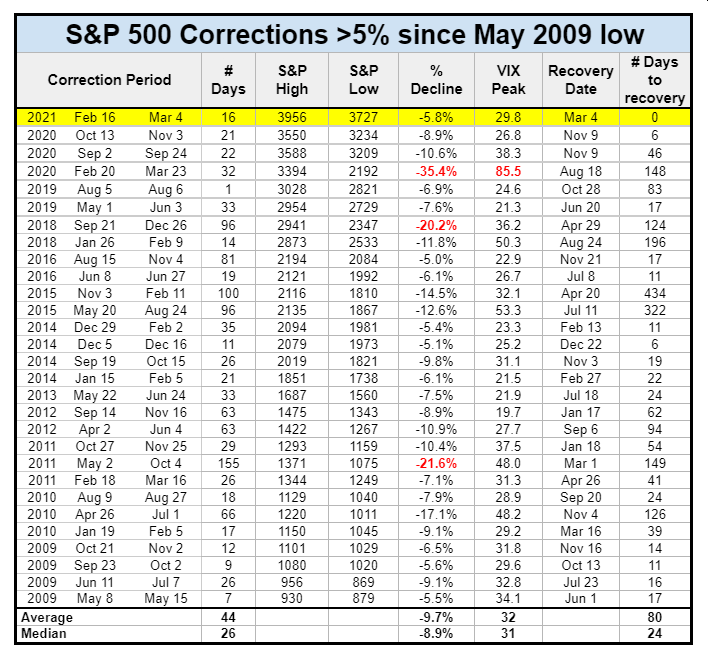

Today, the stock market went down again marking a drop below the 5% threshold and beginning a 5% to 10% correction. It now counts for 16 days of selling and choppy movement up and down. As of today, we closed 5.9% off of the peak. And it may not be over yet as fear is out there.

Today’s drop below 5% started our counter. However, this type of correction is normal and to be expected. It can end here, or develop into something more serious. We can go 10% down or even more as people start panicking and selling everything.

These are the times I like to be in high-quality dividend stocks because no matter what happens from now on, I still will be receiving my dividends and my stocks most likely recover the losses. In fact, I will be buying more shares if the market keeps going down.

Adding high yield dividend stocks to fight the 5% to 10% correction

Despite the selling pressure I decided to boost our portfolio with some high yield dividend stocks and raising more cash reserves. I did some reading and research hoping to find some good stocks that can provide income and perform well during market tension.

I found the following stocks:

QYLD

Global X NASDAQ Cov Calls

ETF Monthly (NASDAQ Covered Calls)

Price: $21.75

Yield: 11.49%

CHI

Calamos Convertible Opps

Closed-End Monthly (U.S. Stocks & Bonds)

Price: $14.16

Yield: 8.05%

CSQ

Calamos Total Return

Closed-End Monthly (U.S. Stocks & Bonds)

Price: $16.42

Yield: 7.49%

APAM

Artisan Partners Asset Mgmnt.

Private Equity

Price: $45.77

Yield: 6.73%

OMF

OneMain Holdings

Div. Speculators (Personal Loans)

Price: $51.06

Yield: 13.83%

Bullish case

Investors are selling stocks despite good economic data and a dovish stance from Powell. And reason? Rising bond yields.

They say: “Higher rates are bad for stocks.”

That might be true, then you look at the data.

The truth is a higher 10-year yield has been extremely bullish for stocks, especially since the mid-’90s.

Bearish case

And here is a not-so-good view. It is evident that the stock market is significantly detached from the underlying earnings. Either earnings will catch up or valuation must go down:

But then, there is that pesky FED…

Leave a Reply