There is an old adage on Wall Street – “Sell in May and run away”. If you have done that, then you missed a nice returns overall as markets grew quite nice in May 2014. S&P 500 rose by nice 2.18% in May and closed near all-time high. What a blessing!

Should I have sold and stay away from the markets? Absolutely not! Well, it depends.

My overall May 2014 account was down by -2.15% but only because I made a few deposits which lowered my adjusted balance and also my options trades are normally deferred into a later time. What does it mean?

It means that when I sell a premium, I receive cash right away, but my account balance won’t reflect it until expiration or a significant time decay destroys the value of that option. So if I sell a put premium at bid price, let’s say $1.05, my account liquidation value at that same point will be the ask price at let’s say $1.10 and thus showing a loss.

This principle is behind my May 2014 negative account growth along with some deposits I made during the month.

But, because of a sell off at the beginning of May (see my post “Today it was a massacre in my account” or “Disaster continued, but navigated my account well thru the storm” my account was actually down by -10.54% at the beginning of the month!

I was able to recover almost everything! Thus far, I am satisfied with May 2014 returns and results. But my satisfaction is actually elsewhere, not only in the overall recovery during the same month. Check the graph below showing my account balance (note, this is my TD Ameritrade balance only, for all accounts visit “My Trades & Income” page and scroll all the way down to see a table of all my accounts):

A hint: the red area indicates previous years closing balance. With a previous year closing balance of $10,072.25 I am about to double my account value this year! In May 2014 I closed at 17,804.66 with only $2,195.34 to go to close at 20k mark. This is something exciting to me. If my dividend growth & options strategy continues providing with the same results in the following years, I believe I should retire in 6 years.

I understand that it might be tougher every year since it seems easy to double my money when you need to make only $10k to double your account instead of $80k of dollars, for example. But I am optimistic.

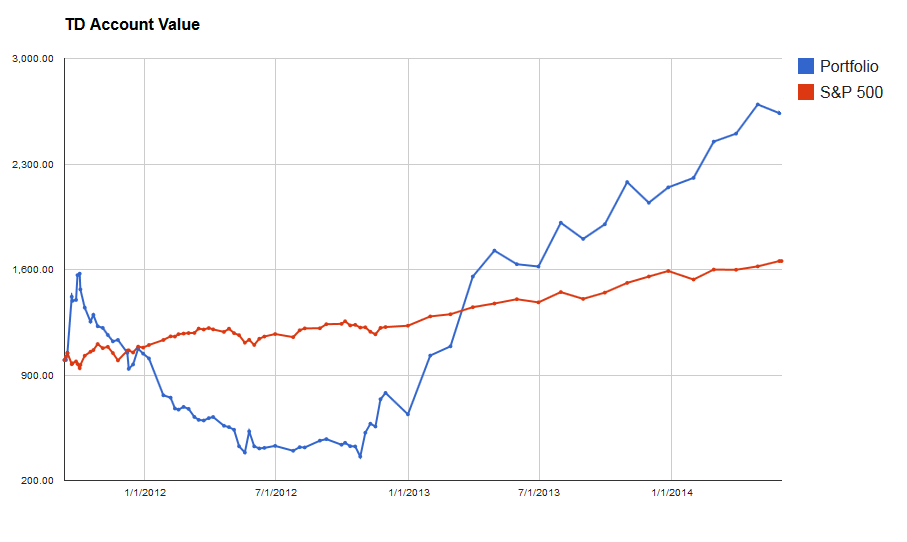

To be fair I am posting my account vs. S&P 500 chart. The chart is adjusted for contributions (basically it shows only gains or losses). That clearly indicates what I mentioned above, that the account closed at a small loss of its value or balance.

That didn’t affect my income at all. May 2014 was my second best month as far as options premiums collected goes and the second best month when speaking of dividends.

Here are new results for May 2014 (TD account only):

| January 2014 premiums: | $156.10 (1.55%) |

| February 2014 premiums: | $139.26 (1.38%) |

| March 2014 premiums: | $746.62 (7.41%) |

| April 2014 premiums: | $421.63 (4.19%) |

| May 2014 premiums: | $803.32 (7.98%) |

| January 2014 dividends: | $25.87 (0.26%) |

| February 2014 dividends: | $167.02 (1.66%) |

| March 2014 dividends: | $68.77 (0.68%) |

| April 2014 dividends: | $25.91 (0.26%) |

| May 2014 dividends: | $168.51 (1.67%) |

| Total 2014 income: | $2,733.09 (27.13%) |

| 2014 unrealized premiums: | $2,318.00 (23.01%) |

| Account balance: | $17,804.66 (4.53%) |

| December 2013 balance: | $10,072.25 |

There is one more thing I would like to mention. Today I also reached my last year options income. Last year I made $2,576.30 in collected premiums. As of today, this year 2014, I collected $2,634.01 in premiums.

You can see my dividend and options income on My Trades & Income page.

I think that’s it for now. I am looking forward to the next month. What about you? How was your May 2014 and the entire year so far? Post a link to your website or write down your results to encourage other investors!

Have a great June 2014 at the markets!

|

We all want to hear your opinion on the article above: 4 Comments |

There are two types of investors. One type chooses an easy way of investing, the second type is more adventurous. Both approaches are legit and investors choose them according to their style, personality and time they are willing to dedicate to their portfolio.

There are two types of investors. One type chooses an easy way of investing, the second type is more adventurous. Both approaches are legit and investors choose them according to their style, personality and time they are willing to dedicate to their portfolio.

Recent Comments