Another week of April is over and it is time to provide our weekly investing and trading report again. I am extremely pleased to see our portfolio growth acceleration. It grows faster every week. Last week, we continued accumulating dividend growth stocks and trading options around our stock positions. Although, last week, we just adjusted our options trades.

Here is our investing and trading report:

| Account Value: | $47,251.51 | +$4,645.16 | +10.90% |

| Options trading results | |||

| Options Premiums Received: | $564.00 | ||

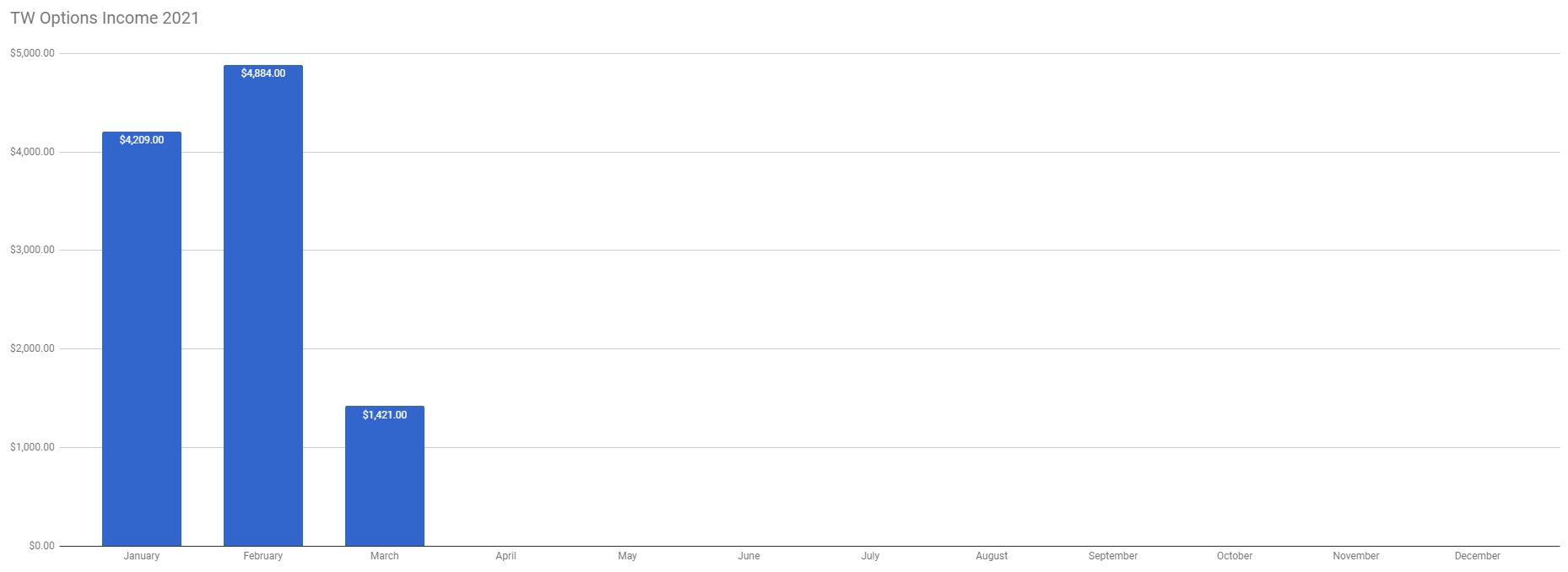

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $1,442.00 | +3.05% | |

| Options Premiums YTD: | $15,793.00 | +33.42% | |

| Dividend income results | |||

| Dividends Received: | $8.31 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $50.52 | ||

| Dividends YTD: | $196.87 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 3.98% | ||

| Portfolio Dividend Growth: | 7.47% | ||

| Ann. Div Income & YOC in 10 yrs: | $5,993.02 | 13.56% | |

| Ann. Div Income & YOC in 20 yrs: | $36,737.44 | 83.15% | |

| Ann. Div Income & YOC in 25 yrs: | $128,526.00 | 290.89% | |

| Ann. Div Income & YOC in 30 yrs: | $633,093.50 | 1,432.87% | |

| Portfolio Alpha: | 24.45% | ||

| Portfolio Weighted Beta: | 0.89 | ||

| CAGR: | 781.03% | ||

| AROC: | 28.25% | ||

| TROC: | 17.29% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 18.37% | |

| 2021 Portfolio Value Goal: | $42,344.06 | 111.59% | Accomplished |

We continued accumulating our stocks to achieve our dividend weekly dividend income. We accumulated shares in Realty Income (O), ABBV, AAPL, and we finished accumulating (we reached 100 shares) PMX according to our plan. Our non-adjusted stock holdings market value increased from $44,923.51 to $47,486.85.

Five of our options trades expired last Friday. One of the trade that expired was a strangle against Wendy’s (WEN). Unfortunately, the call leg was in the money and I forgot to check the trade to roll it. For many months WEN was going sideways (ideal for strangles or Iron Condors) and I became complacent. Our calls expired in the money and now we are a proud owner of -100 shares of Wendy’s. I plan on closing the trade on Monday. That would incur a small loss.

Last week was slow in trading. We only adjusted a few trades only. We received $564.00 in premiums trading options against our holdings. For the entire April 2021, we received $1,442.00 premiums, and all our income was reinvested.

Open trades

The table above shows all our open trades and expirations. It is just a simplified tracking and buying power reduction. Our goal is to trade a set amount of equity strangles in what I call perpetual strangle trading. It is nothing fancy. I just have a list of equities I like to trade options around them, I like to eventually own and I accumulate these stocks. Once a trade expires (or nears expiration) I re-open the trade or roll it into the next expiration (mostly trades that a stock is near the short strike and there is a risk of getting in the money).

We did open any new trades last week. The BP reduction decreased from $39,451.90 to $33,294.50, a BP usage decreased by -$6,157.40 or -15.61%. Of course, next week, I plan to re-open new trades to replace the expired ones.

Investing and trading ROI

Our options trading delivered a 3.05% monthly ROI, totaling a 33.42% ROI.

Our account increased to 111.59% YTD growth.

Our options trading averaged $3,948.25 per month this year. If this trend continues, we are on track to make $47,379.00 trading options in 2021.

We are still on track to complete goals in our portfolio. We made slight adjustments and we are providing our comments to our goals and tasks we set up in the week 6 report:

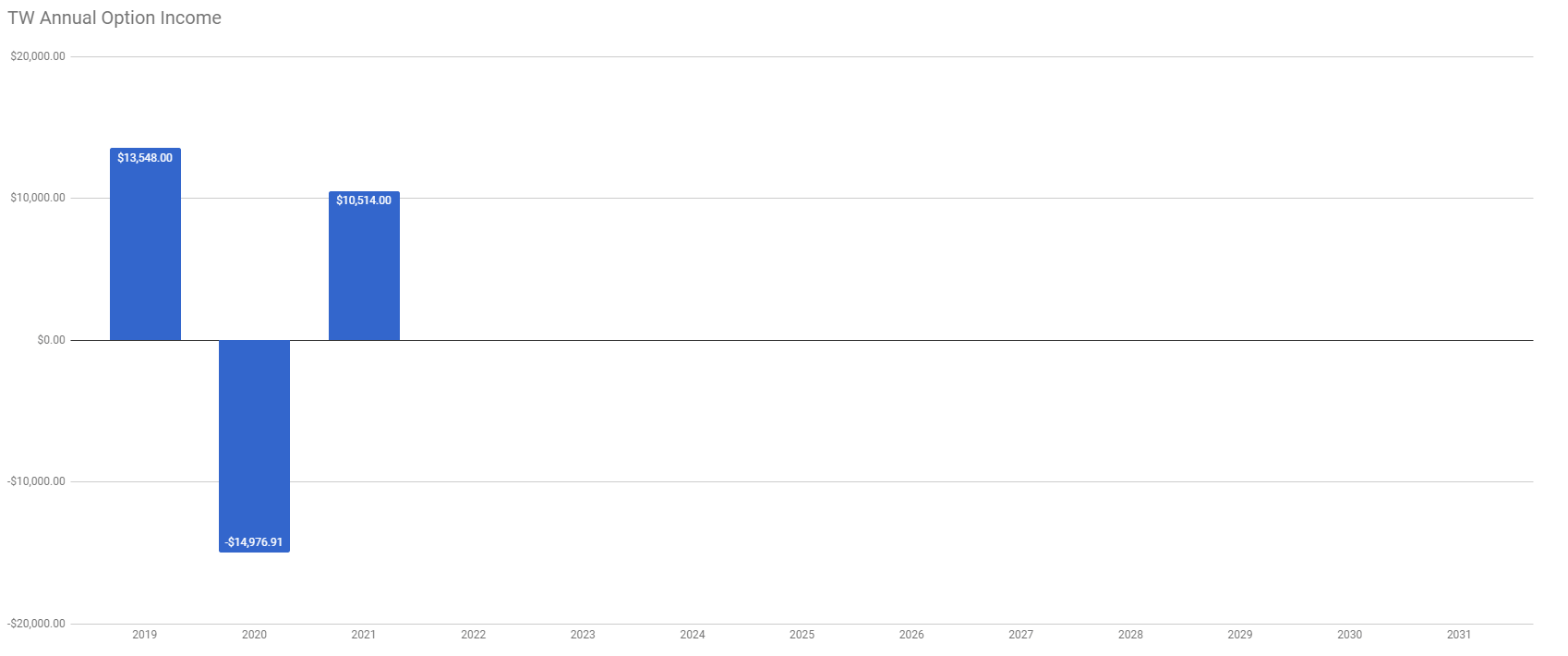

Old SPX trades repair

This week we have not done any adjustments to our old SPX trades. We are still sitting on those trades and waiting for the untouched side to close so we can roll the trades again. The goal will be to roll the trades until we will be able to close them for at least break even and release the buying power. We will keep doing this only if the resulting trade will be a credit trade or a very small debit. If adjusting these trades would require adding more new money, we would rather close these trades and move on.

Accumulating Growth Stocks

Last week, we added AAPL to our portfolio and we added Snowflake (SNOW). For some reason, SNOW is a hated company by Wall Street. It suffered significant selling pressure last few weeks. I do not understand why. I still think SNOW is another Amazon in the cloud services industry. If done right, the company will perform well and could become a significant competitor to AMZN’s AWS. Although SNOW’s net income is declining, its cash is growing and its revenue is also growing year by year. This tells me that they are doing something right.

I plan on continuing to accumulate this stock and reach 100 shares. After I reach 100 shares, I will start selling covered calls. I wanted to sell strangles but the stock is not marginable as of now (at least my broker doesn’t allow to trade on margin as of yet due to the stock’s recent IPO) so it is too expensive to trade cash secured. But once I accumulate 100 shares, I should be able to trade a standard wheel strategy.

Since the stock is in the “hate” territory and investors sold off the stock that now it trades below its IPO price I expect that it may go even lower from here. The stock may go down to $150 a share or even $100 a share. Yet, I still plan on adding shares to build the position.

Accumulating Dividend Growth Stocks

It still is our core investment strategy to accumulate high-quality dividend growth stocks. We continued accumulating the following dividend stocks and as of today hold the following shares:

Realty Income (85), ABBV (25), PMX (100), and AAPL (18)

Our goal is to not only reach 100 shares of high-quality dividend stocks. We also want to build a weekly dividend income as per this calendar:

We are reaching our weekly dividend income goal as almost all weeks are filled with dividend income.

Market Outlook

The market is reaching our goal target of $4,200 level. It was a straight run-up. I definitely didn’t expect this fast move but it happened. A pull-back is now likely, although I expect a minor one, possibly back to $4,000 level (or 4% to 5% pullback).

Trading options

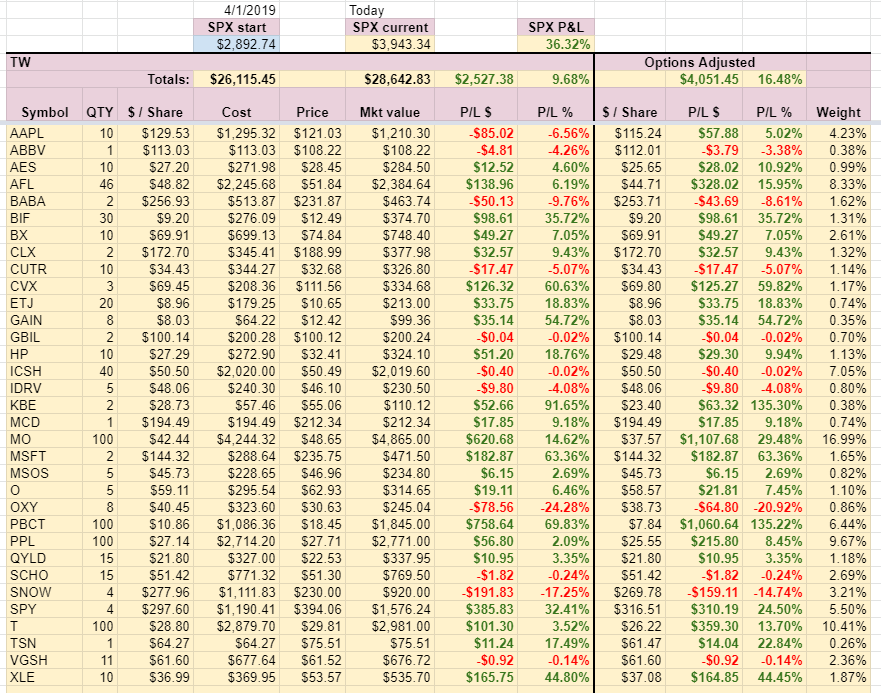

We continue trading options around the stocks we own or plan to own in the future. I call it monetizing our positions. If you look at our holdings table below, there are two column sections. The right section is “Options adjusted”. That section applies options premiums to the cost basis of our stocks. And there you can see how beneficial it is. It will make a significant difference when the market is falling yet our stocks will still be in green.

Investing and trading report in charts

It is amazing to see how the portfolio growth is speeding up once it grows larger. We are almost at $2,000 net-liq gains per week. If I extrapolate this rate of change to the remaining 37 weeks this account should grow by another staggering $74,000, finishing the year 2021 at $121,250.

The table above shows our current holdings and gains on those holdings. Adjusted columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 10.76%. With options, our holdings are up 17.87% (from inception on 4/1/2019). The SPX is up 44.69% since inception. Since the inception of the fund, our stock holdings underperform the overall market (up only 17.87% on a cumulative basis). This week, our adjusted stock holdings underperformed the market. The market gained 14.84% YTD, our portfolio options-adjusted stock holdings grew by 10.89% YTD. This includes stock holdings adjusted by options trading, not the entire account. If we include the entire portfolio and options trading, we beat the market significantly.

The stock holdings growth slowed down because we added many new positions and these positions didn’t have time to grow yet, so I expect the growth trend to improve over time and beat the market.

Our dividend goal and future dividends

Our portfolio still doesn’t represent the true dividend income potential. The $1,071 of dividend income is our goal based on the expected stock accumulation. The chart below indicates the dividend income of currently accumulated stocks. But as of now, we are not yet receiving this income as we just finished accumulating these stocks and since the companies pay quarterly, we already missed the 1st quarter.

Our account cumulative return

This is another metric I started tracking (since March 13, 2021) recently.

As of today, our account cumulative return is 23.38% (since March 13, 2021).

Conclusion of our investing and trading report

This week our options trading was great and we created a lot of income making March our best month so far.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments