The 2020 year was an interesting year. It looked like it would be a complete disaster at first, yet it turned around very fast and it became my best year investing so far. Here are some of the achievements in the charts:

· Net-Liquidation Value

It was in August 2019 when my $20,000 account tanked to $1,600 after a series of costly mistakes trading 0 DTE SPX Iron Condors. I could manage the trades and grow the account until July. After that, volatility in the market kicked in and I was not able to navigate the trades through it. Losses were piling up fast. It took a month to completely destroy the entire account.

For the rest of the 2019 year, I was sitting tight and thinking about what should I do about this situation. I knew, that I will no longer trade SPX. It was a dead-end and I was trying hard. Yet, the strategy was in front of me for the entire time. Right in front of my nose, advocating it on this blog but ignoring it.

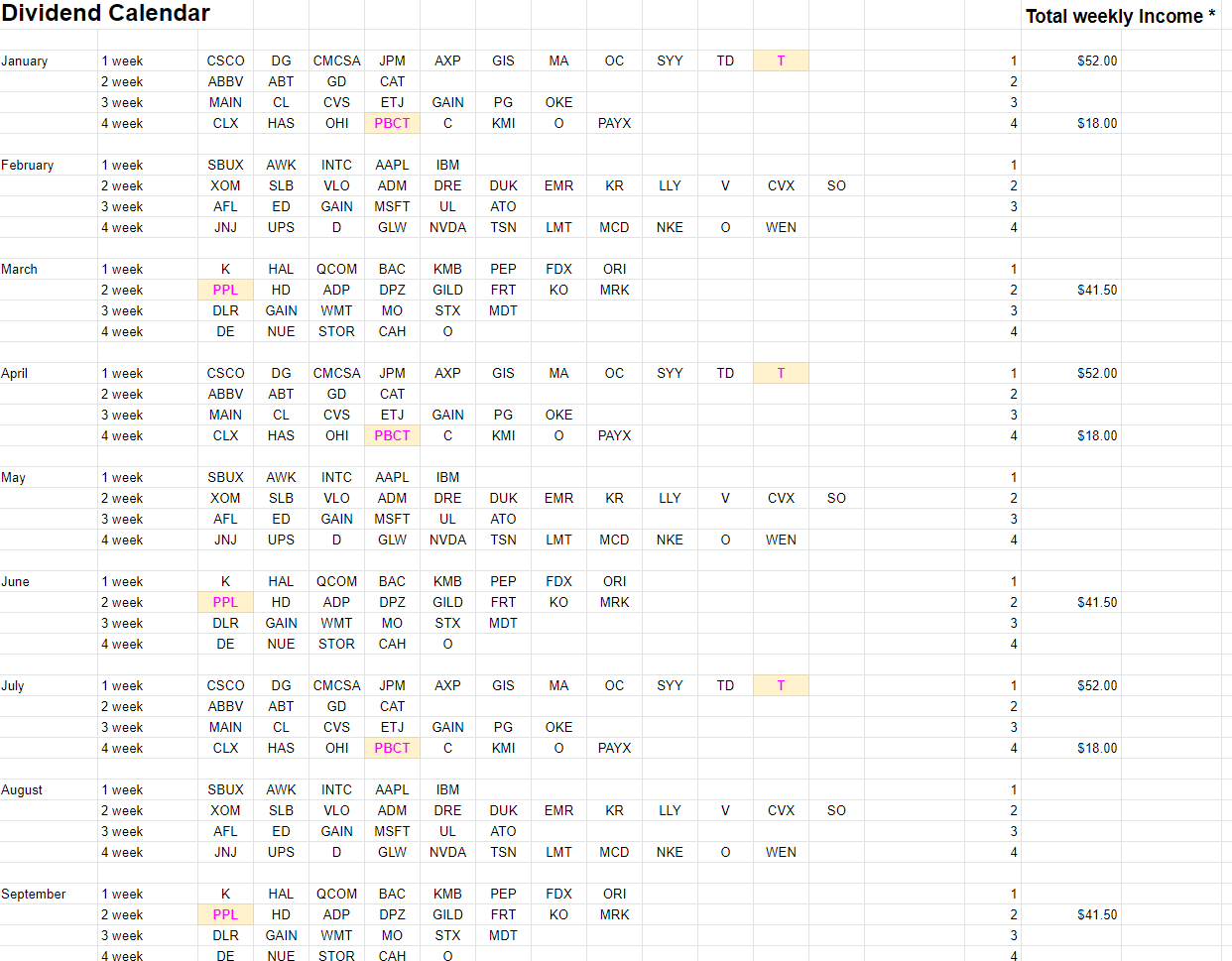

At the beginning of November 2019, I decided to go back to what I knew best – buying dividend growth stocks and monetizing them. I salvaged what I could and started aggressively buying dividend aristocrats such as PBCT, PPL, and AT&T. And, I started selling strangles around these positions. And the account started going up again.

In March 2020 when Covid hit the markets, the account tanked again. At first, I was depressed and on the brink of completely giving up. But I remember 2008 when everyone was panicking and selling I should have been buying. I was telling myself not to make the same mistake. So, I deposited some cash in the account and started aggressively buying depressed stocks. And as the market started recovering, I was selling puts like crazy.

This action paid off. As the markets continued recovering, my options were mostly expiring worthless for full profit. And I kept reinvesting those profits. Soon I could buy LEAPS against SPY and IWM. And I started selling covered calls against those positions. And reinvesting the profits. And the account continued growing even faster.

Could this be the end of my trading experiments and continuous growth? I believe so. My trading was a zig-zag move so far and not very encouraging:

I am pleased with the new strategy and its results. But I will not be as aggressive in 2021 as I was in 2020. I will be building reserves in cash to protect the trades in case I get assigned (the biggest issue is not the options, they have very little to no risk, but the assignment and not having enough cash to cover it). I will also start depositing $1,000 a month to this account and grow it even faster.

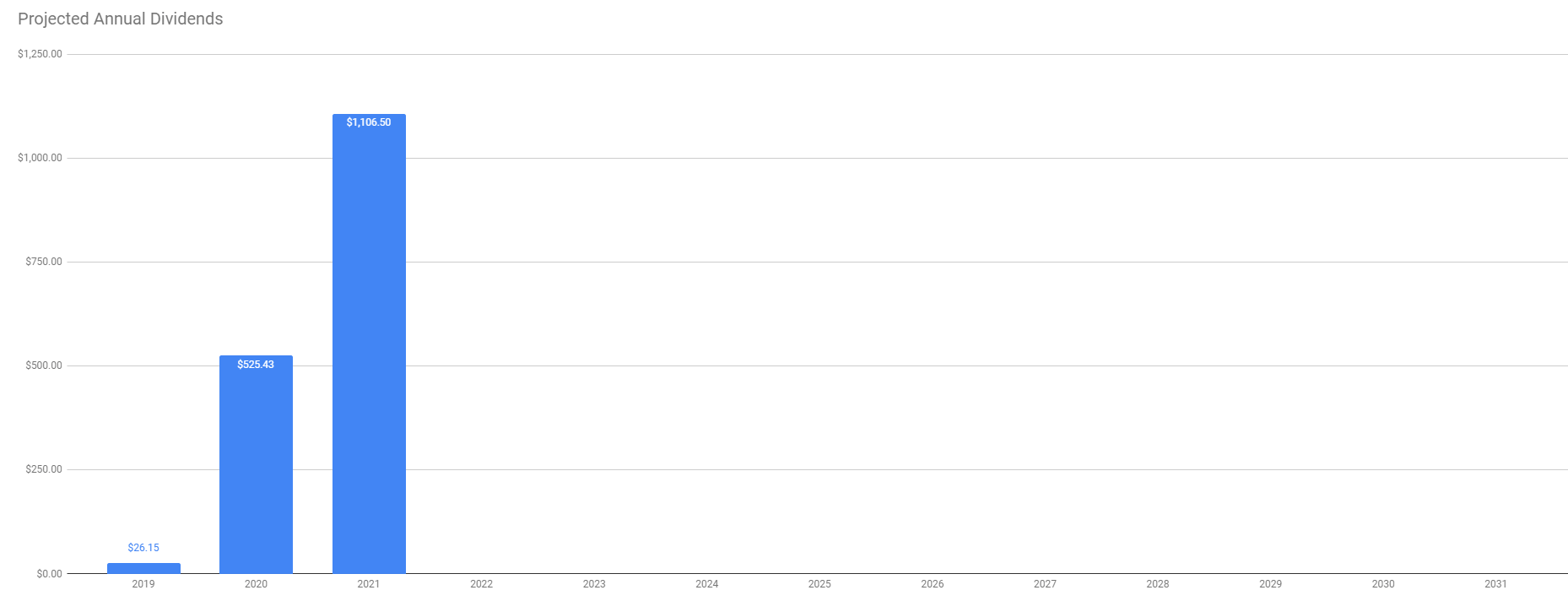

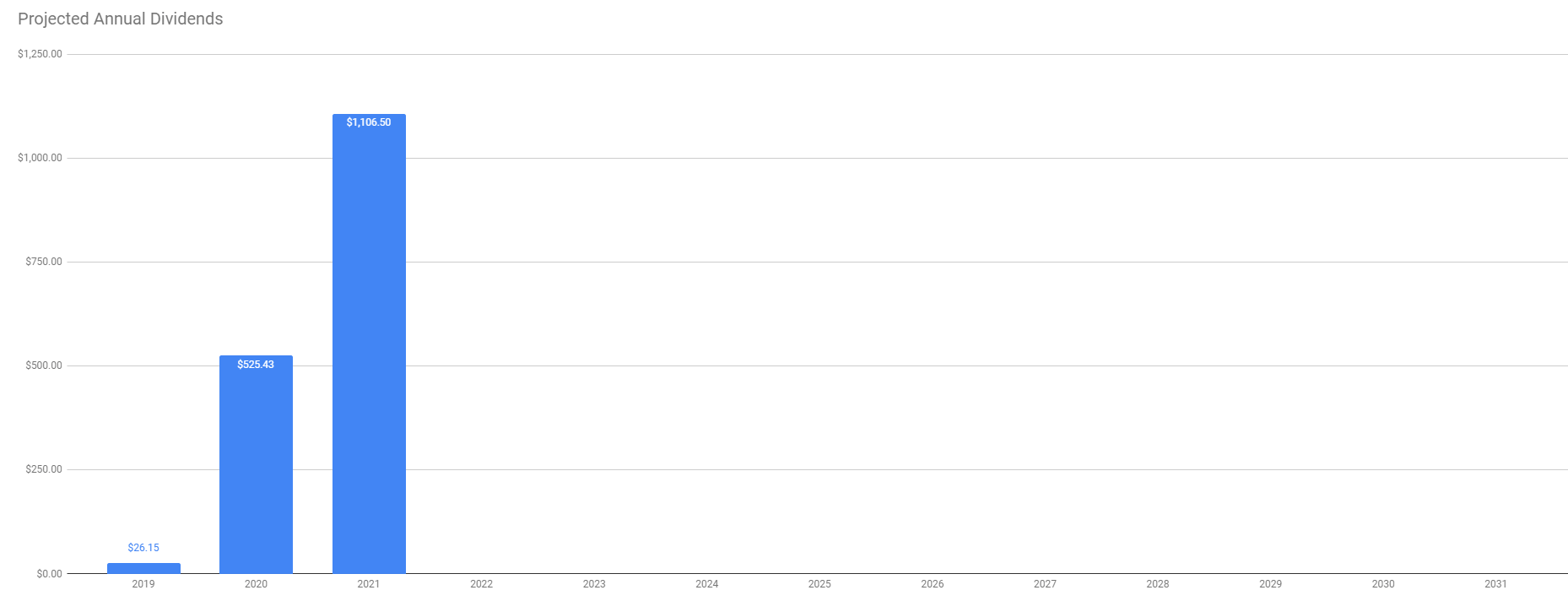

· Dividends

Prior to 2020, I had no stock positions. I only traded SPX. I might have only a few shares as a result of some bright moment in my wicked trading thinking and bought one or two shares here and there. But in 2020, I started aggressively building my dividend aristocrats portfolio. From the dividend perspective, I am at the beginning of my journey. Note, that I am talking about the business account, not my ROTH or IRA accounts where I was investing primarily into dividend stocks and these have nice dividend income already. But this “business account” is a do-over.

Yet, I collected $2.27 in dividends in 2019 and $178 in 2020. My projected dividends grew from $26.15 in 2019 to $525.43 in 2020.

I expect the dividend income to grow as I keep adding more shares to my portfolio. The growth seems high and fast when you look at it but the projected dividend is calculated using the current dividend amount times the existing stock holdings and expected stock holdings or accumulation of the stocks during 2021. I plan on accumulating AT&T, MO, and AFL to reach 100 shares of each company during 2021 (if I get more, the better). If I achieve this goal, my projected dividend will be $1,106.50 in 2021.

I also understand that received dividends will be lagging behind the projected dividends as I will be accumulating stocks during the entire year and I may make some purchases after the dividend ex-day, so the projected dividend will increase yet I will miss that dividend payout in the given period. But I will receive it in the very next period.

· Options

Options income was tricky in 2020. I collected a nice dividend income but the results are skewed due to a few factors:

1) I still hold a few bad SPX trades. These are included in the current net-liq so they will have no impact on the account value. I do not plan on salvaging those trades unless a good and cheap opportunity presents itself. But if these trades expire (mostly call spreads in the money), they will be recorded as a loss in the options income.

2) I am not only selling premiums but I am also buying LEAPS. When I buy a LEAPS call, it will also show up as options cash outflow and could be considered a loss if you do not know that it was a purchase and not a loss. In 2020 I purchased a few LEAPS against SPY and IWM for almost $5,000 dollars. Thus, in 2020, it seems that I have lost $14,976.91 in options premiums. But it is not correct. I yet have to come up with a good recording method to filter out these purchases. Of course, in the following years, I expect these LEAPS to make a profit and it will show up as income in the next year(s).

I hope, this provided a good insight into my 2020 trading and investing efforts. I am happy with the results and I hope, I will continue growing my account in 2021 towards my goal of financial freedom. By 2021 my goal is to reach the $42,344.06 net-liq value of my account. Let’s see, if I will be able to achieve it or even exceed it.

Good luck to you and Happy New Year!

We all want to hear your opinion on the article above:

No Comments |

Recent Comments