Trading and investing this year were a disaster so far. I think this was the worst year and worst decline I have experienced. The Covid plunge? No problem, I could manage the portfolio well and made tons of money. 2018 decline? Not a problem. Yes, I felt the pressure, but I think today, it is worse. 208-2009? I don’t think I experienced the same pressure as today.

It is not that the markets were that bad. Overall, S&P500 barely reached the bear market threshold. But it is the slow decline and depth at which some stocks fell this year. Many high-quality dividend stocks are 30% or more down. And some tech stocks I decided to accumulate in 2021 are 80% or more down. I do not remember this to be happening to my portfolio before. Overall, I am down almost $30,000, and not sure when this carnage stops. Even bonds I bought in my HFEA strategy didn’t protect my portfolio as bonds crumbled more than many of my stocks. There was nowhere to hide.

But I am holding all my shares and try buying when my buying power allows (which is difficult now as my margin requirements are high. I have $60,000 in cash but I cannot use it because the broker blocks it as margin maintenance. And my net-liq is down to $77,000. I have $60,000 cash and $77,000 net liq. Something is not adding up here.

Last week, I was in a defensive mode defending open positions. Options trading was mostly for debit and we lost another -$1,605.00 rolling those trades.

Our Net-liq also dropped significantly by -11.68% last week and overall account is down -26.04% YTD. I hope, that when the market reverses and starts trading up again, this will change. I have not taken any physical losses by closing any stock positions. I hold them all and keep selling covered calls. My options trades were rolled, and they show a realized loss but unrealized gain at the same time. I expect the unrealized gain to move to realized gains once the market changes and the trades will be closed as winners. Until then, we wait and protect the portfolio even for debit. It will change soon.

Here is our investing and trading report:

| Account Value: | $77,399.40 | -$9,040.12 | -11.68% |

| Options trading results | |||

| Options Premiums Received: | -$1,605.00 | ||

| 01 January 2022 Options: | $8,885.00 | +8.36% | |

| 02 February 2022 Options: | $10,009.00 | +10.34% | |

| 03 March 2022 Options: | -$1,662.00 | -1.47% | |

| 04 April 2022 Options: | $1,047.00 | +1.19% | |

| 05 May 2022 Options: | -$6,826.00 | -8.82% | |

| Options Premiums YTD: | $11,453.00 | +14.80% | |

| Dividend income results | |||

| Dividends Received: | $193.72 | ||

| 01 January 2022 Dividends: | $303.38 | ||

| 02 February 2022 Dividends: | $732.81 | ||

| 03 March 2022 Dividends: | $393.74 | ||

| 04 April 2022 Dividends: | $337.31 | ||

| 05 May 2022 Dividends: | $220.20 | ||

| Dividends YTD: | $1,987.44 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 5.89% | ||

| Portfolio Dividend Growth: | 11.61% | ||

| Ann. Div Income & YOC in 10 yrs: | $65,963.99 | 43.42% | |

| Ann. Div Income & YOC in 20 yrs: | $2,748,202.85 | 1,809.18% | |

| Ann. Div Income & YOC in 25 yrs: | $60,938,473.08 | 40,116.55% | |

| Ann. Div Income & YOC in 30 yrs: | $4,850,060,191.32 | 3,192,854.54% | |

| Portfolio Alpha: | 8.73% | ||

| Sharpe Ratio: | 6.20 | EXCELLENT | |

| Portfolio Weighted Beta: | 0.56 | ||

| CAGR: | 382.56% | ||

| AROC: | 10.77% | ||

| TROC: | 7.33% | ||

| Our 2022 Goal | |||

| 2022 Dividend Goal: | $4,800.00 | 41.41% | In Progress |

| 2022 Portfolio Value Goal: | $151,638.03 | 51.04% | In Progress |

| 6-year Portfolio Value Goal: | $175,000.00 | 44.23% | In Progress |

| 10-year Portfolio Value Goal: | $1,000,000.00 | 7.74% | In Progress |

Dividend Investing and Trading Report

Last week we have received $193.72 in dividends bringing our May’s dividend income at $220.20.

Last week, we have not purchased any dividend stock.

I wish I could buy more stocks but my buying power is so depressed that I have to wait for my broker to start releasing the margin and my cash. It should start happening shortly.

Here you can see our dividend income per stock holding:

Growth stocks Investing and Trading Report

Last week we bought the following growth stocks and funds:

- 1 share of SPXL @ $84.02

Options Investing and Trading Report

Last week we rolled our strangle trades to keep our account safe. Some of those rolls could have been avoided if I had enough cash reserves.

However, these adjustments delivered a loss of -$1,605.00 making our May options income -$6,826.00.

We were actively trading our SPX strategy that delivered $185.00 gain.

You can watch all our trades in this spreadsheet. You can watch the spreadsheet and look for a “NEW” indication next to the trading date. When the indicator shows up, it is typically good for up to 3 days to follow that trade.

Expected Future Dividend Income

We have received $193.72 in dividends last week. Our portfolio currently yields 5.89% at $77,399.40 market value.

Our projected annual dividend income in 10 years is $65,963.99 but that projection is if we do absolutely nothing and let our positions grow on their own without adding new positions or reinvesting the dividends.

We are also set to receive a $5,883.34 annual dividend income ($490.28 monthly income). We are 8.92%% of our 10 year goal of $65,963.99 dividend income.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value decreased from $135,128.05 to $132,071.97 last week.

In 2022 we plan on accumulating dividend stocks, monetizing these positions, HFEA strategy, and SPX trading. We plan on raising more of our holdings to 100 shares so we can start selling covered calls. We continued rebalancing our options trades that released buying power significantly. That allowed us to start buying shares of our interest again.

Our goal is to accumulate 100 shares of dividend growth stocks we liked and then start selling covered calls or strangles around those positions. We also planned on reinvesting all dividends back into those holdings.

Investing and trading ROI

Our options trading delivered a -8.82% monthly ROI in May 2022, totaling a 14.80% ROI YTD. We hope that in 2022 we exceed our 45% annual revenue selling options against dividend stocks target, although as of today, we are getting way behind this goal and it seems we will not achieve it at all.

Our entire account is down -26.04%.

Our options trading averaged $2,290.60 per month this year. If this trend continues, we are on track to make $27,487.20 trading options in 2022. As of today, we have made $11,453.00 trading options.

Old SPX trades repair

Last week we have not adjusted any of our old trades. The market is playing with me. When all the ods looked good and I had a chance to get rid of one bad trade, the market tanked ruining my chance to improve the position. Now I am back at the beginning of my attempt to fix the old trade.

We however traded our SPX put credit spread strategy which you will be able to review in my next report. The SPX strategy held well so far, and our signals kept us away from opening new aggressive trades.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

Click here to see the entire portfolio

Last week, S&P 500 grew 34.87% since we opened our portfolio while our portfolio grew 0.94%. On YTD basis, the S&P 500 fell -29.90% and our portfolio -28.83%. We are outperforming the market although by a small percentage point.

The numbers above apply to our stock holdings only. Our overall account net-liq is down by -26.04% this year thanks to our options strategies that generated enough income to stay up a bit.

Stock holdings Growth YTD

Our stock holdings are starting to outperform the market. Hopefully, this trend will stay and we will be doing better than S&P 500 constantly.

Our 10-year goal is to grow this account to $1,000,000.00 value in ten years. We are in year two and we accomplished 7.74% of that goal.

Our 6-year goal is to reach $175,000 account value to be eligible for portfolio margin (PM) and today we accomplished 44.23% of that goal.

Our 2022 year goal is to grow this account to a $151,638.03 and today we accomplished 51.04% of this goal.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We planned to make $4,800.00 in dividend income in 2022. As of today, we received $1,987.44. This is in line with our projected dividend 2022 goal. We also accumulated enough shares to start making $5,883.34 a year.

Our account cumulative return

The chart below indicates our cumulative adjusted return since we started tracking this metric.

Here is the cumulative return for the year 2022:

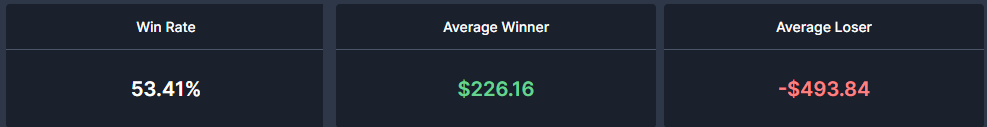

Our win ratio overall:

Our win ratio for 2022:

As of today, our account overall cumulative return is -30.53% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics). Our 2022 cumulative return is -52.94%. That means we erased the entire 2021 revenue. That is a horrible result. But I am optimistic. As I mentioned above, the results are temporary as we are rolling our trades and these rolls cause realized losses while we have open unrealized gains. Once the open trades end (when this horrible market finally calms down), the gains will offset the losses.

I have a favor to ask. If you like this report, please, hit the like  button so I know that there is enough audience that like this content. Also if there is something you want to know or you want me to change this report to a different format, let me know in the comments section.

button so I know that there is enough audience that like this content. Also if there is something you want to know or you want me to change this report to a different format, let me know in the comments section.

Leave a Reply