I started trading an SPX Crumbs Strategy and developing it into other instruments such as individual stocks and futures. And it is working. I still deal with the old SPX trades that got me into trouble, but I am slowly eliminating them. It will take time, but I am confident. In the meantime, I trade the SPX crumbs and generate the desired income.

What exactly is the SPX crumbs Strategy?

The SPX Crumbs refers to a trade collecting a tiny premium (hence crumbs) but significantly increasing the probability of profit. A few days ago I watched a Tasty Trade video about this and they were not in favor of this strategy. Honestly, I do not remember why anymore because I disagreed with them. The strategy works for me, so what is the problem?

But what exactly is SPX Crumbs? First of all, I sell options. I do not buy them. I only buy them as protection, which is a part of a trade, like an Iron Condor or a single vertical spread. Buyers are suckers, and eventually, they will lose money. There may be a few traders that make money. I am not one of them, so I need a trade that works most of the time.

Selling options can be tricky and also riskier than buying them. That’s why many people do not sell options. When you buy an option, you pay a premium. The premium can be small, but you can make a lot of money if the stock moves in your favor. All you risk is the premium you paid. In general terms, you risk 1 to make 9. But your probability of profit (of it happening) is extremely small, and you must be right on three determining aspects – time, magnitude, and direction. If you are wrong on any of those, you will lose money.

You can be wrong on all three aspects as a seller and still make money. The probability of profit is high (in my “crumbs” case, over 95% of it happens), but the income is tiny. You literally risk 9 to make 1. Discouraging?

But win 95 times of 100, and you will make money!

What about the 5 times losers? If not managed, these can wipe out your gains and more.

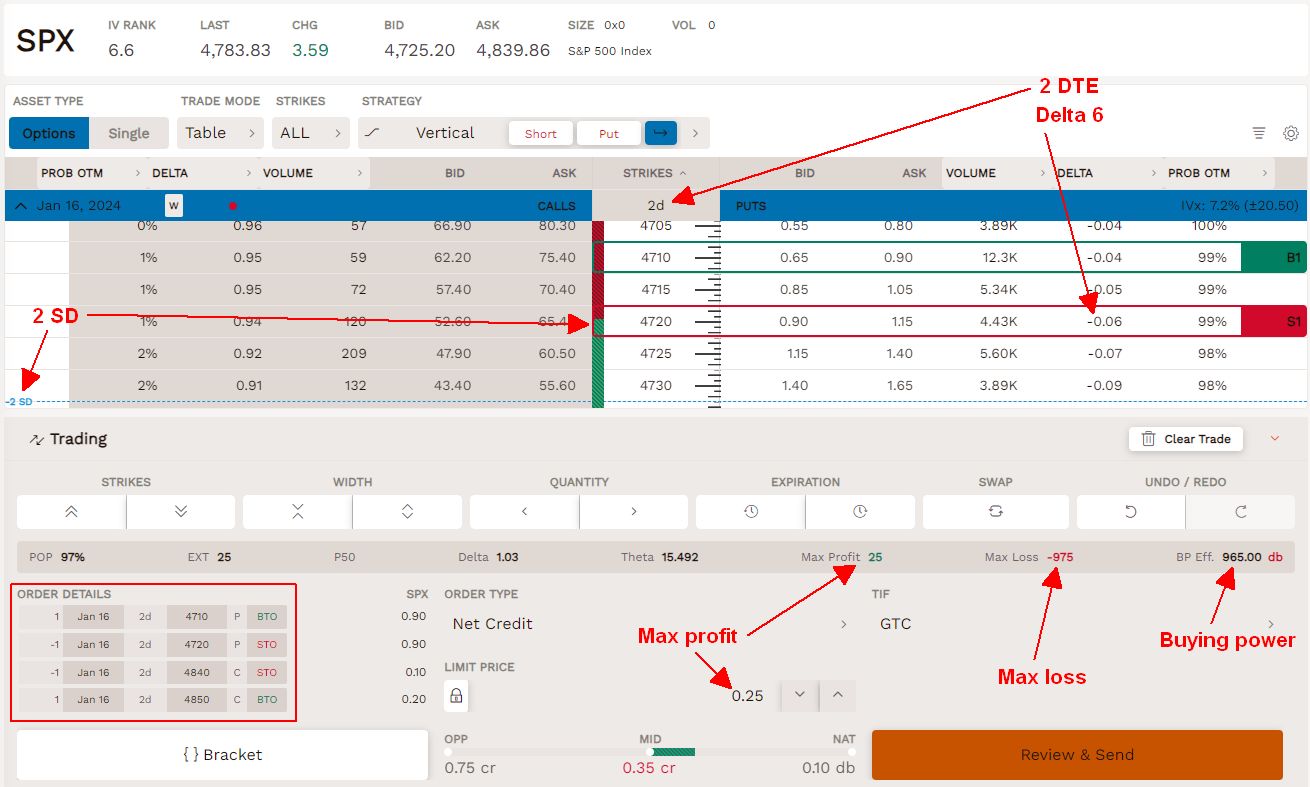

Example of the SPX crumbs trade

Yes, you can make a tiny profit 95 times and lose money five times. With the crumbs, you can make $30 every 95 times, but you can lose $970 every remaining five times of the time. That doesn’t look good.

That is what happened to me when I traded a regular strategy with 30 – 10 deltas. I was looking for a trade that would improve my chances of making a profit, sleeping well, and not worrying about every open trade.

The crumbs strategy is a trade in which you place your short strikes far away from the current market. With SPX, I trade Iron Condors (short and long calls and short and long puts). The reason is buying power. I need to limit the BP to a minimum to be able to trade. I prefer trading strangles (short call and short put only), but the buying power requirements are enormous! I would need over $90,000 in buying power to trade one 2-DTE trade. Not doable.

I can do this with futures (E-minis) as one strangle would require around $6,000 in buying power, but not with SPX. So, I must trade an Iron Condor and buy protective puts and calls to limit my exposure. I usually go with $ 10 wide spreads.

Then, you place your short strikes as far away from the market. I go way beyond 2-SD (2 standard deviations). The delta of the trade is 1 and up to 4, sometimes 5, but not higher. And the premium is about $15 to $30 before fees (I hear many saying phew, not worth it! I don’t want to risk over $900 and make $15!). But it works. Do this 100 times, and you will make a lot of money.

The charts above indicate how my accounts improved since September 2023, when I started trading this strategy. I hope the trend will continue. You can also follow me on Kinfo, a third-party website that verifies my trading. So, all trades are now third-party verified.

Here is an example of constructing a trade. I start with puts and calls at 2 SD and then check the premium. In the example below, the premium was 0.60, allowing me to lower the put strikes. When I did, the premium dropped to 0.35. I changed it to 0.25 for it to fill.

Here is the call side example:

As you can see, the entire trade has a 97% probability of profit. The markets would have to rally or crash more than 1.5 – 2% in two days for this trade to go bust. How often can this happen?

I analyzed all SPX trades since 2007. I checked how often the market dropped by over 2% in two consecutive days. And the market dropped more than 2% in a single day in 205 occurrences out of 4,278 trading days since 2007. That represents 4.79% of occurrences when this can happen. Your chances of winning are high.

What about those 4.79% of losses?

The losses can happen, and they will be happening. Although we have over 95% chance of constantly winning, the losses can still wipe out all winning trades, plus more! The math is simple. Out of 100 trades, we will make $30 premium 95 times, which is $2,850, but we can lose $970 5 times, which is -$4,850. So we still can lose more than what we make!

That’s why the losers still have to be managed – either closed before the loss gets larger, roll it, or any other type of management. I usually roll the trades, keep them alive, and manage them to minimize a loss or even turn the trade into a winner.

Of course, the losing trades may occur fewer times than indicated above because I only trade 2 DTE trades. When the market starts crashing, I can react to it by stopping trading puts (until the bear market ends) or opening new trades with lower strikes every time I open a new trade. But that is a future to be seen.

Conclusion

I am happy with this trading so far. It delivers the results I wanted and always dreamed of and provides enough safety that I do not have to worry about the trade once I put it on. I collect small premiums every time I place a trade, which will add up. It is just a matter of time.

Leave a Reply