The only bubble out there is the fear bubble.

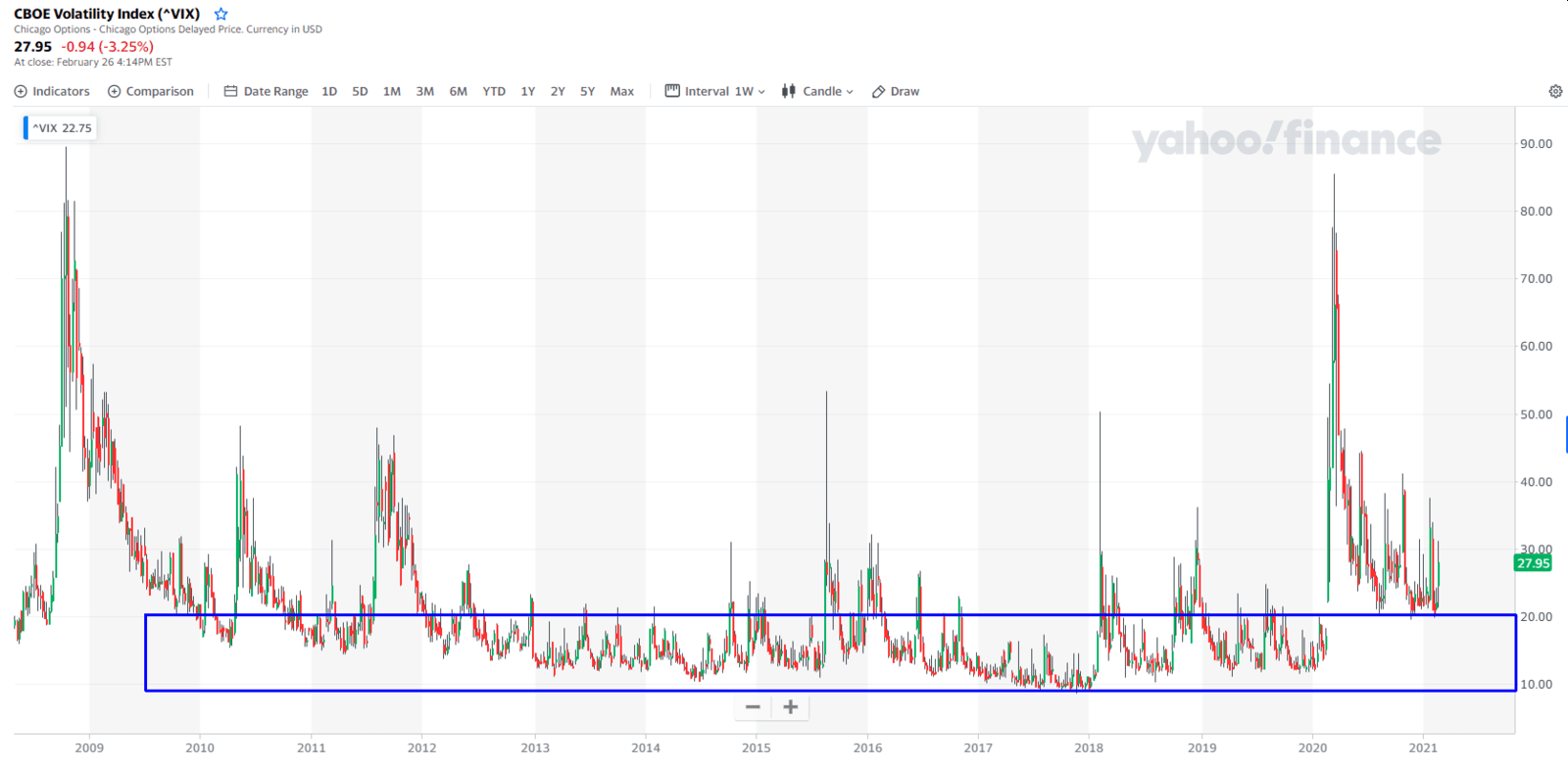

The best way to look at the psychology of the markets and how Wall Street works. And the best way to look at market psychology is to look at VIX.

The long-term mean value of VIX is between 10 and 20, see the blue box. Recently we saw a large spike in March 2020 due to covid but the fear has not disappeared. VIX is still well above 20 (27.95 as of today). That means that there is a lot of fear out there and investors are hedging and buying protection. Money is flowing out of the equities and into protective and defensive vehicles or sidelines. That’s not how bubbles are created and how they burst.

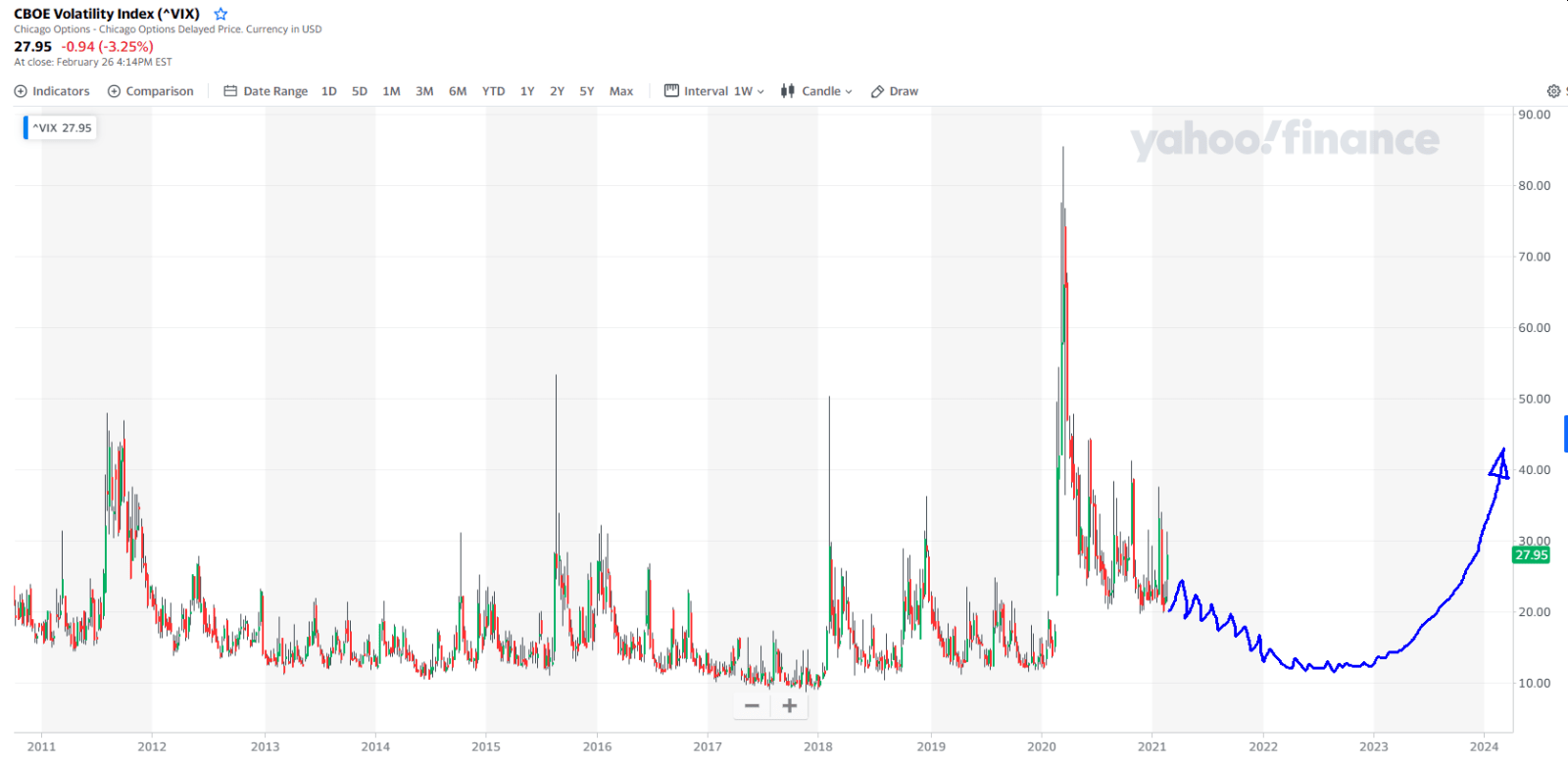

In order for this to be a bubble and burst, you need to see money flowing into equities, everybody investing in stocks, VIX dropping well below 20 (more like 10 – 12) indicating large complacency among investors. That is not what we are seeing in the market today. Every spike in VIX started when VIX was trading at 12 or around.

This is what you want to see first to happen before there will be any serious sell-off again. And given the dynamic of the VIX today, dropping below 20 would take some time, possibly the entire 2021. However, there still may be spikes and pullbacks but not any serious crashes.

The House of Representatives approved the $1.9 trillion stimulus package this last Saturday and that may add more fuel to the market to go higher. Polls show that up to 37% of people eligible to get the stimulus check will invest it or save it. This behavior may prop the market higher but not if there is fear out there and people sitting on the sidelines and saving money in savings accounts or buying protective hedges.

We need VIX to get down first to see a bubble of everything to burst.

Leave a Reply