I decided to post my monthly investing and trading reports instead of weekly ones. It is too much time-consuming writing about my investments every week, mainly when I also write a newsletter and do research for it. That takes a lot of time.

January 2023 was a good month when our portfolio recovered many 2022 losses. In January 2023, we are up 19.58%, and our overall loss decreased to -28.86% (from January 2022 peak). Our stock holdings increased significantly, and our options income erased previous early losses (incurred by rolling our trades). Our Net-liq grew by 12.36% in January, our options income finished from -$1,487 at $1,466, our dividend income was in line with our plan, and we received $407 in dividends. Given the market conditions, I think this is a spectacular result.

Our NetLiq-cash-buying power ratio improved with the market, but it is still vulnerable to market declines. I need to build more cash reserves.

Our trading delivered $2,953.00 gain last week, ending January 2023, at $1,466.00 (1.97%) of options income. Our net-liq value increased by +12.36% to $74,446.65 value. Our overall account is up 19.58% YTD and -28.86% from when the bear market started in January 2022.

Here is our investing and trading report:

| Account Value: |

$74,446.65 |

+$9,204.70 |

+12.36% |

| Options trading results |

| Options Premiums Received: |

+$2,953.00 |

|

|

| 01 January 2023 Options: |

+$1,466.00 |

+1.97% |

|

| Options Premiums YTD: |

+$1,466.00 |

+1.97% |

|

| Dividend income results |

| Dividends Received: |

+$325.61 |

|

|

| 01 January 2023 Dividends: |

+$407.13 |

|

|

| Dividends YTD: |

+$407.13 |

|

|

| Portfolio Equity |

| Portfolio Equity: |

$192,888.86 |

+$17,843.95 |

+10.19% |

| Portfolio metrics |

| Portfolio Yield: |

5.33% |

|

|

| Portfolio Dividend Growth: |

15.73% |

|

|

| Ann. Div Income & YOC in 10 yrs: |

$127,453.90 |

62.05% |

|

| Ann. Div Income & YOC in 20 yrs: |

$25,927,526.43 |

12,622.91% |

|

| Ann. Div Income & YOC in 25 yrs: |

$3,759,296,201.36 |

1,830,226.56% |

|

| Ann. Div Income & YOC in 30 yrs: |

$5,928,391,657,607.50 |

2,886,258,300.06% |

|

| Portfolio Alpha: |

-3.32% |

|

|

| Sharpe Ratio: |

5.58 |

EXCELLENT |

|

| Portfolio Weighted Beta: |

0.47 |

|

|

| CAGR: |

259.46% |

|

|

| AROC: |

1.40% |

|

|

| TROC: |

2.37% |

|

|

| Our 2023 Goal |

| 2023 Dividend Goal: |

$8,000.00 |

5.09% |

In Progress |

| 2023 Options Income Goal: |

$70,000 |

2.09% |

In Progress |

| 2023 Portfolio Value Goal: |

$96,532.51 |

77.12% |

In Progress |

| 6-year Portfolio Value Goal: |

$175,000.00 |

42.54% |

In Progress |

| 10-year Portfolio Value Goal: |

$1,000,000.00 |

7.44% |

In Progress |

Dividend Investing and Trading Report

In January 2023 we have received $325.61 in dividends bringing our dividend income at $407.13.

We did not purchase any dividend stock this month.

Here is a chart of our account equity showing our accumulation goal and the value of all stocks in our account. It shows a nice upward-sloping chart as our equities grow. This is a result of our options trading and using premiums to buy dividend stocks:

And here you can see the dividend income those equities pay us every year:

Growth stocks Investing and Trading Report

In January 2023, we bought the following growth stocks and funds:

- 50 shares of AMZN @ $97.39

It was a repurchase of shares we bought earlier in 2022, but we had to sell them to release buying power. We will be repurchasing other companies such as Google or Netflix (maybe) to get our portfolio back to the “base core holdings.”

Options Investing and Trading Report

In January 2023, our options trading delivered a gain of $2,953.00 making our January options income $1,466.00. This is a promising outcome for our trading, and I hope it will continue this way for the rest of the year.

We were actively trading our SPX strategy that delivered $2,476.00 gain.

Expected Future Dividend Income

We received $325.61 in dividends last month. Our portfolio currently yields 5.33% at $74,446.65 market value.

Our projected annual dividend income in 10 years is $127,453.90, but that projection is if we do absolutely nothing and let our positions grow without adding new positions or reinvesting the dividends.

We are also set to receive a $7,137.45 annual dividend income ($594.79 monthly income). We are 5.60% of our 10 year goal of $127,453.90 dividend income.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect. The expected dividend growth depends on what stocks we add to our portfolio and the stocks’ 3 years’ average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

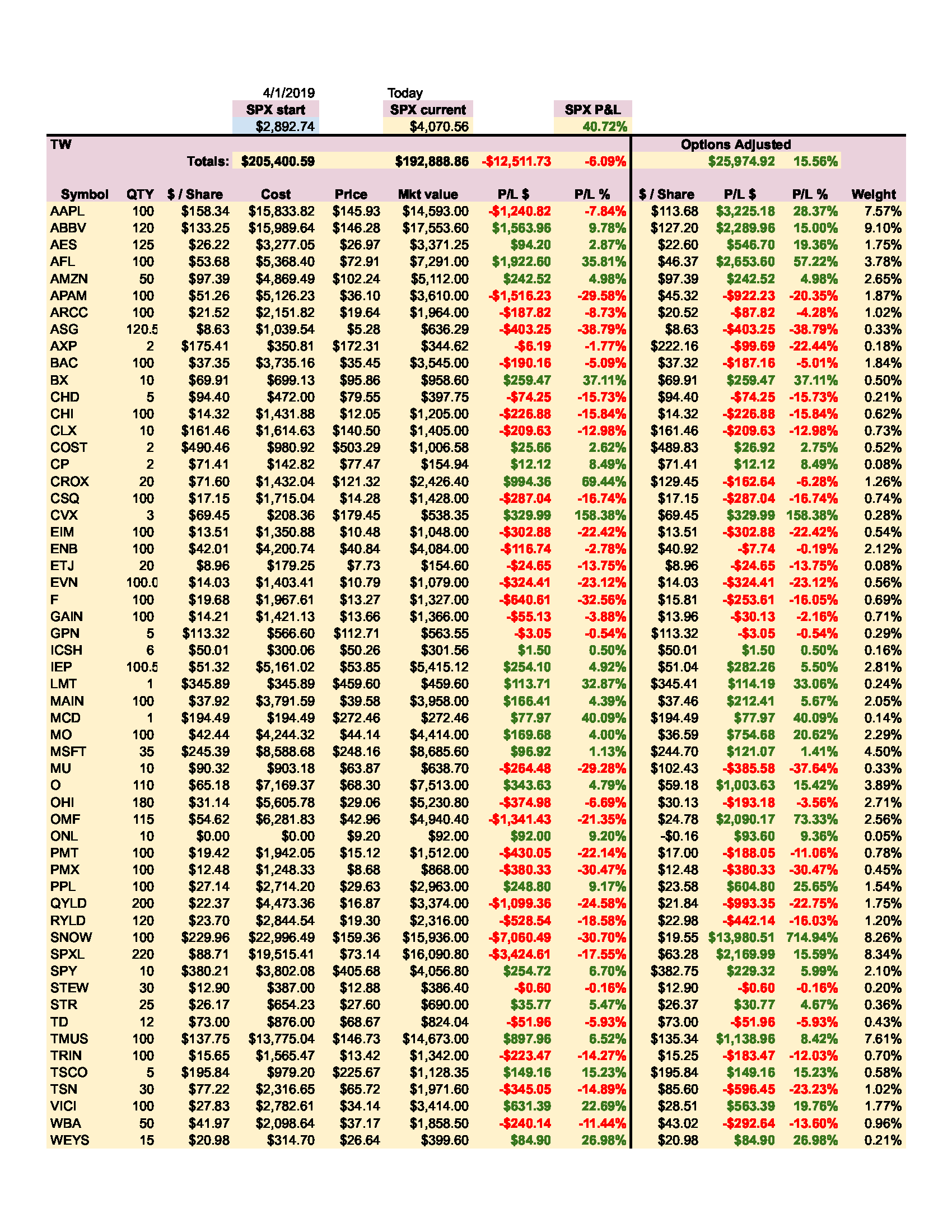

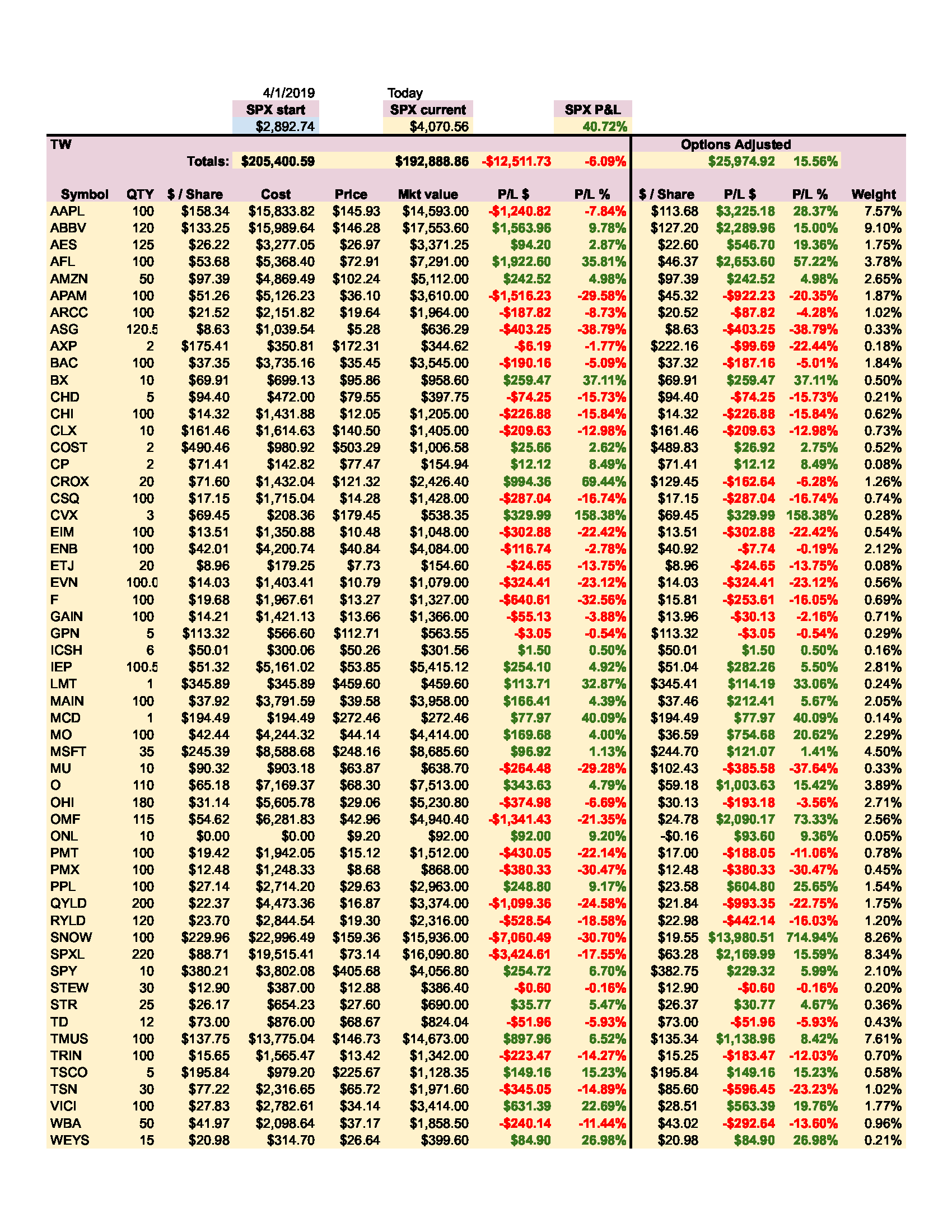

Market value of our holdings

Our non-adjusted stock holdings market value increased from $175,044.91 to $192,888.86 last month.

In 2023 we planned on accumulating dividend stocks, monetizing these positions, HFEA strategy, and SPX trading. We plan to raise more of our holdings to 100 shares to sell covered calls. We continued rebalancing our options trades that released buying power significantly. That allowed us to start repurchasing shares of our interest.

We aim to accumulate 100 shares of dividend growth stocks we like and then start selling covered calls or strangles around those positions. We also planned on reinvesting all dividends back into those holdings.

Investing and trading ROI

Our options trading delivered a 1.97% monthly ROI in January 2023, totaling a 1.97% ROI YTD. We plan to exceed our 45% annual revenue goal in selling options against dividend stocks.

Our entire account is still down -28.86% from when the bear market started. However, in 2023 our account is up 19.58% YTD.

Our trading averaged $1,466.00 per month this year. If this trend continues, we will make $17,592.00 in trading options in 2023. As of today, we have made $1,466.00 in trading options. This is below our projected goal. Based on the goal, we should average $5,834 options income per month. But I hope, as the year progresses, we can increase options income to our goal.

Old SPX trades repair

We traded our SPX put credit spread strategy, which you will be able to review in in our next post. The SPX strategy provided $2,476.00 income (6.00%) while SPX delivered 4.51%.

Investing and trading report in charts

Account Net-Liq

The drawdown of our account is highly discouraging, but it started improving. I am not selling any stock positions, and I will be buying back those I sold to release our Buying power. On top of that, I will be buying more dividend-paying shares as much as possible. My new addition to the watchlist is Arbor Realty Trust, Inc. (ABR) which I plan on purchasing next week.

Account Stocks holding

Last week, S&P 500 grew 40.72% since we opened our portfolio while our portfolio grew 15.56%. On YTD basis, the S&P 500 grew 7.99% and our portfolio 6.08%. We are underperforming the market.

The numbers above apply to our stock holdings only.

Stock holdings Growth YTD

Our stock holdings are underperforming the market. Hopefully, this trend will stay, and we will constantly do better than S&P 500.

Our 10-year goal is to grow this account to $1,000,000.00 value in ten years. We are in year two, and we accomplished 7.44% of that goal.

Our 6-year goal is to reach $175,000 account value to be eligible for portfolio margin (PM), and today we accomplished 42.54% of that goal.

Our 2023 year goal is to grow this account to a $96,532.51, and today we accomplished 77.12% of this goal.

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We planned to make $8,000.00 in dividend income in 2023. As of today, we received $407.13. This week, we completed our 2023 dividend goal. We also accumulated enough shares to start making $7,137.45 a year. Our monthly projected dividend income is $594.79, and our current monthly dividend income is $33.93.

I have a favor to ask. If you like this report, please, hit the like  button, so I know that there is enough audience that like this content. Also, if there is something you want to know or you want me to change this report to a different format, let me know in the comments section.

button, so I know that there is enough audience that like this content. Also, if there is something you want to know or you want me to change this report to a different format, let me know in the comments section.

We all want to hear your opinion on the article above:

No Comments |

button, so I know that there is enough audience that like this content. Also, if there is something you want to know or you want me to change this report to a different format, let me know in the comments section.

button, so I know that there is enough audience that like this content. Also, if there is something you want to know or you want me to change this report to a different format, let me know in the comments section.

Recent Comments