Here we are again, the end of a month! I feel like I have no time and once I get the time and sit down to rest a bit, it is the end of month.

Time to report my options trading income!

April 2017 was very successful month.

I made a lot of money while eliminating losing trades! That was the greatest achievement of the last few months and April 2017 excelled in it.

I could close many losing trades (my skeletons in the closet) and yet come out with big income.

My plan for April 2017 was to make $1,837.56 dollars of income.

I am happy to announce that we were able to make $3,716.77 dollars of option income in April 2017.

· Options Trading Strategy

Over time since I learned trading options I went from trading spreads, single naked puts, later added naked calls and landed on trading strangles. Many people are afraid trading strangles. They do not know how to protect themselves when having naked calls trades. I was afraid too until I found out that it is not as dangerous as others say.

I am not saying that there is no risk, but if you know how to handle the risk, you will be able to navigate through strangles with no fear.

Over time I developed my own rules and strategy. You can review it in this section.

Are you Ready to Trade?

Your new trading account will come with a paper money account and will be immediately funded with $5,000 of virtual money for you to test the options trading and if you join our trading group on Facebook you can get a guidance, ideas, and trading education. Before you commit your real hard-earned money you can use the virtual account to test our strategies, learn, and ask all questions you need to learn options trading.

Once you learn and get ready, start trading live account and earn monthly income similar to ours. And we will be happy to assist you with that.

Seize the opportunity. Open a new OptionsHouse Account Today! Open and fund an OptionsHouse account to receive up to $1,000 worth of commissions on online trades for 60 days.

· Options Trading Results

As stated above our trading in April was really great and we made $3,716.77 dollars.

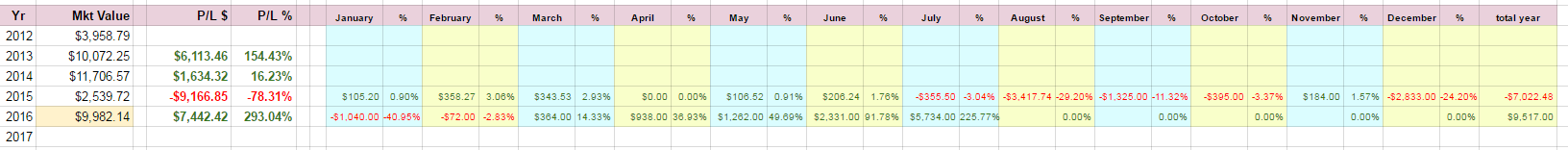

Below you can see all data and progress in our trading account:

Month-to-moth trading results

(The red dots on the chart indicate income estimate, blue bars actual earnings.)

| In April 2017 we made: | 44 trades |

| Total trades in 2017: | 180 trades |

| April 2017 options trading income: | $3,716.77 (108.48%) |

| 2017 portfolio Net-Liq (net)*: | $4,256.13 (24.22%) |

| 2017 portfolio Net-Liq (gross)*: | $24,756.13 (6.67%) |

| 2017 portfolio Cash Value (net)*: | $29,494.13 (4.80%) |

| 2017 portfolio Cash Value (gross)*: | $49,994.13 (2.78%) |

| 2017 portfolio Equity (net)*: | $33,707.13 (1.13%) |

| 2017 portfolio Equity (gross)*: | $54,207.13 (0.70%) |

| 2017 Liability/Debt: | $20,500.00 (0.00%) |

| 2017 overall trading account result: | 32.67% |

* The numbers marked as “net” and “gross” are results with loan (liability) included (gross) or excluded (net).

We are presenting you our month-to-month business performance review:

April 2017 was a great month.

It could have been even better and bigger income if I had no bad trades which I decided to close rather than keep rolling them.

Our account grew well during last month and we even saw our netliq growth again. We saw our netliq growing all the way up to $27,000 +/- until we got hit by X and STX earnings report which sent the stocks down (X by 25% and STX by 8%).

I do not think it was a justified drop (its depth) and I think these stocks will do well again. Also at the end of the month we were assigned to STX stock @ $47.50 a share. Not great, but I am OK holding this stock for some time and be paid the dividend while holding and selling covered calls. The assignment was a result of my mistake. I advocate to trade deep in the money having them far away from expiration (normally we trade weeklys, but when an option gets deep in the money, go more r=than 30 DTE to prevent early assignment). I neglected to do this and let deep in the money put option with only 13 DTE sit instead of rolling it. I got assigned.

· Our Options Trading March 2017 rank

I am also happy to announce that our company account (or our blog reporting our trading results) is listed on a blog Easy Dividend run by Christopher (Chri) from Austria, a valuable member of our Facebook trading group, who lists dividend and options income achievement of a small community of traders and investors.

Every month he publishes results according to income of each member.

Our trading revenue in March 2017 resulted in #6 position among the community traders/investors.

You can review Revenue in March 2017 – Community Edition results here.

· Options Trading April 2017 outlook

The stock market seems to become a range bound and oscilating between $2,340 and $2,400:

On one hand this is definitely an improvement from last month when the market broke up from a descending triangle and we moved higher again.

But I have one fear and that is that investors are likely realizing that Trump will not deliver his promises and that will have a negative impact on the stock market.

If we break up above resistance of the channel, we will see new highs, but if we reverse from here and continue down and even break the support, we may see correction.

Also note, that if we stay in this channel long enough, it will become a consolidation channel for another leg up.

I do not predict the market though, so do not ask me what happens. I do not know it and I do not care.

As a dividend investor I will continue investing into dividend growth stocks and as an option trader I trade strategies where it doesn’t matter which direction the market or stocks go.

What do you think about options trading? What do you think about today’s market amid the weak GDP data? Will Trump be able to positively affect the stock market?

great result for the month of april. This will definitly get you to one of the first places in my income report.

thanks for mentioning my blog. By the way: I am from Austria, but it doesnt matter :)

best regards

Chri

Ha, I thought you were from Germany. I will correct it.

I like your reports and hope they will develop into a regular somewhat “prestige award winning competition”… :)

Ciao Mart,

Great month! this time I think you’ll come on top of the community list!! :)

I am also in STX @ 47, but I think that the sun might shine again on this company, earnings were not terrible at all, and I did not understand the huge drop… Oh well, Mr.Market… :)

As to the state of the market, I still think that it’s going on Trump’s fuel, post-election euphoria, in Europe we are having elections and those might get some “pressure” on stocks in the coming month (especially Britain elections). But “I know nothing John Snow”, so I guess we’ll have to wait and see really…

Compliments again and ciao!

Stal

Oh, yes, with STX I am not worried at all. I owned it at the beginning of the year, I was selling covered strangles and in about 4 months I was out and made nice cash in dividends. I believe this will be a repetition of the same procedure.

If this was X stock I would be worried but not with STX!

Awesome results! Good to read real life stories on strangles…!

I wish I had more time, I would write more.