Another week of August is over. We had our server migrated on Saturday and our website was down the entire day! This investing and trading report shows that it was again a successful week! At first, it looked like a dull week but then the market started sell-off throwing a taper tantrum over FEDs meeting minutes and everything changed. I make the most money rolling and adjusting trades than the original ones.

Last week we received a large dividend from our holdings. It was a surprise. That makes August our best month of dividend income so far! Our options income also jumped up significantly in the second half of the week bringing August to be the 6th best month in options income. But August is not over yet! We have two more weeks to trade! And, we had 11 trades that expired last Friday that we will be reopening next week. These trades will deliver additional options income.

Our Net-Liq dropped, however, due to the market turmoil. But at this point, it doesn’t matter to me. The pullback is temporary.

Here is our investing and trading report:

| Account Value: | $77,551.40 | -$1,899.31 | -2.39% |

| Options trading results | |||

| Options Premiums Received: | $2,327.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $4,524.00 | +5.83% | |

| Options Premiums YTD: | $36,099.00 | +46.55% | |

| Dividend income results | |||

| Dividends Received: | $168.07 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $635.48 | ||

| Dividends YTD: | $1,527.64 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.72% | ||

| Portfolio Dividend Growth: | 8.13% | ||

| Ann. Div Income & YOC in 10 yrs: | $18,917.72 | 19.05% | |

| Ann. Div Income & YOC in 20 yrs: | $166,773.41 | 167.93% | |

| Ann. Div Income & YOC in 25 yrs: | $796,831.62 | 802.36% | |

| Ann. Div Income & YOC in 30 yrs: | $6,127,104.50 | 6,169.59% | |

| Portfolio Alpha: | 39.56% | ||

| Portfolio Weighted Beta: | 0.66 | ||

| CAGR: | 689.54% | ||

| AROC: | 47.92% | ||

| TROC: | 21.74% | ||

| Our 2021 Goal | |||

| 2021 Dividend Goal: | $1,071.42 | 142.58% | Accomplished |

| 2021 Portfolio Value Goal: | $42,344.06 | 183.15% | Accomplished |

Dividend Investing and Trading Report

Last week, we have received a $168.07 dividends income. We have enough stock holdings to generate a $4,282.26 annual dividend income.

Last week, our dividend income reached 142.58% of our dividend income goal. We projected to receive $1,071 in dividends in 2021. Our growth was fast and we have received $1,527.64.

Here are our stock holdings that contribute to our dividend income:

Options Investing and Trading Report

Last week we rolled options that got in trouble. Rolling trades make us the most cash income, although not always that income is available to withdraw due to buying power collateral. The biggest trouble but also money maker was again BABA. We rolled our strangles to lower our puts as it seems, BABA is on the way down to $100 a share. So we wanted to give our trade more room to absorb this downtrend.

We had 11 trades that expired on August 20th. Next week, we will re-enter these trades (tickers). We will only replace the expired trades and we will not be adding any new ones for the rest of the year to consolidate our gains and account.

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

Expected Future Dividend Income

As the table at the beginning of this report indicates, our aggressive dividend growth stocks accumulation is starting to show significant progress in our current and future dividends income. Our portfolio dividend yield and dividend growth will be bringing us almost $166,773.41 in 20 years and $6,127,104.50 in 30 years. I wish, I had that $6.2 million income now. But that is the fate of dividend growth investing. It is not a quick rich scheme and building an account takes time.

We will keep aggressively accumulating dividend growth stocks to generate liveable income sooner than in 20 years. And the portfolio is starting to show this to be happening. In just 10 years, we will start receiving $18,917.72 in today’s dollars. It is not bad considering that in March 2021 it was only $3,202.52 in projected future dividends.

Our projected annual dividend income in 10 years is $18,917.72 but that is if we do absolutely nothing and let our positions grow on their own.

We are also set to receive a $4,282.26 annual dividend income. We are 22.64% of our 10 year goal!

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $103,867.40 to $106,171.06.

As the markets and businesses continue growing, we expect the value of our holdings to grow even more. We are also building cash reserves to buy depressed stocks during selloffs and corrections as well as negative analysts reports (as long as the company is still good long term).

We are accumulating the dividend growth stocks (and some income-only stocks) not only to build a strong dividend income but also to create a “rental property” in our portfolio that can be monetized and generate additional income. This strategy will also provide safety for our strangles and cover our call side.

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

Investing and trading ROI

Our options trading delivered a 5.83% monthly ROI in July 2021, totaling a 46.55% ROI YTD. We exceeded our 45% annual revenue selling options against dividend stocks target!

Our account grew by 276.97% beating our projections and the market.

Our options trading averaged $4,512.38 per month this year. If this trend continues, we are on track to make $54,148.50 trading options in 2021. As of today, we have made $36,099.00 trading options. We are over halfway of the projected annual income.

Old SPX trades repair

This week, we didn’t adjust any SPX trades. Our goal is to reach a level that we will be eligible for portfolio margin (PM). Once that happens, we plan on converting the existing SPX Iron Condors to strangles and trade these positions as strangles.

With RegT margin, the capital requirements would be approx. $66,586.06 and that is beyond our means. With PM the requirement for margin would drop to around $10k. That is doable in our account. Once we reach this level, we will start adjusting our SPX trades accordingly. Until then, we will just roll these trades around.

Accumulating Growth Stocks

Last week, we added 1 share of TSLA and 2 shares of SNOW to our holdings.

Our plan for the rest of the year is to accumulate cash. We only add dividend growth stocks when an opportunity shows up. Our rule for the rest of the year is to use 20% of our available buying power that is above $2,000 to buy new shares per week. The rest of the BP will be kept intact to grow our cash reserves.

Accumulating Dividend Growth Stocks

Last week, we added 6 shares of VICI, 25 shares of ICSH, 50 shares of PMT, and 5 shares of TD.

In the upcoming weeks, we will continue to accumulate the higher yield income stocks to boost our income and reinvest the proceeds but within our share purchasing plan for the rest of the year (see above section).

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

The S&P 500 is in a strong uptrend and even a little taper tantrum the market threw at us because of FED’s meeting minutes talking about possible tapering (talking, not doing!) didn’t derail this trend.

There is still no resistance for S&P500, so the sky is the limit. The support is at $4,353. The market’s intrinsic value is at $4,259 for the rest of 2021 and the trend is still bullish. It may change in the future, but it hasn’t changed yet.

The market priced in the earnings season that was one of the best seasons since 2009 and now we are entering a dull period until Jay Powell planned speech in Jackson Hole on August 27th. I expect the market zig-zagging through that time, going nowhere. The speech will give us a clue on the next FED’s monetary policy. That can shake the market.

I expect the market to reach $4,500 by the end of August but it may change.

Investing and trading report in charts

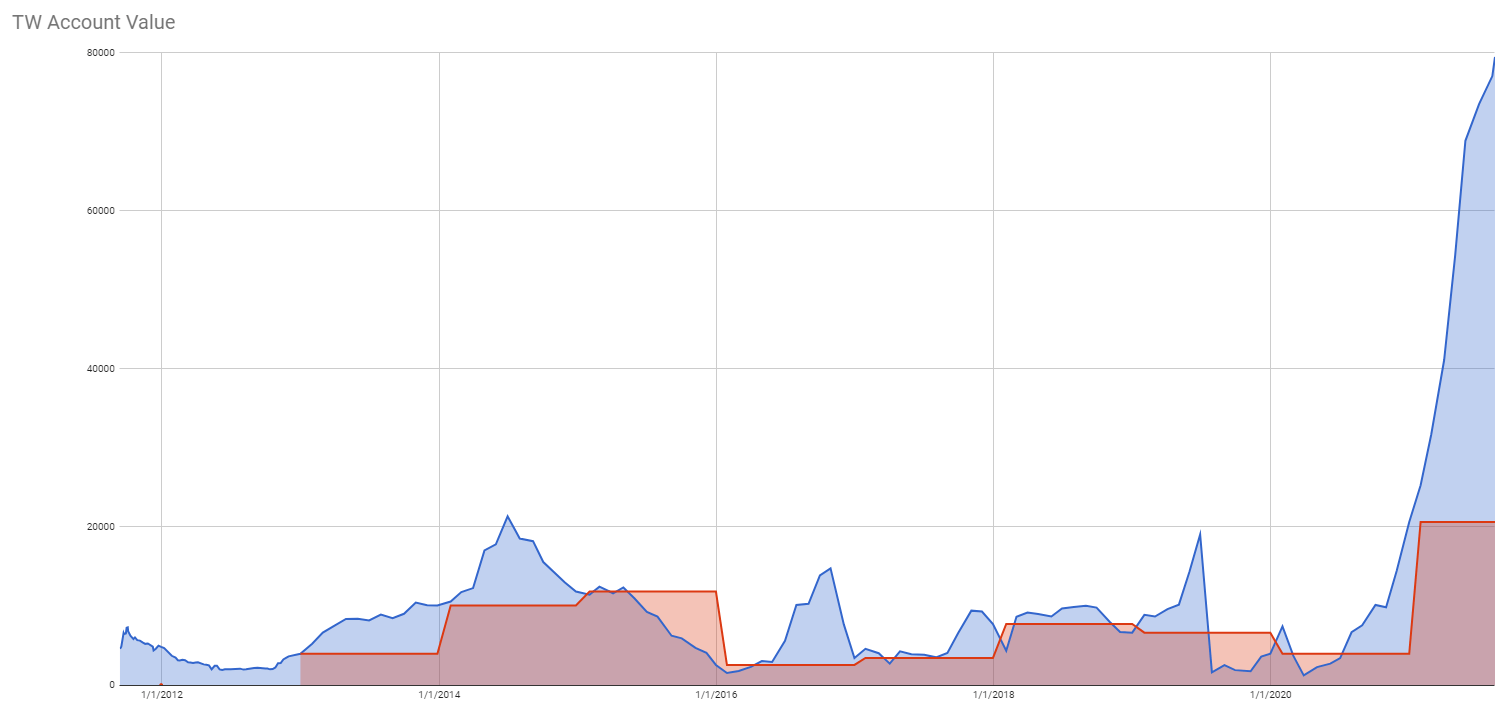

Account Net-Liq

Account Stocks holding

Our stock holdings still do not beat the market but I am positive that the growth will pick up and exceeds the market. We just need time and continue reinvesting the proceeds. S&P 500 grew 53.55% since we opened our portfolio while our portfolio grew 18.81% only. On YTD basis, the S&P 500 grew 23.70% and our portfolio 11.82%.

But the numbers above apply to our stock holdings in our account, not the overall account net-liq growth. Our overall account beats the market growing by 276.97%!

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market as they mature. However, these are just our stock holdings. The entire portfolio beats the market by far thanks to monetizing those positions.

Our goal is to grow this account to $1,000,000.00 value in ten years. We are in year two.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We have accomplished our dividend income goal. We planned to make $1,071 of dividend income this year and we finished receiving $1,527.64. However, we accumulated enough shares to start making $4,282.26 a year.

The chart above shows that our dividend holdings caught up with the dividend payout cycle and we started receiving monthly dividends as projected. For August 2021 the projection was $439.75 and we have received $635.48. For September, our projection is $392.97. If we receive this income (or more), it will confirm that we are now in line with projections.

Our account cumulative return

The chart below indicates our cumulative adjusted return. It shows how the last week’s selloff shook down our returns but we are recovering along with the market.

As of today, our account cumulative return is 35.15% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading was within our expectations and I believe, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares and continue building our cash reserves so we have enough cash to sustain any market corrections and be able to buy depressed stocks.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

Leave a Reply