You can predict the market all day long and yet you will end up 50% chance of being wrong. Sometimes you will be wrong right at the beginning of the trade.

And that is a reason why I do not predict the market or stocks’ move.

You plan a trade, set expectations, and everything runs perfect. Until it doesn’t.

STX opened more than 2 dollars down and dropped all the way down to 45 dollars. That wasn’t a price action I would like to see when playing the triple play trades.

I opened a new strangle with 48.50 puts and 50.50 calls and my intention was to let the puts assign and capture the dividend.

After today’s sell off I didn’t like it and didn’t want to be assigned at 48.50 when the stock is trading at $45 a share (although by the end of the day the stock recovered a bit)!

But it happened and these are the events you will never be able to predict. Our 48.50 puts are now ITM and our calls are worthless.

We decided to adjust the trade.

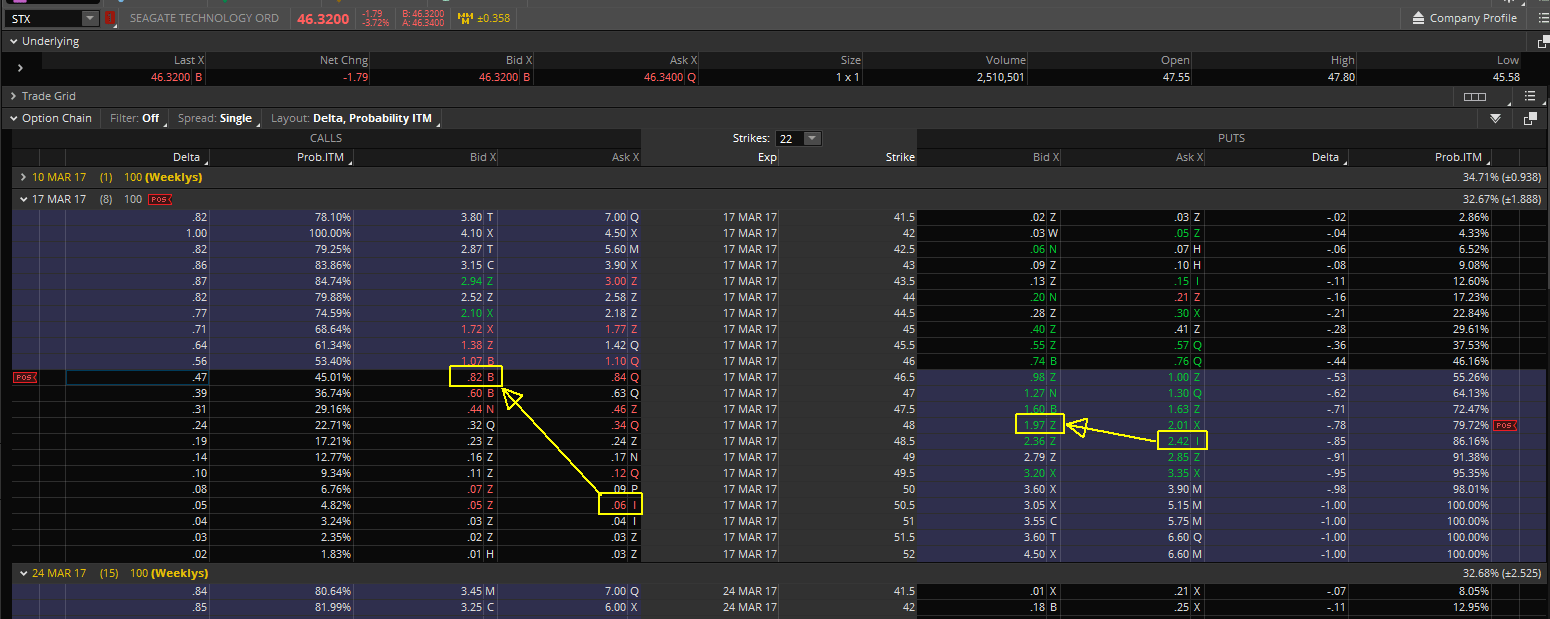

First, we closed our calls:

BTC 1 STX Mar17 50.50 calls @ 0.04 debit

Then we rolled our puts lower and sold new, lower calls too:

BTC 1 STX Mar17 48.50 put

STO 1 STX Mar17 48.00 put

STO 1 STX Mar17 46.50 calls

@ 0.15 credit limit day

This adjustment would require more attention and more adjustments in the near future.

Our calls are now at the money which is OK with me and I am prepared to roll them if they get in the money.

If the stock starts recovering, I may leave the puts at the new strike ($48.00) assigned next week and just manage calls using strangles and later covered strangles.

If the stock stays where it is or even continues falling during the rest of this week or next week, I may choose the following trade adjustments:

1) Abandon the triple play trade and continue treating the trade as a strangle (and avoid assignment).

2) Still let the trade go as a triple play, but roll the puts away and lower (not letting them assign); and buy shares outright at a lot lower price.

3) After assignment or purchase I would continue as per the original plan and sell covered calls.

Some investors from our Facebook Group asked me if I knew why STX dropped so hard today.

I do not care much what’s going on or why the stock dropped so much. I may find out later during the day or next day what caused this but I do not care for the reasons. I care about the impact this could have on our trade, our plan for the trade, and how I will be adjusting the trade.

The balance of this trade is as follow:

| Original credit received: | $117.00 |

| Today’s adjustment credit: | $11.00 |

| Expected dividend: | $68.00 |

| Current stock price: | $46.68 |

| Break even price: if assigned at $48.00 |

$46.04 |

Here is the previous post about the trade which we have adjusted today:

– STX dividend capture – triple play Published 2017/03/07

Leave a Reply