Another nice and interesting ride today in the stock market. After resignation of Gary Cohn from Trump’s administration which was announced yesterday at 5:30 ET the futures at S&P and Dow dropped 32.25 points and 400 points respectively.

S&P 500 was losing 1.41% and all our trades looked very gloomy.

Although I kept saying to myself that Trump’s ongoing tariff threats are just over reaction and only a short term bearish factor for the stock, it is difficult to stay calm when you are facing trades with expiration round the corner and deep in the money.

As a dividend investor it is easy to stay calm. Of course, you must train your mind set to be like that. It take training, it takes patience, maybe even guidance by someone experienced, and it takes a lot of guts to stay calm. I can proclaim that I am already there and these volatile days do not derail me a bit. I actually welcome these days as they allow me to add more great dividend aristocrats to our portfolio. And we can buy cheap!

Two great investors and billionaires Warren Buffett and Ray Dalio came out with a great advice for long term investors. Something you have probably heard many times:

But for the average person, shifts in the market, even ones as dramatic as the ones we’ve seen this year, shouldn’t be cause for panic. During times of volatility, seasoned investors Warren Buffett and Ray Dalio agree that it’s best to stay calm and stick to the basics.

“Don’t watch the market closely,” Buffett told CNBC in 2016 amid wild market fluctuations. “If they’re trying to buy and sell stocks, and worry when they go down a little bit … and think they should maybe sell them when they go up, they’re not going to have very good results.” (Source USA Today)

You may say, “it is easy to say than to do”. True, sort of. But that’s when training comes handy. I trained my mind the similar way as Ben Graham says in his book Intelligent Investor:

Look at the prices of the stock when they go down as that they are on sale. Imagine, that a CNBC commentator or talking head exclaims “Stocks on Sale! AAPL is now 4% cheaper! Never before at this price! And we hope that this promotional sale will continue tomorrow and we get the stocks even cheaper tomorrow! Great stock liquidation prices!”

How many times we go shopping and look for lower prices; comparing prices on internet who sells goods cheaper?

And why we do not do the same when purchasing stocks?

Warren Buffett says that “If [you] buy good companies, buy them over time, they’re going to do fine 10, 20, 30 years from now.”

And that is exactly how I look at them. I do not buy dividend aristocrats to trade the, I buy them to hold them. And hold them means forever. There is only one exception to this rule when I decide to sell. And that is when the dividend aristocrat cuts the dividend.

However, I also trade!

And if you trade, your mindset needs to be a bit different than that one of a long term dividend investor. You cannot open a trade and walk away. Those trades need constant watch (or at least a watch when you are nearing to a decision point of that trade, so it also depends, what you trade and what is your time horizon).

When I approached stock market for the very first time in 1996 I wanted to learn trading to generate cash which can be invested.

Sad thing is, it took me so long to learn it. True, I lost money, lost interest in stock market and quit. I got back in 2006 and decided to learn again. Another 10 years of a college and doctorate of investing before I can say, I finally learned the topic and now make enough money trading to spend 50% of all my proceeds to invest into dividend aristocrats.

Yet, there is still a lot to learn – consistency. But I am getting there!

· Trading activity today

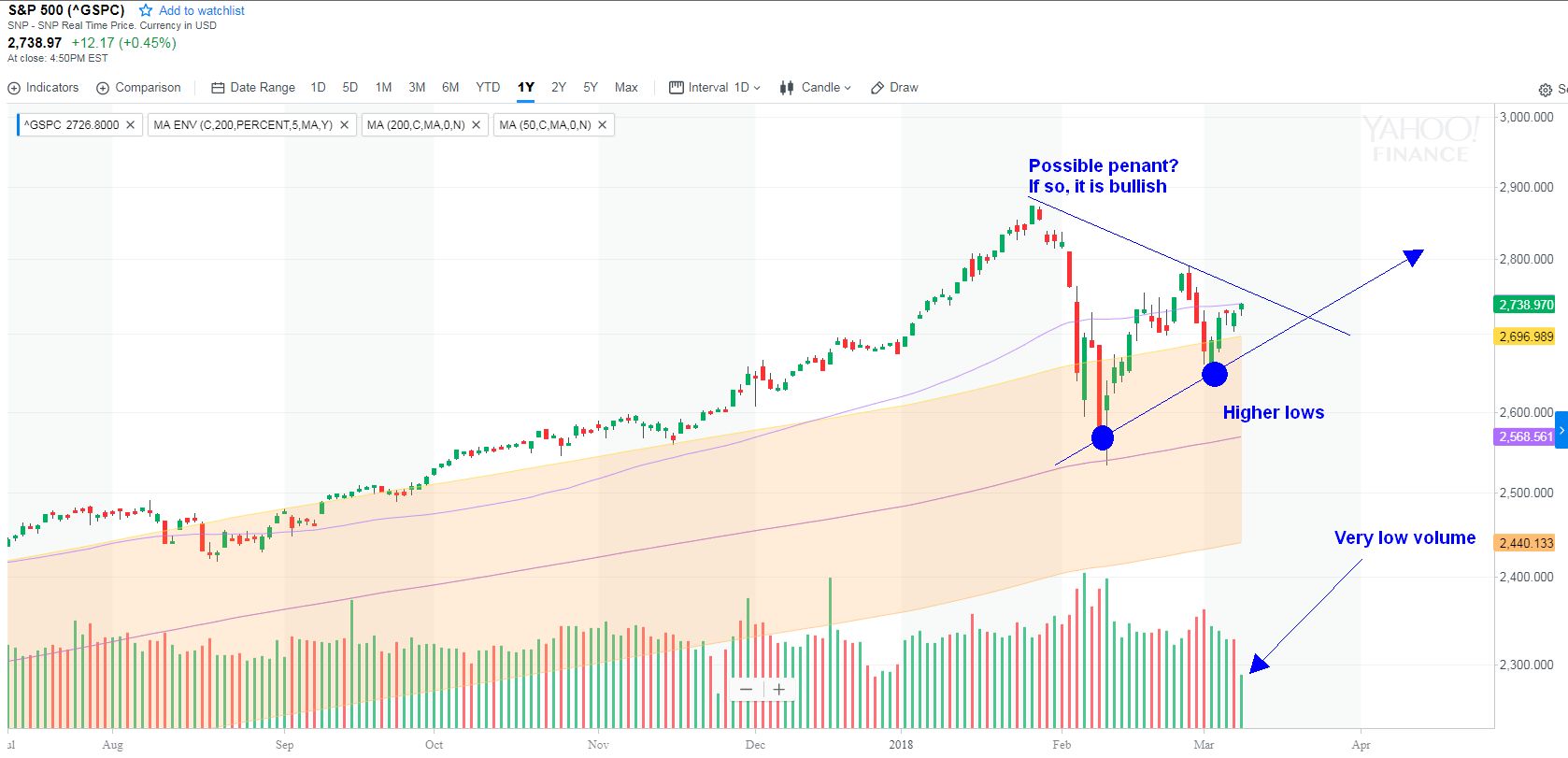

Before the trading ended today, the market recovered all losses from the morning. It was something I didn’t imagine nor envision. I was ready and prepared for another catastrophic selling. What was surprising though that the market seemed very lazy the entire morning. First the futures recovered from the lows and the market opened down only approx. 15 – 20 points and moved nowhere the entire morning. It was the time when I lost faith in this market and decided to roll my SPX puts into the next expiration to avoid troubles should the market suddenly collapse.

Then, rumors about possible tariffs exemptions came up and the market shot up and at one moment it was in green. We closed only 1.32 points down!

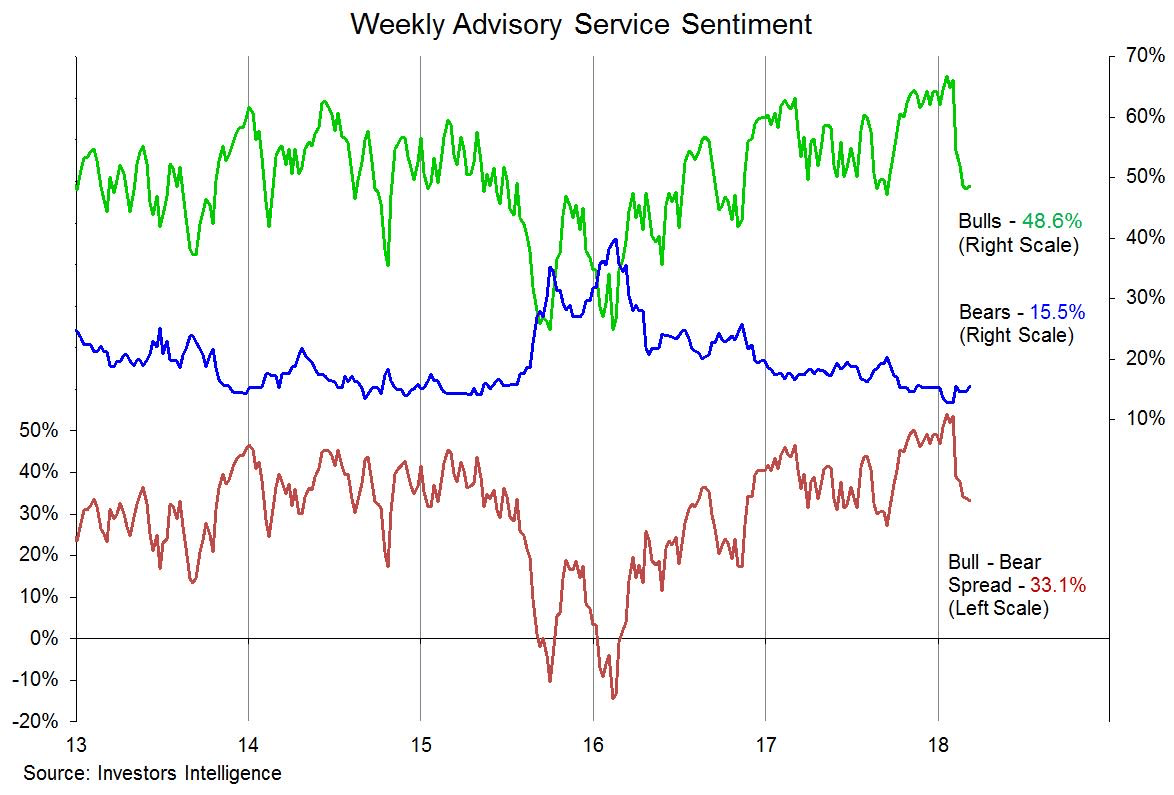

This indicates that we are really in a bull market and Trump’s economic extempore has no long term impact on the bull. I am expecting the market to be in its bullish mode for the next year or two but there are some so called experts who predict this bull to last for the next 20 years! I wonder what kind of crystal ball are they looking at.

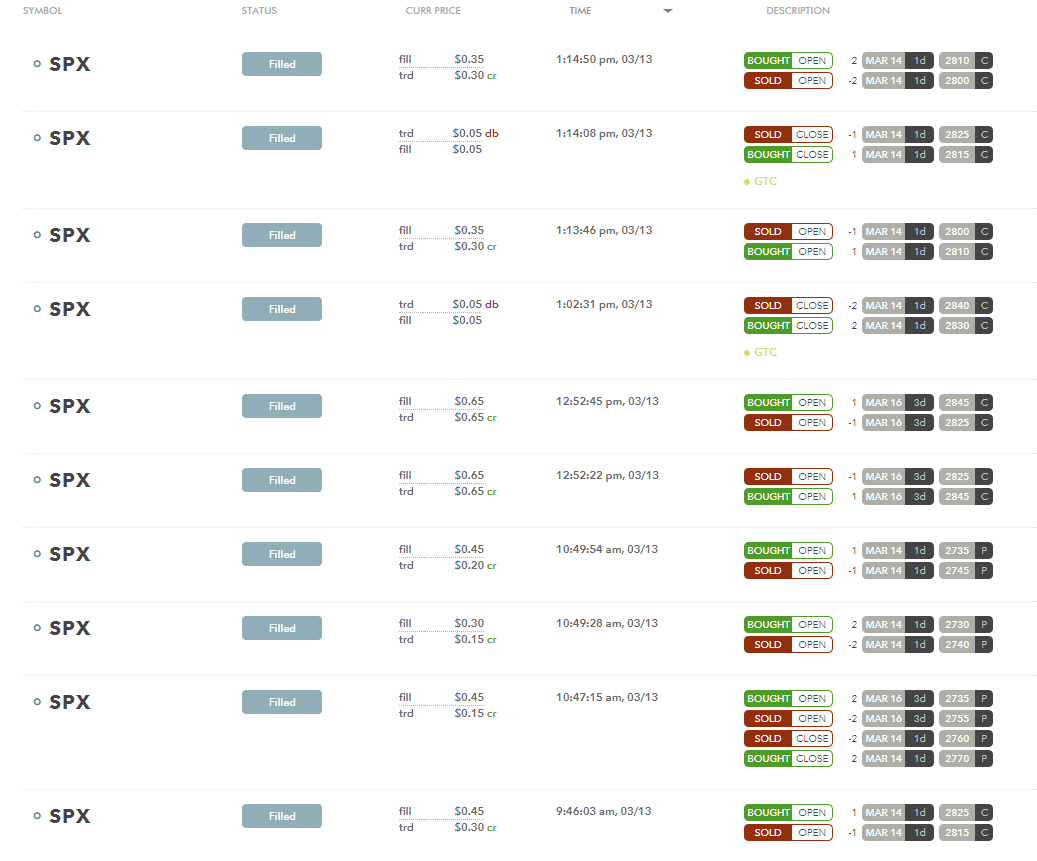

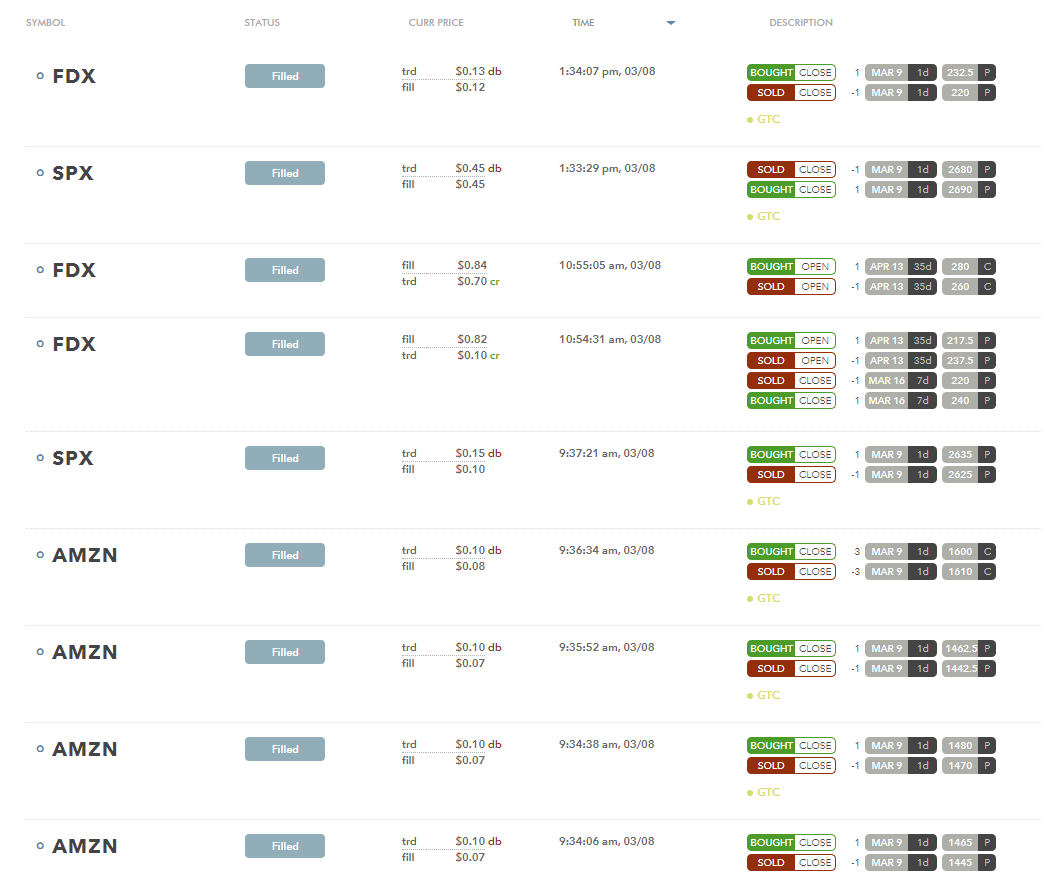

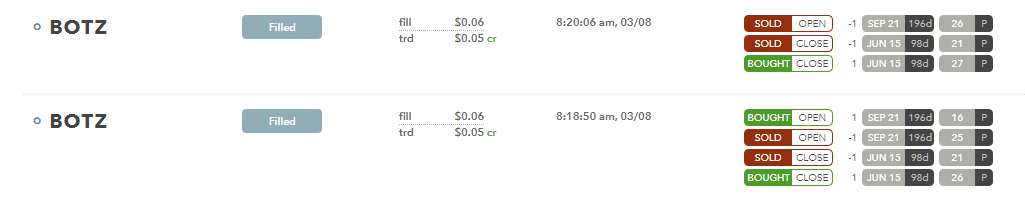

Out of nervousness that the market may crash by the end of the trading day I decided to do some adjustments on my existing trades:

A summary of opening and closing trades.

(balance + $375.00)

Today, I also purchased OHI stock which is not included in the balance (income/expense) report above.

· Dividend stocks to buy

Out of our watch list of 36 dividend stocks the following ones are a good buy at today’s prices (03/07/2018):

AGNC

AWK

CVX

HD

KMB

MCD

OXY

PG

XOM

Disclaimer: The list above is based on calculated fair value and 52wk high offset valuation. The values are subjective to our calculations and opinion and may differ from your own. If you decide to trade or buy these stocks, do so on your own risk and do your own homework. The list is not our recommendation to you.

We all want to hear your opinion on the article above:

No Comments |

In our trading group a trader posted this question:

In our trading group a trader posted this question:

Everybody is going bearish these days and our economy and politicians are not helping much. Retails saw three consecutive months of slowing sales and tomorrows data will probably help sinking this market lower. Trump fired another of his advisers (as I read on Investing.com: making this Presidency a joke) and futures sold off.

Everybody is going bearish these days and our economy and politicians are not helping much. Retails saw three consecutive months of slowing sales and tomorrows data will probably help sinking this market lower. Trump fired another of his advisers (as I read on Investing.com: making this Presidency a joke) and futures sold off.

Recent Comments