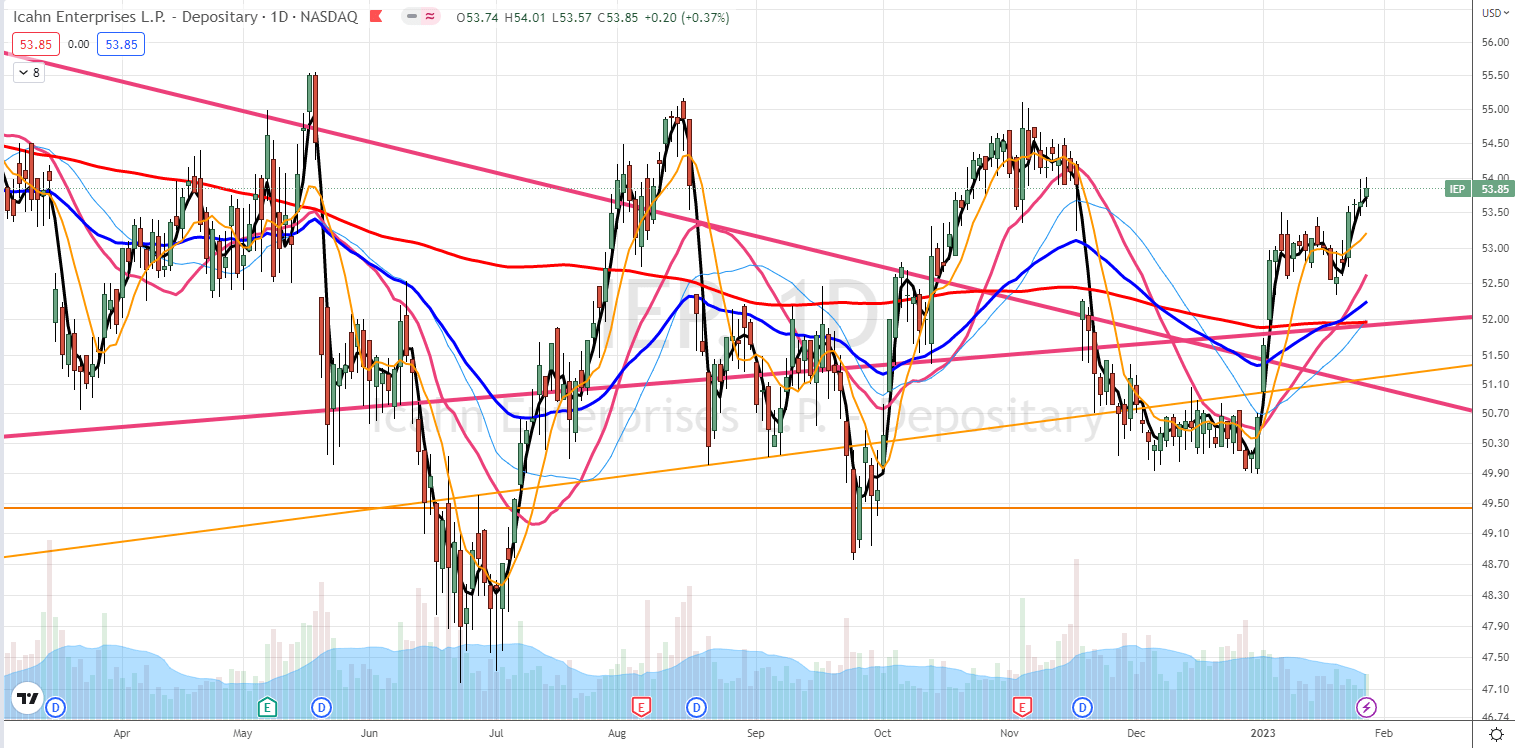

IEP is in stage #2. The stock started declining as is typical but then reversed, possibly on the news that Carl Icahn reached the deal with Crown Holdings to add the activist investor’s members to the Crown’s board. The weekly chart shows a sideways pattern.

The company’s revenue is erratic but improving since 2020. If it keeps going higher, it may have a positive impact on the stock pushing the price higher:

Free cash flow is also choppy which may explain the stock price choppiness:

But the company has more cash in hand to pay its $7 billion debt (despite the recent cash decline, possibly resulting from the recent acquisitions).

The stock is more like a bond. It pays a great dividend but offers very little growth. This lack of growth is possibly a result of stock dilution that is extremely high. So, buying this company is for income than appreciation. In this case, I want to be buying at lower prices in the price cyclical decline.

The stock is now HOLD

This post was published in our newsletter to our subscribers on Sunday, January 28th, 2023. If you want to learn more about our stock technical analysis subscribe to our weekly newsletter.

Leave a Reply