Another week of February is gone and it is time to provide our investing and trading report again. This week was slow but as the market continued mostly lower, our portfolio held value and grew moderately. We adjusted a few of our positions removing some speculative stocks, adding a few growth stocks, and adjusted a few of the options trades. Overall, this week was a success again.

But now, let’s jump to our investing and trading report:

| Account Value: | $31,640.60 | $503.9 | +1.62% |

| Options trading results | |||

| Options Premiums Received: | $673.00 | ||

| 01 January 2021 Options: | $4,209.00 | +16.65% | |

| 02 February 2021 Options: | $3,575.00 | +11.30% | |

| Options Premiums YTD: | $7,784.00 | +24.60% | |

| Dividend income results | |||

| Dividends Received: | $20.47 | ||

| 01 January 2021 Dividends: | $53.04 | ||

| 02 February 2021 Dividends: | $60.92 | ||

| Dividends YTD: | $113.96 | ||

| Portfolio metrics | |||

| Portfolio Yield: | 3.51% | ||

| Portfolio Dividend Growth: | 5.91% | ||

| Portfolio Alpha: | 18.86% | ||

| Portfolio Weighted Beta: | 0.52 | ||

| CAGR: | 750.17% | ||

| AROC: | 21.13% | ||

| TROC: | 39.52% | ||

| Our 2021 Goal | |||

| 2021 Portfolio Value Goal: | $42,344.06 | 74.72% |

We received $673.00 in premiums trading options against our holdings and shares we want to own. Our options trading delivered a 11.30% monthly ROI, totaling a 24.60% ROI. Also, our net-liq increased amid the weak market. The entire week, our net-liq was suppressed by higher volatility and the broker’s higher margin requirements, however, it was slowly trending upwards.

Our account jumped up to 53.80% YTD growth. We are very happy with this result.

We are still on track to complete goals in our portfolio. We make slight adjustments and we are providing our comments to our goals and tasks we set up in the week 6 report:

Old SPX trades repair

We are still on track to attempt fixing our SPX trades that still block approximately $12,000 in our buying power. We set a buy-back order for deep OTM put spreads for 0.10 debit. Once these get closed, we will roll the deep ITM higher and sell new OTM put spreads to offset the cost. It will be a slow process but I believe, it will be worth releasing an additional $12,000 in cash. As I said last week, we will be rolling these trades only if it will be resulting in credit rolls or a wash. If rolling for a credit or a small debit (no more than $10 or $15) will not be possible, we will let those trades go.

Accumulating Speculative Stocks

There has been a change to my mind trading speculative stocks and I decided not to do that. I do not feel comfortable with it and it is not my money-making strategy. I still may use these stocks for options trading as I feel fit, however.

I decided to sell NIO, ISR, and XONE. I will plan for exposure in these stocks using ETFs instead. As of now, I kept some other stocks such as DDD, RESN, and NNDM but I may unload them in the future too.

Instead, I have created a screener in Finviz.com to help select stocks that are more solid investments and growth potential rather than the speculative penny stocks in overhyped industries such as “electric vehicles”. The screener returns stocks that are considered by analysts, institutional investors, and insiders as a great investment and that these stocks are accumulated by these investors. The stocks also create revenue and growth and increase that growth.

One example was Cutera, Inc. (CUTR) that was on the list for a while and since we purchased the stock last week, it is already showing 7.94% gain.

Here is a picture of the screener and all settings if you want to follow it and try it for yourself.

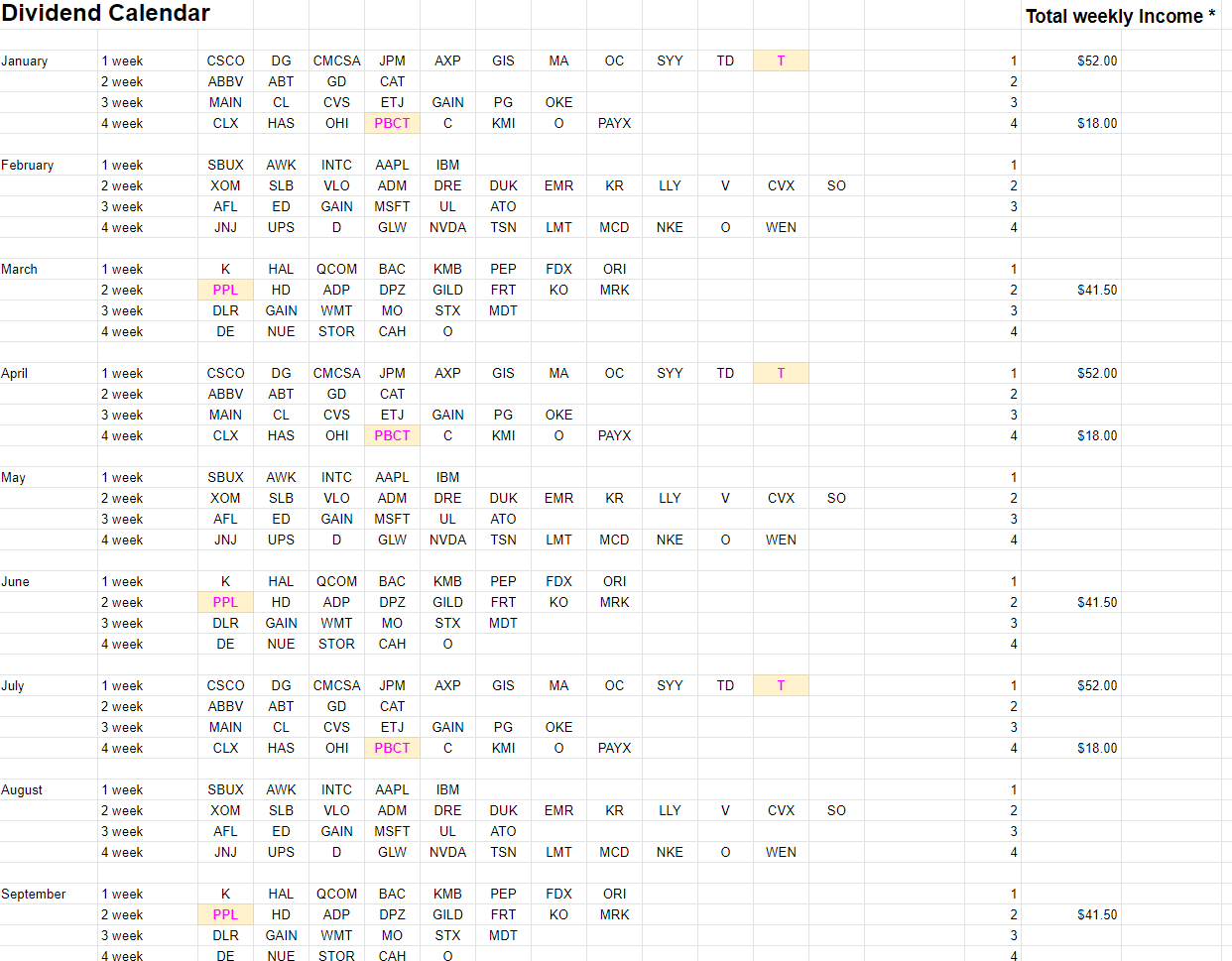

Accumulating Dividend Growth Stocks

Buying high-quality dividend stocks is our core strategy in our fund. And we will continue to do so and at a faster pace. Last week we finished accumulating our position in Altria (MO) and now we hold 100 shares of this stock. We can now proceed to sell more covered calls or have the existing strangles partially covered. Now, we will start accumulating Aflac (AFL) stock to reach 100 shares.

We want to accumulate 100 shares of each stock in our watchlist or list of stocks we want to own. This lot of shares is not, however, the end number. Once we are fully invested (own all stocks we want to own), then we will start adding on top of those 100 shares.

Trading options

We will continue trading options around the stocks we own or plan to own. I call it monetizing our positions. It has a threefold benefit. It lowers our cost basis (at some point we will own all our shares for free), it covers our call sides of each trade and generates an additional income on top of the dividends. And that income is significant as you can see from our report at the top of this post.

Our fund in charts:

The table above shows our current holdings and gains on those holdings. Adjusted columns indicate how options help to boost (or ruin) our stock holdings appreciation, or in other words, lowering the cost basis. Without options, our holdings would be up 6.79% with options, our holdings are up 12.11% (from inception on 4/1/2019). The SPX is up 35.05% since inception. Our stock holdings track the market. This week, our adjusted stock holdings didn’t beat the market either. The market gained 5.21% YTD, our portfolio adjusted stock holdings grew by 5.13% (note this includes stock holdings adjusted by options trading, not the entire portfolio).

We will continue trading options and accumulating dividend-growth stock next week and report our results on Saturday next week. Until then, good luck and good trading!

|

We all want to hear your opinion on the article above: No Comments |

Recent Comments