I was busy with many things last two months to report our SPX trading and today I am going to report both months I missed – our SPX trading in September and October 2023. Many things happened during these two months. I switched trading strategy once again as the previous ones didn’t work well to my taste. I switched to trading broken wing butterflies. But I was not happy with it. So, I turned into what I call SPX Crumbs trades. So far, the trading worked perfectly. Out of 36 trades, I only had 3 losing trades and we collected $1,229.28 in premiums.

Our SPX account is up +1,332.05% since the beginning of this program.

Initial SPX trade set ups

I dedicated a $3,600 initial amount that will be used to trade SPX PCS (Crumbs) strategy per week. Today, the account is up at $51,553.82.

Our SPX Crumbs strategy is designed as neutral options trading. We select our strikes far away from the market, so they are more than 2 SD (standard deviation) away. The premiums are smaller, but the chance of profit is 99%. Even during last week’s rally (due to better-than-expected CPI report) when the markets rallied more than 2.4% in a single day, our trades remained safe.

Here you can see our 2023 Crumbs trades:

Click on the picture above to see the entire list.

Last month trading

Overall, the strategy resulted in a +1,332.05% gain last month.

| Initial account value (since inception: 12/07/2021): | $3,600.00 |

| Last month beginning value: | $49,376.95 |

| Last month ending value: | $51,553.82 (+1.55%; total: +1,332.05%) |

| The highest capital requirements to trade this strategy: | $7,151.63 |

| Current capital at risk: | $3,151.63 |

| Unrealized Gain: | $77.63 |

| Realized Gain: | $709.58 |

| Total Gain: | $1,229.28 |

| Win Ratio: | 99.99% |

| Average Winner: | N/A |

| Average Loser: | N/A |

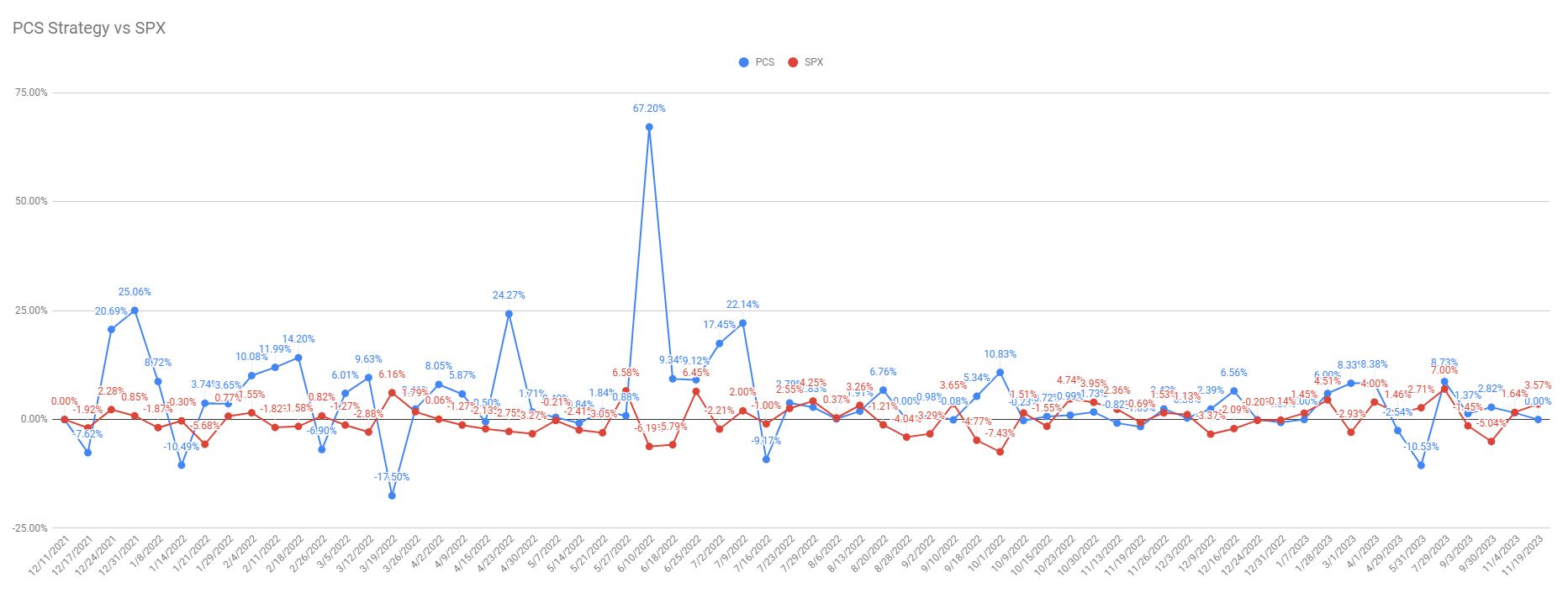

SPX PCS account vs SPX index net liq

SPX PCS account vs SPX performance

If you want to receive trade alerts whenever we open a new SPX put credit spread or a hedge trade, you can subscribe to our service:

Note that if you wish to subscribe to multiple levels, you can only subscribe to one level and send us an email that you want to be added to other levels.

Also, if you like this report, hit the like button so I know there is enough audience wanting to see this type of report. If you have any questions or want to see anything else about my SPX trading, do not hesitate to contact me or comment in the comments section. Thank you!

Leave a Reply