5 – 6 months to claim the money to be finally mine.

To go around this obstacle I created my option time ladder. It is a strategy similar to a CD ladder when you sell options contracts so you have expiration literally every month. Yes, you will wait the first period for 5 – 6 months, but after that, you will have expirations every month. So, just keep it rolling the same way as in CD ladder.

And that’s what’s happening to me tomorrow. Not only it is my pay day as I will be able to claim my premiums as definitely mine, but it is also my first expiration in a ladder.

My ladder is not yet completed, but is set well to start my money rolling.

(MORE: Covered Calls and Cash Secured Puts – Covered Calls and Cash Secured Puts)

I will have two contracts expiring tomorrow:

Demand media (DMD) total gain from this trade: $41.21

Ferrellgas Partners LP (FGP) total gain from this contract: $101.21

February TOTAL: $142.42 (after commissions)

Not bad, considering that I collected $208.45 in dividends this month. With dividends and options, my total income for February is $350.87 and I am satisfied with this result.

That doesn’t mean I do not want to strive for more of course.

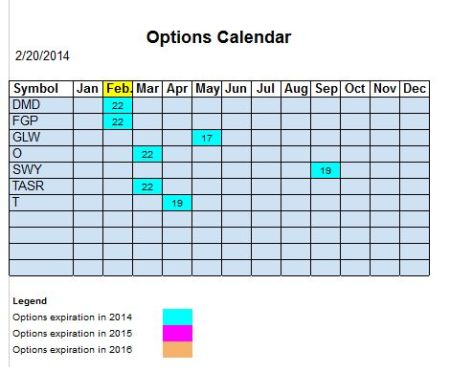

Once the option contracts expire tomorrow, I will be opening new contracts in the next empty months, see the print of my calendar as of today:

As you can see, my next empty months are June, July, and August. Those are the months I will try to fill and collect as much in premiums as possible.

You can see my real time calendar in the calendar page.

How was your February financially?

Leave a Reply