Definitely bullish. I expect this market to go a lot higher. However, there will be corrections on the way up. By “a lot higher” I am referring to the secular bull market which in my opinion will last for the next 15 to 18 years and delivers substantial gains.

However, it will not be a straight shot up. There will be corrections and bear markets along the way. In a secular bull market stocks tend to raise every year but they can have large corrections (4% to 6% drops) or even bear markets (20% drops) which do not disrupt overall trend and the market recovers fairly quickly and continues up.

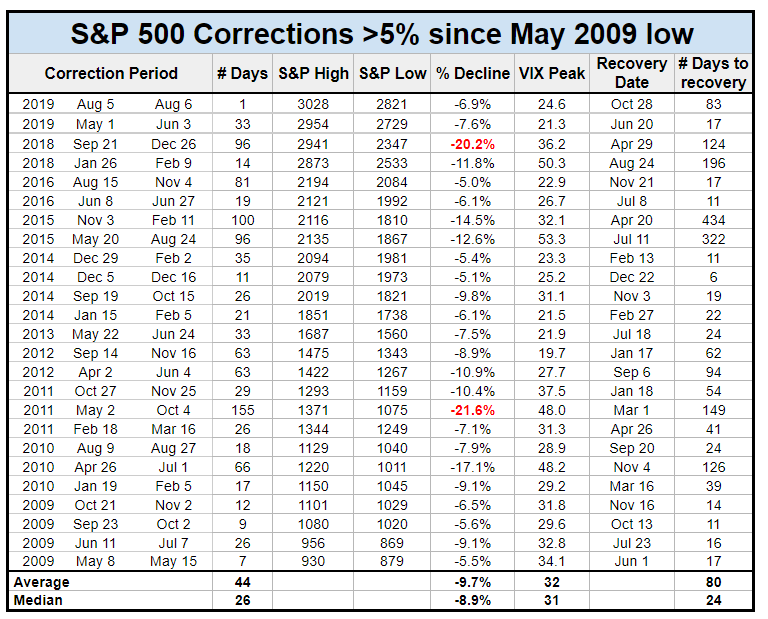

This table indicates corrections larger than 5% we have had since 2009 recovery:

As you can see, we can expect to have in average two corrections every year. And you can expect a bear market (by a definition of 20%+ drop) approx. 7 years. Again, these are not an in stone set rules but possibilities.

Nevertheless, although we have had these corrections and even two bear markets such as one in 2011 and in 2018, these didn’t disrupt the overall secular market. In fact, these corrections actually WILL benefit this bull market to consolidate its gains and allow it to go higher.

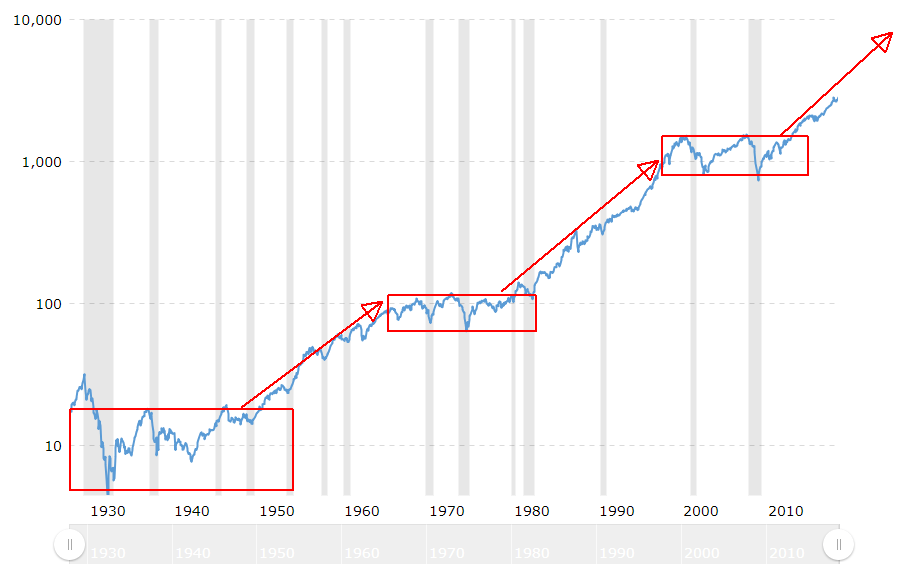

Here is the chart of a 100 year market which will allow you to identify the big picture market. And as you can see, we had three periods of extremely difficult markets (which were painful and the market pretty much got nowhere in a decade or more) and periods of easy markets (secular bull market). We broke from the difficult market in 2013:

We are lucky today as we are at the beginning of a great bull market (unlike our predecessors who lived and invested in the “lost decade” 2000 – 2009, for example). But if you correctly identify what type of market you are in, you can tailor your investing strategy for that particular market. If we get hit with another “difficult market” period (which I do not think it would happen anytime soon), your strategy needs to be adjusted and you need to be able to weight your positions carefully.

And that is one of the reasons why I am investing in dividend stocks – high quality dividend growth stocks – so I do not have to worry about these periods and do not have to weight my positions in and out of the stocks as that is extremely difficult to do. If the cycles above are correct and we really will see another 18 years of a bull market, I will be retiring when the secular markets ends. By then, I want my portfolio to generate enough income regardless its value, market fluctuations, panics, losses, and all sorts of craziness out there. With constant and growing dividend income, I do not have to worry if the market enters another decade or two decades long difficult market cycle.

Leave a Reply