S&P 500 2,840.35 +13.13(+0.46%) Dow 30 25,462.58 +136.42(+0.54%) Nasdaq 7,812.01 +9.33(+0.12%)

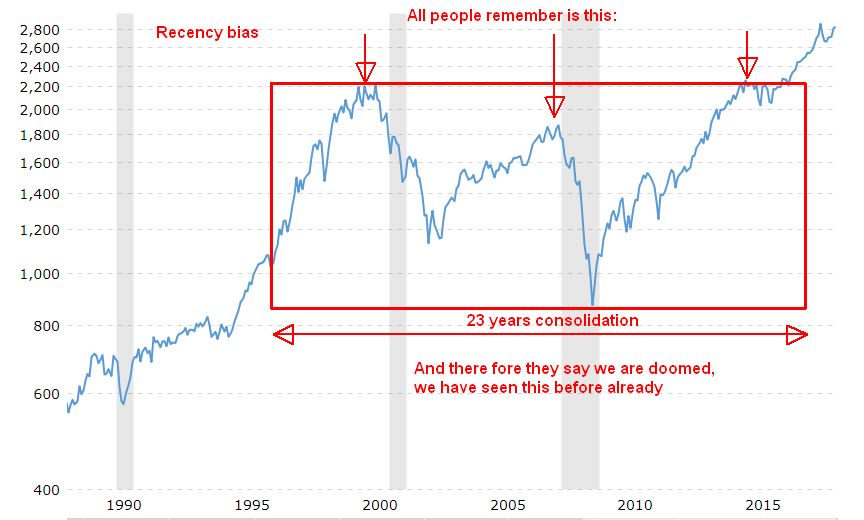

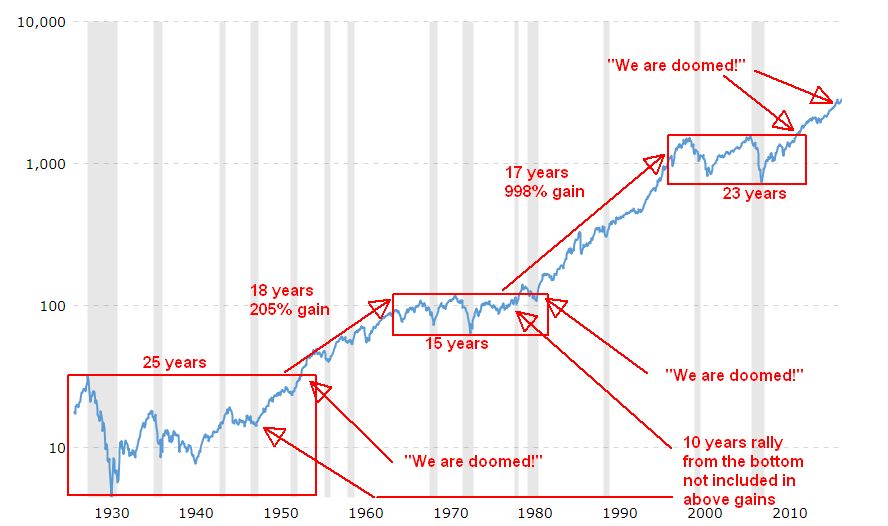

July market was volatile and hectic to our trading and investing. Trump’s trade war, although archaic news, still rattle the markets and spook the investors. there is however no need to be spooked and be afraid of the market.

July market was volatile and hectic to our trading and investing. Trump’s trade war, although archaic news, still rattle the markets and spook the investors. there is however no need to be spooked and be afraid of the market.

The price action of the current market points to a lot higher and better days to come. Although some time ago I was cautious and expecting this market to turn bearish at the end of 2018 or beginning of 2019 the recent charts proved me wrong. We may see pullbacks and corrections but overall we are heading higher. A lot more higher.

Of course, this is not a prediction but a probabilistic view and the market needs to be reviewed on a day to day basis to look for clues of change. We do not have any clues that this market is heading down.

July trading and investing was somewhat mixed and for most of the month our trading was slow with a lot of pullbacks. Our accounts made nice highs just to lose them the very next day.

The end of the month improved and it again became easy to trade.

In July 2018 our combined accounts delivered nice $4,417.54 cash in premiums. Not the best month but acceptable. Our net-liq grew by $8,870.20 in July which is a good growth (given we had a lot of volatility).

July ended well yet we need to focus on our business account more and bring it back up to speed. This year we suffered large losses due to mistakes I made trading unsecured (naked) options against volatile non-dividend stocks such as LULU, X, WYNN, etc., and over-trading a relatively small account. I still have a few bad trades which I am thinking how to best manage them. They are now all secured and with plenty of time to adjust them when needed. So no rush.

I sinned the same in our ROTH IRA account over-trading it. Thus I am now trading that account less and mostly manage open trades only. Most of the growth in the ROTH is cause by dividend stocks. However, I plan on changing it as soon as possible by trading only small trades and depositing more money.

Here are the entire 2018 year trading results:

· Dividend stock investing

Dividend investing is doing great on both accounts – ROTH and IRA. I keep using 50% of all options income and buy dividend stocks. IRA account keeps growing fast with new stocks being purchased every month. ROTH is more or less stagnant. We do not buy new shares as of now as I am focusing on increasing trading capital and then adopt the same strategy used in IRA.

Here is a review of our accounts stock holdings:

Traditional IRA

ROTH IRA

TD account

TBD

As of now, I do not track dividend stocks in TD account. We have a few positions in dividend stocks but our focus in this account would again bringing it up to speed, grow the capital and then adopt the same strategy as in IRA.

In July we purchased the following shares:

In one of the Facebook groups, where we post our trades and purchases, one member asked me why I only buy small amounts of shares, such as 4 shares of a stock, etc. His argument was that spending small amount would be offset significantly by brokerages fees.

Our reasoning is that we want to be buying only smaller amounts and rather more often to eventually dollar cost average the price. The table above indicates that we could purchase 7 shares of ABBV for $89.20 a share and when the stock dropped even lower, we could buy another 7 shares, this time for $86.90. If we have spent all our available money on the first purchase, we would not be able to buy more shares cheaper.

The next rule we have is to purchase shares for minimum $600 purchase or more, not less. With a $5 fee per trade, a 0.83% fee rate is acceptable. As you can see in the table above, this strategy helped us to buy shares of ABBV with over 4% dividend yield at that time and in 14 days we are already sitting on 11.08% capital gain for that particular purchase. If we spent all the money we would only see 8.22% gain.

As a dividend growth investor, capital gain is not important. It is a different mentality you need to adopt as a dividend investor. It is not a capital gain but stream of income what matter. However, even with that, our secondary goal besides the stream of income, is capital appreciation. And if there is a chance to grow the portfolio why not taking that option into account, right?

· Dividend Income

ROTH IRA dividend income

IRA dividend income

We all want to hear your opinion on the article above:

No Comments |

July market was volatile and hectic to our trading and investing. Trump’s trade war, although archaic news, still rattle the markets and spook the investors. there is however no need to be spooked and be afraid of the market.

July market was volatile and hectic to our trading and investing. Trump’s trade war, although archaic news, still rattle the markets and spook the investors. there is however no need to be spooked and be afraid of the market.

June is over and I battle with myself to keep up posting my trades and results. It is hard to do so. I work full time and manage a few accounts at the same time. I trade many trades and it is difficult to post them all.

June is over and I battle with myself to keep up posting my trades and results. It is hard to do so. I work full time and manage a few accounts at the same time. I trade many trades and it is difficult to post them all.

Recent Comments