So the most recent inflation data (September CPI report) indicated that all the fears out there on Wall Street is overblown. But that is what you would expect from investors who normally (when the markets rise) claim to be long term value investors but start haphazardly selling their “long-term” investments as soon as it drops a few points.

What we saw from the CPI report so far was that wages inflation is a bit sticky but easing, rent inflation is stickier but easing too, and economy and the labor market are still very strong pointing to the soft landing. But naysayers, and there is plenty of them, will tall you otherwise. And some of the FED officials are already admitting that the current 5.25% rate level is restricting enough to keep the economy from overheating but not damaging it and sending it into a recession. Good news for the markets although they still do not see it that way. But even the biggest pessimist will come to this realization one day.

The good news is that the core CPI inflation rates (excluding shelter) rose just 2.0% each during September. These two measures of inflation are already at the Fed’s 2.0% target! Price inflation has turned out to be remarkably transitory after all.

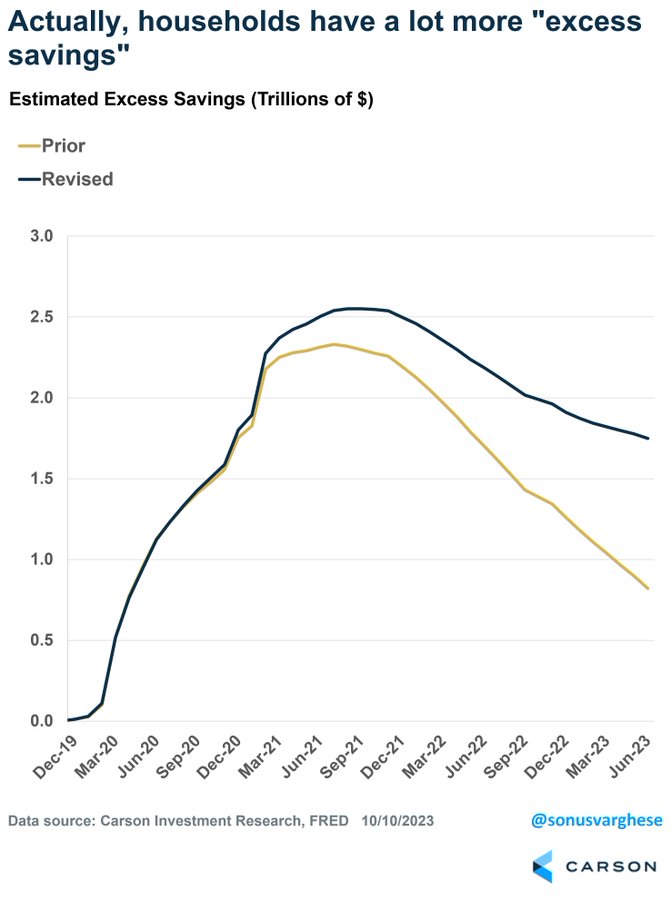

On another note, we just found out that there is $1 trillion more savings sitting on the sidelines waiting to be invested than anyone expected. How can you miss a trillion dollars?

That being said, we are at the beginning of correction recovery and a new bull market.

Today, the investors are digesting (of course) the CPI report. The markets opened lower but we see a few bullish signals on the charts. The market may be flat to bullish today. We may even end in green by the end of the day.

Leave a Reply