Our HFEA strategy got a severe beating in April as there was nowhere to hide. Stocks got beaten down as well as bonds. A TMF position that was supposed to protect the account got sold off terribly and we hold larger losses in TMF than in the SPXL.

The only unit that held a bit up was an inverse bond ETF TBT but, unfortunately, we do not have a very large position in it, so the protection is insignificant.

So what is next? I reconsidered the HFEA strategy and decided to abandon the TMF position at some point in the future. As of now, I hold some options against TMF but as soon as I will be able to close them (now it would be for a loss), I will re-allocate TMF funds into SPXL and let SPXL run only. As of today, I am investing heavily in SPXL adding more shares, and waiting for the market to finally end its craziness over nothing (yes, I do not consider the fears that our there significant enough to cause the selling that will be forgotten next quarter or next year… I do not care when, but it will be forgotten). And when that happens, I expect the SPXL position to outperform the market significantly. I am also selling covered calls against SPXL (TMF, and TBT).

Originally, I dedicated $15,000 to this strategy. That represented approx. 15% of our portfolio. If the strategy underperforms and is below this amount, I will add cash to it. If it outperforms and ends above this threshold, I will trim the position and save the cash aside. We will be rebalancing quarterly and our next rebalancing will occur at the end of June 2022.

The HFEA strategy is about investing in leveraged ETF but adding protection to the downside since the leverage works both ways. I like the idea because drawdowns can be significant.

Initial HFEA allocation

Start date: 11/27/21

Approach: Variable allocation* – 75%/25% SPXL/TMF

Rebalancing frequency: Quarterly*

Return (total / YTD): -44.95%/-44.95%

Initial contribution: 15% of portfolio Net-Liq (~ $15k)

* Variable allocation will be adjusted based on the moving averages and VIX term structure. When moving averages turn negative (downside) and VIX turns into backwardation, the SPXL allocation will be decreased and TMF allocation increased.

Current HFEA allocation

Goal Approach: 75% SPXL, 25% TMF

Current Approach: 64% SPXL, 36% TMF

| MONTH | NET-LIQ | PROFIT/ LOSS |

PROFIT/ LOSS %% |

| November 2021 | $13,441.91 | $0.00 | 0.00% |

| December 2021 | $14,773.72 | $1,331.81 | 9.91% |

| January 2022 | $12,597.96 | -$2,175.76 | -14.73% |

| February 2022 | $11,665.69 | -$932.27 | -7.40% |

| March 2022 | $12,483.01 | $817.32 | 7.01% |

| April 2022 | $8,694.65 | -$3,788.36 | -30.35% |

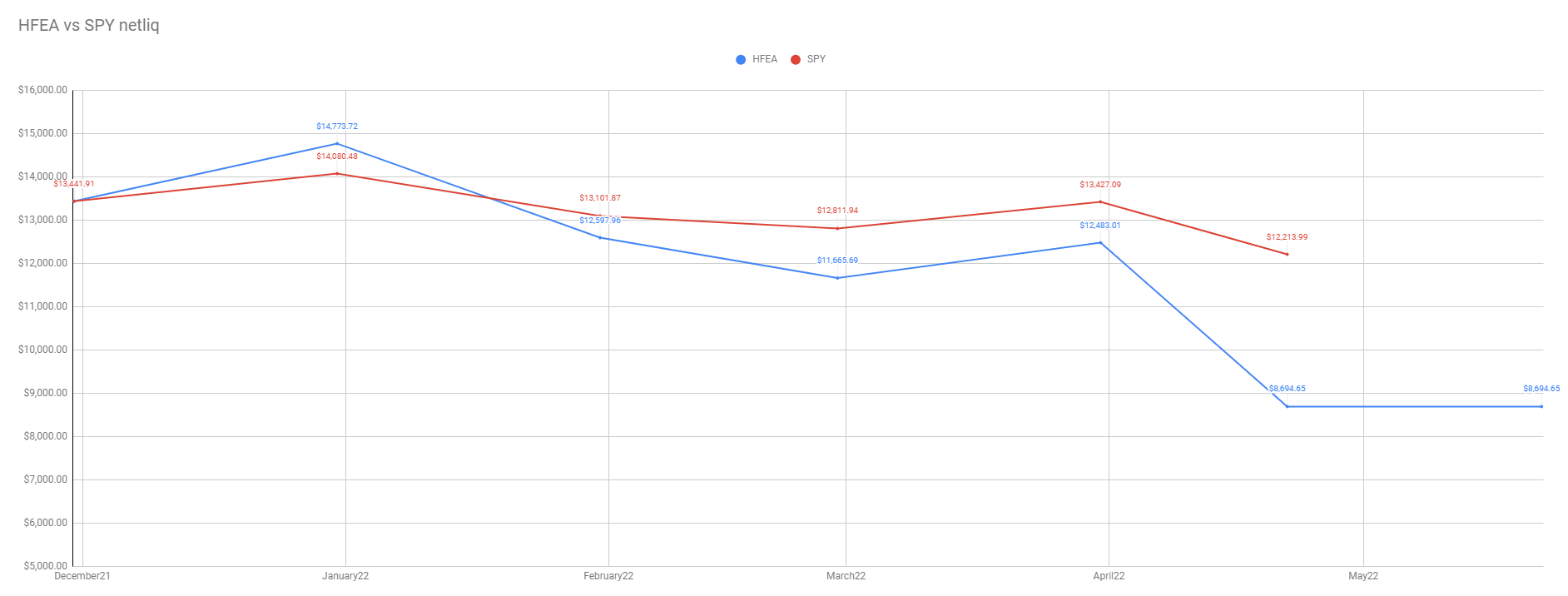

Our HFEA strategy lost -30.35% in April 2022 while the entire market lost -9.03%.

HFEA charts

Strategy Net liquidation value

Strategy vs SPY Net liquidation value

April turned out to be the worst month ever for this strategy as both the SPXL and TMF funds declined significantly. However, I am going to slowly re-allocate funds into SPXL in preparation for the next market rally. When it comes, I expect this strategy to outperform the market significantly.

Leave a Reply