S&P 500 2,913.98 -0.02(0.00%) Dow 30 26,458.31 +18.38(+0.07%) Nasdaq 8,046.35 +4.38(+0.05%)

September 2018 is over and it is time to report our trading and investing results. Overall September was a great month but it was also a very volatile month.

Our IRA account performed great. Our cash increased to $104,600.00 and we purchased a few new stock position in dividend growth stocks. Our net-liq is stagnating as we are opening new trades which lower it temporarily. As trades get to close net-liq will grow too.

Our ROTH account is however showing signs of great improvement. Last year, we got into a few trades which went bad preventing us trading the account. If however, the trend of improvement continues we will be again trade ROTH more actively.

Our TD account is still depressed but also getting better consolidating it.

In September, we achieved the following results:

We made $5,998.56 dollars in September. Net-liq of all accounts increased by $5,625.27 this month.

We post our trades on our Facebook page and we also post (or try to post when I have time to do so) our end of day trading results.

Here are a few posts from the Facebook page you can review:

WEEKLY RESULTS, September 28, 2018

Trading day September 28, 2018

Trading day September 27, 2018

Trading day September 26, 2018

Trading day September 25, 2018

Trading day September 24, 2018

Here are the entire 2018 year trading results:

· Dividend stock investing

Dividend investing is doing great on both accounts – ROTH and IRA. I keep using 50% of all options income and buy dividend stocks. IRA account keeps growing fast with new stocks being purchased every month. ROTH is more or less stagnant.

Here is a review of our accounts stock holdings:

In August we purchased the following shares:

We keep spending 50% of our options trading proceeds to buy good dividend growth stocks using our screener to get a better entry into the stocks. Although capital appreciation is not our goal but a secondary target, timing the entry creates good results as our positions are mostly up. However, do not be too excited, any large selloff can temporarily send those stocks down again. It is a dividend income what matters to our portfolios, not the portfolio value and capital appreciation. It seems to be evident that using options to grow the portfolio is the right way to do.

· Dividend Income

|

We all want to hear your opinion on the article above: No Comments |

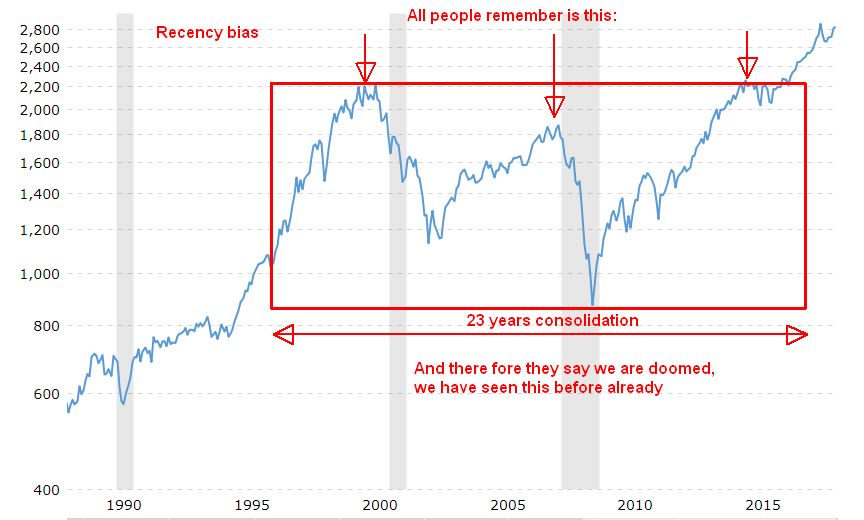

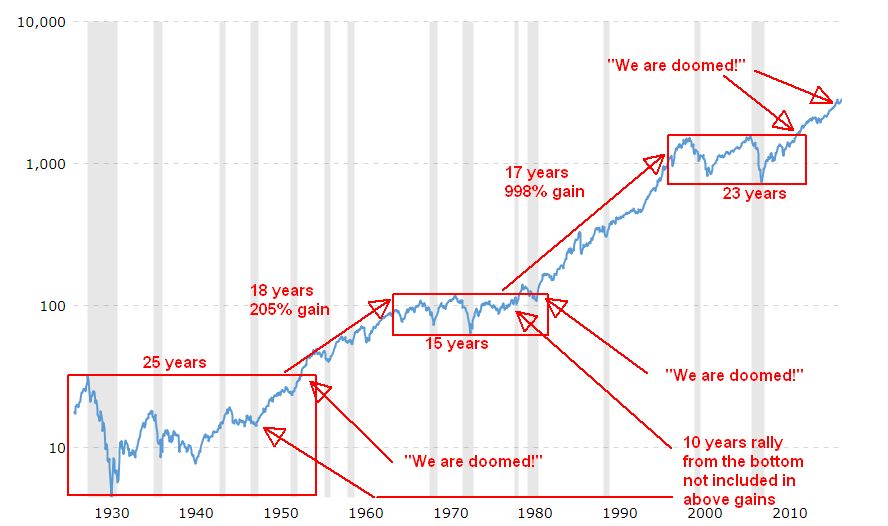

July market was volatile and hectic to our trading and investing. Trump’s trade war, although archaic news, still rattle the markets and spook the investors. there is however no need to be spooked and be afraid of the market.

July market was volatile and hectic to our trading and investing. Trump’s trade war, although archaic news, still rattle the markets and spook the investors. there is however no need to be spooked and be afraid of the market.

Recent Comments