TMUS is in stage #3. The stock struggles to break above its all-time high at 155 a share. It bounced off of it and falls lower. The trend is still intact but already vulnerable. On the weekly chart, we are seeing a V-shape recovery from 2022 lows, but it may also turn into a cup-and-handle pattern. If so, we will need to form the handle and that may send the stock below $130 a share.

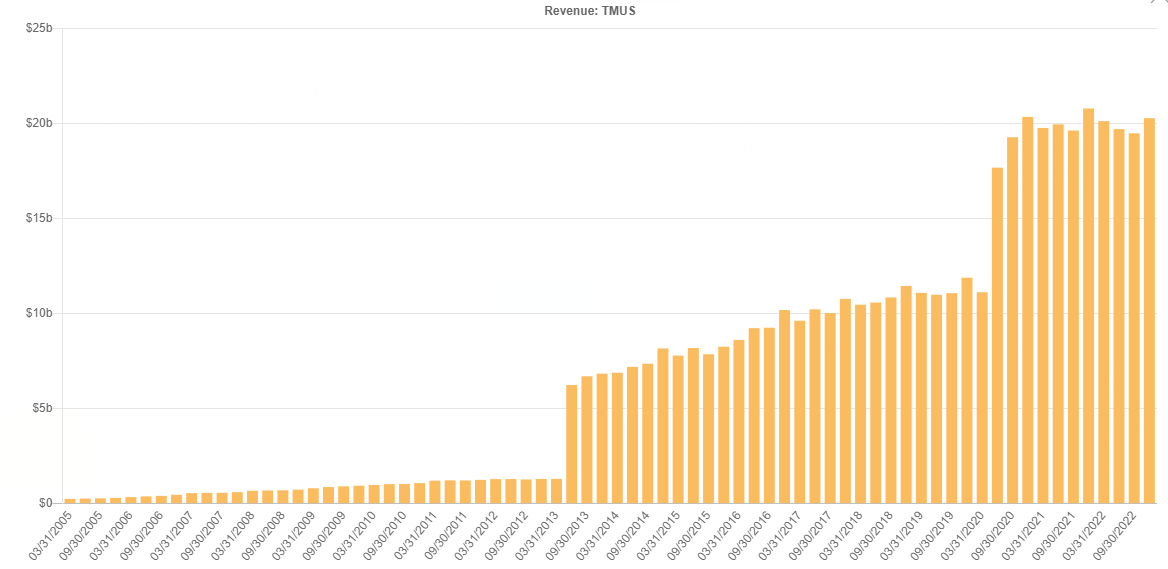

One reason for price stagnation could be stagnating revenue. The company saw a very strong boost in revenue during and after the Covid lockdown but then moved sideways. In previous years, the company saw steady revenue growth. Not anymore.

The free cash flow of T-Mobile is horrible.

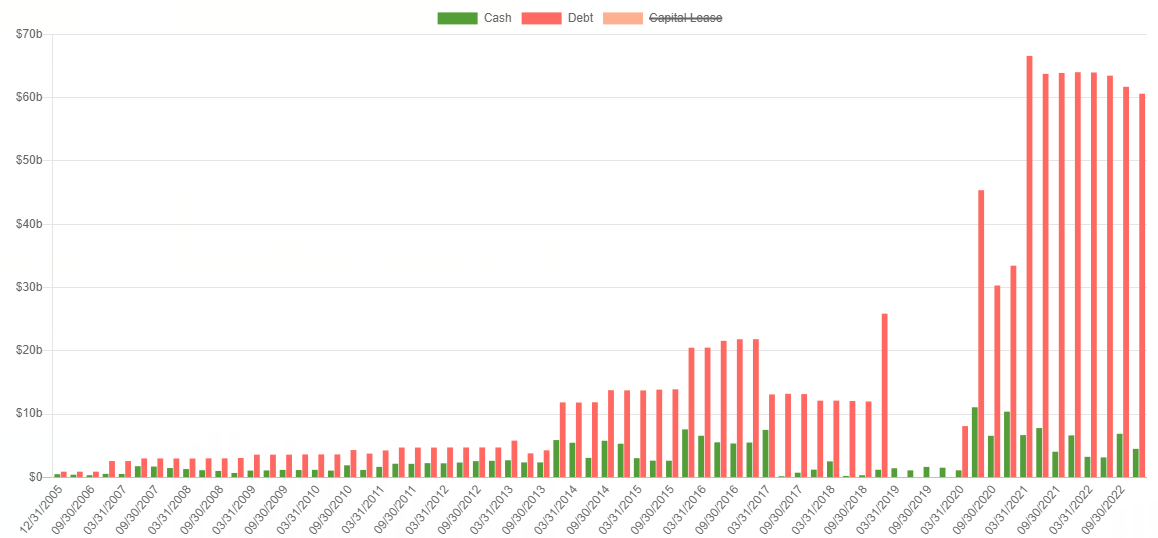

TMUS has enormous debt and very little cash to pay it, though lately, the company was paying the debt of:

Fundamentally, TMUS is overvalued. But we received an estimate for 2025 already, and it is higher by a double-digit number. Buying today would mean a 14% annualized return by 2025, which beats the market. So, although the stock is overvalued, it is a good buy for future valuation. As of today, the stock appears to undergo a time-based correction.

The stock is now HOLD

This post was published in our newsletter to our subscribers on Saturday, February 25th, 2023. If you want to learn more about our stock technical analysis subscribe to our weekly newsletter.

Leave a Reply