I cannot believe October is gone already. I was so busy lately that I even haven’t noticed that we are approaching mid-November already and I haven’t posted my monthly review of my trading and investing effort.

Although October was spectacular as far as the market moves I wasn’t able to adjust my positions successfully. Let’s take a review of my October though.

You may be interested in:

A quick visit to the country of the middle class at the Aldeburgh Food and Drink Festival By Ermine with Simple Living in Suffolk

What Happened To Make Our Grocery Bill So High?! By Thousand Days with Thousand Days to Retirement

A Richer Understanding: Living and Eating Well By SavvyJames with Retirement Savvy

Understanding the Power of Compound Interest By Mr. Utopia with Personal Finance Utopia

How Safe Are Your Dividends? By AAI with All About Interest

Are You Contrarian? By FI FIGHTER with FI FIGHTER

· October 2015 trading results

Trading can be frustrated and I must admit that the whole 2015 year was a disaster for me. Whatever trade I made, it went wrong. No matter how I adjusted my positions to be on the right side of the market, it went wrong. I was losing money the whole year and I am not able to stop it.

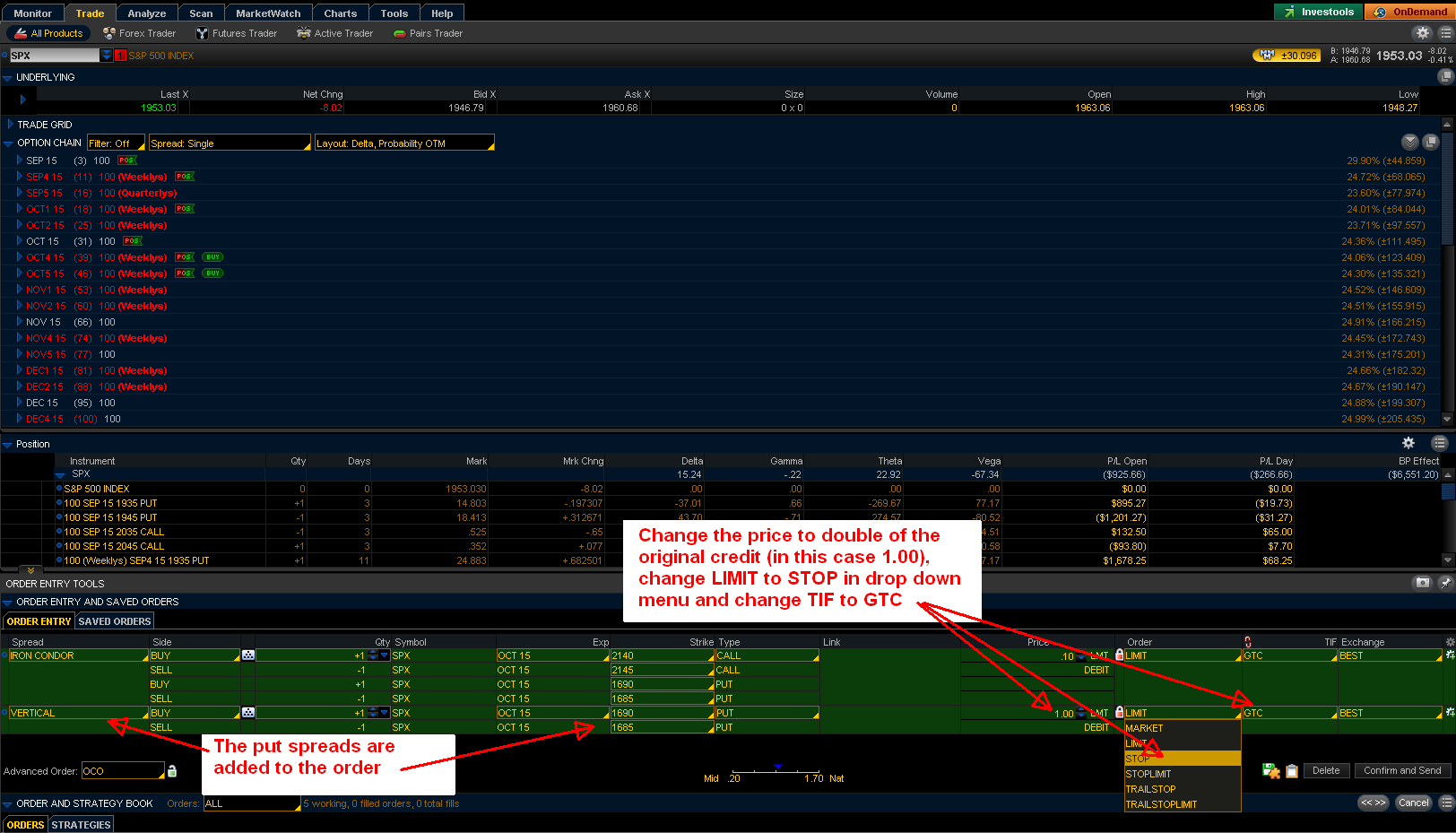

In October 2015 we saw a spectacular recovery of the market coming up from the lows of 1900 to 2100. At some point we saw the market reaching 2115 level. All call spreads I had open and which were safe and making me money suddenly turned up to be a loser. I tried to close them or convert them intoi a bullish trade to protect myself and as soon as I finished, the market stalled and now is turning back down. Now I have bullish spreads which are working against me. Should I leave them and wait them out or convert them back into call spreads? As of now I will wait and see how the price moves. I have a plenty of time in those put spreads, they are all expiring in December.

However, this is being frustrating that I am really so close to give up on trading. It was my dream to be a trader. I wanted to be like some of the traders you read on the internet who turned their tiny accounts into millions. Like Karen the Supertrader who turned her $10k account into $300M in about 5 to 10 years. Apparently, I am not gifted to be like them.

I will give it a bit more time and if this trading continues to be a roller coaster losing game I will stop it for good and continue investing in dividend stocks only.

You may be interested in:

7 Do’s and 7 Don’ts for a New Forex Trader By Adam with Modest Money

HAPPY BE A MILLIONAIRE DAY! By Teenygreen with The Pursuit of Green

Money moves for graduates: How to set up a budget By Honey Smith with Get Rich Slowly

Planning a Trip?! By Bryan with Income Surfer

Rethink Retirement – Create Your Own Target Date Fund By Jason Fieber with Dividend Mantra

Scripps Network Interactive By Dennis McCain with Denis McCain Investing

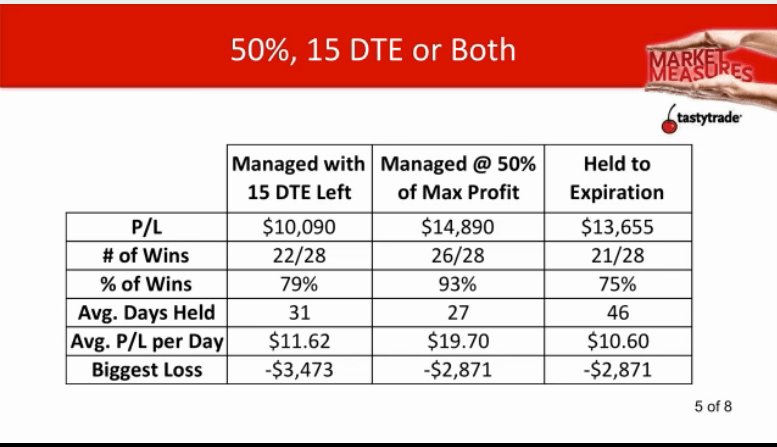

At least, I learned a lesson which may be helpful to improve and that is that I was overtrading again. That is a behavior I must stop. For this reason, I am adjusting my trading strategy to trade only one trade at a time and opening a new trade only when the old one is closed. I will be opening only 1 trade per each $5000 of account value. Let’s see if this helps to reverse my record and if not, I will be forced to say good bye to my trading as I am not willing to put more money into my trading account.

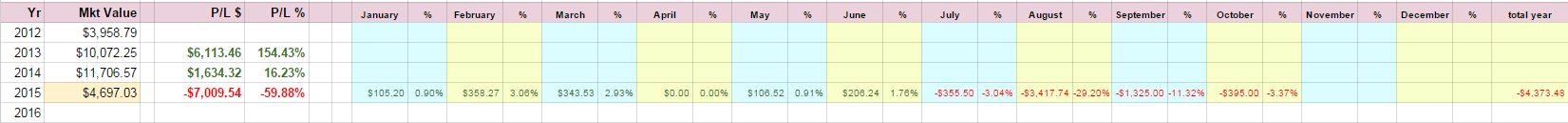

Here is my trading result for the month:

| October 2015 options trading income: | -$395.00 (-3.37%) |

| 2015 portfolio Net-Liq: | $4,697.03 (-20.44%) |

| 2015 portfolio Cash Value: | $6,843.03 (-14.07%) |

| 2015 overall trading account result: | -60.29% |

Here are the results of my options trading:

Here are the results of my new options strategy:

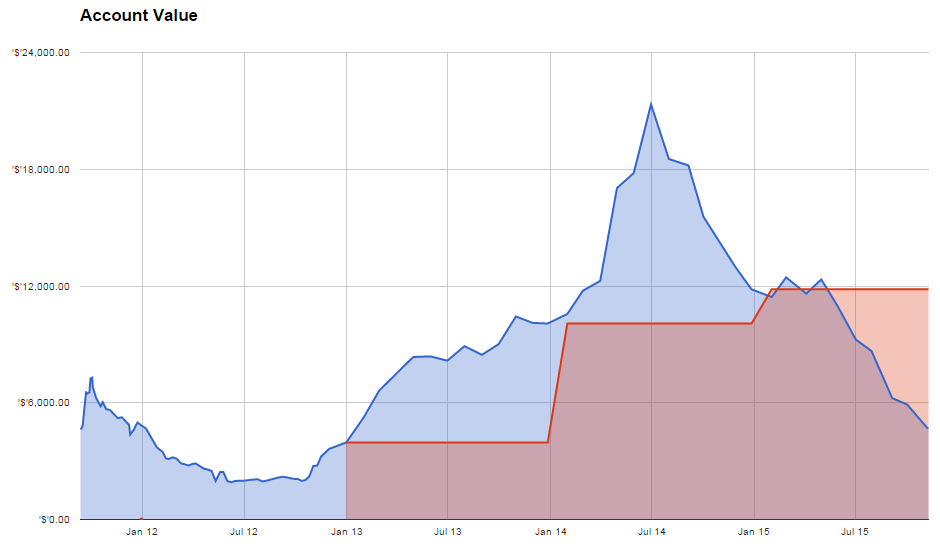

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

Why Is Investing So Hard? By Michael Johnston with ETF Reference

Money Smart Giving By Daniel Graff with Well Kept Wallet

Learning How To Survive On A College Budget By Michelle Schroeder-Gardner with Making Sense of Cents

Stretching Your Remodeling Dollar By Brian with Long Term Mindset

Pursuing My Dream – Remortgaging My House By Mike with DivGuy

· October 2015 dividend investing results

This month, I added new shares of KMI to my holdings and continue reinvesting dividends via DRIP reinvestment program. In my ROTH I also downsized my trading effort and focus only on dividend investing. As of now, dividend investing still wins over my trading results. Although, my stocks suffered during the recent correction dividend reinvesting is upholding the entire account value. It is down, but still above the 2015 year’s starting value.

Dividend stocks added or removed from portfolio:

| October 2015 dividend stock buys: | 20 shares Kinder Morgan (KMI) @ 29.24 |

| October 2015 dividend stock sells: | none |

I decided to add KMI although it is now a hated stock due to the Keystone pipe line refusal from Obama. But Obama will not be in the office forever and one day the company will be able to build the infrastructure. I am not following this much, but I think in the next 20 years this will not be an issue and since the stock lost almost 40% of its original value (my average cost was at $41 a share, now the stock trades at $25 a share) I see it as a good deal. So although analysts are downgrading the stock (they did the same with JNJ a few years ago too), I considered this a buy.

Dividend stocks DRIP:

| October 2015 DRIP: | PPL RAI AGNC O VNR PSEC |

This is my first month applying DRIP and I am happy for it. I can feel that this is adding the desired speed to my dividend investing. I should have done that a lot earlier and not today. But I thought I was smarter than others who already did it and recommended it in the past.

I was actually using DRIP in my Scottrade account (I am not listing it in here) and I can see the snowball rolling faster and faster down the hill. Hope I will soon see the same result in my ROTH IRA account.

Here are my ROTH IRA trading/investing results:

| October 2015 dividend income: | $83.01 |

| October 2015 options income: | $0.00 |

| 2015 portfolio value: | $16,054.84 (-2.35%) |

| 2015 overall dividend account result: | -8.00% |

Here my dividend income:

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

101 Dividend Investing Tips from the Experts By Jimmy Atkinson with Dividend Reference

Dividend Income Log: September 2015 By Alex with Zero to Zeros

Financial Benefits of Apartment Living By Sarah Greesonbach with Suburban Finance

Is Contentment The Enemy of Progress? By RETIREBYFORTY with RETIREBYFORTY

Playing the Probabilities By Ben Carlson with A Wealth of Common Sense

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts dropped from previous month and are losing -1.61% (up from previous month) for the year. Considering how bad my trading was this month I think, this is not a bad result.

What do you think?

How about your investing or trading result?

|

We all want to hear your opinion on the article above: 4 Comments |

Recent Comments