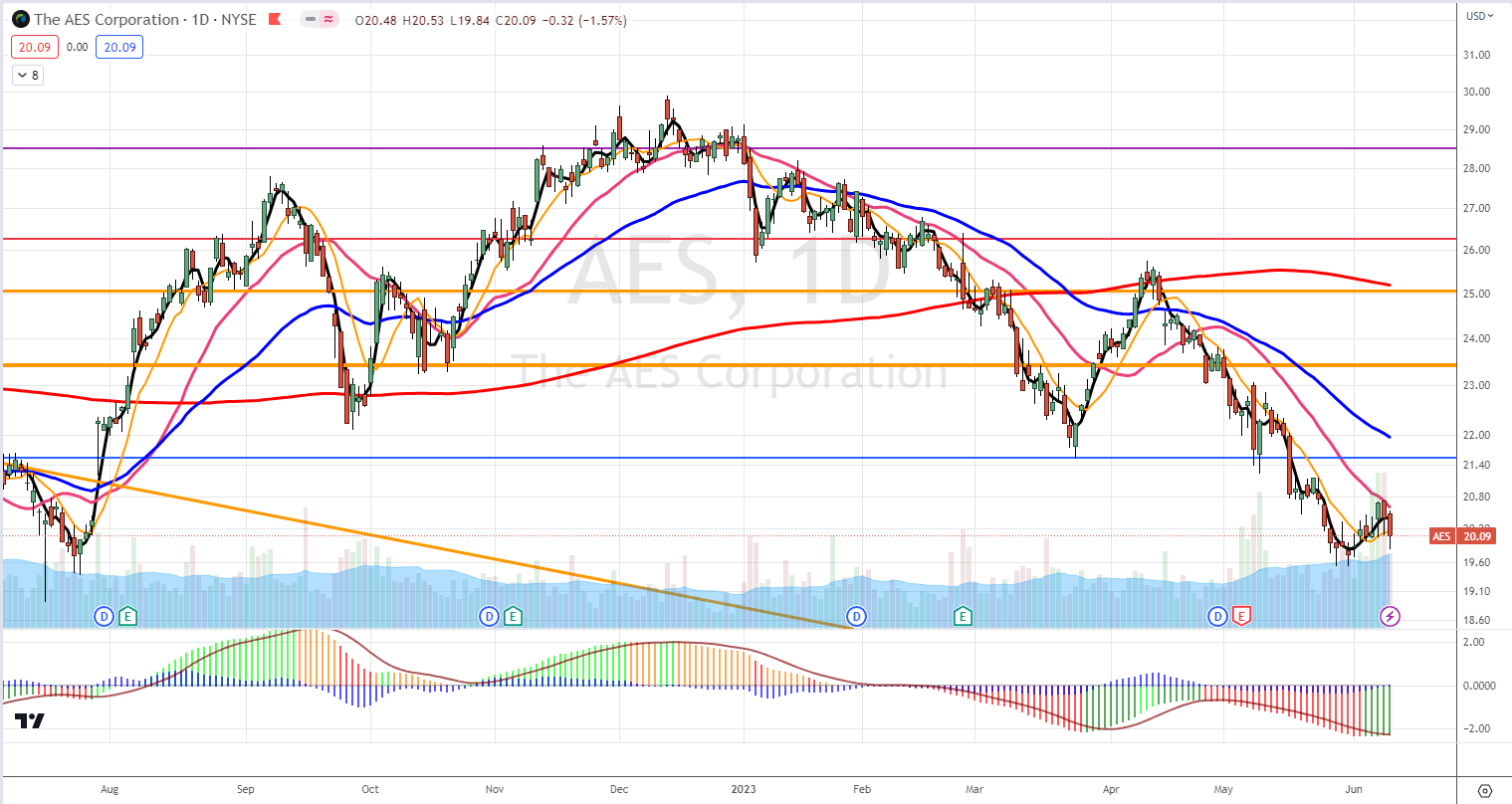

AES is in stage #4. The stock reversed sharply, and it is now trading at levels last seen in August 2022. And one would wonder what has happened. In the previous months the stock was rallying hard and reached its previous all-time high just to reverse and drop like a rock. One reason could be that the market participants expected a weak Q1 and started selling. Utilities didn’t perform well, so the selling might be justified. But given the current valuation, this may offer as good opportunity to buy.

For years, since 2014 AES revenue was declining but after 2020 the company started seeing reversal in the trend and the revenue was going up. Even in Q1 2023 revenue was up. If this trend continues, this should help to prop the stock higher. After the recent selling, we may see a reversal:

The revenue is now growing at 13% annual and 3.4% 5-year average. That is not bad. Free cash flow of the company is growing at 120% 2-year average thought he last few quarters were declining:

Earnings are bad and the company seems to be losing money at 26% 5-year average:

The company has a large debt and very little cash on hand to cover it, so they have to be issuing new debt and refinance. Just recently they announced a new offering of senior notes worth $900 million to possibly finance the debt. Given the debt and declining EPS could be a reason for Wall Street dumping the stock:

The company pays a dividend of 0.66 per share (3.21% yield) and increases it regularly at 5% 5-year average (5.08% annual rate).

The company was diluting investors until 2010 when they started buybacks and since 2015 the amount of shares outstanding remains at the same level with some irregular issuances and buybacks down the road:

Fundamentally, the stock is trading below its current fair value and offers great valuation for 2025. If the EPS growth continues as expected, buying at the current price offers a good opportunity. The operating earnings are still expected to grow, and the stock may follow, though in the past, it was always trading at a discount. The stock’s growth is mediocre and barely beats the index. I buy this stock in my portfolio for dividend income.

The stock is now AGGRESSIVE BUY

This post was published in our newsletter to our subscribers on Sunday, June 10th, 2023. If you want to learn more about our stock technical analysis subscribe to our weekly newsletter.

Leave a Reply