As stocks are on the verge of fall there are now stocks which are providing yet another great entry point in my opinion. Since I started investing into dividend growth stocks last year I love to see stocks of my interest falling down. They still pay the same dividend payout or even increased their dividend rate, but some investors dump those stocks because they think that those stocks are doomed just because they missed one quarter or their outlook for next period is weak.

When looking at human life what is 80 or so years compared to eternity? Nothing. A spit into an ocean. I have the same look at Wall Street’s obsession about evaluating stocks based on one quarter. What is one quarter compared to 30 years of your investing time frame? Nothing.

Of course, you shouldn’t ignore those stocks. Our investing strategy isn’t buy and forget. But in our case we will see the troubles coming well before the Wall Street gurus tell us based on their thinking of a missed quarter. We will see a stagnant dividend or even a dividend cut and many times before it really happens. If the company is still doing great, increases the dividend and other metrics point to a fat cash flow, so the dividend remains sustainable, there is no need to panic. There actually is a need for opening our wallets and buying.

I believe, there are now stocks in this category offering nice entry point for your 30 year long dividend accumulation journey. Here they are:

Kinder Morgan Partnership (KMP)

I love KMP. It pays nice dividend. It’s current yield is at 6.40% and the company paid the dividend and increased it in 16 consecutive years. Do you think this long dividend increase history will suddenly stop today? I doubt.

It is one of the largest master limited partnerships with a very large economic moat. It’s recent acquisitions and portfolio cultivation poised this stock to a steady growth and there is no sign of troubles in the horizon (correct me if I am wrong).

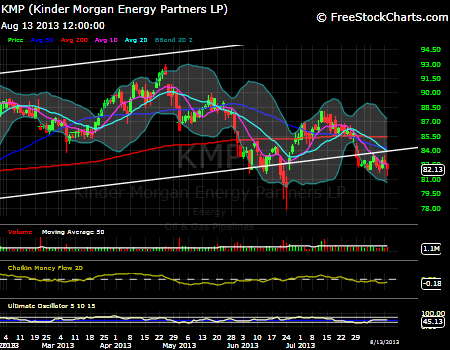

Let’s take a look at the chart:

The chart shows 6 months time frame. The white lower line indicates a 5 year long support trend. the stock broke below this support time several times in 2009, 2011, 2012 and twice this year (both shown on the chart). It always recovered and continued higher. The entire stock history since 1992 is even better and I wish I could buy this stock back then.

Anytime KMP falls below a certain level when the yield gets close to 6.5% or above it more buyers chasing nice YOC step in and start buying. With current yield we are close to this point.

Stock details

| Consecutive Dividend Increase: | 16 years |

| Dividend yield today: | 6.40% |

| Dividend 5yr Growth: | 6.68% |

| Dividend paid since: | 1992 |

Morningstar provides a fair value of this stock at $98 a share, so if that is something we can rely on, the stock is trading at a discount. An estimated growth rate is at 31.20%

Continue reading…

I have a small holding in Lorilard, the potential methanol ban has got reevaluating this position. I’m looking to top up my McDonalds holding given where it is trading right now. I may do a swap out of Lorilard and into McDonalds.

For that same reason I am not increasing my stack in LO although it is very appealing to buy. But I will keep the existing position and watch it closely.

Great pick on Lorillard. It’s kind of like a sleeper I forgot with Altria standing in the way. Do you happen to know what assets they have or could utilize in the event of a menthol ban? Many have made the argument that the tobacco companies are actually well-equipped for all out tobacco bans. Some are even going so far as to suggest, patents they have on the production and distribution of marijuana (if legal) will keep them afloat. Do you know of Lorillard has any of this?

Unfortunately LO is pretty vulnerable to the regulation. 90% of its revenue comes from menthol cigarettes. They sold their international rights to their brand in 1977 so they won’t be able to generate revenue overseas and the only I know right now is a production of blue e-cigarettes, for which they are gaining nice market share. However the revenue from e-cig is miniscule. Marijuana ma be a good replacement, but I do not know if LO will be participating. However, if FDA bans menthol, it will be the end of LO, so if investors are not willing to take this risk, they shouldn’t invest in LO. I do not think FDA will take this step although they have been talking about it for years. First they claimed that they need to take scientific approach to study the impact of menthol cigarettes. None of the studies revealed that menthol cigarettes are worse than any other cigarettes on the market. All what happened so far was a recommendation from Tobacco Products Scientific Advisory Committee that removal of menthol cigarettes would benefit to the public health. FDA then must weight the black market and almost $10 billion of lost government revenue if they ban it. So far this step from FDA is very unlikely. But everything can happen.

[…] Great dividend stocks offering a good entry point by Martin […]

Another correction to the upside. Most financial sites don’t list the correct dividend for Realty Income. It’s 2.179/year which puts the yield at 5.2%.

That is correct. My own spreadsheet list the last dividend times 12 to get the yield, but sometimes I use my broker’s listing. I asked them why they are showing a different rate and yield and they responded that they calculate last 12 dividends paid rather than the last dividend times 12. That’s why you may see different yields. However for consistency matter I will list last dividend times 12 next time. I corrected the yield on this one.

Thanks for the stock tips. I’ll have to add these to my watch list. It’s been a bit difficult to find value lately, but it looks like these may be good buys.

Thanks for sharing detailed insights about KMP. I will check it out

I like KMP and will probably pick up a few shares soon. O looks good to me too. thanks for the suggestions.

Hello!

Enjoy reading your entertaining posts. Just wanted to point out that I think you have an error with respect to the MCD dividend changing from $0.52 to $0.58. Last time I checked it is $0.77 per share!

Cheers,

MG

Hey, thanks for the catch. I checked it out and the rate was for KMP and MCD. I mistakenly looked at the wrong line. MCD doesn’t seem to have raised the dividend recently at all. I will correct the post. And yes, it is 0.77 a share / quarter.