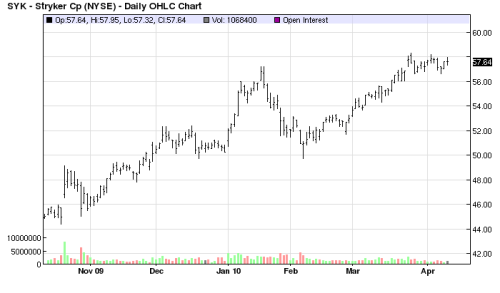

Stryker Corporation (SYK) is once again on my buy list with a target price at $70 per share. I reviewed the trend of the stock and the only thing which I do not like so far is that the stock was growing in price on drying volume.

So I decided to watch this stock for couple of days to see where the stock will go next. I also run my position sizing and risk control calculation with the following results:

With the buy price at $58.00 per share, total risk per the portfolio at 2% I can buy 37 shares. However that would increase my total exposure to the entire portfolio to 8.64% per this trade and this is what I am not willing to accept. So if I buy 17 shares only, my trade size still will be above $800 per trade and my total risk per trade will be less than 6% (5.95% to be exact) and this meets all my criteria for opening a new position. I will risk roughly $50 on this trade only and that is acceptable for me.

I am not buying yet, just adding this stock to my watch list to see what the next movement will look like. I would like to avoid a similar mistake I did with DeVry (DV) where I overlooked the price – volume behavior of the stock and had to be watching the stock falling down just right after I bought it.

When speaking about DeVry, I am still quite confident about this stock, since it still presents strong fundamental values, it broke up through 2-year resistance, so this pullback may actually be a great opportunity to either buy or add DeVry to your portfolio.

Leave a Reply