S&P 500 2,506.85 -253.32(-9.18) Dow 30 23,327.46 -2,211(-8.66%) Nasdaq 6,635.28 -695.26(-9.48%)

December 2018 passed and it is time to once again provide a report on our trading and investing. The month turned to be the worst month ever. Historically, December was a good month with modest gains but this year, the markets lost almost 10% and that is unseen since 1930’s (correct me if I am wrong).

Of course these losses had impact on our accounts and our net liquidation values.

However, none of this draw-down translate into physical losses (sort of). As we rolled all trades down and away.

But to make sure we are all on the same page – rolling a trade means closing the old one at a loss and opening a new one which collects enough premium to pay for the loss. So, technically, we took losses in but offset them by new trades.

That’s why the net liquidation values of our accounts went down. as the new trades mature, though, the net-liq values will start rising again (which will be seen in January 2019, unless the markets crash again, as is widely expected these days).

However, all the 2018 mess in Wall Street had impact on our trading and we needed to adjust it slightly to reduce exposure of our capital.

What I will be doing from now on?

Overall, we will continue reducing our capital exposure and trading less throughout 2019 or until the market tells us where it wants to go. As of now, it looks like that we want to go up and that everything is rosy again. But historically, this can be deceiving. In all historical bear markets, this V shape recovery we are currently witnessing spelled out trouble without a low retest.

If that is the case today, we have the following possible outcomes:

1) V recovery will continue without retest nor consolidation – bearish.

2) V recovery will stall at or above 200 day moving average and then the market will consolidate – bullish.

3) We bounce down from 200 day moving average (or even above it), go down and retest December lows – bullish.

Without knowing what is going to happen I do not want to have overly large exposure in the market. Not that I am scared trading any outcome, I was able to navigate through both corrections in 2018 without losing my shirt, but I want to have my accounts manageable and too many open trades can make it difficult to adjust them should the market slump down fast.

So what are we going to do until the situation in the markets change?

In the IRA account:

1) We open only one weekly trade at a time with Friday expiration. A new trade can be opened only when the old trade closes. If the old trade is rolled into the next expiration and not closed a new trade will not be opened. You can follow the trades in our Facebook page.

2) We open up to two 45 DTE trades but with different time to expiration. We will be creating a ladder. This was our old theory we started doing a few years ago but abandoned and never finished. This means, we will open a 45 DTE expiration trade one week and then a second 45 DTE next week.

3) After a trade is open we immediately place a closing GTC (good till cancelled) trade for 50% profit.

4) We open a new 45 DTE trade only when the old trade is closed. If an old trade is rolled or otherwise kept open no new trade can be opened.

5) A new additional 45 DTE (above 2 contracts mentioned above) trade can be added only when BP is higher than the cash management limit allowed.

6) We will keep managing old open trades already in the account to close them successfully as winners.

In the ROTH account:

1) There will be no new trading in this account. Only managing old open trades. And saving more cash for trading.

In the TD account:

1) There will be no new trading in this account. Only managing old open trades. And saving more cash for trading.

It is really time to stop the madness and reckless trading I did sometimes in my accounts and bring it back to boring strategy and discipline.

We are now publishing our tracking of our accounts for the entire year. If you are interested, you can review it here:

- Review our IRA account 2018 trading and investing data.

- Review our ROTH IRA 2018 trading and investing data.

- Review our TD Account 2018 trading and investing data.

We post our trades on our Facebook page.

Here are the entire 2018 year trading results:

· Dividend stock investing

Dividend investing is doing great on both accounts – ROTH and IRA. We keep using 50% of all options income and buy dividend stocks. IRA account keeps growing fast with new stocks being purchased every month. ROTH is more or less stagnant.

Here is a review of our accounts stock holdings:

In August we purchased the following shares:

We haven’t purchased any shares in ROTH or TD this month.

We keep spending 50% of our options trading proceeds to buy good dividend growth stocks using our screener to get a better entry into the stocks. Although capital appreciation is not our goal but a secondary target, timing the entry creates good results as our positions are mostly up. However, do not be too excited, any large selloff can temporarily send those stocks down again. It is a dividend income what matters to our portfolios, not the portfolio value and capital appreciation. It seems to be evident that using options to grow the portfolio is the right way to do.

· Dividend Income

|

We all want to hear your opinion on the article above: No Comments |

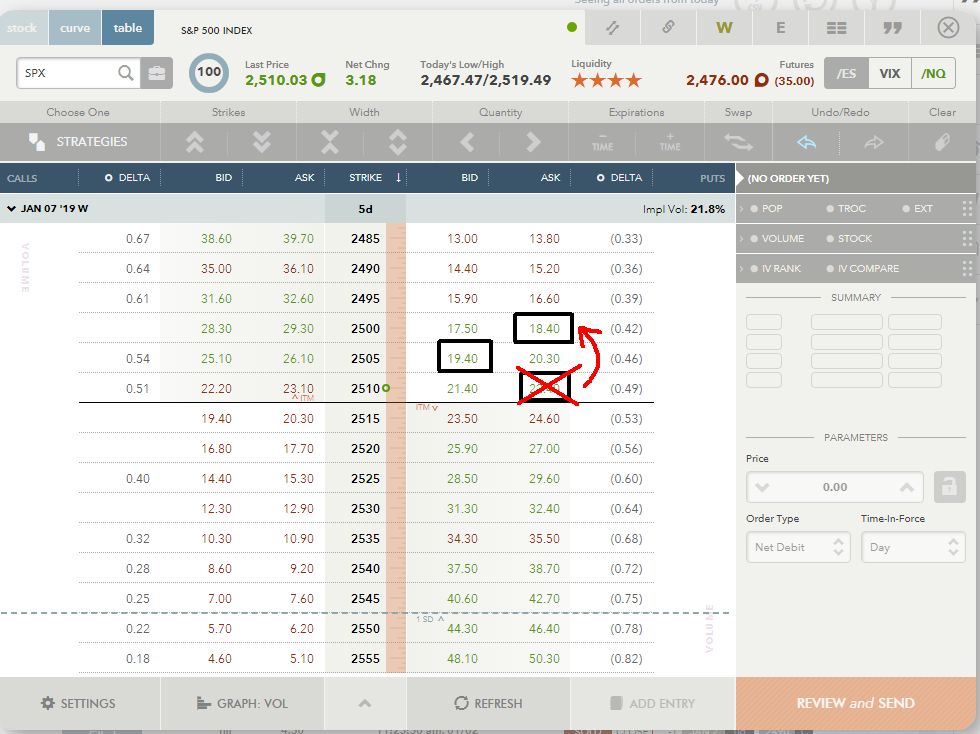

But, what if I am wrong again? And in today’s market it is quite often. Let’s say I convert a debit trade into a credit trade and the market starts falling again (like today). Then I use a butterfly to protect the new trade.

But, what if I am wrong again? And in today’s market it is quite often. Let’s say I convert a debit trade into a credit trade and the market starts falling again (like today). Then I use a butterfly to protect the new trade.

Recent Comments