August is gone and it is time to review my investing and trading effort again.

This month was bad as far as results go. First in my trading account I was getting rid of bad trades from the beginning of the year I no longer wanted. I had a question from one investor why I was getting rid of those stocks when I was so enthusiastic about them in the first place.

The reason wasn’t that I no longer liked them (for example LGCY), but they no longer fit into my new trading strategy. I still continue investing into these stocks in my ROTH IRA account and in my Scottrade account where I use FRIP program and currently reinvest all my dividends into LGCY. In my Motif account I still invest into Conoco Phillips (COP) and plan on adding more shares.

I still expect the energy stocks perform excellent when all this mess ends. That’s why I rebalanced my 401k just today and trimmed gains from REITs, S&P 500 (yes, I was surprised too that the SPX fund was showing a significant profit even after the market slump) and moved it into Energy sector and precious metals funds.

You may be interested in:

Investing: What You Can Control By Jon Dulin with Money Smart Guides

How much I spent on coffee my first three and half years of grad school By Dylan with Mr Modern Millennial

Naturally Frugal? Try Passive Budgeting By Thias with It Pays Dividends

What Is The Point Of Private Banking? By RUDDIGAR SIMPSON with Faithfull With A Few

Investing Series: What is Investing, exactly? By Save. Spend. Splurge.

This month was definitely interesting and scary at the same time.

But it also offered a great opportunity to invest more money contrary to what others said about the market during the selloff.

If you are a long term investor, this is a great opportunity. And don’t be worry seeing your portfolio down a lot. It is OK when everybody is selling and panicking that your account will be down. But as a dividend investor, it doesn’t matter. If you hold good quality stocks, they still pay you dividends every month, or quarter and if you are reinvesting dividends (dripping) you are buying cheaper and cheaper every day the market drops more.

And that’s what I love!

And if you are a trader, yes, it may be a bit frustrating if you get caught on the wrong side of the market, but if you have a plan and strategy, you do not have to worry either.

August brought bad results a few-fold. Once when I got rid of the bad trades, second, when I got caught in bad trades which turned against me quickly, and third, by increased volatility which sent even good trades into a red territory.

· August 2015 trading results

There was a significant lesson to be learned in my trading account.

I had a great strategy which worked so well that when SPX started falling I refused to believe that the drop would go so far that my trades would be in danger. I was in such disbelief that I didn’t act and didn’t close suddenly endangered trades.

Now I am stuck in trades which I am forced to take loss and manage them carefully to minimize that loss. Originally, all those trades were profitable and showing more than 70% profit before the market collapsed.

You probably already see the pattern here and what my lesson was.

Yes, I waited too long (until expiration) and let those trades turn into losers. And yet I refused to act and close those losers before they turned into even bigger losers.

Modifying my strategy

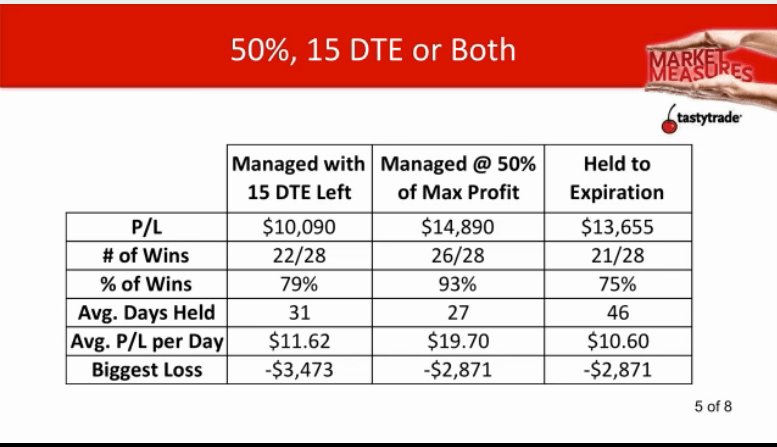

To avoid this mistake I decided to apply a 50% credit capturing strategy. What is a 50% credit capturing strategy?

Per Tom Sosnoff and his Tasty Trade study it is actually more profitable to take 50% of your gain off the table and move on. For example, if I originally open a trade and collect $180 credit, I will be better off closing that trade at 50% of that credit (pay $90 to close the trade) and move on. Yes the total credit received will only be $90 instead of $180, but the probability of profit is larger.

Why is it? The main reason is that this typically occurs around 15 days to expiration. After that the gamma risk starts increasing and the trade may turn against you. So not only I will block my money for only around 15 days instead of 45 days, I will be able to trade more often.

At first I refused to use this strategy as I was looking at credit size but later I realized that if I will really be able to close a trade every 15 days, I will be able to make 3 trades instead of one in my 45 day cycle. If each will be $90 credit, I will actually make more money than with only one trade.

You may be interested in:

How to Start Investing When You’re Young By John Schmoll with Wise Dollar

Should We Consider Giving Our Kids An Allowance? By Money Beagle with Money Beagle

5 Steps to Financial Education for Adults By Evan with My Journey to Millions

How Do You Invest When You Don’t Have Much Money? By DivHut

Step 2: Create a Passive Income Stream By Bryan with Just One More Year

My August trading results were not as I would like them to be. Partially due to closing old trades with a loss, partially due to volatility, and partially due to a few of my trades being now ITM and showing a loss.

But I am positive and understand that a drawdown is a part of the trading business and that I will be able to move over it and have more profits than losses.

Here is my trading result for the month:

| August 2015 options trading income: | -$3,417.74 (-29.20%) |

| 2015 portfolio Net-Liq: | $6,238.30 (-27.95%) |

| 2015 portfolio Cash Value: | 9,495.80 (-26.55%) |

| 2015 overall trading account result: | -46.71% |

Although the results are not anything great this month, I believe I will be able to manage this account into a positive territory later this year.

Here are the results of my options trading:

I also write about my new SPX trading strategy selling spreads for a premium, mostly Iron Condors. Many times I mentioned that the strategy worked well so far and makes me money. You may ask, why is then your account down almost 50% if your trading strategy is making you money?

The reason is a consolidation of my account I decided to take. I decided to close losing trades instead of rolling them and dragging them behind me like a steel ball on a chain. I also didn’t have enough money to drag those trades further and I wasn’t willing to commit the rest of my money for that. So in July but mostly in August I closed those trades.

However, here is my trading journal to show how the new strategy performs.

Here are the results of my new options strategy:

I still hold a trade against AGU, but I decided to deal with this trade later and either close it or move it. Besides that trade I now only trade options against SPX.

Here is the entire account value from the beginning of tracking it up to today:

· August 2015 dividend investing results

Since I decided to trade my new options strategy to trade it in my ROTH IRA account too, this now has impact on the account volatility. The cash value is now swinging up and down more than when I only held stocks.

However, my primary goal is dividend investing in my ROTH IRA account.

This month, I only traded options against SPX and I had no new stock addition or removal from my portfolio. The portfolio is down because of some oil exposed companies I added in the previous months. I still will be accumulating oil and energy companies to my portfolio if my money management rules allow it and as long as those companies will be depressed.

Dividend stocks added or removed from portfolio:

| July 2015 dividend stock buys: | none |

| July 2015 dividend stock sells: | none |

Here are my ROTH IRA trading/investing results:

| July 2015 dividend income: | $91.75 |

| July 2015 options income: | $0.50 |

| 2015 portfolio value: | $15,101.29 (-15.33) |

| 2015 overall dividend account result: | -13.46% |

Here is the entire account value from the beginning of tracking it up to today:

You may be interested in:

August 2015 YTD Progress Toward Goals By Stocks and options

End of the Month Summary – August 2015 By Alexander Fotopoulos with My Trader’s Journal

Dividend Stocks Do Worse By DivGuy with The Dividend Guy

Below is my dividend income review for the entire year:

My ROTH IRA dividend income breakdown per month and per company.

· All accounts

Besides trading and dividend accounts I also have 401k account, emergency savings account, etc., which I do not report in detail. You can review those accounts in my “All Accounts Value” table at the bottom of My Trades & Income page.

My accounts dropped from previous month and are losing -6.25% for the year. Considering how bad the market was this month I think, this is not a bad result. I believe, that this is just a temporary drop which in 6 months nobody will remember.

What do you think?

How about your investing or trading result?

|

We all want to hear your opinion on the article above: 2 Comments |

Recent Comments