July 2021 is behind us and we can close the books for week #30. We can also report our first week of August 2021 (week #31). I was on vacation last week of July and I was not able to report July trading, so I will do so here.

Last week of July we received $537.00 of options premiums ending the month of July at $3,865.00 total premiums received. Our dividend income brought in $56.95 finishing the month at $228.62.

Below is our August week #31 report.

Here is our investing and trading report:

| Account Value: | $77,024.88 | $1,885.18 | 2.51% |

| Options trading results | |||

| Options Premiums Received: | $527.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $4,884.00 | +15.41% | |

| 03 March 2021 Options: | $5,258.00 | +12.79% | |

| 04 April 2021 Options: | $2,336.00 | +4.30% | |

| 05 May 2021 Options: | $6,346.00 | +9.22% | |

| 06 June 2021 Options: | $4,677.00 | +6.37% | |

| 07 July 2021 Options: | $3,865.00 | +5.14% | |

| 08 August 2021 Options: | $527.00 | +0.68% | |

| Options Premiums YTD: | $32,102.00 | +41.68% | |

| Dividend income results | |||

| Dividends Received: | $7.28 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $63.00 | ||

| 03 March 2021 Dividends: | $30.31 | ||

| 04 April 2021 Dividends: | $139.70 | ||

| 05 May 2021 Dividends: | $167.45 | ||

| 06 June 2021 Dividends: | $168.56 | ||

| 07 July 2021 Dividends: | $228.62 | ||

| 08 August 2021 Dividends: | $7.28 | ||

| Dividends YTD: | $899.44 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 4.70% | ||

| Portfolio Dividend Growth: | 8.13% | ||

| Ann. Div Income & YOC in 10 yrs: | $17,666.52 | 18.95% | |

| Ann. Div Income & YOC in 20 yrs: | $155,096.04 | 166.38% | |

| Ann. Div Income & YOC in 25 yrs: | $738,559.26 | 792.29% | |

| Ann. Div Income & YOC in 30 yrs: | $5,653,530.69 | 6,064.83% | |

| Portfolio Alpha: | 34.44% | ||

| Portfolio Weighted Beta: | 0.69 | ||

| CAGR: | 716.27% | ||

| AROC: | 43.27% | ||

| TROC: | 19.06% | ||

| Our 2021 Goal | |||

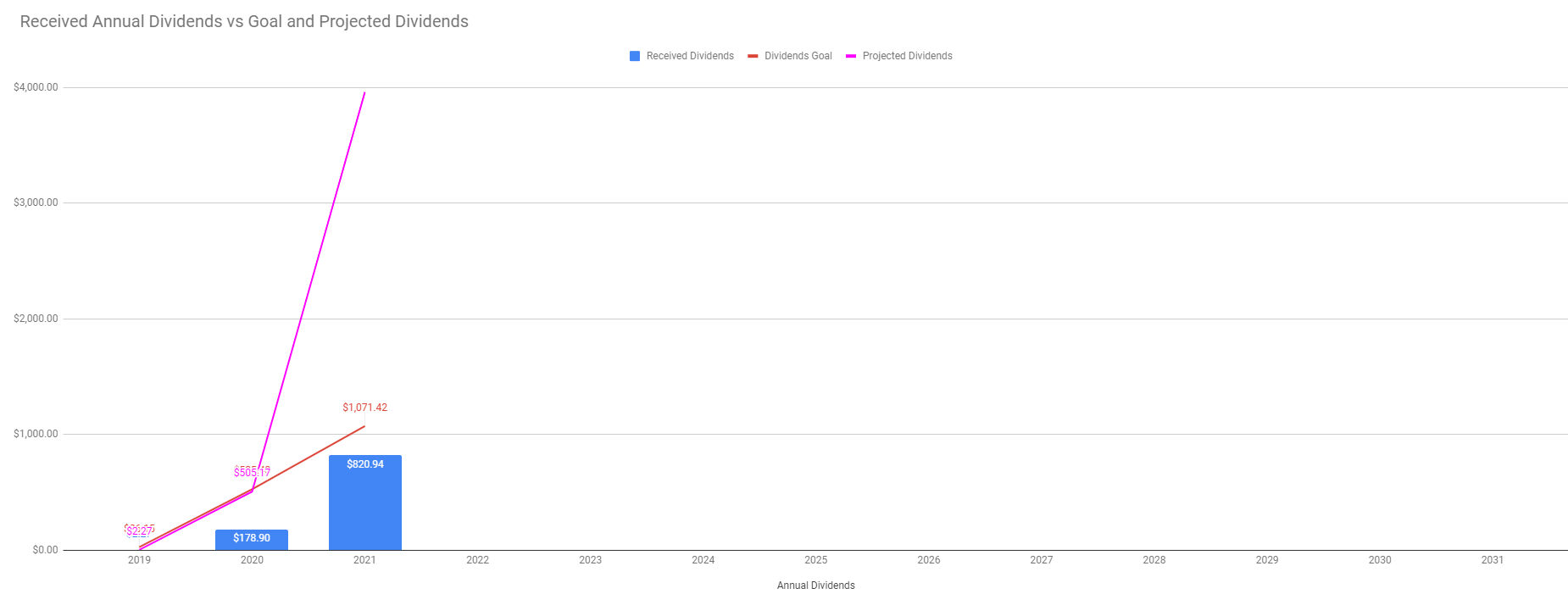

| 2021 Dividend Goal: | $1,071.42 | 83.95% | |

| 2021 Portfolio Value Goal: | $42,344.06 | 181.90% | Accomplished |

Dividend Investing and Trading Report

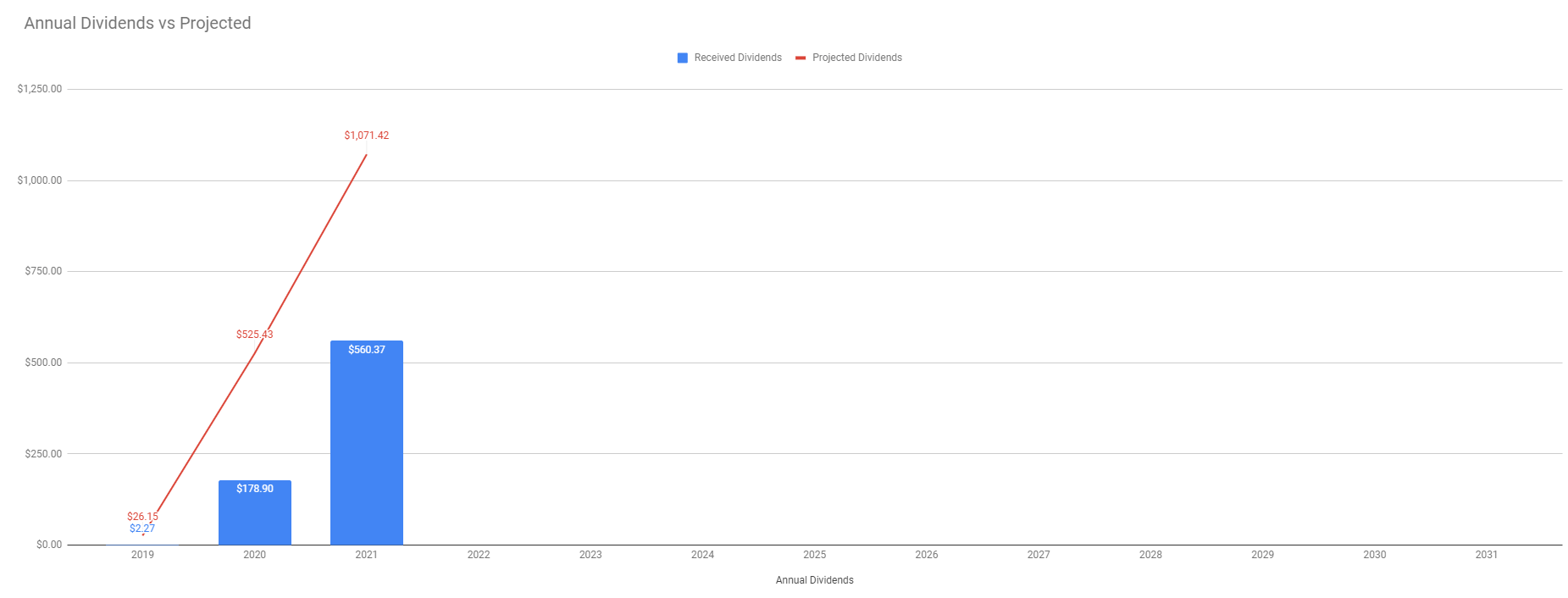

Last week, we have received a $7.28 dividends income. According to our holdings currently on our balance sheet, all stocks should generate $4,082.46 annual dividend income. We are not receiving these dividends yet because many of the stocks were purchased recently and we missed their most recent dividends. But next year, we should be receiving the full amount.

The chart below indicates our current annual dividend payout from our dividend stock holdings.

Last week, our dividend income reached 83.95% of our dividend income goal.

Options Investing and Trading Report

Last week we rolled options that got in trouble. We were not opening any new trades. Just managing the old ones. We rolled OXY, PBCT, XOM, TSLA, AES, and BA. The purpose of rolling those trades was to move the stock price to the center of the strangle. That releases a significant amount of buying power. These adjustments also delivered nice credits.

You can watch all our trades in this spreadsheet and you can also subscribe to our newsletter for our trade alerts.

Expected Future Dividend Income

As the table at the beginning of this report indicates, our aggressive dividend growth stocks accumulation is starting to show significant progress in our future dividends income. Our portfolio dividend yield and dividend growth will be bringing us almost $155,096.04 in 20 years and $5,653,530.69 in 30 years. I wish, I had that $5.6 million income now. But that is the fate of dividend growth investing. It is not a quick rich scheme and building an account takes time.

We will keep aggressively accumulating dividend growth stocks to generate liveable income sooner than in 20 years. And the portfolio is starting to show this to be happening. In just 10 years, we will start receiving $17,666.52 in today’s dollars. It is not bad considering that in March 2021 it was only $3,202.52 in projected future dividends.

The chart above shows how our future dividend income is based on the future yield on cost and what dividend income we may expect in the future. The expected dividend growth depends on what stocks we are adding to our portfolio and the stocks’ 3 years average dividend growth rate. It is interesting to see what passive income we may enjoy 10, 20, 25, or 30 years from now.

Market value of our holdings

Our non-adjusted stock holdings market value increased from $97,113.20 to $100,173.83.

Our holdings reached $100k market value. It is a good milestone to celebrate.

Our goal is to accumulate 100 shares of each stock of our interest and we are getting to that goal.

Investing and trading ROI

Our options trading delivered a 0.68% monthly ROI in July 2021, totaling a 41.68% ROI YTD. We are getting close to our 45% annual revenue selling options against dividend stocks!

Our account grew by 274.41% this year despite very slow growth in June and July.

Our options trading averaged $4,012.75 per month this year. If this trend continues, we are on track to make $48,153.00 trading options in 2021. As of today, we have made $32,102.00 trading options. We are halfway to the projected annual income.

Old SPX trades repair

This week, we didn’t adjust any SPX trade.

Accumulating Growth Stocks

Last week, we added 1 share of SNOW to our holdings. Our goal is to accumulate 100 shares and start selling covered calls. SNOW is an expensive stock to trade naked strangles, so we will proceed with covered calls once we accumulate enough shares. As of today, we hold 21 shares.

Accumulating Dividend Growth Stocks

Last week, we added 10 shares of VICI, and 15 shares of ICSH. In the upcoming weeks, we will be accumulating aggressively the higher yield income stocks to boost our dividend income furthermore.

Our goal is to reach 100 shares of high-quality dividend stocks and build a weekly dividend income as per this calendar, but we have made no changes to this goal last week:

You can see the entire spreadsheet here.

Market Outlook

I am still bullish and think this market is going higher in the upcoming weeks. The reason? Earnings! No matter what you believe about the current market valuation, this market is heading higher because of earnings. What location is for real estate valuations, earnings is the most important metric for the stock market.

And the second quarter of earnings was spectacular. On a per-share basis, earnings grew from an expected 205 per share to 255 per share. That translates to a $5,533 SPX value. At today’s prices, we have a lot of room to go higher.

Investing and trading report in charts

Account Net-Liq

Account Stocks holding

Our stock holdings still do not beat the market. However, I expect it to change over time. S&P 500 grew 53.37% since we opened our portfolio while our portfolio grew 19.18% only. On YTD basis, the S&P 500 grew 23.52% and our portfolio 12.20%.

But the numbers above apply to our stock holdings in our account, not the overall account net-liq growth. Our overall account beats the market growing by 274.41%!

Stock holdings Growth YTD

I expect our stock holdings to start outperforming the market as they mature. However, these are just our stock holdings. The entire portfolio beats the market by far thanks to monetizing those positions.

Our goal is to grow this account to $1,000,000.00 value in ten years. We are in year two.

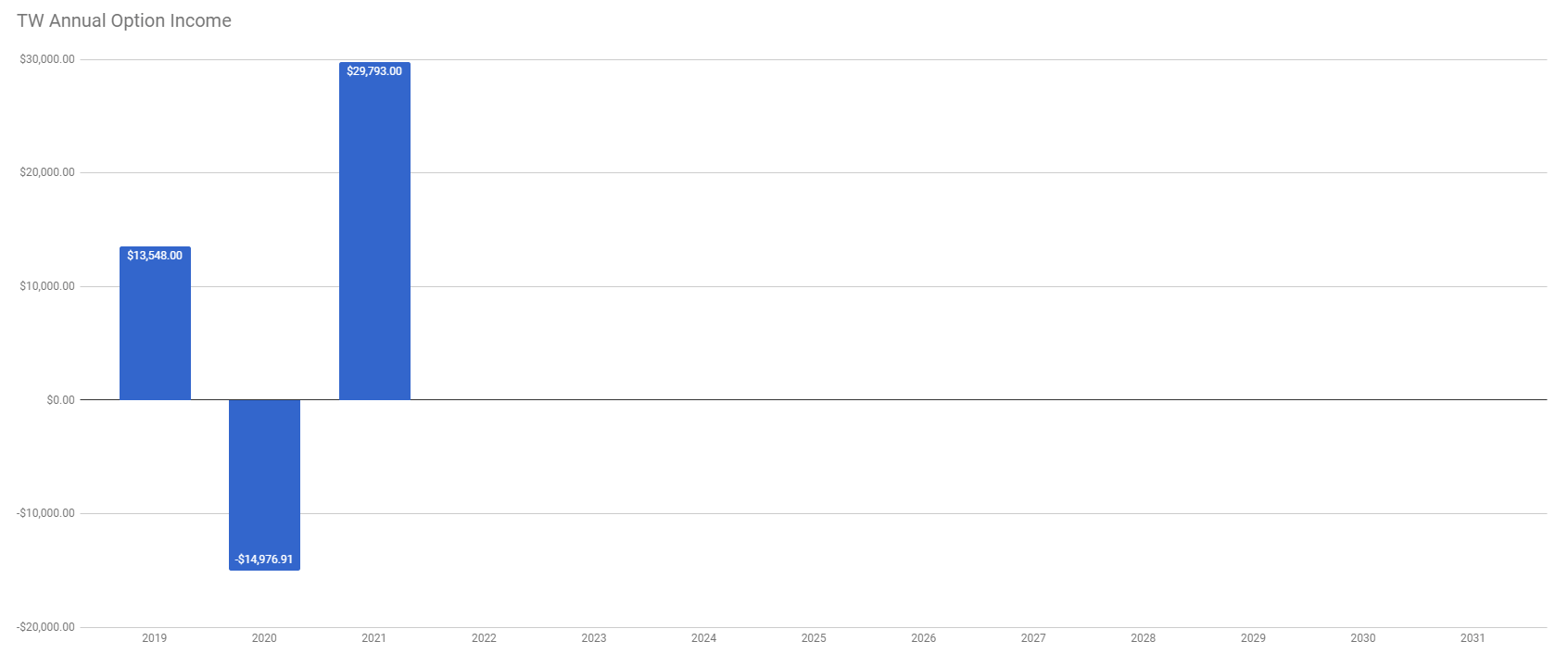

Investing and Trading Report – Options Monthly Income

Investing and Trading Report – Options Annual Income

Our dividend goal and future dividends

We are on track to accomplish our dividend income goal, currently, we are at 83.95% of the goal to reach $1,071 of dividend income this year. Currently, we accumulated enough shares to receive $4,082.46 in annual dividends if we have held through the entire dividend cycle.

The chart above is the corrected chart comparing the projected MONTHLY dividend income vs received dividend income. And again, the projected dividend income is based on the stock holdings up to date. That is the income we would have received if we have held over the entire dividend cycle.

Our account cumulative return

The chart below indicates our cumulative adjusted return. It shows how the last week’s selloff shook down our returns but we are recovering along with the market.

As of today, our account cumulative return is 34.23% (note, data in this section are since March 13, 2021, only as that is the date we started tracking these metrics. Thus the results are skewed a bit and will show full picture next year.).

Conclusion of our investing and trading report

This week our options trading exceeded our expectations. I hope, the rest of the month will be even better.

We will continue accumulating the dividend growth stocks in our portfolio to reach 100 shares. We will also replenish our cash reserves to bring them back to 25% of our current net-liq value.

We will report our next week’s results next Saturday. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments