We had a bull put spread against SPX which today became worthless and we could close it early. The trade was originally remnants of an Iron Condor we put our on October 21, 2014. The trade didn’t go well originally as our call side 1955/1960 call spread was breached when markets continued their incredible recovery from October lows.

We originally put the Iron Condor 1955/1960/1820/1815 that day and collected 0.40 premium per contract (since we sold 2 contracts we collected $80 premium total). Later the put side expired worthless, but the call side ended in the money (ITM).

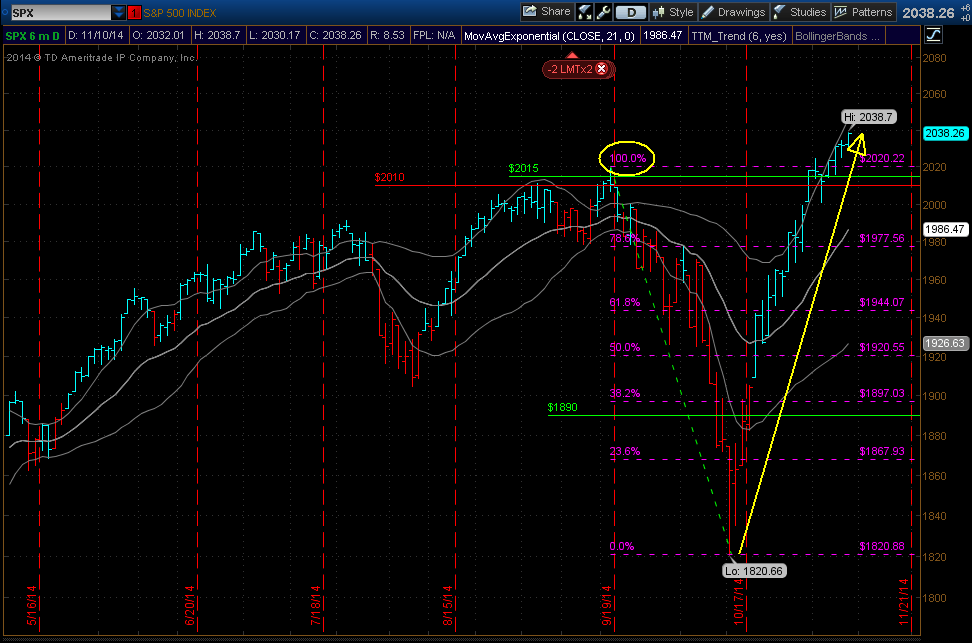

When adding this trade on, the market was at 1944 and at 61.8% of Fibonacci retracement level where everybody expected the trend pull back. Although we put the Condor way out of the 1 standard deviation, the market relentlessly marched up and broke thru our call side without hesitation.

We had a dilemma whether to roll the call spread further away in time and keep it a call spread or convert to a put spread. There were no signs of the market to stop so we decided to convert the trade into a bull put spread.

On October 23, 2014 we reversed the 1955/1960 call spread into 1960/1955 put spread and collected another $40 premium. The total premium now reached $120 per the entire trade.

Today, the markets are at 2038 level. I am so glad we reversed the trade.

The SPX is now showing some weakness. It may be a temporary consolidation before the next move or bears exhaustion and we may see trend reversal or pull back. I would say the latter would happen as we are terribly overbought. Look at the chart below and the Fibonacci levels. The market moved up without a stop by more than 100% of the previous fall. I do not think this is a typical behavior.

I believe this trend is not sustainable. I cannot say how long this would continue (and don’t take me wrong, it may continue for a long time in this crazy manner). It may also crush soon or even this week.

Therefore I deemed it wise to take the sure profits off of the table and buy the put spread back for a few cents.

Last week we placed the order to buy this spread back for 0.05 per contract. Today the order got executed. We paid $15 total and our total premium received ended at $105 or 11.29% gain. Taking this trade off also released our margin now available for next trading (week early) and secured our profits.

Happy trading and have a great week!

Leave a Reply