As I mentioned in my post on Friday, I was expecting two more trades to close soon as they would get closer to becoming worthless. It happened today!

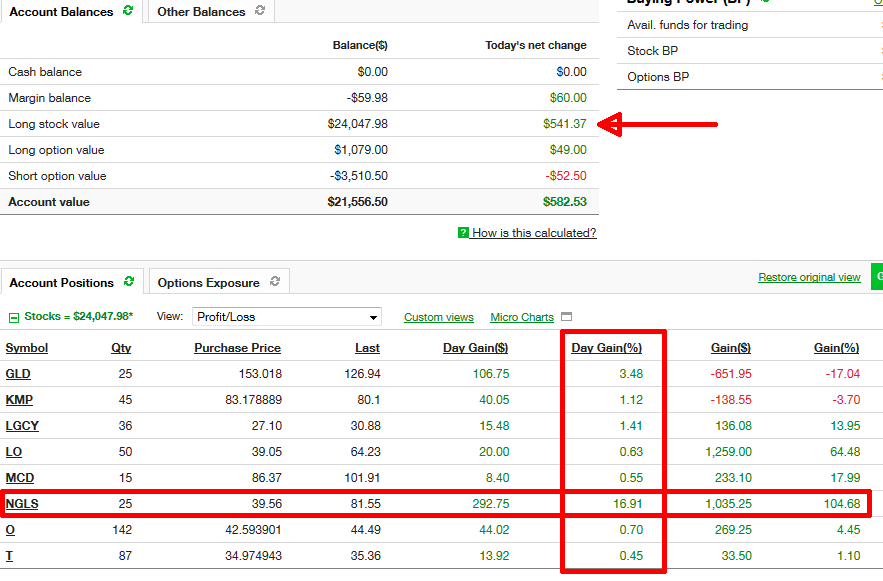

On Friday last week, my put selling trade against LINE lost value to $0.05 per contract, so I could buy it back (for free) and keep the entire profit. Today my last two trades with July expiration became worthless and I could buy them back (again for free) and release my margin cash for next trading.

There is no reason, or value waiting until July 18th to let those options expire (which may not happen if the stocks suddenly fall), so why leaving money on the table and risk three more weeks that I may lose them.

A few days ago I read in a book “Mastering the Trade” by John F Carter about a trader who did just that. Her option contract was already worthless and she refused to take the trade off the table. She thought that when a trade is already worth only 0.05 then there is no way the trade may turn bad. Well, it did. Not only the trader lost the entire premium she received, but the trade turned into a much larger loss.

I do not want to be such a sucker and I took those trades off the table as soon as they reached 0.05 value.

That allowed me to keep the entire profit (minus original entry commission and a buyback price). For Franklin Resources Inc. (BEN) options trade that turned to be $96.18 premium (2.15%) in two months and for GameStop Corp. (GME) the trade delivered $174.18 (5.69%) in little less than two months.

I will use the released margin for another trade, which I will report tomorrow. You can follow my twitter account for details.

Happy Trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments